Cold Chain Packaging Market Outlook:

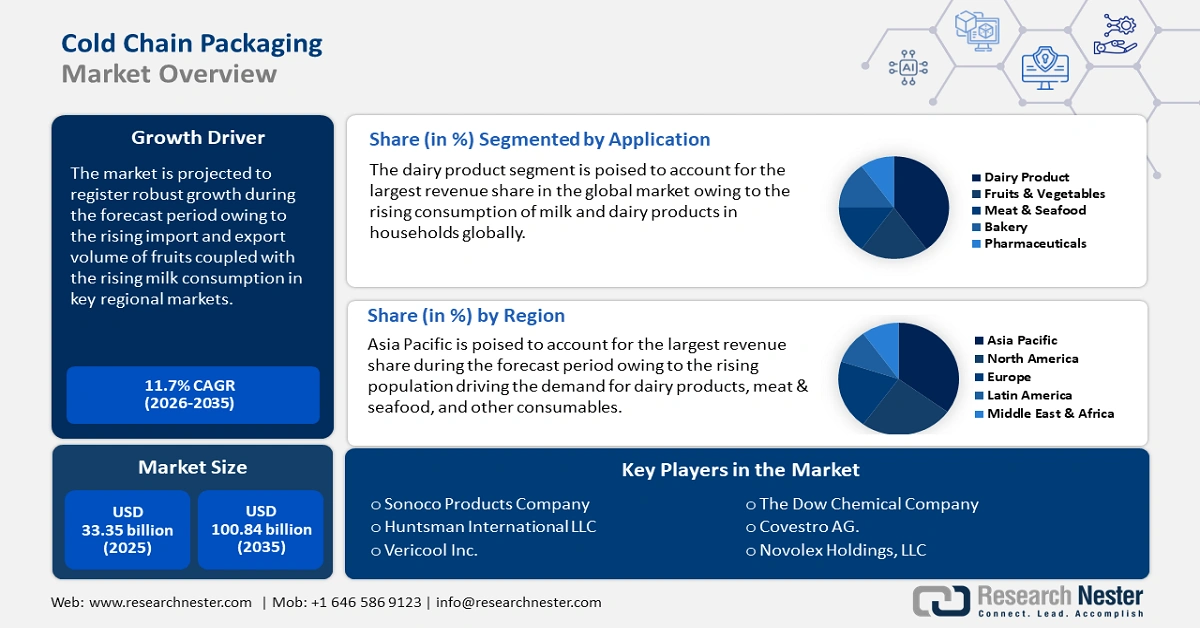

Cold Chain Packaging Market size was over USD 33.35 Billion in 2025 and is poised to exceed USD 100.84 Billion by 2035, growing at over 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cold chain packaging is estimated at USD 36.86 Billion.

The growth of the market can primarily be ascribed to the growing consumption of meat across the globe. For instance, in 2021, about 300 million metric tons of meat were consumed worldwide.

Global cold chain packaging market trends such as, rising consumption of seafood and remarkable surge in disposable income are projected to influence the growth of the market positively over the forecast period. For instance, in 2021, the sales of fresh shrimp were estimated to rise by approximately 10% in the USA. Additionally, the spiking utilization of cold chain packaging in bakeries and growing population across the globe are further expected to flourish the growth of the market during the forecast period. It was observed that around USD 25 billion are generated by the baking industry every year.

Key Cold Chain Packaging Market Insights Summary:

Regional Highlights:

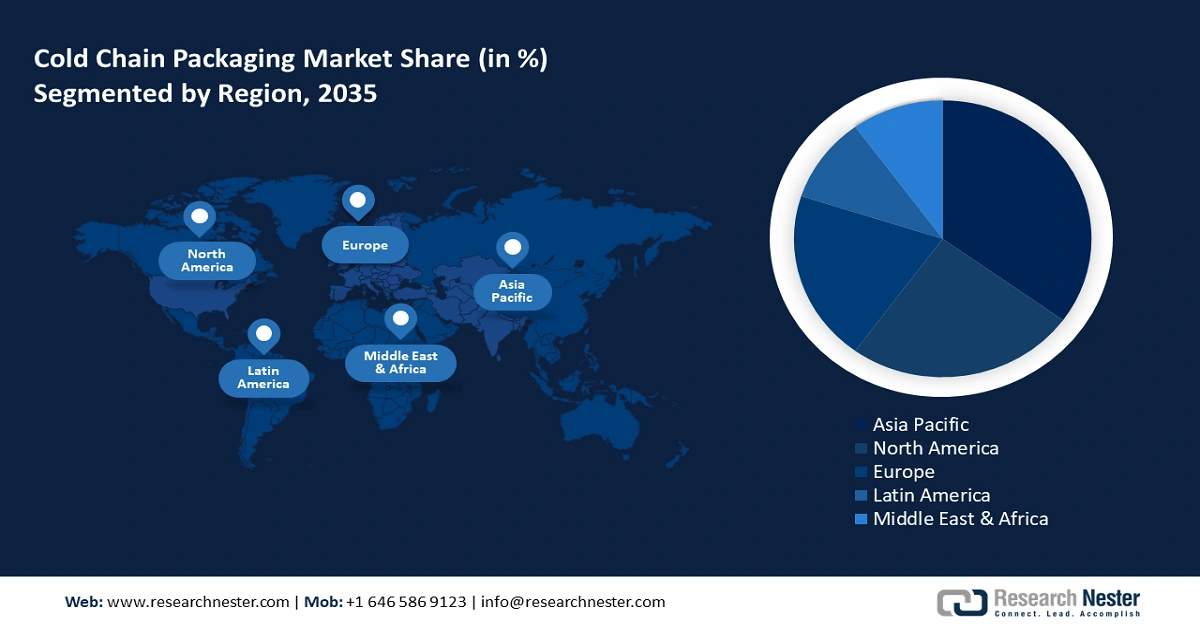

- Asia Pacific cold chain packaging market, the largest share by 2035, is driven by rising population boosting demand for dairy, vegetables, and meat products.

Segment Insights:

- The dairy product segment in the cold chain packaging market is projected to exhibit noteworthy growth from 2026-2035, fueled by higher household consumption of milk and dairy products.

Key Growth Trends:

- Growing Demand for Fresh Vegetables

- Rising Export and Import Volume of Fruits

Major Challenges:

- Negative Government Initiatives regarding Cold Chain Packaging

- High Cost Associated with the Manufacturing

Key Players: Sonoco Products Company, Huntsman International LLC, Vericool Inc., The Dow Chemical Company, Covestro AG., BioPak Pty Limited, Armstrong Brands, Inc., Mondi plc, Amcor plc, Novolex Holdings, LLC.

Global Cold Chain Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33.35 Billion

- 2026 Market Size: USD 36.86 Billion

- Projected Market Size: USD 100.84 Billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Cold Chain Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Fresh Vegetables - As of 2022, the export volume of fresh and processed vegetables from India was estimated to be approximately USD 800 million and USD 400 million respectively.Fresh vegetables are consumed by the global population at a high scale since it consists of low calories and countless health properties. Vegetables are mixed in various types of cuisines and dishes to improve their appearance and quality. it has been found that consuming a rich diet of fruits and vegetable reduces the risk of blood pressure, stroke, heart disease, cancer, and eye disorders.

- Rising Export and Import Volume of Fruits- For instance, in 2022, fresh fruits worth nearly USD 850 million were exported across the globe while the total export volume of processed fruits was estimated to be around USD 750 million.

- Increasing Consumption of Milk - In 2021, the total consumption of milk in India was estimated to be around 80,000 metric tons, additionally, the United States accounted for approximately 20,000 metric tons, and for the EU the figure reached nearly 22,000 metric tons.

- Skyrocketing Demand for Cold Chain Packaging in Pharmaceutical Industry - The total revenue generated by the pharmaceutical industry was estimated to be around USD 1.5 trillion in 2021.

Challenges

-

Possibility of Negative Impact on the Environment

-

Negative Government Initiatives regarding Cold Chain Packaging

-

High Cost Associated with the Manufacturing

Cold Chain Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 33.35 Billion |

|

Forecast Year Market Size (2035) |

USD 100.84 Billion |

|

Regional Scope |

|

Cold Chain Packaging Market Segmentation:

Application Segment Analysis

The global cold chain packaging market is segmented and analyzed for demand and supply by application into fruits & vegetables, meat & seafood, dairy product, bakery, pharmaceuticals, and others, out of which, the dairy product segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the higher consumption of milk and other dairy product in household settings on a daily basis. For instance, in 2020, milk production across the globe was estimated to reach approximately 900 million tonnes.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Chain Packaging Market Regional Analysis:

Regionally, the global cold chain packaging market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in the Asia Pacific region is projected to hold the largest market share by the end of 2035. The growth of the market can be ascribed to the rising population boosting the demand for daily purchases of dairy products, vegetables, meat, and others. As of 2018, the total Asian population was projected to reach approximately 45 million. Additionally, the growing export volume of vegetables and rising disposable income are further anticipated to hike the growth of the market in the region over the forecast period. Hence, all these factors are projected to flourish the market growth during the forecast period.

Cold Chain Packaging Market Players:

- Sonoco Products Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC

- Vericool Inc.

- The Dow Chemical Company

- Covestro AG.

- BioPak Pty Limited

- Armstrong Brands, Inc.

- Mondi plc

- Amcor plc

- Novolex Holdings, LLC

Recent Developments

-

Mondi plc to build strategic collaboration with Heiber + Schroder. The collaboration between these companies is placed to launch eComPack, a high-performance machine, for automated packaging. The machine is developed to provide work efficiency with mid to large-size eCommerce operations.

-

Amcor plc’s Amcor Rigid Packaging (APR) unit to unveil a new line of packaging, DairySeal, featuring ClearCor. The DairySeal Line has been developed and launched for the ready-to-drink and other dairy alternatives to receive more sustainable packaging.

- Report ID: 4532

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Chain Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.