Carboxymethyl Cellulose Market Outlook:

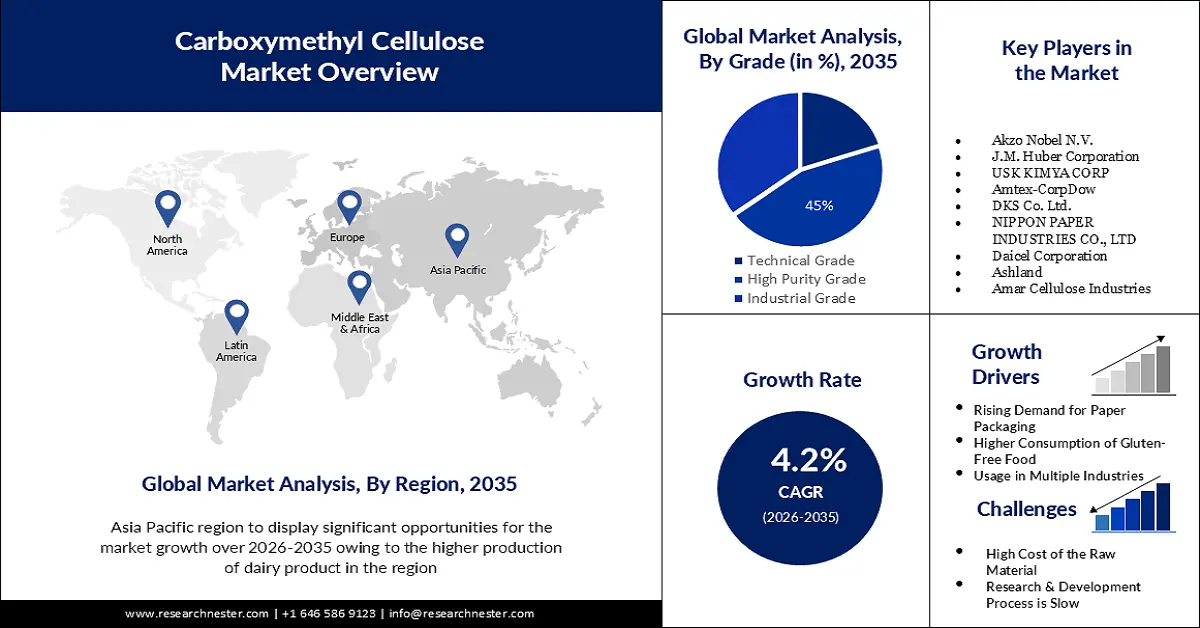

Carboxymethyl Cellulose Market size was valued at USD 1.65 billion in 2025 and is set to exceed USD 2.49 billion by 2035, expanding at over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carboxymethyl cellulose is estimated at USD 1.71 billion.

The growing consumption of gluten-free products is the major factor driving the market growth. Various additives, including carboxymethyl cellulose, are used to improve the texture, consistency, and shelf life of gluten-free products to compensate for the lack of gluten. In the world, around 13%% of people affected with celiac gluten sensitivity, and 1% with autoimmune celiac disease have switched to gluten-free food. Moreover, around 51% of gluten-free food consumers are adopting it for other reasons.

In addition to these, a factor that significantly contributes to the market expansion is the rising demand for detergent. Carboxymethyl cellulose can suspend solid particles in the detergent solution. This is especially useful in laundry detergents, where it helps to keep dirt and other particles suspended, preventing them from redepositing on the garments during the washing process.

Key Carboxymethyl Cellulose Market Insights Summary:

Regional Highlights:

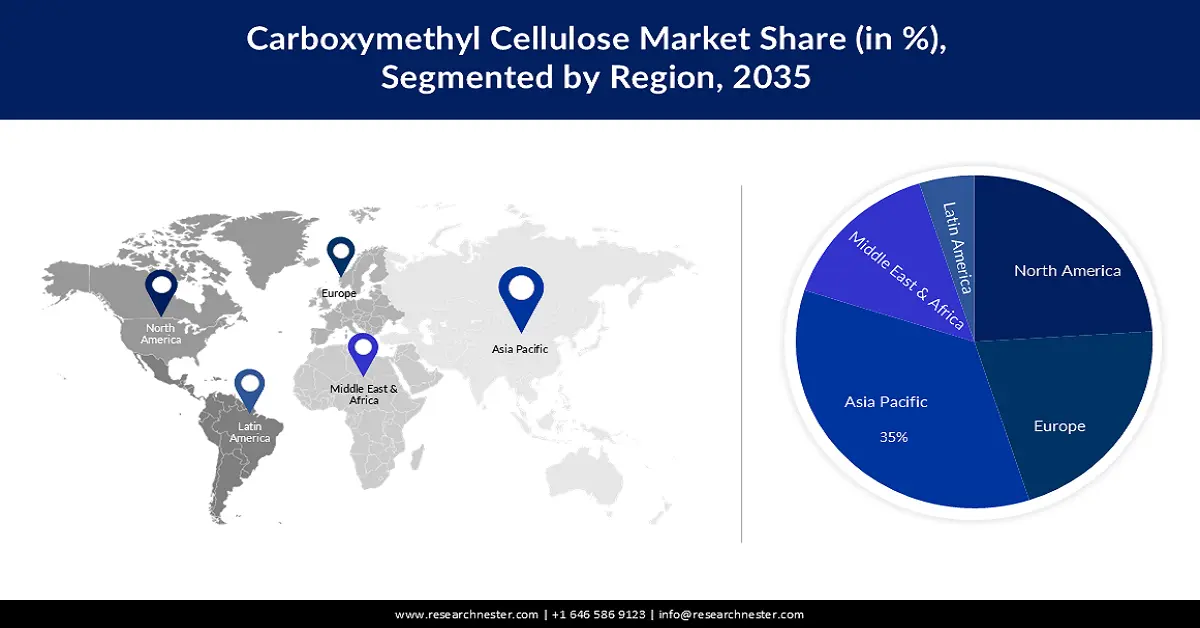

- Asia Pacific carboxymethyl cellulose market will secure around 35% share by 2035, driven by rising dairy production and increasing expenditure on cosmetics and pharmaceuticals.

- North America market will capture a 24% share by 2035, driven by rising population consuming gluten-free food and presence of large manufacturers.

Segment Insights:

- The high purity grade segment in the carboxymethyl cellulose market is projected to secure a 45% share by 2035, attributed to the increasing use of high-purity grades in cosmetics, pharmaceutical, and food industries.

- The food & beverage segment in the carboxymethyl cellulose market is projected to hold a 35% share by 2035, driven by growing consumption of packaged and ready-to-cook food items.

Key Growth Trends:

- Growing Production of Oil and Gas

- Rising Use of Paper in the Packaging Industry

Major Challenges:

- Presence of Other Alternatives in the Market

- Changing Prices of the Raw Materials

Key Players: SINOCMC CHEMICAL CO., LTD, Akzo Nobel N.V., J.M. Huber Corporation, USK KIMYA CORP, Amtex-CorpDow, DKS Co. Ltd., NIPPON PAPER INDUSTRIES CO., LTD, Daicel Corporation, Ashland, Amar Cellulose Industries.

Global Carboxymethyl Cellulose Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.65 billion

- 2026 Market Size: USD 1.71 billion

- Projected Market Size: USD 2.49 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 May, 2025

Carboxymethyl Cellulose Market Growth Drivers and Challenges:

Growth Drivers

- Growing Production of Oil and Gas– Global crude oil output climbed by around 5% in 2022, much above growth in 2021 which was nearly 1.6%. Carboxymethyl cellulose is a fluid loss control compound that produces a thin, impervious filter cake in the wellbore walls, decreasing fluid loss during drilling.

- Rising Use of Paper in the Packaging Industry– In 2021, the global production of packaging paper and paperboard reached around 264 million metric tonnes. Carboxymethyl cellulose is used to improve the characteristics of paper as a coating or surface treatment in the packaging industry. These packagings are then applied in various sectors such as healthcare packaging.

- Increasing Use of Personal Care Products- Lately, usage of products such as facewashes, moisturizers, exfoliators, and scrubs has increased, around 40% of facial skincare customers across the world use these products more often. CMC is frequently used to improve the consistency and texture of moisturizers, creams, lotions, and gels.

Challenges

- Presence of Other Alternatives in the Market- Stabilizers and food additives with similar properties gives tough competition to carboxymethyl cellulose. Manufacturers and formulators sometimes also consider these alternatives or prefer the cheaper ones which impacts the market growth.

- Changing Prices of the Raw Materials

- Slow Process of Research and Development

Carboxymethyl Cellulose Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 1.65 billion |

|

Forecast Year Market Size (2035) |

USD 2.49 billion |

|

Regional Scope |

|

Carboxymethyl Cellulose Market Segmentation:

Application Segment Analysis

The food & beverage segment in the carboxymethyl cellulose market is estimated to gain the largest revenue share of about 35% in the year 2035. The growth of the segment can be attributed growing consumption of packaged food, ready-to-cook meals, and instant noodles. The average American consumes 31% more packaged food than fresh food. Carboxymethyl cellulose is commonly used in food items as a thickening and stabilizer. It aids in the creation of a constant texture and the prevention of ingredient separation in sauces, gravies, and dressings.

Grade Segment Analysis

The high-purity grade segment is expected to hold nearly 45% share of the global carboxymethyl cellulose market in the year 2035. The growing use of high-purity grades in various industries, including cosmetics, pharmaceutical, and food & beverage industries is to boost the segment’s growth. Owing to its excellent purity and higher dependency, the high purity percentage of carboxymethyl cellulose is increasing. The efficiency of the end products, such as viscosity, particle size, solubility, and other properties are dependent on the degree of polymerization, purity, uniformity, and degree of substitution of the carboxymethyl cellulose. Therefore, its usage will continue to rise over the years.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

Property |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carboxymethyl Cellulose Market Regional Analysis:

APAC Market Insights

The carboxymethyl cellulose market in Asia Pacific is projected to be the largest with a share of about 35% by the end of 2035. The market growth in the region is primarily expected on the account of rising production of dairy products. India is the world's largest milk producer, accounting for 24% of the world's milk output in the years 2021-22. During the last eight years, from 2014-15 and 2021-22, India's milk output has increased by 51%. Furthermore, rising expenditure on cosmetic and pharmaceutical products is also expected to drive market growth in the region. Out of all the regions in Asia-Pacific, China is the leading consumer of carboxymethyl cellulose, the demand is driven by its use in several end-user industries.

North American Market Insights

The North America carboxymethyl cellulose market is set to register a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the rise in the number of population consuming gluten-free food. Gluten intolerance affects 18 million people in the United States. Gluten-free food options are currently available on 26% of US restaurant menus. Moreover, around 30% of Americans have willingly refused to consume gluten. Furthermore, the growing industrialization and presence of one of the largest manufacturers of carboxymethyl cellulose is also expected to drive market growth in the region.

Carboxymethyl Cellulose Market Players:

- SINOCMC CHEMICAL CO., LTD

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- J.M. Huber Corporation

- USK KIMYA CORP

- Amtex-CorpDow

- DKS Co. Ltd.

- NIPPON PAPER INDUSTRIES CO., LTD

- Daicel Corporation

- Ashland

- Amar Cellulose Industries

Recent Developments

- AkzoNobel N.V. announces the acquisition of Chinese decorative paints business of Sherwin-Williams, this will solidify its position in to five geographical place in China. The acquisition will be compledted in the second half of 2023.

- Nippon Paper Industries Co., Ltd. announce to set up a manufacturing and sales subsidiary for Sunrose Mac carboxymethyl cellulose in Hungary. It will increase its application in lithium-ion batteries in electric vehicles and will later joining the sypply chain of Europe.

- Report ID: 5100

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carboxymethyl Cellulose Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.