Cloud API Market Outlook:

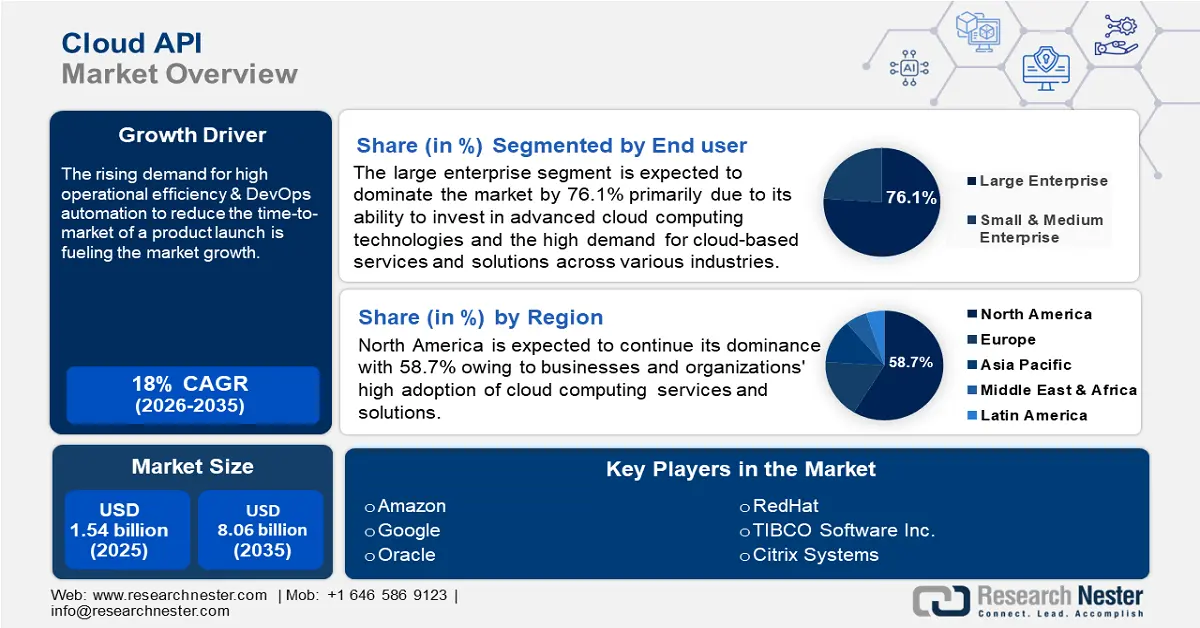

Cloud API Market size was valued at USD 1.54 billion in 2025 and is likely to cross USD 8.06 billion by 2035, registering more than 18% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud API is assessed at USD 1.79 billion.

Cloud APIs are among the revolutionary changes that are emerging within the technological environment to bring disparate software applications and cloud services together with minimal resistance to interact. With the rising number of companies that have made the transition to cloud-based solutions, the demand for APIs has been high to make these applications scalable so they can leverage the potential of cloud computing. For instance, in October 2024, SoftwareOne launched its new cloud competency center in collaboration with AWS in Malaysia. This establishment will assist customers with generative artificial intelligence (AI) tools. In addition, it will offer a single API to access and leverage high-performing foundation models from top AI companies. This enables organizations to gain agility and scalability by empowering teams.

Furthermore, the growing interest in real-time analytics and the need to make data-driven decisions further fuel the growth of the cloud API market as organizations look for ways to process large quantities of data generated by the operations. For instance, in August 2024, Oracle announced that its Enterprise Communications Platform (ECP) will now integrate AT&T network APIs and IoT connectivity. Through this integration, users of Oracle's industry cloud applications will be able to connect and control their Internet of Things devices on the AT&T network from a single platform. Overall, these factors have been converging and propelling the market forward into its position as a critical enabler of digital transformation across industries.

Key Cloud API Market Insights Summary:

Regional Highlights:

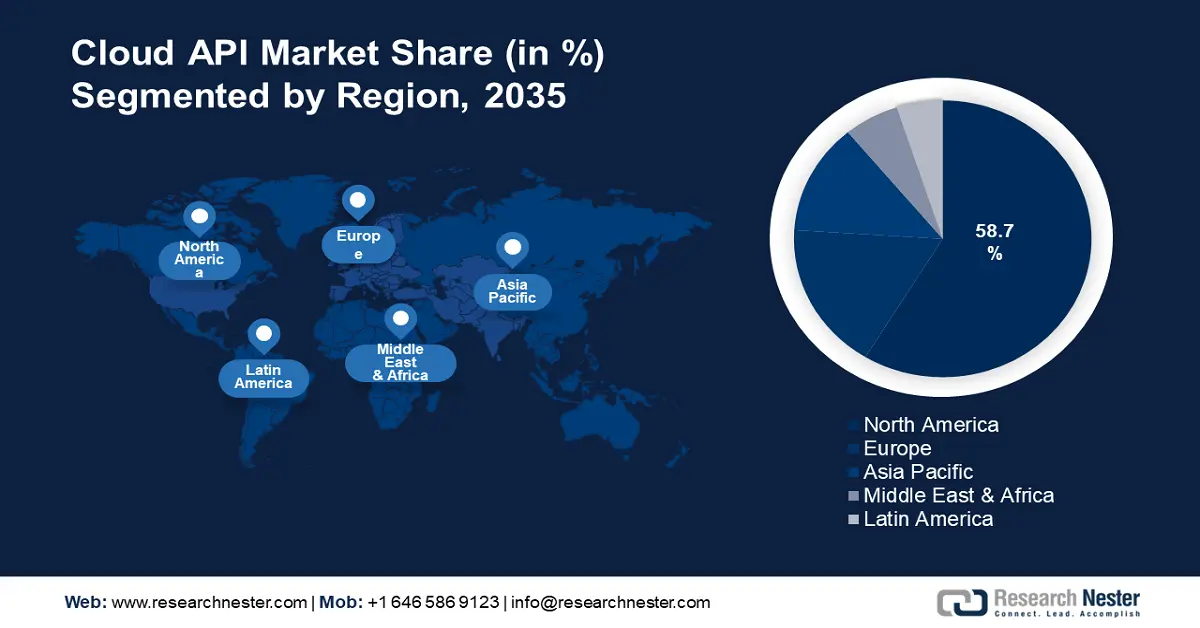

- North America dominates the Cloud API Market with a 58.7% share, propelled by the need for secure, timely, and cost-effective cloud API solutions to enable remote work and increased investments in cloud computing capabilities, driving growth through 2026–2035.

Segment Insights:

- The IT and Telecommunication segment is projected to hold a significant share by 2035, driven by the rapid expansion of 5G technology requiring advanced APIs.

- Large Enterprises segment are forecasted to hold over 76.1% share by 2035, driven by the need for enhanced data interoperability and integration across business units.

Key Growth Trends:

- Growing developer ecosystem

- Rise in microservices architecture

Major Challenges:

- Monitoring and management

- Vendor lock-in

- Key Players: Amazon, Google, Salesforce, SAP SE, IBM Corporation, Citrix Systems, RedHat.

Global Cloud API Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.54 billion

- 2026 Market Size: USD 1.79 billion

- Projected Market Size: USD 8.06 billion by 2035

- Growth Forecasts: 18% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (58.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, Australia

Last updated on : 13 August, 2025

Cloud API Market Growth Drivers and Challenges:

Growth Drivers

- Growing developer ecosystem: The ecosystem in cloud API market has increased the number of developers equipped with the tools, resources, and community support needed to create and integrate APIs properly. For instance, in November 2024, Comviva and AWS announced their collaboration to create a cloud-first, AI-driven strategy that will speed up time to market and encourage non-linear revenue growth. Comviva will supply next-generation software platforms and products to Communication Service Providers (CSP) via a Software-as-a-Service (SaaS) model. Such innovations not only build speed and efficiency into API development but foster best practices that lead to more robust and scalable cloud solutions.

- Rise in microservices architecture: The architectural approach in the cloud API market allows the development of applications as a collection of loosely coupled services, where each is responsible for some specific functionalities. Organizations are increasingly using microservices to improve scalability and flexibility. For instance, in June 2022, according to the 2022 Service Mesh Adoption Survey, conducted by Solo.io, 85% of businesses are switching to microservices architecture for their apps. Microservices' quick development and uptake contribute to its mainstreaming. The report further states, that the service mesh and API gateways are helping businesses to manage the increasingly complex application environment.

Challenges

- Monitoring and management: The most crucial challenge in the cloud API market is the difficulty in monitoring API usage and performance metrics in different environments and applications. As APIs multiply in an organization, tracking their interactions and anomaly detection and lifecycle management will become increasingly complicated. Without monitoring tools and practices, organizations risk experiencing problems such as poor performance, exposed security vulnerabilities, and failures in compliance, which can ultimately render ineffective the promise that cloud APIs seek to fulfill.

- Vendor lock-in: One of the major challenges in the cloud API market is vendor lock-in because an organization may become overdependent on a single cloud service provider for its API solution. This is one of the most relevant reasons for such a challenge because most cloud APIs are proprietary and therefore do not allow for much interoperability, making it challenging for organizations to shift their applications or data to other platforms. This dependency, however, limits flexibility in vendor choice or switching. Also, it can become expensive and diminish bargaining power over time.

Cloud API Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18% |

|

Base Year Market Size (2025) |

USD 1.54 billion |

|

Forecast Year Market Size (2035) |

USD 8.06 billion |

|

Regional Scope |

|

Cloud API Market Segmentation:

End user (Large Enterprise, Small & Medium Enterprise)

Large enterprise segment is poised to account for cloud API market share of more than 76.1% by the end of 2035, owing to the growing need for enhanced data interoperability and integration across diverse business units and systems. As a result, large enterprises are increasing investments and demanding cloud APIs to integrate and optimize their operations in a very data-driven business environment. For instance, in November 2024, Google Cloud and KPMG LLP announced a significant extension of their partnership aimed at promoting cybersecurity, data analytics, and generative AI among Fortune 500 companies. The Google Cloud practice will receive a historic USD 100 million investment from KPMG

Vertical (BFSI, IT and Telecommunication, Manufacturing, Education, Healthcare, and Media & Entertainment)

The IT and Telecommunication segment continues to hold a significant share of the cloud API market attributable to the rapid expansion of 5G technology, which requires stronger APIs to support the deployment and management of new services and applications. For instance, in September 2024, Ericsson announced collaborating with telecom giants such as América Móvil, AT&T, Bharti Airtel, Deutsche Telekom, Orange, Reliance Jio, Singtel, Telefonica, Telstra, T-Mobile, Verizon, Vodafone. This collaborative move aimed to open their networks and use a global platform for combined network APIs to make advanced network capabilities such as 5G easily accessible.

Our in-depth analysis of the global market includes the following segments:

|

End user |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud API Market Regional Analysis:

North America Market Statistics

North America in cloud API market is estimated to capture around 58.7% revenue share by the end of 2035. In order to enable remote work for their staff members, such as contact center agents and creative professionals, organizations are in greater need of safe and effective solutions. By providing specialized cloud-based API solutions that guarantee security, timeliness, and cost-effectiveness, providers are meeting this need.

The cloud API market in the U.S. is experiencing remarkable growth owing to the presence of well-established businesses rendering their expertise services in cloud services. Furthermore, businesses tend to invest more in widening their portfolios and gaining proficiency in cloud computing capabilities. For instance, in January 2024, AWS announced its plans to invest USD 14.9 billion by 2027 to support the growing artificial intelligence (AI) services in Japan and strengthen its cloud computing capabilities.

Several investments are also being made in the cloud API market in Canada, which greatly accelerates the uptake of cloud computing. For instance, in June 2024, the federal and provincial governments emphasized the value of the Arbutus Cloud infrastructure for Canada research. To revitalize the Arbutus Cloud infrastructure, the Digital Research Alliance of Canada provided USD 10.2 million, making it the country's top research cloud and one of the five National Host Sites. In addition, a USD 6.1 million investment was also announced by the British Columbian government to support the Arbutus Cloud renewal efforts.

Europe Market Analysis

The cloud API market in Europe is expected to be one of the emerging regions during the forecasted timeline. As businesses digitize their processes, maintaining data security and regulatory compliance becomes more important. Such technologically advanced solutions comply with regulations and offer strong security measures, many cloud providers are appealing to businesses that handle sensitive data. Moreover, the growing complexity of cloud solutions and the need for businesses to strategically use these tools are reflected in the emphasis on API management.

The cloud API market in Germany is significantly growing due to the rising need for application development and maintenance services and increasing reliance on cloud computing and mobile applications. For instance, in August 2024, IONOS introduced a platform for utilizing the most significant generative open-source AI models with its new AI Model Hub offering. The platform is housed in German data centers on IONOS' independent cloud infrastructure. Through a common API, businesses can incorporate the models that generate text and images into their applications.

The companies in the cloud API market in France are experiencing a transformation in providing efficacy in services to their end users. For instance, in December 2024, four top mobile operators in France namely Bouygues Telecom, Free, Orange, and SFR announced to collaborate to assist app developers in combating online fraud and safeguarding digital identities. of mobile users. Two network APIs such as KYC Match and SIM Swap being introduced by the operators for the French market under the new CAMARA standard.

Key Cloud API Market Players:

- TIBCO Software Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon

- Oracle

- RedHat

- SAP-HANA

- CA Technologies Inc.

- Microsoft Corporation

- Citrix Systems

- Rackspace Inc.

- Zend Technologies Ltd. Inc.

- Dell

- IBM Incorporation

- Salesforce

The global cloud API market is highly competitive with the presence of several established players and new entrants. They are constantly offering high-end cloud API services, including API gateways, security, and analytics. For instance, in May 2024, Private AI released a Cloud API, a tool for its cutting-edge PII detection, redaction, and data minimization. This innovative API has the potential to handle and safeguard sensitive client data. The Private AI Cloud API is positioned to be a crucial tool for developers and businesses alike due to its unmatched ease of use, scalability, and accuracy. Here's the list of some key players:

Recent Developments

- In September 2024, Kong Inc., unveiled its most recent iteration of Kong Konnect, the API platform for the AI era at API Summit 2024. Kong Konnect is the enterprise-grade unified platform that allows businesses all over the world to safely develop, implement, and manage API and GenAI applications.

- In June 2024, Nokia and Google Cloud joined forces to use telco APIs to speed up 5G applications. Collaboration between these two providers enabled developers globally to produce 5G applications more quickly and enhance the developer experience with generative AI capabilities.

- Report ID: 6833

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud API Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.