Global Masterbatch Market TOC

- An Introduction to the Research Study

- Preface

- Market Taxonomy

- Definition of the Market and the Segments

- Acronyms and Assumptions

- The Research Procedure

- Sources of Data

- Secondary

- Primary

- Manufacturer Front

- Supplier/Distributor Front

- End user front

- Calculation and Derivation of Market Size

- Top-down approach

- Bottom-up approach

- Sources of Data

- Recommendation by Analyst for C-Level Executives

- An Abstract of the Report

- Evaluation of Market Fluctuations and Outlook

- Market Growth Drivers

- Market Growth Deflation

- Market Trends

- End user based

- Product based

- Fundamental Market Prospects

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Regulation & Standards Landscape

- Economic Outlook: US, Europe

- Industry Value Chain Analysis

- Impact of COVID-19 on the Global Masterbatch Market

- Recent Trends in the Masterbatch Market

- Pricing Analysis

- End-use Analysis

- Global Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- Color, Market Value (USD million), CAGR, 2023-2036F

- White, Market Value (USD million), CAGR, 2023-2036F

- Black, Market Value (USD million), CAGR, 2023-2036F

- Additives, Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By Carrier Polymer

- Polypropylene (PP), Market Value (USD million), CAGR, 2023-2036F

- LDPE & LLDPE, Market Value (USD million), CAGR, 2023-2036F

- HDPE, Market Value (USD million), CAGR, 2023-2036F

- Polyvinyl Chloride (PVC), Market Value (USD million), CAGR, 2023-2036F

- Polyethylene Terephthalate (PET), Market Value (USD million), CAGR, 2023-2036F

- Polyurethane (PUR), Market Value (USD million), CAGR, 2023-2036F

- Polystyrene (PS), Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By End-user

- Packaging, Market Value (USD million), CAGR, 2023-2036F

- Building & Construction, Market Value (USD million), CAGR, 2023-2036F

- Consumer Goods, Market Value (USD million), CAGR, 2023-2036F

- Automotive, Market Value (USD million), CAGR, 2023-2036F

- Agriculture, Market Value (USD million), CAGR, 2023-2036F

- Petrochemicals, Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By Region

- North America, Market Value (USD million), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD million), CAGR, 2023-2036F

- Europe, Market Value (USD million), CAGR, 2023-2036F

- Latin America, Market Value (USD million), CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD million), CAGR, 2023-2036F

- By Product

- North America Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- Color, Market Value (USD million), CAGR, 2023-2036F

- White, Market Value (USD million), CAGR, 2023-2036F

- Black, Market Value (USD million), CAGR, 2023-2036F

- Additives, Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By Carrier Polymer

- Polypropylene (PP), Market Value (USD million), CAGR, 2023-2036F

- LDPE & LLDPE, Market Value (USD million), CAGR, 2023-2036F

- HDPE, Market Value (USD million), CAGR, 2023-2036F

- Polyvinyl Chloride (PVC), Market Value (USD million), CAGR, 2023-2036F

- Polyethylene Terephthalate (PET), Market Value (USD million), CAGR, 2023-2036F

- Polyurethane (PUR), Market Value (USD million), CAGR, 2023-2036F

- Polystyrene (PS), Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By End-user

- Packaging, Market Value (USD million), CAGR, 2023-2036F

- Building & Construction, Market Value (USD million), CAGR, 2023-2036F

- Consumer Goods, Market Value (USD million), CAGR, 2023-2036F

- Automotive, Market Value (USD million), CAGR, 2023-2036F

- Agriculture, Market Value (USD million), CAGR, 2023-2036F

- Petrochemicals, Market Value (USD million), CAGR, 2023-2036F

- Others, Market Value (USD million), CAGR, 2023-2036F

- By Country

- US, Market Value (USD million), CAGR, 2023-2036F

- Canada, Market Value (USD million), CAGR, 2023-2036F

- By Product

- Asia Pacific Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- By Carrier Polymer

- By End-user

- By Country

- China, Market Value (USD million), CAGR, 2023-2036F

- Japan, Market Value (USD million), CAGR, 2023-2036F

- India, Market Value (USD million), CAGR, 2023-2036F

- South Korea, Market Value (USD million), CAGR, 2023-2036F

- Australia, Market Value (USD million), CAGR, 2023-2036F

- Singapore, Market Value (USD million), CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD million), CAGR, 2023-2036F

- Europe Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- By Carrier Polymer

- By End-user

- By Country

- Germany, Market Value (USD million), CAGR, 2023-2036F

- UK, Market Value (USD million), CAGR, 2023-2036F

- France, Market Value (USD million), CAGR, 2023-2036F

- Italy, Market Value (USD million), CAGR, 2023-2036F

- Spain, Market Value (USD million), CAGR, 2023-2036F

- Russia, Market Value (USD million), CAGR, 2023-2036F

- Netherlands, Market Value (USD million), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD million), CAGR, 2023-2036F

- Latin America Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- By Carrier Polymer

- By End-user

- By Country

- Brazil, Market Value (USD million), CAGR, 2023-2036F

- Argentina, Market Value (USD million), CAGR, 2023-2036F

- Mexico, Market Value (USD million), CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD million), CAGR, 2023-2036F

- Middle East & Africa Masterbatch Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Product

- By Carrier Polymer

- By End-user

- By Country

- GCC, Market Value (USD million), CAGR, 2023-2036F

- Israel, Market Value (USD million), CAGR, 2023-2036F

- South Africa, Market Value (USD million), CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD million), CAGR, 2023-2036F

- Comprehensive Analysis of Leading Players in the Market

- Market share of Key Competitors in the Market, (%) 2022

- Benchmarking of the Competitors

- Competitor Cost Advantage Analysis

- Profile of the Major Vendors

- LyondellBasell Industries Holdings B.V.

- Avient Corporation

- Ampacet Corporation

- Cabot Corporation

- Plastika Kritis S.A.

- Plastiblends

- Hubron International

- Tosaf Inc.

- Penn Color Inc.

- Astra Polymers

- Americhem

- Gabriel-Chemie Gesellschaft m.b.H.

- Coperion GmbH

- TREFFERT GMBH & CO. KG

- Ingenia Polymers Corp.

Masterbatch Market Outlook:

Masterbatch Market size was over USD 11.75 billion in 2025 and is poised to exceed USD 21.24 billion by 2035, witnessing over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of masterbatch is estimated at USD 12.4 billion.

The demand for masterbatch is growing faster due to the increasing demand from the packaging industry globally. As per the Waste and Resources Action Programme, nearly 141 million tons of plastic packaging are produced every year worldwide.

Moreover, the end-use sectors such as the construction industry in the masterbatch market are witnessing an increasingly high demand for sophisticated color formulations which is driving the demand for masterbatch across the globe.

Key Masterbatch Market Insights Summary:

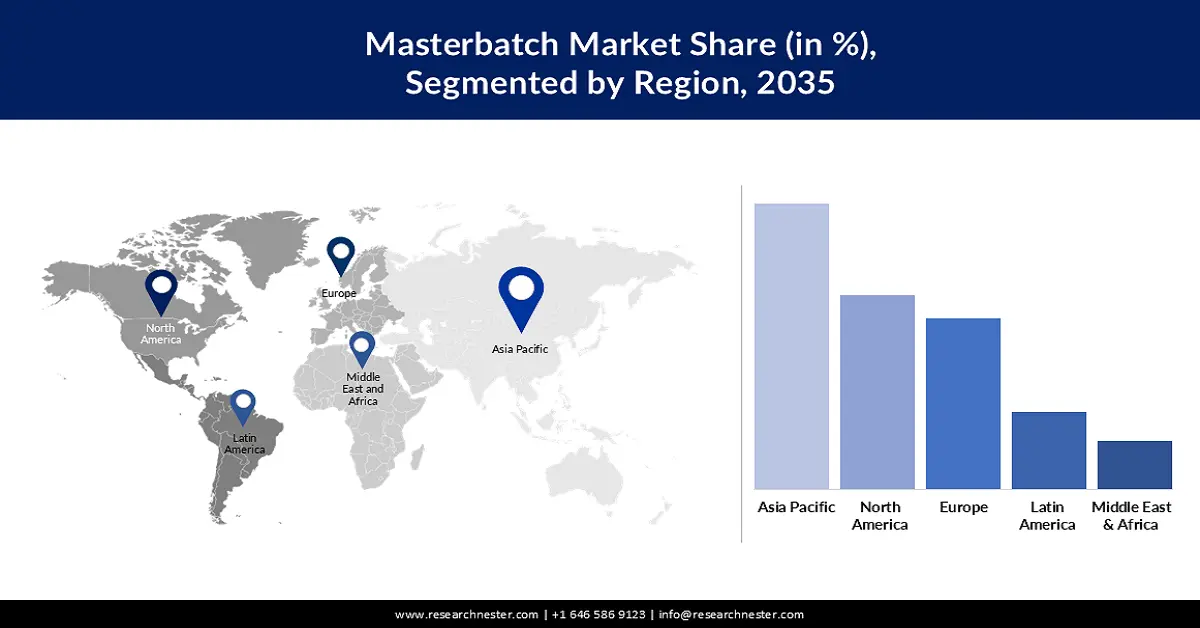

Regional Highlights:

- The Asia Pacific masterbatch market is projected to achieve a 36.7% share by 2035, attributed to population surge, availability of raw materials, adoption of innovative technologies, and low labor costs.

- The Europe market is expected to experience notable growth from 2026 to 2035, driven by rising demand for polymers and special effects, and a push for biodegradable masterbatches due to strict environmental regulations.

Segment Insights:

- The packaging segment in the masterbatch market is anticipated to hold a significant share by 2035, attributed to plastic packaging needs for UV stability and protection.

- The white masterbatch segment in the masterbatch market is expected to capture the largest share by 2035, driven by its use in thermoplastics for opacity and whiteness.

Key Growth Trends:

- Increasing Adoption in Automotive Industry

- Rising Demand for Biodegradable Masterbatches

Major Challenges:

- Fluctuation in Raw Material Prices

- Availability of low-quality and cheaper products

Key Players: LyondellBasell Industries Holdings B.V., Avient Corporation, Ampacet Corporation, Cabot Corporation, Plastika Kritis S.A., Plastiblends, Hubron International, Tosaf Inc., Penn Color Inc., Astra Polymers, Americhem, Gabriel-Chemie Gesellschaft m.b.H., Coperion GmbH, TREFFERT GMBH & CO. KG, Ingenia Polymers Corp.

Global Masterbatch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.75 billion

- 2026 Market Size: USD 12.4 billion

- Projected Market Size: USD 21.24 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Masterbatch Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Adoption in Automotive Industry – The increasing focus on replacing metal with plastic in the automotive industry to reduce vehicle weight and thereby improve fuel efficiency is driving the demand for a variety of plastics that use the masterbatch for imparting several functional properties. According to the International Energy Agency statistics, electric car sales reached a record high in 2021, despite the restrictions imposed due to the COVID-19 pandemic. The electric car sales globally amounted to nearly 6.6 million in 2021, which was double the total sales recorded in 2020. Besides, according to the International Organization of Motor Vehicle Manufacturers (OICA), 80,145,988 automobiles were manufactured in 2021, and 77,621,582 were manufactured in 2020.

- Rising Demand for Biodegradable Masterbatches – The threat posed by plastics to the environment has given way to the use of biodegradable masterbatches. Today’s consumers are demanding that polymers used in manufacturing be biodegradable plastics and compostable. The government is also pushing corporates and manufacturers, especially those in the plastics industry towards sustainability and renewability of their offerings and execute initiatives to reduce their carbon footprint. For instance, according to the International Trade Council, Saudi Arabia released regulations requiring manufacturers, brand owners, and importers to prove that their plastic products are oxo-biodegradable, by using a masterbatch during the manufacturing of their products which has been approved by SASO (Saudi Standards, Metrology and Quality Organisation). The legislation ensures that plastic products made with d2w technology will not be an environmental nuisance.

- Cost Benefit of Masterbatches- When opposed to employing pure pigments or additives, masterbatches provide more cost-effective alternatives. They allow for the efficient dispersion of additives, colorants, and other functional components in finished products, resulting in improved performance and cost savings for manufacturers.

Challenges

-

Fluctuation in Raw Material Prices - Since polymers are crude oil derivatives, their prices are as unpredictable as the prices of crude oil. The prices of key raw materials such as polymers and other chemicals namely titanium dioxide, are highly volatile owing to the fluctuations in demand. Crude oil production by the Organization of the Petroleum Exporting Countries (OPEC) is an important factor that affects oil prices. The frequent changes in crude oil prices may negatively impact the market growth.

- Availability of low-quality and cheaper products

- Supply chain disruption due to war & other external factors

Masterbatch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 11.75 billion |

|

Forecast Year Market Size (2035) |

USD 21.24 billion |

|

Regional Scope |

|

Masterbatch Market Segmentation:

Product Type Segment Analysis

The white masterbatch market is estimated to gain the largest revenue share over the projected time frame. It is frequently employed in the production process of polymers or thermoplastics such as polyethylene, PET, and PP to add whiteness or opacity to the finished products. On the other hand, the color segment is projected to witness a high CAGR during the forecast period, owing to the wide-ranging use of color masterbatches by several market sectors like the electronic, sport & leisure, automotive, agriculture, building & construction, packaging, and textile industries. Color masterbatches have many applications in the electronics industry. For instance, they are used in the coloring of wires, lighting fixtures, and electrical components.

End-user Segment Analysis

Masterbatch market from the packaging segment is expected to garner a significant share. This is mostly because of the increasing application of masterbatch in the plastics utilized in packaging to provide numerous properties like UV stability, weather resistance, antioxidant, and antistatic properties for the protection of packaged products. For instance, an anti-fog additive masterbatch is used in flexible packaging to increase the precision of packaging and maintain the freshness and quality of the food. Similarly, color masterbatches are used to color caps and closures of plastic packaging bottles. This, as a result, is anticipated to create numerous opportunities for boosting the demand for masterbatches in the packaging industry in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Carrier Polymer |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Masterbatch Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 36.7% market share by 2035, attributed to population surge, availability of raw materials, adoption of innovative technologies, and low labor costs. For instance, according to World Bank statistics, the population of the South Asia region rose from 1.68 billion in 2011 to 1.9 billion in 2021. Furthermore, key market players are aggressively expanding their operations to support the market demand across the globe. For instance, in February 2021, Avient Corporation completed the expansion of existing production capabilities at its Binh Duong site in Vietnam for color concentrates.

European Market Insights

The growth of the masterbatch market is poised to show notable revenue in the upcoming years. This can be attributed to the due to the increasing demand for polymers and special effects that are used to differentiate the products. There has been an increasing focus in Europe on manufacturing superior products for food packaging & non-food packaging applications. Europe has stringent environmental regulations for plastic production & consumption, which would encourage the production of biodegradable masterbatches. For instance, oxo-biodegradable masterbatch can degrade in the presence of oxygen (Heat and UV light accelerate the process) much more quickly than ordinary plastic and then biodegrade in the open environment.

Masterbatch Market Players:

- LyondellBasell Industries Holdings B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avient Corporation

- Ampacet Corporation

- Cabot Corporation

- Plastika Kritis S.A.

- Plastiblends

- Hubron International

- Tosaf Inc.

- Penn Color Inc.

- Astra Polymers

- Americhem

- Gabriel-Chemie Gesellschaft m.b.H.

- Coperion GmbH

- TREFFERT GMBH & CO. KG

- Ingenia Polymers Corp.

Recent Developments

- LyondellBasell Industries Holdings B.V. announced that its black color masterbatch with the name Polybatch 73641 NIR had been provided with the COTREP certification. The certification signifies that the plastics having COTREP-certified masterbatches can be separated using conventional Near-Infrared (NIR) sorting equipment.

- Avient Corporation launched two additions to its MEVOPUR line of medical-grade materials. These additions were intended to assist pharmaceutical packaging and medical device manufacturers to reach their sustainability goals more easily. The Mevopur range includes functional additives that improve the performance of polymers used in medical devices, pharmaceutical packaging, etc.

- Report ID: 5154

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Masterbatch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.