Cloud Load Balancers Market Outlook:

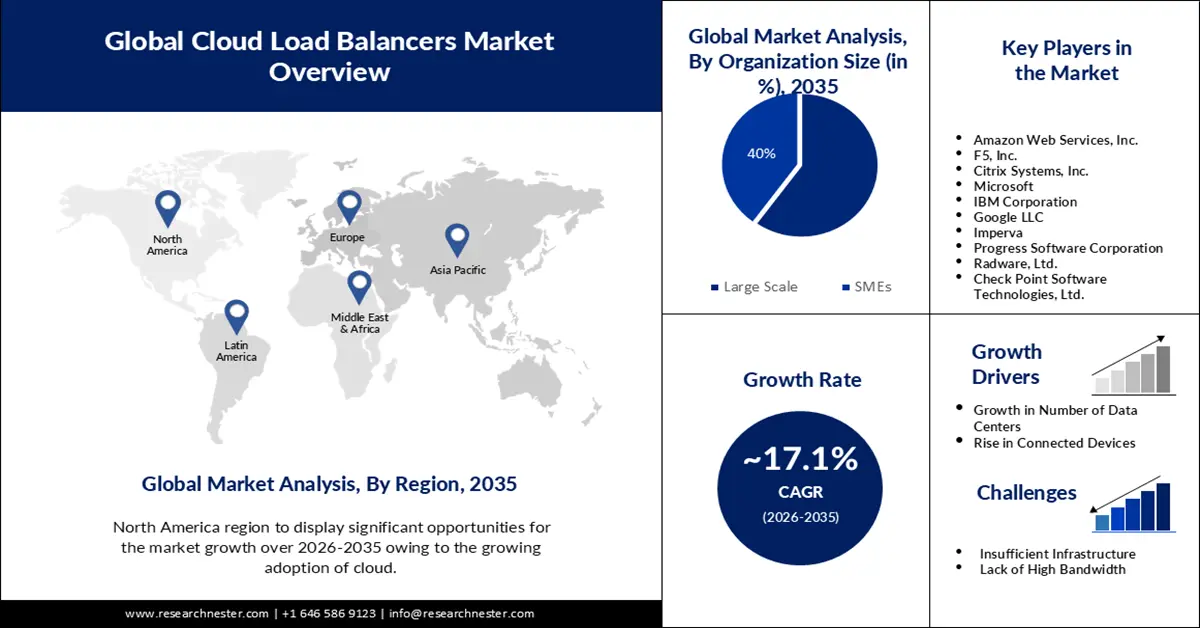

Cloud Load Balancers Market size was over USD 10.29 billion in 2025 and is poised to exceed USD 49.89 billion by 2035, witnessing over 17.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud load balancers is estimated at USD 11.87 billion.

This growth of the market could be due to growing preference for e-commerce. Further, as e-commerce expands, so would the number of online shoppers globally. As of 2023, there are about 3 billion digital consumers worldwide. This represents approximately 32% of the world's population. Hence, cloud load balancers are estimated to be beneficial for e-commerce businesses since their workload is set to increase.

Additionally, the government is focusing on digital transformation and launching various programs in order to encourage companies to adopt digitalization. The government itself made great progress in digitalizing its services and adopting the cloud. They are putting great emphasis on e-government further boosting the need for cloud load balancers in order to efficiently manage its data.

Key Cloud Load Balancers Market Insights Summary:

Regional Highlights:

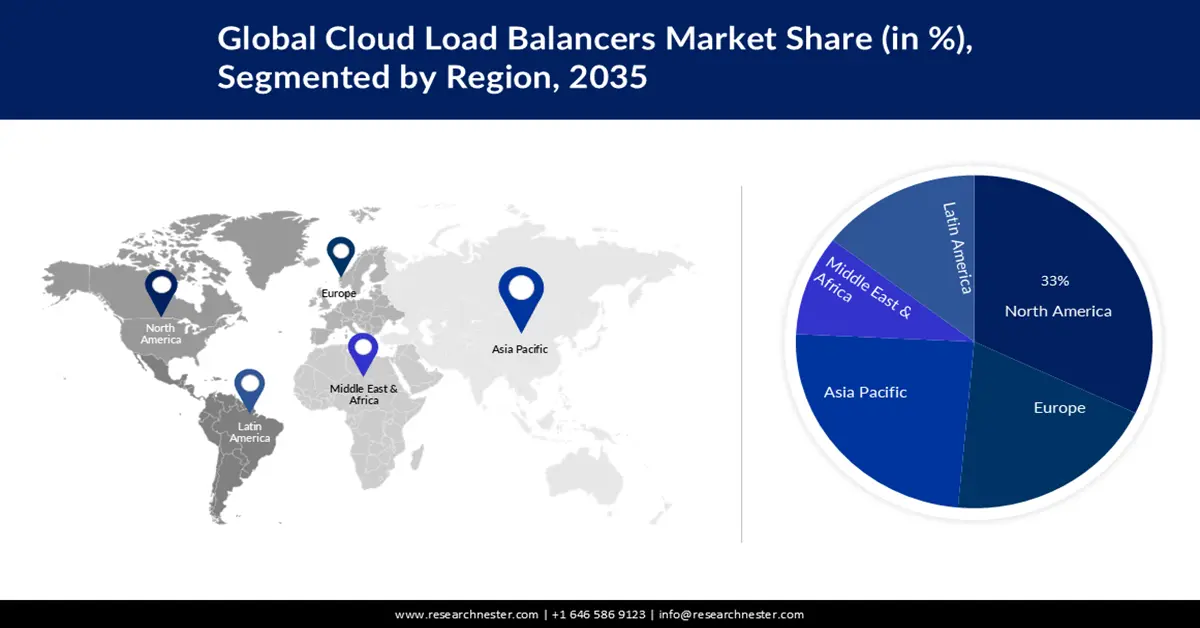

- The North America cloud load balancers market is projected to capture a 33% share by 2035, fueled by growing adoption of the cloud.

- The Asia Pacific market is anticipated to experience substantial CAGR from 2026 to 2035, attributed to mechanical improvements and shift towards cloud load balancers.

Segment Insights:

- The it & telecom segment in the cloud load balancers market is projected to maintain the highest market share by 2035, attributed to high workloads and network needs in IT and telecom sectors.

- The large scale segment in the cloud load balancers market is anticipated to experience significant growth over 2026-2035, driven by the need for fast, reliable content delivery.

Key Growth Trends:

- Growth in the Number of Data Centers

- Rise in the Number of Connected Devices

Major Challenges:

- Insufficient Infrastructure

- Lack of High Bandwidth

Key Players: Amazon Web Services, Inc., F5, Inc., Citrix Systems, Inc., Microsoft, IBM Corporation, Google LLC, Imperva, Progress Software Corporation, Radware, Ltd., Check Point Software Technologies, Ltd.

Global Cloud Load Balancers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.29 billion

- 2026 Market Size: USD 11.87 billion

- Projected Market Size: USD 49.89 billion by 2035

- Growth Forecasts: 17.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Cloud Load Balancers Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the Number of Data Centers Currently, there are about 7,999 data centers all across the world. Hence, the demand for cloud load balancers is poised to grow. Data center cloud load balancing typically involves two application scenarios. One approach is to evenly distribute network traffic or large-scale concurrent access to several server nodes in order to create multiple servers that could reply to requests from various users. Another is to distribute the load from the large-scale compute unit evenly among several servers.

- Rise in the Number of Connected Devices As connected devices become more commonplace, there is bound to be a growth in the need for cloud load balancing. IoT also sees widespread use of cloud load balancers as a result of the need for powerful request processing due to device interconnection. Global sensor deployment initiatives in numerous industries and the multi-access edge computing revolution are both growing the customer base for cloud load balancers. Since artificial intelligence solutions need to be highly responsive and include models, the demand for load-balancing components is rising significantly.

- Surge in the Number of Small Businesses Currently, there are about 315 million small enterprises worldwide. Implementing an effective cloud load balancing provider allows companies to give superior cloud service quality to all of their clients and increase their long-term dependability. The fact that everything is accomplished at a substantially cheaper cost of ownership is a benefit. Hence, the adoption of cloud load balancers is on the rise.

Challenges

- Insufficient Infrastructure

- Lack of High Bandwidth - One of the key problems impeding market expansion is the absence of high bandwidth service providers. It is frequently essential to use high bandwidth suppliers for an effective load-balancing strategy. However, difficulties associated with the implementation of advanced load balancer components in a conventional systems administration environment limit the rise of the load balancer market.

- Lack of Skilled Workers

Cloud Load Balancers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 10.29 billion |

|

Forecast Year Market Size (2035) |

USD 49.89 billion |

|

Regional Scope |

|

Cloud Load Balancers Market Segmentation:

Vertical Segment Analysis

The IT & telecom segment in the cloud load balancers market is set to garner highest revenue by the end of 2035. The IT and telecom industries provide the basis for operating for every sectors of the economy hence, further creating a huge workload. In terms of controlling workloads, distributing resources is important in the IT industry, where cloud load balancers are closely entwined. Furthermore, networking plays a significant role in the telecommunications sector, and cloud load balancers are crucial for distributing traffic.

Organization Size Segment Analysis

The large-scale segment is anticipated to have significant growth over the predicted period. Industrial revolutions, modularity, and successful industrial interoperability offer large enterprises a competitive edge in the market. Due to the urge to be present in the age of technology, large enterprises are using solutions that enable them to offer speedy and reliable content across several servers. Owing to this growing demand, large enterprises have embraced cloud load balancers more frequently.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Load Balancers Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 33% by 2035, backed by growing adoption of the cloud. Every industry of the economy in this region has embraced cloud-based services, making the North America region the area where cloud computing services initially gained popularity. In order to maintain flexibility and scalability, more businesses are expected to integrate their infrastructure and systems with load balancers, which is expected to fuel market expansion in the region.

Additionally, this region's rapid adoption of cutting-edge technology and large expenditure on information and communication technologies are the prime factors boosting the market revenue for cloud load balancer. Further, this region has a high number of online gamers, and video streamers, driving the need for data center service. Moreover, about 24% of North American employees were expected to work almost permanently commencing in 2022. This could also be an influencing factor for market growth.

Asia Pacific Market Forecast

The Asia Pacific cloud load balancers market is estimated to register substantial growth rate through 2035. The economies of numerous nations, including China, India, Japan, and many others, have an important effect on the APAC region. Businesses in these countries desire more capable, trustworthy, cost-effective, and secure cloud-based load balancers. The mechanical improvements in this area and the increasing shift towards cloud load balancers are predicted to provide further benefits for the surge in the global cloud load balancers market share.

Cloud Load Balancers Market Players:

- Amazon Web Services, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F5, Inc.

- Citrix Systems, Inc.

- Microsoft

- IBM Corporation

- Google LLC

- Imperva

- Progress Software Corporation

- Radware, Ltd.

- Check Point Software Technologies, Ltd.

Recent Developments

- CloudGuard Network Security with Azure Gateway Load Balancer has been made available, according to Check Point Software Technologies, Ltd. With the premier advanced threat prevention solution from Check Point, Azure security is strengthened. Customers could now more effectively defend their data, applications, and services from potential threats in the cloud thanks to CloudGuard, and the integration makes it easier to create secure Azure installations.

- Clinical apps are currently being developed and deployed by eHealth NSW, the digital division of NSW Health, using its cloud architecture, which was created in collaboration with the hyperscale providers Amazon Web Services, Inc. and Microsoft Azure.

- Report ID: 5077

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Load Balancers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.