Chemical Distribution Market Outlook:

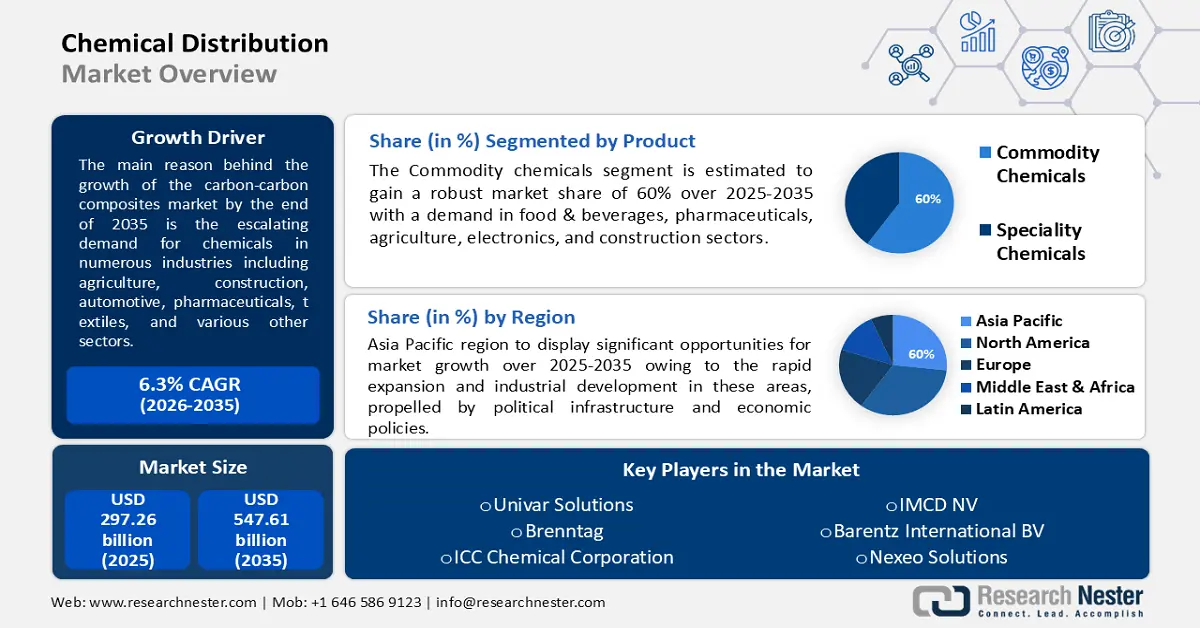

Chemical Distribution Market size was valued at USD 297.26 billion in 2025 and is likely to cross USD 547.61 billion by 2035, registering more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chemical distribution is assessed at USD 314.11 billion.

The market is experiencing a considerable increase due to the escalating demand for chemicals in numerous industries including agriculture, construction, automotive, pharmaceuticals, textiles, and various other sectors.

Within the next quarter of a century, it is anticipated that India will be responsible for up to twenty percent of the additional global consumption of chemicals. Through the year 2040, it is expected that the domestic demand will have increased from 185 billion US dollars in 2021 to 1,050 billion US dollars altogether.

Key Chemical Distribution Market Insights Summary:

Regional Highlights:

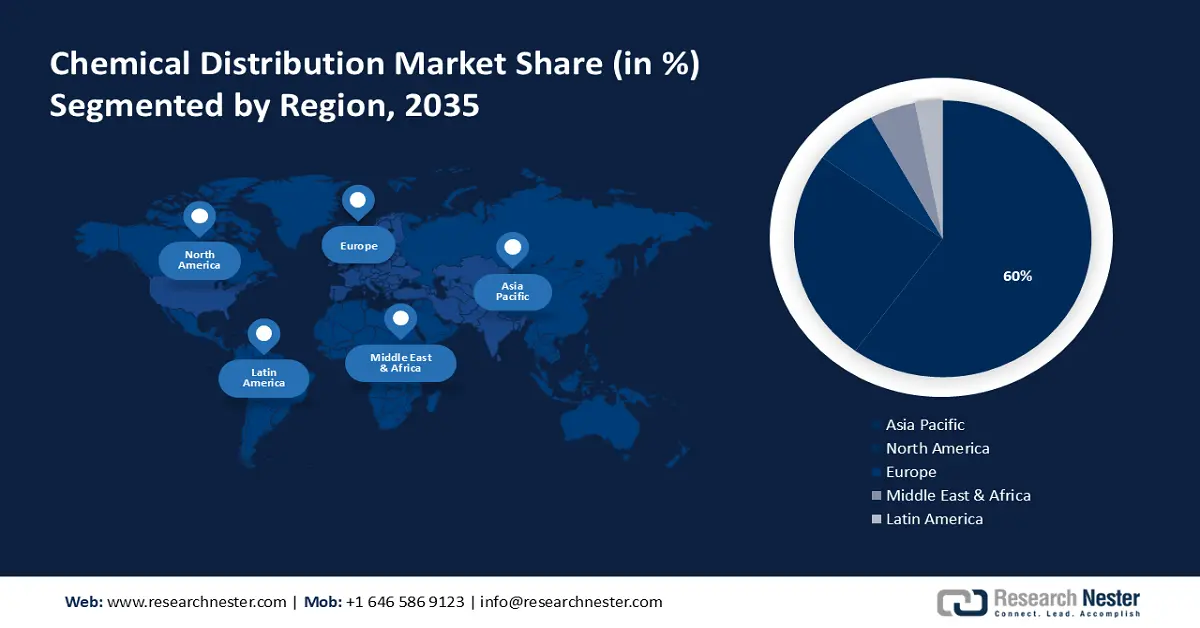

- Asia Pacific chemical distribution market will dominate around 60% share by 2035, driven by rapid industrial development and enhancements in local chemical distribution capacity.

- North America market will account for 25% share by 2035, driven by the fast-growing automotive, construction, and pharmaceutical sectors in the region.

Segment Insights:

- Commodity chemicals segment in the chemical distribution market is projected to achieve 60% growth by the forecast year 2035, driven by strong demand across food & beverages, pharmaceuticals, agriculture, electronics, and construction sectors.

- The construction segment in the chemical distribution market is projected to hold a 19% share by 2035, fueled by tremendous growth in building and construction industries in developed markets.

Key Growth Trends:

- Increased services offered by distributors

- Shifting Consumer Preferences

Major Challenges:

- Increasing Health Concerns

- Environmental regulations

Key Players: Univar Solutions, Brenntag, ICC Chemical Corporation, IMCD NV, Barentz International BV, Nexeo Solutions, Obegi, ChemicalsGroup, STOCKMEIER Chemie GmbH & Co. KG, MANUCHAR nv.

Global Chemical Distribution Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 297.26 billion

- 2026 Market Size: USD 314.11 billion

- Projected Market Size: USD 547.61 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Chemical Distribution Market Growth Drivers and Challenges:

Growth Drivers

-

Increased services offered by distributors - The expansion of services provided by distributors and the outsourcing of work to them are the primary drivers of additional growth. Increased chemical consumption is not the only factor contributing to the expansion of the chemical distribution market but there are few more factors that also drive the market growth.

A bigger proportion of distribution was outsourced among companies between the years 2008 and 2012, which resulted in an annual growth rate of approximately 1.2 percent. - Shifting Consumer Preferences - Environmentally conscious consumers are attentive to information about the environment and products, processing, and brands that may affect it. Consumers are increasingly environmentally sensitive and prefer organic products and services, favoring businesses that follow environmental policies.

The American Chemical Society (ACS) promotes green and sustainable chemistry and engineering to create cost-effective, healthier, and more sustainable processes and products. Innovations in this sector include biobased chemicals, catalysis, endangered elements, green chemistry metrics, process engineering, rational molecular design for reduced toxicity, pharmaceutical solvents, and chemical waste. - Increasing Spending Power - The chemical distribution industry has experienced growth over the projection period due to the combination of robust consumer expenditure and the increasing demand for ecologically sustainable infrastructure. The increasing use of large quantities of chemicals, including specialized ones, by the oil, gas, and petroleum sectors is expected to drive the expansion of the chemical distribution industry.

The American Chemistry Council (ACC) has recently reported that investments in the U.S. chemical sector, which are directly related to the abundant and cost-effective availability of domestic natural gas and natural gas liquids (NGLs), have exceeded USD 200 billion.

Challenges

-

Increasing Health Concerns - During the "green revolution," farmers adopted technology to boost productivity and meet the expanding food needs of a rapidly growing population. The Green Revolution yielded significant returns by substantially expanding food grain production. This has also increased the use of chemical fertilizers and pesticides, which affect the environment and human health.

-

Environmental regulations - Chemical companies are required to adhere to environmental regulations that dictate the production and disposal of their products when they are no longer required. This is true for both manufacturers and consumers. This regulation alone is anticipated to necessitate an expenditure of over USD 300 billion by chemical industries in the coming years for pollution prevention apparatus and compliance costs.

Chemical Distribution Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 297.26 billion |

|

Forecast Year Market Size (2035) |

USD 547.61 billion |

|

Regional Scope |

|

Chemical Distribution Market Segmentation:

Product Segment Analysis

Commodity chemicals segment is poised to dominate chemical distribution market share of over 60% by 2035, Due to the demand of commodity chemicals in food & beverages, pharmaceuticals, agriculture, electronics, and construction. Almost every business employs commodity chemicals to make many products.

Belgium-based Novasol Chemicals is a 100% privately held chemical distribution firm founded in 1997. Novasol Chemicals is ISO 9001-certified, among the ICIS TOP 100 EU chemical distributors, and REACH and GHS-CLP compliant. They offer custom distribution and packaging for a wide range of commodity and specialty chemicals. The Belgian-based company has local teams in over 25 countries in Asia, Europe, and North America and is intimately tied to its main logistics hubs.

End Use Segment Analysis

In chemical distribution market, construction segment is estimated to dominate revenue share of over 19% by 2035, due to the tremendous growth of the building and construction industry in developed markets. It is expected to witness this segment rise due to emerging area industrialization and urbanization in the projected period.

V.K. Brothers is a significant Indian construction chemical and specialty chemical provider. Construction systems and solutions for building and civil works are developed, manufactured, and sold by the firm. It makes all kinds of chemical construction products, including Dr. Fixit waterproofing solutions, concrete-repair-system, tile-fixing adhesives, concrete premixtures, crack-repair sealants, grouts, concrete curing compounds, membranes, jointing compounds, and more. Hence, such manufacturers tend to drive the chemical distribution industry growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chemical Distribution Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 60% by 2035, with a compound annual growth rate (CAGR) of 3.5% by 2035. Rapid expansion and industrial development in these areas, propelled by political infrastructure and economic policies, have resulted in enhancements in the capacity of local chemical distributors.

The findings indicate that there are regional disparities in the utilization of third-party distribution. 91% of the respondents in China anticipate a growth in the proportion of outsourcing within the next three years, while 84% in the APAC region have the same expectation. They are becoming more in line with international standards, providing professionalization and supply reliability, and broadening their range of services.

In addition, the chemical distribution business in South Korea is expected to reach maturity and align with the Western market within the next decade, owing to its technical expertise and regulatory support.

North America Market Insights

By 2035, North America segment is set to dominate over 25% chemical distribution market share. Top players like IMCD, and Brenntag, who represent 40% of the North American market, impact it. The North American chemical distribution industry is predicted to develop because of the fast-growing automotive, construction, and pharmaceutical industries.

Rising spending by US chemical businesses on North American production unit development promises a strong chemical distribution industry in the future years. The US chemical sector has invested USD 109 billion in new and expanded facilities since 2010.

In Canada, the market is growing due to cheaper labor costs, accessibility to growth markets, reduced raw material costs, and favorable regulatory conditions.

Chemical Distribution Market Players:

- Azelis Holding S.A

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Univar Solutions

- Brenntag

- ICC Chemical Corporation

- IMCD NV

- Barentz International BV

- Nexeo Solutions

- Obegi Chemicals Group

- STOCKMEIER Chemie GmbH & Co. KG

- MANUCHAR nv

The market for chemical distribution is dominated by key market players who are gaining traction in the market by adopting several strategies including mergers and acquisitions.

Recent Developments

- Azelis Holding S.A.(2023) - Azelis acquires 100% of Localpack S.A., a Colombian life sciences and industrial chemicals wholesaler. The acquisition meets the Group's regional growth goals by strategically expanding its footprint. Localpack is a top domestic specialized chemical distributor. The 27-person company conducts an application laboratory near Medellin for Colombian customers. Azelis' Latin American lateral value chain is expanded by Localpack's long-standing partnerships with global and regional principals and technical product expertise.

- Univar Solutions LLC (March 1, 2024 ) - a leading global solutions provider to users of specialty ingredients and chemicals, today announced the acquisition of Valley Solvents & Chemicals Company and certain of its affiliates ("Valley Solvents"), a long-time distributor of solvents and inorganics and provider of waste management services in the Texas and Gulf Coast region. The acquisition expands the Company's local chemical distribution network and valued-added services across its Chemical Distribution division, while strengthening environmental services capabilities for its ChemCare business under its Services division.

- Report ID: 6193

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chemical Distribution Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.