Cetyl Esters Market Outlook:

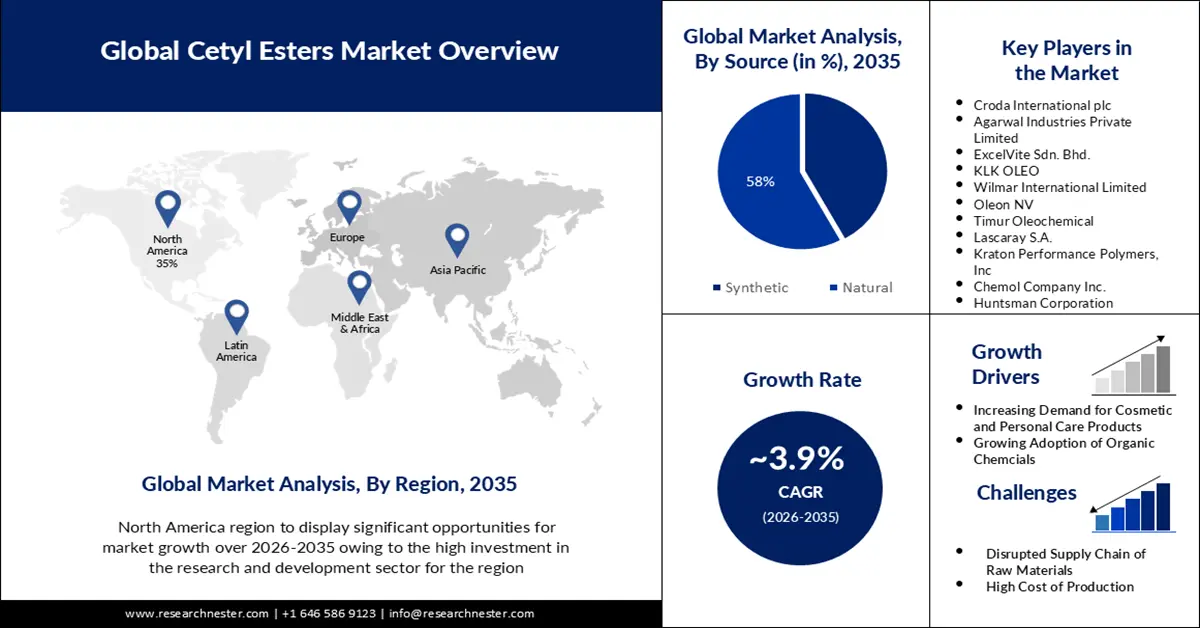

Cetyl Esters Market size was valued at USD 401.77 million in 2025 and is set to exceed USD 589.02 million by 2035, expanding at over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cetyl esters is evaluated at USD 415.87 million.

The rising application of cetyl esters in color cosmetics and beauty products is anticipated to bring lucrative growth opportunities for an increment in revenue share in the upcoming years. The growth in the global cetyl esters market revenue is owing to its application in personal care products. Cetyl esters have aromatic properties and can work as an emulsifier which makes it an ideal product for such products.

Key Cetyl Esters Market Insights Summary:

Regional Highlights:

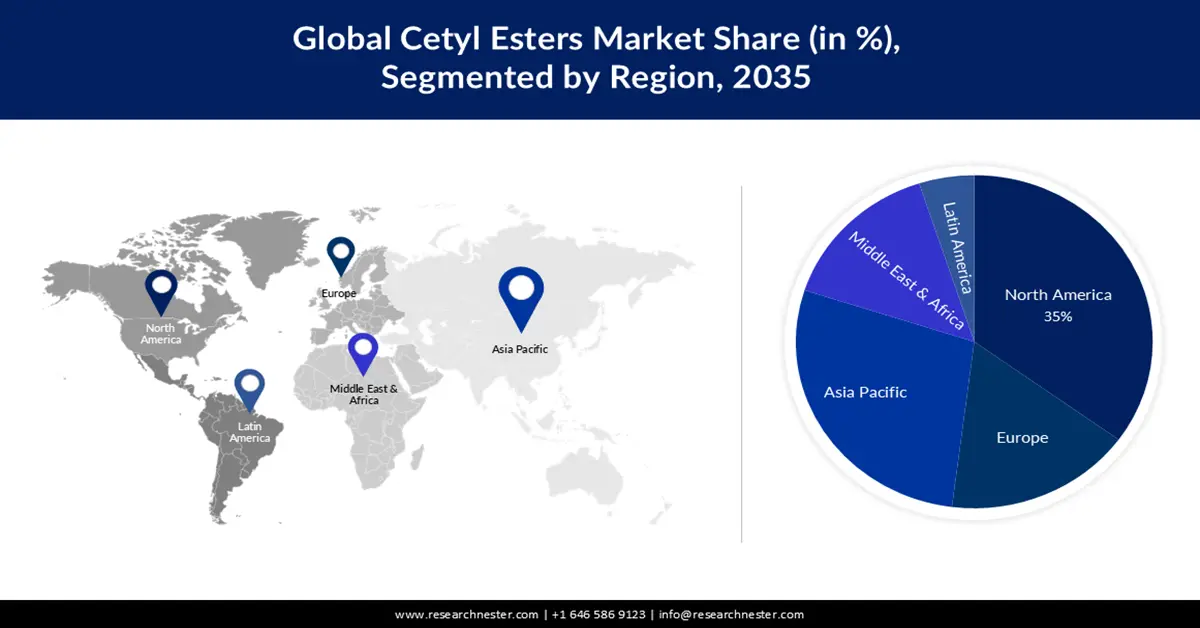

- By 2035, North America is projected to secure a 35% share of the Cetyl Esters Market, bolstered by escalating R&D investments from the U.S. government and major industry players.

- Asia Pacific is anticipated to command a 24% share by 2035, supported by the surging demand for cosmetic and personal care products in rapidly industrializing nations such as Japan, India, and South Korea.

Segment Insights:

- The cosmetic segment of the Cetyl Esters Market is expected to capture a 36% share by 2035, underpinned by rising global beauty standards and increasing emphasis on appearance among teens.

- The natural source segment is set to account for a 58% share by 2035, stimulated by growing consumer preference for mild, skin-friendly formulations and cost-efficient production cycles.

Key Growth Trends:

- Growing Pharmaceutical Industry

- Increasing Expenditure on Research and Development Activities

Major Challenges:

- Rising Concern about Side Effects of Excessive Use

- Long Production Cycles

Key Players: Croda International plc, Agarwal Industries Private Limited, ExcelVite Sdn. Bhd., KLK OLEO, Wilmar International Limited, Oleon NV, Timur Oleochemicals, Lascaray S.A., Kraton Performance Polymers, Inc, Chemol Company Inc., Huntsman Corporation.

Global Cetyl Esters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 401.77 million

- 2026 Market Size: USD 415.87 million

- Projected Market Size: USD 589.02 million by 2035

- Growth Forecasts: 3.9%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietn

Last updated on : 20 November, 2025

Cetyl Esters Market - Growth Drivers and Challenges

Growth Drivers

- Growing Pharmaceutical Industry – Cetyl ester is in high demand in the pharmaceutical industry owing to its increasing application in various medical products such as ointment and lotions. In 2021, as per reports, North America contributed 52% of world pharmaceutical sales.

- Increasing Expenditure on Research and Development Activities – Government and key players have been putting hefty investments in research and development activities which are anticipated to aid the production rate of cetyl ester.

- Growth in the Chemical Sector – Recent focus on developing the chemical sector is poised to bring opportunities for the development of production facilities which will aid in increasing the production of cetyl ester and aid in market expansion.

Challenges

- Rising Concern about Side-Effects of Excessive Use – High-usage products made with a mixture of cetyl ester on an everyday basis can cause skin irritation and allergies. This could hamper market expansion in the next few years.

- Long Production Cycles

- Stringent Government Rules

Cetyl Esters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 401.77 million |

|

Forecast Year Market Size (2035) |

USD 589.02 million |

|

Regional Scope |

|

Cetyl Esters Market Segmentation:

Application Segment Analysis

The cosmetic segment in the cetyl esters market is attributed to holding the largest revenue during the projected timeline and gaining 36% of the market share, owing to the rising beauty standards across the world and most of the global people being shifted towards beauty products and cosmetics products. Also, growing stress levels about looks and appearances among teenagers are anticipated to rise the demand for cosmetic commodities and cetyl ester for its production.

Source Segment Analysis

The natural source segment is poised to generate more revenue than synthetic sources in the forecasted timeline and holds a 58% market share due to the rising demand for natural products that are not harsh on the skin. Also, the production of natural cetyl ester is cost-effective and requires short production cycles which propels the manufacturers to shift towards producing cetyl ester from natural sources.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cetyl Esters Market - Regional Analysis

North American Market Insights

North America industry is likely to hold largest revenue share of 35% by 2035. The rising investments in research and development activities for introducing high-quality cetyl ester by the United States government and key players are considered to be the primary factor for the expansion of market value in the region.

Furthermore, the presence of production facilities for manufacturing cetyl ester along with the availability of sufficient funds with manufacturers is also anticipated to create a positive outlook for aiding a robust market revenue generation shortly.

APAC Market Insights

The Asia Pacific cetyl ester market size is estimated to garner the largest share of 24% by the end of 2035. The burgeoning population demanding cosmetic and personal care products in developing countries, especially, Japan, India, and South Korea is propelling the production rate of cetyl ester in the next few years. The growth in the end-use industries of the region owing to rapid industrialization is poised to bring growth opportunities for market expansion.

Cetyl Esters Market Players:

- Croda International plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agarwal Industries Private Limited

- ExcelVite Sdn. Bhd.

- KLK OLEO

- Wilmar International Limited

- Oleon NV

- Timur Oleochemicals

- Lascaray S.A.

- Kraton Performance Polymers, Inc

- Chemol Company Inc.

- Huntsman Corporation

Recent Developments

- Kraton Performance Polymers, Inc., a global producer of bio-based specialty polymers, announced its merger with DL Holdings Co., Ltd.

- Huntsman Corporation to acquire Gabriel Performance Products to expand its portfolio as a specialty chemical manufacturer.

- Report ID: 3976

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cetyl Esters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.