Houseware and Kitchenware Market Outlook:

Houseware and Kitchenware Market size was valued at USD 166.6 billion in 2025 and is projected to reach USD 279.3 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of houseware and kitchenware is evaluated at USD 175.4 billion.

The demand for houseware and kitchenware market continues to be shaped by the consumption trends, housing activity, and income-linked spending patterns across the major economies. In the U.S., the personal consumption expenditure on durable goods, including kitchen and household equipment, reflects a steady rise. Further, the OEC 2023 report depicts that the global trade of tableware and kitchenware, of wood, accounted for USD 2.08 billion, supported by the rising demand and continued household formation. The inflationary pressures have moderated but not disappeared. The report from the U.S. Bureau of Labor Statistics in December 2025 indicates that the consumer price index for household furnishings and operations, which encompasses appliances relevant to the houseware and kitchenware market, rose 4.1% over the 12 months ending September 2025.

From a structural standpoint, urbanization and housing investment remain key macro-level demand anchors. The World Health Organization report in November 2024 indicates that nearly 55% of the global population lives in urban areas, and this portion is expected to rise, sustaining a baseline demand for household goods across emerging markets. The OECD housing statistics further show that the residential construction spending across the economies rebounded modestly, improving the downstream procurement of kitchen and household items for new housing stock. In parallel, sustainability-linked procurement is gaining relevance in institutional and commercial channels. Overall, the houseware and kitchenware market is characterized by stable replacement-driven demand, strong exposure to macro consumption indicators, and increasing influence of public policy on materials, sourcing, and lifecycle management rather than rapid cyclical growth.

Key Houseware and Kitchenware Market Insights Summary:

Regional Highlights:

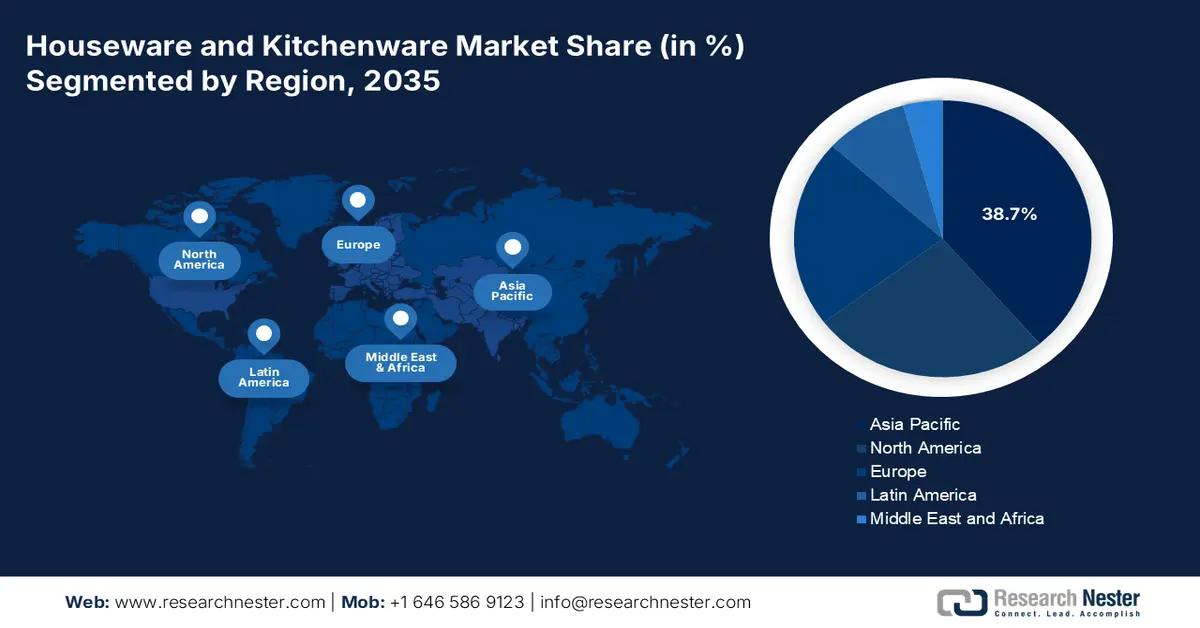

- Asia Pacific is projected to command a 38.7% share by 2035 in the houseware and kitchenware market, underpinned by rapid urbanization, rising middle-class incomes, and expanding modern retail and e-commerce penetration

- North America is anticipated to be the fastest-growing region during 2026–2035 at a CAGR of 4.2%, supported by steady housing activity, high disposable incomes, and accelerating omnichannel retail adoption

Segment Insights:

- Within the technology segment, the conventional sub-segment is expected to account for an 85.4% share by 2035 in the houseware and kitchenware market, sustained by frequent replacement cycles for essential durable household goods

- The residential end-user segment is set to retain the largest share by 2035, reinforced by continuous household demand for everyday items and upgrades linked to housing activity and lifestyle shifts

Key Growth Trends:

- Public housing investment and residential construction programs

- Trade policy, tariffs, and government import dependency

Major Challenges:

- Intense market competition and brand saturation

- Rapidly evolving consumer trends and product cycles

Key Players: The Vollrath Company, LLC (U.S.), Church & Dwight Co., Inc. (U.S.), SEB Group (France), Zwilling J. A. Henckels (Germany), WMF Group (Germany), Fissler (Germany), IKEA (Sweden), Dualit (UK), Meyer Corporation (U.S.), Instant Brands (U.S.), Tupperware Brands Corporation (U.S.), SharkNinja (U.S.), Midea Group (China), Zojirushi Corporation (Japan), Tiger Corporation (Japan), Lock & Lock (South Korea), Hawkins Cookers (India), TTK Prestige Ltd (India).

Global Houseware and Kitchenware Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 166.6 billion

- 2026 Market Size: USD 175.4 billion

- Projected Market Size: USD 279.3 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 6 January, 2026

Houseware and Kitchenware Market - Growth Drivers and Challenges

Growth Drivers

- Public housing investment and residential construction programs: Government-funded housing programs remain a foundational demand driver for the houseware and kitchenware market, mainly cookware, storage, cleaning tools, and other basic kitchen fittings required during the initial household setup. In the U.S., the federal and state housing expenditure continues to support steady residential formation. The U.S. Census Bureau in February 2025 indicates that the total value of the residential construction put in place exceeded USD 917.9 billion in 2024, sustaining downstream demand for household goods during move-in and refurbishment cycles. In Europe, the continued public co-financing for the energy efficient housing renovations under the cohesion and recovery frameworks indirectly increases the replacement demand for kitchen and household items.

U.S. Private Construction Spending

|

Construction Category |

2023 Spending (USD bn) |

2024 Spending (USD bn) |

YoY Growth (%) |

Margin of Error |

|

Total Private Construction |

1,573.0 |

1,661.7 |

+5.6% |

±1.2% |

|

Residential Construction |

866.9 |

917.9 |

+5.9% |

±2.1% |

|

Nonresidential Construction |

706.1 |

743.8 |

+5.3% |

±1.2% |

Source: U.S. Census Bureau February 2025

- Trade policy, tariffs, and government import dependency: The houseware and kitchenware market is highly trade-exposed, making the government trade policy a material demand driver. The OEC 2023 data shows that the rate of trade in the tableware and kitchenware products over the past five years has grown to 6.07%. Tariff adjustments custom enforcements and trade diversification policies directly affect the pricing and sourcing decisions. The U.S. International Trade Administration highlights the continued import monitoring of metal and ceramic household goods, influencing the procurement strategies for large buyers. Further, the tableware and kitchenware supply are import-dependent, making buyers' demand highly sensitive to changes in tariffs, anti-dumping duties, and customs enforcement actions that can rapidly alter landed costs and supplier selection.

- Government and institutional spending on public housing and hospitality: Public procurement for the social housing, military facilities, university dormitories, and the government-run hospitality represents a significant, stable B2B demand channel. The government spending data on the infrastructure and public works directly correlates to bulk purchases of durable commercial-grade products. For instance, the European Union Renovation Wave strategy aims to double annual energy renovation rates, which includes upgrading the kitchens in millions of buildings. The manufacturers should develop product lines meeting robust public procurement standards for durability and value, and actively monitor government tender announcements in relevant sectors.

Challenges

- Intense market competition and brand saturation: The market is dominated by established giants such as the SEB Group and Newell Brands, making it difficult for the new entrants to gain shelf space and consumer attention. This requires an immense marketing expenditure. For instance, SharkNinja competes by heavily investing in digital marketing and viral product launches. Further, the global houseware advertising highlights the costly battle for visibility in a crowded field where brand loyalty is strong.

- Rapidly evolving consumer trends and product cycles: The houseware and kitchenware market is driven by the fast-changing trends, such as air fryers and specific kitchen aesthetics. Missing a trend cycle can mean obsolete inventory. Instant brands faced challenges after their core product’s hype cycle peaked, underscoring the need for continuous innovation. Manufacturers must balance trend-driven hero products with a stable core lineup requiring agile design and manufacturing capabilities.

Houseware and Kitchenware Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 166.6 billion |

|

Forecast Year Market Size (2035) |

USD 279.3 billion |

|

Regional Scope |

|

Houseware and Kitchenware Market Segmentation:

Technology Segment Analysis

Within the technology segment, the conventional sub-segment is leading in the houseware and kitchenware market and is expected to hold the share value of 85.4% by 2035. While the smart kitchen appliances generate media attention, the core market is driven by the reliable, affordable, and easy-to-use traditional items such as basic cookware and utensils. The high cost, consumer privacy concerns, and a lack of perceived necessity for connectivity in many daily tasks limit smart product penetration. A primary driver is the replacement cycle for essential durable goods. The U.S. market highlights this, where the shipments for the major home appliances, a key indicator of conventional product demand, remained robust. The report from the OEC 2023 indicates that the U.S. has imported over USD 1.82 billion of domestic appliances, highlighting the immense and steady volume of the conventional market that underpins the industry.

End user Segment Analysis

The residential is leading the end-user segment in the houseware and kitchenware market and is expected to maintain the largest share value in 2035. The market is driven by the sustained demand from households for everyday items, replacement purchases, and upgrades influenced by lifestyle and design trends. The growth is further propelled by the rising home ownership rates and increased time spent in homes, which spurs investment in the domestic environment. The key commercial segments, such as foodservice, drive the innovation in durability but represent a smaller, more cyclical market. The residential demand is closely tied to consumer confidence and housing activity. For instance, the data from the U.S. Census Bureau in January 2024 shows that the new housing starts in 2023 were 1,460,000, each representing a new kitchen requiring a full suite of houseware directly fueling the residential market expansion.

Price Point Segment Analysis

The mid-market/premium price tier is projected to capture the largest share in the houseware and kitchenware market, signaling a decisive consumer shift towards premiumization. This trend moves buyers away from the low-cost disposable items toward products that offer better design, enhanced functionality, superior materials, and perceived sustainability. Consumers are willing to pay more for durability, brand heritage, and products that align with a health-conscious or experiential cooking lifestyle. This is supported by strong consumer spending patterns. For example, the FRED December 2025 reported that the personal consumption expenditures on durable goods such as furnishings and household equipment reached USD 507.270 billion (SAAR) in Q2 2025, up from USD 503.129 billion in Q1 2025. This data reflects a sustained consumer investment in better quality home goods even amid broader economic fluctuations.

Our in-depth analysis of the houseware and kitchenware market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Distribution Channel |

|

|

Price Point |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Houseware and Kitchenware Market - Regional Analysis

APAC Market Insights

The Asia Pacific is dominating the houseware and kitchenware market and is expected to hold the market share of 38.7% by 2035. The market is defined by its immense size, rapid growth, and vast diversity. The primary demand drivers are rapid urbanization and a ballooning middle class with increasing disposable income and the proliferation of modern retail and e-commerce channels. Trends across the region include a strong shift from basic utensils to branded, durable cookware, the integration of smart technology and digital connectivity in kitchen appliances, and a growing via nascent consumer preferences for sustainable and aesthetically designed products. The landscape varies significantly from the ultra-mature and innovative Japan market to the volume-driven growth in India and premiumization wave in China.

In Japan, the houseware and kitchenware market is strongly influenced by the import dependency and trade flows mainly for metal-based household articles. The trade flow data shows that Japan has imported over USD 1.36 million worth of table, kitchen, and other household articles in 2023, based on WITS data, indicating a sustained demand for the overseas-sourced products to complement domestic manufacturing. This import activity reflects Japan’s focus on quality material performance and specialized designs, where foreign suppliers often meet niche or cost efficiency requirements. Stable household consumption combined with limited domestic mass production capacity continues to support the inbound trade. For the B2B stakeholders, Japan represents a market where compliance, material safety, and consistency of supply are vital purchasing criteria.

The houseware and kitchenware market in India is being structurally supported by the government-led urban housing expansion under the Pradhan Mantri Awas Yojana Urban 2.0, based on the PIB August 2024 report. The scheme’s approval of ₹2.30 lakh crore in assistance to enable 1 crore urban households to construct, purchase, or rent homes over the next five years is expected to drive the sustained first-time demand for essential kitchenware and household products. With 1.18 crore houses already sanctioned and over 85.5 lakh homes delivered under the earlier phases, PMAY-U has proven its capacity to generate large scale non-discretionary consumption of cookware, storage, cleaning, and basic household items. The demand is concentrated in mass and mid-market segments, favoring volume-oriented manufacturers and organized distribution networks.

North America Market Insights

North America is the fastest-growing houseware and kitchenware market is the and is expected to grow at a CAGR of 4.2% during the forecast period 2026 to 2035. The market is defined by maturity, high consumer spending, and a strong shift towards premiumization and omnichannel retail. The key drivers include steady housing activity, with the NAHB in January 2025 reporting 1.42 million total housing units in 2023, creating a consistent baseline demand. The replacement cycles and the discretionary upgrades are fueled by the high disposable income and personal consumption expenditure on household durables. The dominant trend is the seamless integration of online and offline channels, with e-commerce penetration accelerating. Sustainability and health-conscious design are non-negotiable product expectations driven by both consumer values and regulatory attention on materials. The market is highly competitive, requiring innovation in direct-to-consumer engagement and supply chain resilience to manage costs.

In the U.S. houseware and kitchenware market, the demand growth is increasingly driven by the small household appliances that address the space efficiency, healthier cooking, and time-saving needs. The recent product launches by the Electrolux Group under the Frigidaire brand in September 2024, including the large capacity air fryers, multi-function combo ovens, and compact espresso machines, highlight sustained replacement and upgrade demand among U.S. households. With the list prices ranging from USD 129.99 to USD 154.99, these products are positioned in the mid-market segment, aligning with the mass premium consumption trends rather than the discretionary luxury spending. Their availability across the direct-to-consumer and large U.S. retail platforms reflects the strong omnichannel distribution penetration. The focus on the multifunctionality and compact design further reflects the urban living patterns and a smaller kitchen footprint.

The houseware and kitchenware market in Canada is highly influenced by the value of durability, multifunctionality, and environmental responsibility. Dense urban living in the major centers fuels the demand for innovative, space-saving storage and kitchen solutions. The country is further driven by the export-oriented manufacturing and cross-border trade dynamics. In 2023 OEC data, Canada has exported USD 7.26 million worth of tableware and kitchenware globally, indicating a steady participation in international supply chains despite Canada’s smaller manufacturing base compared with the U.S and Asia. This export activity is supported by Canada’s trade integration in the U.S. and other developed markets, where the household goods benefit from regulatory alignment and tariff preferences. At the domestic level, stable household construction and continued residential construction underpin replacement-driven demand for the kitchenware and tabletop products.

Export Trade Flow of Tableware and Kitchenware (2023)

|

Country |

Value (USD) |

|

U.S. |

6.54 M |

|

South Korea |

76.7 K |

|

Netherlands |

127 K |

|

UK |

85.2 K |

Source: OEC 2023

Europe Market Insights

The houseware and kitchenware market in Europe is mature and driven by the high consumer standards for quality design and sustainability. The replacement purchases and upgrades form the core demand with a strong consumer shift towards premium multi-functional products and durable materials. The key growth drivers include robust EU regulations promoting the circular economy, which push manufacturers towards sustainable design and materials. The market is also adapting to the right to repair movement and new packaging waste regulations, making product longevity and recyclability critical competitive factors. Major pan-European retail chains and a rapidly growing e-commerce sector dominate the distribution landscape, with the omnichannel strategies becoming essential for a brand's success.

In Germany, the houseware and kitchenware market is closely linked to the advanced manufacturing inputs and industrial innovation, mainly in cookware and bakeware. The acquisition of Weilburger Coating by Kansai Helios in May 2024 boosts Germany’s position in the upstream supply chain for high-performance coating used in food contact and heat-resistant household products. Germany manufacturers are recognized for quality, durability, and regulatory compliance, making co-creation technology a critical enabler rather than a peripheral input. This consolidation is expected to support faster innovation cycles, improved sustainability performance, and stable sourcing for cookware and appliance producers in Germany serving both domestic and export markets. As Germany remains a key European manufacturing hub, stronger integration among coating suppliers and household goods manufacturers reinforces competitiveness, mainly in premium compliance-driven segments.

The houseware and kitchenware market in the UK is driven by the intense retail competition, high rates of new household formation, and a strong culture of home improvement. The acquisition of Horwood Homewares by India-based TTK Prestige in February 2022 highlights the sector’s growing emphasis on the brand led consolidation and international expansion. The Horwood’s portfolio of established cookware and tableware brands, its relationships with over 1,000 UK retailers, and its long operating history position it as a strategic platform for accessing high-value European markets. For the UK market, this transaction underscores a continued demand for the branded mid to premium cookware and tabletop products supported by strong retail penetration across department stores and specialist channels. The integration of TTK Prestige’s manufacturing scale and innovation capabilities with Horwood’s distribution strength is expected to enhance the product availability and competitiveness.

Key Houseware and Kitchenware Market Players:

- Newell Brands (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Vollrath Company, LLC (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- SEB Group (France)

- Zwilling J. A. Henckels (Germany)

- WMF Group (Germany)

- Fissler (Germany)

- IKEA (Sweden)

- Dualit (UK)

- Meyer Corporation (U.S.)

- Instant Brands (U.S.)

- Tupperware Brands Corporation (U.S.)

- SharkNinja (U.S.)

- Midea Group (China)

- Zojirushi Corporation (Japan)

- Tiger Corporation (Japan)

- Lock & Lock (South Korea)

- Hawkins Cookers (India)

- TTK Prestige Ltd (India)

- Newell Brands is a dominant player in the houseware and kitchenware market, leveraging its extensive brand portfolio, such as the Rubbermaid, Calphalon, and Pyrex. Its key strategy involves portfolio optimization acquitting strong brands and divesting non-core assets to focus on high-growth categories. The company heavily invests in e-commerce in material science for durable, premium products. The company has made the net sales of USD 7,582 million in 2024.

- The Vollrath Company LLC is a leading privately held supplier primarily to the foodservice industry, which heavily influences the commercial houseware and kitchenware market. Its strategic initiatives are deep vertical integration, controlling manufacturing from raw material to finished products, to ensure quality, efficiency, and supply chain resilience. Vollrath focuses on engineering ergonomic and durable products for professional kitchens while strategically expanding its offering for the growing healthcare and institutional segments.

- Church & Dwight Co., Inc., via its OXO brand, has revolutionized the houseware and kitchenware market with its universal design philosophy of Good Grips. Its core strategy is user-centric innovation, designing products that are ergonomic and accessible for all. The company excels at identifying the mundane kitchen tools and reinventing them, then leveraging its strong brand trust to expand into adjacent categories, driving consistent organic growth via problem-solving design. The company has witnessed a net sales of USD 6,107 million in 2024.

- SEB Group is a global powerhouse in the houseware and kitchenware market owing a vast portfolio including Tefal, Moulinex, and Krups. Its primary growth engine is strategic acquisitions to enter new markets and categories. SEB aggressively pushes innovation in non-stick technology, connected kitchen appliances, and eco design while utilizing its unparalleled global distribution network to market mass premium products worldwide.

- Zwilling J.A. Henckels represents the premium and professional segment of the global houseware and kitchenware market. Its strategy is built on a multi-brand approach, owing to Zwiling, Staub, and Demeyere, to cater to different premium price points and styles, from Japanese-style knives to French enameled cast iron. The company emphasizes heritage craftsmanship and Made in Germany quality, while innovating with new materials such as the ceramic coating and promoting direct consumer engagement via flagship stores and cooking experiences.

Here is a list of key players operating in the global market:

The global houseware and kitchenware market is highly fragmented and competitive, and is defined by a mix of legacy brands, emerging direct-to-consumer players, and low-cost manufacturers. The key competitive strategies include a strong emphasis on design innovation and material technology, such as the durable non-stick coating suitable for bamboo and smart kitchen integration. Major players are aggressively expanding via acquisition to enter the new categories and regions. For example, Kitchen Supply, a leading name in premium at-home kitchenware, has announced the acquisition of Here and Now Supply Company to create quality products in the great outdoors. A significant strategic shift is the heavy investment in omnichannel retail and digital marketing to connect with consumers directly, alongside a focus on premiumization and products that align with health, wellness, and environmental sustainability trends to drive loyalty and higher margins.

Corporate Landscape of the Houseware and Kitchenware Market:

Recent Developments

- In December 2024, Vitu Zote Supplies Limited, Kenya’s leading housewares shopping website, www.vituzote.com, announced the acquisition of Kenya’s premier kitchen cookware shop, The Kitchen Company, which is located at the Junction shopping mall in Nairobi, Kenya.

- In February 2024, Groupe SEB embarks on a new culinary excellence chapter and acquires Groupe Sofilac and its iconic brands Lacanche and Charvet. This acquisition aims to strengthen its presence in the cooking equipment segment by rounding out its existing high-end brand offering.

- Report ID: 1806

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Houseware and Kitchenware Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.