Cloud Kitchen Market Outlook:

Cloud Kitchen Market size was valued at USD 82.5 billion in 2025 and is projected to reach USD 263.3 billion by the end of 2035, rising at a CAGR of 12.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cloud kitchen is estimated at USD 92.6 billion.

The cloud kitchen market is being shaped by the structural shifts in urban consumption, digital payments, and foodservice formalization, as evidenced by the public sector data rather than private company disclosures. The rapid urbanization is a core demand driver, as the WHO data in November 2024 indicates that 55% of the world population lives in urban areas, and this percentage is expected to rise in the coming years. This data directly increases the reliance on off-premise food consumption in dense cities where the commercial real estate costs remain high. The government data also indicates sustained growth in the food delivery and takeaway industry. The USDA August 2024 report shows that spending on food away from home has increased by 12% and grew to USD 4,485 per capita in 2023. This reflects the long-term shift towards externally prepared meals.

From a supply-side perspective, the cloud kitchen market growth is supported by the government-backed MSME digitization and food safety compliance programs. The report from the PIB in June 2025 depicts that over 5.70 crore MSMEs were registered on the Udyam portal till 2025, many operating in food processing and services, supported by the credit-linked subsidy and digital onboarding schemes. Food safety authorities are also formalizing operations; the Food Safety and Standards Authority of India reported a rise in licensed food businesses, improving the regulatory clarity for delivery-only operators. In Europe, the European Commission highlights that online food services are a growing component of the digital economy, with many consumers ordering food online at least once a year. Collectively, the trends such as the urban density, rising food-away-from-home expenditure, MSME digitalization, and regulatory formalization are creating a scalable operating environment for cloud kitchens without reliance on dine-in infrastructure.

Key Cloud Kitchen Market Insights Summary:

Regional Highlights:

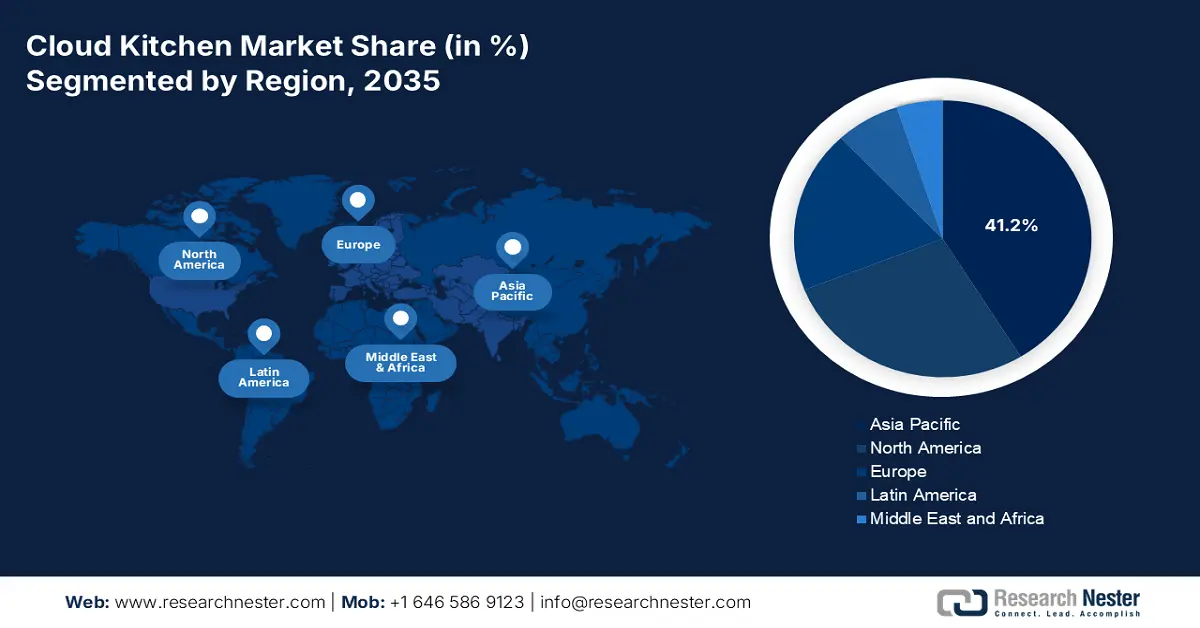

- Asia Pacific in the cloud kitchen market is expected to secure a 41.2% revenue share by 2035, as large digitally native urban populations, widespread smartphone adoption, and government-backed SME digitalization collectively accelerate food delivery penetration.

- North America is projected to grow at a CAGR of 10.8% during 2026-2035, as leading quick-service restaurant chains and delivery platforms scale capital-efficient cloud kitchen models, reinforced by high digital food expenditure and dense urban logistics networks.

Segment Insights:

- The chain-based delivery kitchen segment in the cloud kitchen market is forecast to capture a 45.6% share by 2035, as established restaurant brands expand delivery-only operations to tap rising off-premise demand, anchored by strong brand equity and advanced supply chain integration.

- The platform-to-consumer segment is emerging as the leading order platform category over 2026-2035, as major food delivery apps deploy proprietary cloud kitchens and virtual brands at scale, strengthened by expansive digital consumer ecosystems.

Key Growth Trends:

- The shift in household food expenditure patterns

- Public investment in employment and skill development programs

Major Challenges:

- Prohibitive real estate & operational costs

- Dependence on third-party delivery platforms

Key Players: DoorDash Kitchens (U.S.), REEF Technology (U.S.), Kitchen United (U.S.), Trailer Park (South Korea), Keatz (Germany), Wolt (DoorDash) (Finland), Deliveroo Editions (UK), Swiggy Access (India), Zomato Infrastructure Services (India), Rebel Foods (India), Wow! Momo Foods (India), Gourmet Kitchen (Japan), Kitch (Portugal), Taster (France), Tclouds (Malaysia), Food Market Hub (Malaysia), Tokyo Kitchen (Japan), Karma Kitchen (UK), Tuk Tuk (Australia), Cloud Eats (Australia).

Global Cloud Kitchen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 82.5 billion

- 2026 Market Size: USD 92.6 billion

- Projected Market Size: USD 263.3 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, United Kingdom, Japan

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 8 January, 2026

Cloud Kitchen Market - Growth Drivers and Challenges

Growth Drivers

- The shift in household food expenditure patterns: The government consumption data show a sustained shift toward food prepared outside the home. This is strengthening long term demand for the cloud kitchen market. In the U.S., the USDA data in August 2024 depicts that the food-away-from-home spending increased by 7.1% in 2023. This structural change reflects time constraints, dual-income households, and urban lifestyles rather than short-term trends. Similar patterns are noted by the OECD, which highlights an increased reliance on prepared meals in urban economies across Europe and Asia. For cloud kitchens, this demand shift favors standardized repeatable menus optimized for delivery rather than dine in experience. This expenditure shift is reinforcing the scale efficiencies and centralized production models, allowing cloud kitchen operators to optimize the ingredient sourcing, labor utilization, and unit economies compared with traditional dine-in formats.

- Public investment in employment and skill development programs: Government-funded skill development initiatives are expanding the labor pool required for standardized process-driven kitchen operations. The report from the MSDE in 2023-2024 indicates that there are 1,019 training centers, such as Skill India Mission, including the food processing and hospitality roles. Moreover, the 50,000 young people, with 60% women, benefit from this mission, which is one of the key drivers in the cloud kitchen market. Similarly, the International Labor Organization notes that the government-backed vocational training in food services across the APAC has improved workforce readiness for centralized kitchen models. Cloud kitchen which rely on standardized workflows rather than front-of-house staff benefit from such programs by reducing the training costs and labor volatility. This growing availability of semi-skilled certification-backed labor enables faster multi-location rollouts and supports consistent service quality across high-volume delivery kitchens.

- Rising online food delivery platforms: The rise of the online food delivery ecosystem is a key driver of the cloud kitchen market. This growth is due to the advantage in platform-based ordering, as it expands consumer access to diverse cuisines without reliance on physical storefronts. Mobile food delivery platforms aggregate to a large user bases lowering the customer acquisition costs and enabling delivery-only kitchens to operate at scale. In India, the leading food delivery platforms have millions of active users monthly, indicating sustained growth in digital food consumption. This expansion is reinforced by the rising internet accessibility and digital transaction adoption. The report from the International Labor Organization in May 2025 states that nearly 67.6% of people in 2024 had internet access, indicating the active utilization of food orders. Further, combined with simplified e-banking and a real-time payment system, this digital infrastructure supports the higher-order frequency menu customization and repeat consumption.

Challenges

- Prohibitive real estate & operational costs: Securing and outfitting the urban real estate with the commercial-grade ventilation, gas, and electrical systems demands a massive upfront capital, which is a major constraint in the cloud kitchen market. The high rents in prime delivery zones erode thin margins. The top players tackle this by converting underutilized urban assets such as parking lots into modular kitchen pods, significantly reducing the traditional build-out costs and leveraging non-prime real estate. Their model demonstrates an innovative workaround to one of the sector’s biggest barriers to entry. The need for such innovation is clear, as commercial rents in the U.S. have surged, squeezing the new entrants.

- Dependence on third-party delivery platforms: High commission fees from the platforms, such as DoorDash and Uber Eats reduces the profitability. This dependence also cedes customer data and relationship control. The player in the cloud kitchen market in India strategically built its own dedicated delivery fleet and app to complement aggregator sales, regaining the margin and direct customer access. Their hybrid approach is vital as the aggregators' commission can consume a certain percentage of an average order value, making unit economics challenging without a diversified sales channel.

Cloud Kitchen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 82.5 billion |

|

Forecast Year Market Size (2035) |

USD 263.3 billion |

|

Regional Scope |

|

Cloud Kitchen Market Segmentation:

Nature Segment Analysis

The chain-based delivery kitchen is dominating the nature segment in the cloud kitchen market and is poised to hold the share value of 45.6% by 2035. The segment is distinguished by its leverage of existing brand equity and advanced supply chains. These kitchens are operated by established restaurant chains such as the Chick fil A, Panera, or Sweetgreen, specifically for delivery and takeaway, allowing them to expand their digital footprint without the overhead of full-scale dine-in facilities. This model efficiently captures the growing off-premise demand while maintaining strict towards digital ordering. The report from the National Restaurant Association in 2025 depicts that 35% of the limited service restaurants are likely to be open in 2025. The trend fundamentally motivates large chains to prioritize dedicated efficiency cloud kitchen formats to capture this revenue stream.

Order Platform Segment Analysis

Under the order platform, platform to consumer segment is leading the segment in the cloud kitchen market, leveraging the immense market power of major food delivery apps. By operating their own dedicated cloud kitchens, these platforms create a high-efficiency closed-loop ecosystem. They can rapidly launch and test virtual brands using proprietary consumer data, guarantee delivery fleet allocation, and capture all revenue streams from both the brand and the delivery fee. This model’s growth is underpinned by the vast digital consumer base. The USDA in December 2024 report states that hotel companies have surged their expansion plans, resulting 35%rise in opening new hotels or expanding existing ones. This data highlights the rapid shift to platform medicated transactions.

Type Segment Analysis

The commissary/shared kitchen model is dominating the type segment in the cloud kitchen market, which functions as the essential infrastructure backbone for industry growth. Unlike the independent single-brand kitchens, these large centralized facilities house multiple restaurant brands under one roof, sharing utilities, equipment, and space. This model dramatically lowers the barrier to entry for entrepreneurs and reduces the expansion costs for the established chains by eliminating the need for individual real estate investment and fit-outs. Its economic necessity is clear in government data tracking business formulation. For example, a report indicates that the food services and drinking places sector indicates a substantial proportion of new market entrants relied on shared commercial kitchen spaces or similar low capital models to launch, fueling the segment’s expansion.

Our in-depth analysis of the cloud kitchen market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Nature |

|

|

Product Type |

|

|

Service Type |

|

|

Order Platform |

|

|

Technology Integration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Kitchen Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the cloud kitchen market and is expected to hold the revenue share of 41.2% by 2035. The market is defined by the explosive demand, intense innovation, and a complex, multi-layered competitive landscape. This dominance is driven by a confluence of powerful self-reinforcing factors. The region’s massive digitally native and increasingly affluent urban population provides an unparalleled addressable market for food delivery. Second, the exceptionally high penetration of smartphones and the super app ecosystem has made ordering food online a daily habit for hundreds of millions. Third, supportive government initiatives aimed at digitalizing small and medium enterprises, formalizing the food sector, and creating a favorable environment for organized, scalable food service models.

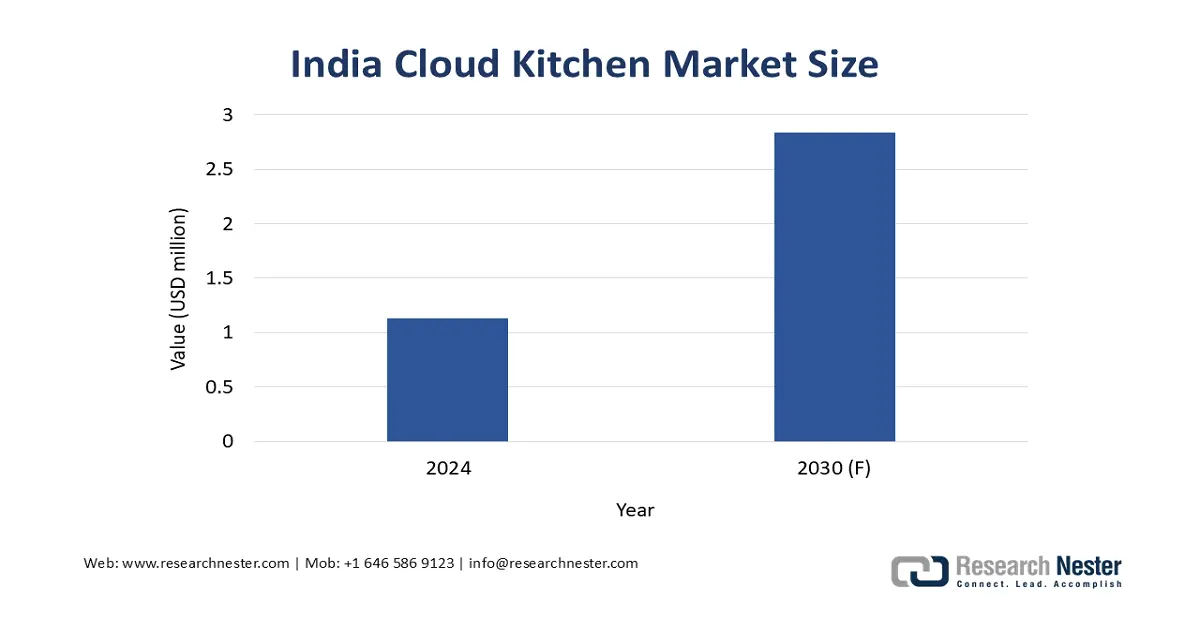

The India’s cloud kitchen market is expanding rapidly and is driven by the rising digital food ordering, cost-efficient business models, and supportive regulatory formalization. The report from the IBEF in August 2025 states that the 12% of the food delivery in the country is based on online services, and this share is projected to rise to 20%. The growth is supported by the increasing smartphone penetration, a growing middle-class population with higher disposable incomes, and sustained demand for convenience-led meal consumption. Post pandemic shifts have stimulated the cloud kitchen adoption beyond Tier 1 cities into Tier 2 and Tier 3 urban centers, improving the delivery density and scalability. With lower real estate and staffing costs compared to dine-in restaurants, cloud kitchens in India are well-positioned to scale via standardized menus, multi-brand operation, and platform-led distribution.

Source: IBEF August 2025

China cloud kitchen market is the most technologically integrated, defined by the dominance of its super app platforms such as Meituan and Alibaba’s Ele.me. The NLM study in July 2025 indicates that by the end of 2023, 49.9% of the internet users in China, which is over 500 million people, had used online food delivery services, making takeaway consumption a routine part of urban lifestyles. The market is defined by the high platform concentration, with Meituan Waimai and Ele.me are accounting for more than 90% of the food delivery transactions, providing cloud kitchens with immediate access to large, demand-dense user bases. Growth momentum is further stimulated during the pandemic period, reinforcing the delivery-first consumption habits that persist post pandemic. As China is expected to lead the global online food delivery revenue, cloud kitchens benefit from high order frequency, standardized menu execution, and platform-led logistics, positioning the country as the most scalable and competitive market globally.

North America Market Insights

North America is the fastest-growing cloud kitchen market and is poised to grow at a CAGR of 10.8% during the forecast period, 2026 to 2035. The market is defined by the maturity and consolidation transitioning from a fragmented landscape of independent operators to a strategy dominated by the major Quick Service Restaurants chains and food delivery platforms. The growth is propelled by the region’s high digital food spending, dense urban populations, ideal for delivery logistics, and the pursuit of capital-efficient expansion by established brands. The key trend is the scaling of enterprise-grade chain-operated ghost kitchens, which prioritize operational consistency and data-driven menu optimization over experimental virtual brands. The government influence is indirect but supportive; agencies such as the Small Business Administration in the U.S. provide financing pathways for operators.

The U.S. cloud kitchen market is consolidating, with growth driven by the major quick service restaurant chains leveraging cloud kitchens for capital efficiency and digital expansion. A primary trend is the professionalization of the space, moving from freelance virtual brands to enterprise-grade chain-operated facilities that ensure consistency and scale. This is supported by the robust digital spending. The report from the USDA August 2024 shows that the U.S. consumers spend 5.9% of their disposable personal income on food away from home in 2023, which is a rise of 5.6% from 2022. This data indicates an increased reliance on prepared and externally sourced meals. Cloud kitchens, which fall within the food away from home category, are structurally positioned to capture this demand via delivery only cost-efficient operating models. The trend reflects broader lifestyle factors, including time constraints and dual income households, reinforcing the U.S. market’s attractiveness for scalable standardized cloud kitchen expansion without dependence in dine in infrastructure.

Strategic relationships between kitchen operators and national supermarket or retail chains drive the Canada cloud kitchen market, which has a strong growth potential. The industry is closely tied to the urban delivery cost dynamics and consumer reliance on prepared food services. The Statistics Canada data in June 2024 shows that the prices for local messenger and delivery services, which include take-out food and grocery delivery, increased 3.6% YoY in April 2024, indicating a clear moderation in the last-mile delivery cost inflation. This easing cost environment supports improved unit economics for delivery-only kitchens operating in major urban centers. As the delivery expenses stabilize, the cloud kitchen operators gain a greater pricing flexibility and margin predictability, hence enabling scalable expansion without proportional increases in logistics costs.

Europe Market Insights

The Europe cloud kitchen market is evolving from a post pandemic delivery solution into a mature segment defined by strategic consolidation. The growth is driven by the sustained consumer demand for food delivery, high urban density, facilitating efficient last-mile logistics, and the need for traditional restaurants to expand digitally with lower capital expenditure. The key trends include the rise of integrated kitchen as a service platforms that provide infrastructure technology and operational support to multiple food brands and the expansion of large international operators via mergers and acquisitions. Further established quick service restaurant chains are increasingly adopting dedicated ghost kitchen models to enter new markets and serve digital only customer segment without the cost of a full dine-in location.

The Germany cloud kitchen market is characterized by the rapid adoption driven by a significant cultural shift towards food delivery and convenience in a traditionally dine-out-oriented culture. The growth is fueled by the high smartphone penetration, urban density, and the entry of international delivery platforms optimizing their local logistics networks. In Germany, the food service sales increased by 12.2% YoY to USD 91.3 billion in 2023, indicating a sustained rebound and expansion in out-of-home and takeaway food consumption, based on the USDA December 2024 report. This growth reflects on a changing consumer lifestyles including urban living, high workforce participation, and increasing reliance on convenient meal solutions. The cloud kitchen is well-positioned to capture this demand via delivery-focused standardized operating models that avoid high dine-in real estate costs common in German city centers. As the foodservice spending scales, the delivery-only kitchens benefit from improved order density and more predictable demand patterns.

Accommodation & Food Services Turnover (April 2022 vs Benchmarks)

|

Metric |

April 2022 vs March 2022 |

April 2022 vs April 2021 |

April 2022 vs Feb 2020 |

|

Real (price-adjusted) |

+2.6% |

+138.4% |

-24.0% |

|

Nominal (not price-adjusted) |

+3.6% |

Not specified |

Not specified |

Source: Destatis June 2022

Rising takeaway food prices alongside sustained consumer reliance on prepared meal is driving the UK cloud kitchen market. Its leadership is driven by London’s dense population, exceptionally high consumer acceptance of food delivery apps, and a competitive landscape of both agile startups and established quick service restaurant chains leveraging ghost kitchens for expansion. The report from the Office of National Statistics in May 2023 indicates that 3 in 10 fast food and takeaway items experienced an average price increase of 15% or more in the 12 months, highlighting persistent cost pressures across the foodservice sector. The demand for takeaway and delivered meals has remained resilient, suggesting limited short-term elasticity for the convenience-driven food consumption. For the cloud kitchens, this environment reinforces the importance of centralized production, standardized menus, and tight cost controls to mitigate input and pricing volatility.

Annual Rate for Fast Food and Takeaway Good Services

|

Name |

Annual Growth Rate (%) |

|

Takeaway fish and chips |

19 |

|

Takeaway or eat in burger |

17 |

|

Takeaway chicken & chips |

17 |

|

Takeaway cooked pastry |

15 |

|

Takeaway kebab |

14 |

|

Takeaway or delivery pizza |

13 |

|

Takeaway cold sandwich |

11 |

|

Takeaway coffee |

11 |

|

Takeaway tea |

10 |

|

Chinese takeaway, main-course |

10 |

|

Indian takeaway, main-course |

10 |

|

Takeaway soft drink |

10 |

|

Fast food and take away food service |

12.7 |

Source: Office of National Statistics May 2023

Key Cloud Kitchen Market Players:

- DoorDash Kitchens (U.S.)

- REEF Technology (U.S.)

- Kitchen United (U.S.)

- Trailer Park (South Korea)

- Keatz (Germany)

- Wolt (DoorDash) (Finland)

- Deliveroo Editions (UK)

- Swiggy Access (India)

- Zomato Infrastructure Services (India)

- Rebel Foods (India)

- Wow! Momo Foods (India)

- Gourmet Kitchen (Japan)

- Kitch (Portugal)

- Taster (France)

- Tclouds (Malaysia)

- Food Market Hub (Malaysia)

- Tokyo Kitchen (Japan)

- Karma Kitchen (UK)

- Tuk Tuk (Australia)

- Cloud Eats (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DoorDash Kitchens uses its dominance in food delivery to create a powerful synergy within the cloud kitchen market. Its key strategic goals include integrating its commissary kitchen with its massive logistics network, which ensures unprecedented delivery speed and efficiency for its virtual restaurant partners. By providing data-driven insights on the local food trends and demand gaps, DoorDash empowers entrepreneurs and established brands to launch a successful delivery only concepts with minimized risk and overhead. The company has made USD 60 billion in sales in 2024.

- REEF Technology is redefining the cloud kitchen market by transforming urban parking lots and underutilized real estate into neighborhood hubs known as kitchen pods. Their strategic initiatives focus on hyper-localization, placing compact modular kitchens in high-density residential areas to reduce delivery times drastically. Beyond food, REEF’s model integrates the last-mile logistics and services, creating a multi-use ecosystem that increases the unit economics and resilience of each location.

- Kitchen United operates as a key enabler and infrastructure provider in the cloud kitchen market, targeting both the brands and real estate owners. A core strategic initiative is their Kitchen United Mix platform, which offers a turnkey solution for restaurants to expand into new markets without capital expenditure. They also partner with large retail and grocery chains to convert dormant spaces into revenue-generating kitchen hubs, effectively democratizing access to prime delivery zones for a diverse portfolio of food concepts.

- Trailer Park stands out in the South Korea cloud kitchen market by focusing on a vertically integrated brand-centric model. Its strategic initiative involves not just providing kitchen infrastructure but also actively developing, operating, and scaling its own portfolio of delivery-only virtual brands. By controlling the entire process from R&D and data analytics to marketing and operations, the company achieves a strong brand consistency and can rapidly test and iterate on new concepts based on precise consumer data from the platform.

- Keatz is a major consolidator in Europe’s cloud kitchen market known for its multi-brand platform operating from centralized culinary studios. A key strategic initiative is its house of brands strategy, where it develops, acquires, and operates a wide array of virtual restaurant brands, from the burger joints to health bowls, all from the same facilities. This allows Keatz to maximize kitchen utilization, spread operational costs, and blanket delivery apps with a diverse menu offering that appears to consumers as distinct specialized restaurants.

Here is a list of key players operating in the global cloud kitchen market:

The global cloud kitchen market is fragmented and rapidly consolidating, with the top players those who are actively pursuing expansion and technological integration to secure dominance in the market. For example, in June 2024, London PE Finnest announced the acquisition and took a majority stake in the cloud kitchen firm Kitchens@ with a USD 160 million investment. The competitive landscape is fueled by the food tech giants and specialized pure play kitchen operators. Top companies follow strategic initiatives such as the geographic expansion via franchising and partnerships, using data analytics for optimized menu and location, and implementing advanced logistics software. Major players are also diversifying their brand portfolios via virtual restaurant concepts and forming exclusive partnerships with celebrity chefs and established dining brands to drive customer loyalty in a low-barrier-to-entry cloud kitchen market.

Corporate Landscape of the Cloud Kitchen Market:

Recent Developments

- In May 2025, Cloud kitchen startup Curefoods has marked its entry into North India with the acquisition of seven stores and four cloud kitchens in Delhi NCR. The deal expands Curefoods' reach to over 100 Krispy Kreme outlets, with plans for further growth in India’s western regions.

- In February 2024, Salad Days proudly announced the inauguration of its cloud kitchen in Mumbai's vibrant Chandivali district, situated within Andheri East. This strategic move has established a strong foothold across Mumbai’s key districts, including Andheri West, Lower Parel, and Khar.

- Report ID: 3928

- Published Date: Jan 08, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Kitchen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.