BYOD and Enterprise Mobility Market Outlook:

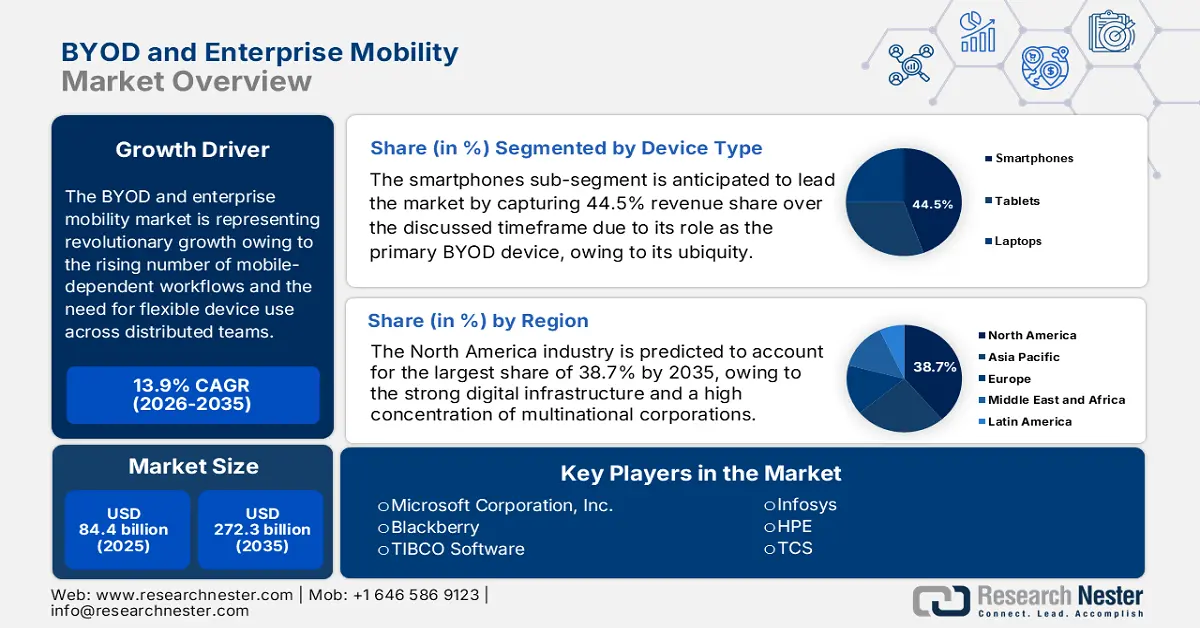

BYOD and Enterprise Mobility Market size was valued at USD 84.4 billion in 2025 and is projected to reach USD 272.3 billion by the end of 2035, rising at a CAGR of 13.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of BYOD and enterprise mobility is estimated at USD 96.1 billion.

The BYOD and enterprise mobility market is representing revolutionary growth owing to the rising number of mobile-dependent workflows and the need for flexible device use across distributed teams. In addition, companies are adopting mobility solutions to give employees consistent access to corporate resources by maintaining clarity of device usage and data handling. In this regard, the Council’s Enterprise Mobility and BYOD Policy in January 2025 established a framework that ensures mobile access to Council systems is granted only to approved users and devices, and is supported through mandatory MDM enrollment and security settings. Hence, this policy reinforces governance, risk management, and legislative compliance to protect Council information while enabling mobile work where operationally justified, hence contributing to the BYOD and enterprise mobility market expansion.

Furthermore, the article published by NIST in September 2023 states that the integration of BYOD within enterprises has positive outcomes for both organizations and employees. It enhances workplace flexibility, allowing staff to use personal devices for work tasks, which supports remote collaboration and eliminates the burden of carrying multiple devices. It also mentioned that organizations can benefit from strengthened security through the use of standards-based tools such as mobile device management, application vetting, and mobile threat defense, which efficiently help them to protect corporate data, detect malware, and prevent unauthorized access. In addition, employee privacy is safeguarded through configurable data collection settings and clear separation between work and personal information, thereby enhancing the uptake in BYOD and enterprise mobility market.

Key BYOD and Enterprise Mobility Market Insights Summary:

Regional Insights:

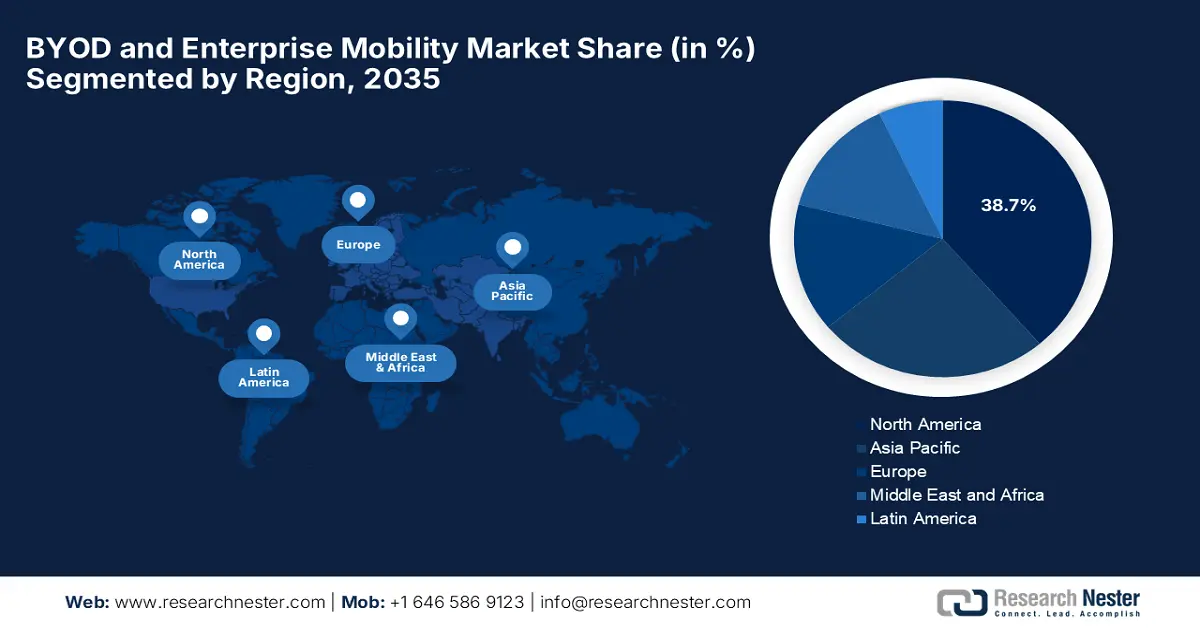

- North America is projected to command a 38.7% share of the byod and enterprise mobility market by 2035, spurred by early technology adoption, mature digital infrastructure, and the strong presence of multinational enterprises.

- Asia Pacific is set to record the fastest expansion from 2026–2035 as rising internet penetration and widespread digital-transformation initiatives catalyze large-scale adoption of enterprise mobility solutions.

Segment Insights:

- The smartphones sub-segment in the byod and enterprise mobility market is anticipated to secure a 44.5% revenue share by 2035, supported by its ubiquity, connectivity, and broad app ecosystem.

- Mobile threat defense is expected to attain a significant revenue share by 2035, propelled by the growing sophistication of mobile cyberattacks such as phishing, malware, and network-based exploits.

Key Growth Trends:

- Shift toward remote and hybrid work models

- Rise in high-speed networks & mobile devices

Major Challenges:

- Security, privacy, and compliance

- Cost and user adoption

Key Players: Blackberry (Canada), TIBCO Software (US), Infosys (India), HPE (US), TCS (India), SAP (Germany), Hexnode (US), Zimperium (US), Cisco Systems (US), Broadcom (US), AT&T (US), Ivanti (US), HCL (India), Zoho Corporation (US), Google (US), Lookout (US), IBM (US), Honeywell (US), Samsung (South Korea), Oracle (US), SOTI (Canada), Miradore (Finland), JumpCloud (US).

Global BYOD and Enterprise Mobility Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 84.4 billion

- 2026 Market Size: USD 96.1 billion

- Projected Market Size: USD 272.3 billion by 2035

- Growth Forecasts: 13.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, United Arab Emirates

Last updated on : 10 December, 2025

BYOD and Enterprise Mobility Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward remote and hybrid work models: Organizations across the world are opting for flexible working arrangements, and there is a growing need for employees to access corporate resources from anywhere, which in turn drives consistent growth in the BYOD and enterprise mobility market. According to the article published by the World Economic Forum in January 2024, by the conclusion of 2030, the worldwide digital jobs that can be performed remotely are projected to grow by around 25%, reaching approximately 92 million roles. In addition, the article also underscored that this growth is effectively fueled by technology advancements, creating higher-wage positions. Therefore, this rise of remote-capable digital jobs enables workers to operate from anywhere, reshapes employment patterns and workforce distribution, and provides encouraging opportunities for pioneers in this field.

- Rise in high-speed networks & mobile devices: This rise in smartphone, tablet, and laptop adoption, coupled with expanding mobile broadband and 5G connectivity, is making mobile devices a viable platform for enterprise use other than relying on fixed desktops. In this regard, the government of India in September 2025 reported that the country’s mobile manufacturing sector has experienced a revolutionary rise, growing from just 2 units a decade back to over 300 today, making the country the world’s second-largest mobile producer. The article also noted that mobile production increased from ₹18,000 crore (USD 2.17 billion) in 2014-15 to ₹5.45 lakh crore (USD 65.66 billion) in 2024-25, and has created more than 12 lakh jobs, thereby accelerating exports globally. Furthermore, these smartphones play a vital role in India’s digital economy, enabling widespread access to information, services, and 5G technology, by fueling socio-economic development.

- Cloud computing & infrastructure availability: This has enabled remote access to data and applications across devices, prompting continuous expansion of the BYOD and enterprise mobility market. Also, this reduces dependence on on-premises infrastructure and supports scalable enterprise mobility as well as BYOD policies. In January 2024, Microsoft announced that Petrobras implemented a cloud-only strategy using Microsoft Intune to manage 82,000 corporate computers, 6,000 company mobile devices, and 30,000 personal devices, enabling a highly secure remote access and BYOD adoption. It also stated that this cloud-based approach allows employees to connect from anywhere, receive policy updates, and deploy applications without any dependence on on-premises infrastructure. Furthermore, by streamlining device management and enhancing visibility, Petrobras ensures security and compliance while empowering a flexible, hybrid workforce.

Challenges

- Security, privacy, and compliance: This is the major challenge in the BYOD and enterprise mobility market since allowing employees to use personal devices for work increases the risk of data breaches, malware infections, and unauthorized access to sensitive corporate information. Also, the IT teams in the major organizations struggle to implement consistent security risks across most of the device types. Simultaneously, the aspect of regulatory compliance, especially in sectors such as finance and healthcare, becomes highly difficult when corporate data resides on personal devices. Furthermore, the balance of productivity with security policies is a major hurdle for the BYOD and enterprise mobility market, making scalable and secure BYOD adoption challenging for organizations across the globe.

- Cost and user adoption: The BYOD and enterprise mobility market is facing multiple challenges associated with integration, expenses, and user adoption. In this regard, organizations must manage a wide range of mobile devices, applications, and operating systems by ensuring access to corporate data. The process of integration can be both expensive and complex, in turn necessitating specialized software or middleware. Additionally, enterprises are witnessing difficulties in monitoring and managing device usage, thereby enforcing compliance policies and providing consistent user experiences across platforms. Furthermore, high implementation and maintenance costs, coupled with employee resistance to new mobile workflows, are ultimately slowing adoption.

BYOD and Enterprise Mobility Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.9% |

|

Base Year Market Size (2025) |

USD 84.4 billion |

|

Forecast Year Market Size (2035) |

USD 272.3 billion |

|

Regional Scope |

|

BYOD and Enterprise Mobility Market Segmentation:

Device Type Segment Analysis

The smartphones sub-segment is anticipated to lead the entire BYOD and enterprise mobility market by capturing 44.5% revenue share over the discussed timeframe. The leadership is highly attributable to its role as the primary BYOD device owing to its ubiquity, connectivity, and app ecosystem. In this context, FNPO in June 2025 revealed that India Post issued BYOD guidelines, which allow delivery staff, including postmen, GDS, and outsourced workers, to use personal smartphones that meet specific Android specifications and age criteria for delivery-related tasks through mobile apps. In addition, the organization provides a monthly reimbursement of ₹500 (USD 5.5) for smartphone usage, which includes data, voice, and SMS, conditional on meeting app-usage requirements to encourage adoption, thus highlighting the role of smartphones as primary BYOD devices.

Security Solution Segment Analysis

Based on the security solution, mobile threat defense is expected to attain a significant revenue share in the BYOD and enterprise mobility market by the end of 2035. The rising sophistication of mobile cyberattacks, which include phishing, malware, and network-based exploits, is the key factor driving adoption in this subtype. In May 2025, Zimperium announced that it had partnered with Android Enterprise to integrate device trust, thereby enabling real-time mobile threat defense across both managed and unmanaged Android devices. Also, this solution allows organizations to verify device trust signals such as patch level, OS version, and network state by enforcing risk-based access policies, extending the support of BYOD programs. In addition, the firm is providing continuous visibility and proactive protection against mobile threats such as malware and phishing, hence helping enterprises secure corporate resources.

Vertical Segment Analysis

By the conclusion of forecast duration healthcare sub-segment is expected to attain a lucrative share in the BYOD and enterprise mobility market. The need for telehealth, remote patient monitoring, and secure access to electronic health records is the key factor behind this robust growth. ASTP states that the U.S. Department of Health and Human Services provides guidance for healthcare professionals who are using mobile devices, emphasizing HIPAA Privacy and Security Rules to protect electronic protected health information. It also notes that physicians, nurses, and other providers can use smartphones, tablets, and laptops for work, including accessing patient records and telehealth services, as long as encryption, secure Wi-Fi, and access controls are properly followed. Hence, this framework supports BYOD and enterprise mobility in healthcare, thereby enabling secure remote access to electronic health records and telehealth applications.

Our in-depth analysis of the BYOD and enterprise mobility market includes the following segments:

|

Segment |

Subsegments |

|

Device Type |

|

|

Security Solution |

|

|

Vertical |

|

|

Deployment |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

BYOD and Enterprise Mobility Market - Regional Analysis

North America Market Insights

In the BYOD and enterprise mobility market, North America is expected to lead the overall global dynamics, capturing the largest revenue share of 38.7% by the end of 2035. The region’s dominance of the region is efficiently propelled by early adoption of advanced technologies, strong digital infrastructure, and a high concentration of multinational corporations. In October 2025, Tangoe announced that it had been named the 2025 mobile device management platform of the Year by the Mobile Breakthrough Awards, which marks its third consecutive win. Besides, the recognition highlights the firm’s excellence in enterprise mobility management, which includes automation, analytics, cost optimization, and full device lifecycle management. Therefore, the recognition of platforms drives market growth by validating enterprise mobility solutions, encouraging adoption of MDM tools, and accelerating investments in BYOD and mobile device management across various organizations.

The U.S. is indefinitely growing in the BYOD and enterprise mobility market owing to the widespread mobile device penetration, increasing remote workforce demands, and the growth of cloud-based enterprise applications. The country’s market also benefits from government initiatives, which are promoting digital transformation in federal and state organizations, contributing to the adoption of enterprise mobility frameworks. Lookout, Inc., in October 2024, announced that it introduced proactive protections against SMS phishing (smishing) and executive impersonation attacks for both iOS and Android devices, which provides administrators with visibility into targeted attacks. This, in turn, strengthens enterprise security by preventing credential theft and unauthorized access to corporate data. Furthermore, it is trusted by government and enterprise customers, making it suitable for overall BYOD and enterprise mobility market growth.

Canada is reaping higher revenue opportunities in the BYOD and enterprise mobility market, supported by high smartphone penetration and strong enterprise IT infrastructure. Organizations in the country are extensively focusing on enhancing mobile security, whereas businesses are also emphasizing employee experience, offering mobile access to internal collaboration tools and enterprise applications. In 2023, BlackBerry Limited announced that its partnership with the country’s government to enhance enterprise mobility across federal departments and agencies involved expanding the use of BlackBerry Cloud, BlackBerry UEM, and BlackBerry SecuSUITE. The company also notes that these tools enable secure remote access to devices and corporate data for government employees, hence maintaining high standards of cybersecurity.

APAC Market Insights

Asia Pacific is set to witness the fastest growth in the regional BYOD and enterprise mobility market from 2026 to 2035. This rapid upliftment is highly driven by the expanding internet penetration and government-backed digitalization initiatives. The regional enterprises in manufacturing, retail, and IT services are integrating mobile applications to streamline workflows, enable remote operations, which enhances workplace collaborations. In addition, the increasing investments in cloud computing and mobile security are highly essential to support this progress, where the mobile-first strategies are gaining traction. Moreover, the rise of 5G networks in the region is expected to accelerate mobile adoption and enhance connectivity for enterprise applications. Furthermore, the growing preference for hybrid work models among businesses is driving demand for secure, scalable BYOD solutions across countries in the region.

China is augmenting its dominance in the regional BYOD and enterprise mobility market, backed by the growing cloud infrastructure. The country’s market also benefits from security measures, which include mobile threat defense and endpoint management, that are increasingly integrated into BYOD policies to mitigate risks associated with the growing use of personal devices for corporate tasks. In May 2023, Yonyou Network Technology announced its globalization 2.0 strategy at the Hong Kong launch event by introducing its new cloud-native ERP products, mobility-ready solutions, and expanded regional plans across various regions. Besides, the company also introduced finance and HR management tools within its Yonyou BIP platform, which are designed to support the worldwide distributed, mobile-first enterprises. Furthermore, with new data centers, localized services, and broader international deployment goals, Yonyou aims to strengthen digital transformation and enterprise mobility adoption.

India is gaining enhanced traction in the BYOD and enterprise mobility market due to the rise of remote work and initiatives such as Digital India. The country’s market also benefits from the surge in affordable smartphones, 4G/5G connectivity, which has impacted adoption, allowing employees to securely connect to corporate networks from their personal devices. Ministry of Statistics & Programme Implementation in May 2025 disclosed that the 2025 Modular Survey by the country’s government found mobile usage among individuals aged 15 to 29 surpassed around 97.1%, whereas smartphone ownership is 95.5% in rural areas and 97.6% in urban areas. It also stated that internet access in the same age group was around 92.7% in rural and 95.7% in urban regions, and more than 85% of households possessed at least one smartphone and had internet access. Hence, these figures highlight the strong foundation for BYOD and enterprise mobility adoption.

Europe Market Insights

Europe has a stronger potential in the international BYOD and enterprise mobility market owing to the regulatory frameworks, including GDPR, that are driving the secure adoption of BYOD policies. Companies across sectors in this region are implementing mobile device management and endpoint security solutions to enable hybrid work models and secure access to enterprise applications. In June 2024, Telefónica announced that it successfully expanded its enterprise managed mobility services by adding new UEM capabilities, device-lifecycle management, workplace digitization, and 24/7 support for frontline workers. The company emphasized strengthened mobile-security offerings, which include threat detection, encrypted communications, and protected work environments as a key differentiator for secure multi-device remote work, hence attracting more players to make investments in this field.

Germany is the key growth contributor for the regional BYOD and enterprise mobility market, which is focused on integrating secure mobility solutions into industrial, automotive, and manufacturing sectors. Also, mobile device management solutions are widely adopted to support collaboration and operational efficiency by keeping sensitive corporate data in safe hands. Ericsson's June 2025 report, which was named a Leader in the IDC MarketScape: European Enterprise Private 5G Solutions 2025 Vendor Assessment, highlights its focus on enterprise mobility and private network deployments. Hence, this recognition reflects the firm’s ability to deliver deterministic, high-mobility, low-latency networks that support Europe’s accelerating digital-infrastructure needs. Furthermore, this recognition signals increasing enterprise readiness for advanced mobile connectivity, which in turn accelerates the adoption of BYOD and mobility solutions across the country.

In the UK BYOD and enterprise mobility market is supported by the digital transformation of enterprises and government bodies. Simultaneously, the country’s business ecosystem benefits from cybersecurity awareness and regulatory compliance, such as adherence to UK GDPR, which is reshaping BYOD policies across numerous industries. As per an article published by NCSC in April 2023 under Cyber Essentials v3.1, personally owned devices that are accessing organisational data are in scope, requiring strong access policies and secure configurations, though devices used only for native voice, text, or MFA applications are exempt. It also stated that the organisations must implement robust controls such as software firewalls, secure authentication, and malware protection to manage the security risks. This regulatory clarity encourages businesses in the country to adopt structured mobility strategies while balancing user flexibility.

Key BYOD and Enterprise Mobility Market Players:

- Microsoft Corporation, Inc. (US)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blackberry (Canada)

- TIBCO Software (US)

- Infosys (India)

- HPE (US)

- TCS (India)

- SAP (Germany)

- Hexnode (US)

- Zimperium (US)

- Cisco Systems (US)

- Broadcom (US)

- AT&T (US)

- Ivanti (US)

- HCL (India)

- Zoho Corporation (US)

- Google (US)

- Lookout (US)

- IBM (US)

- Honeywell (US)

- Samsung (South Korea)

- Oracle (US)

- SOTI (Canada)

- Miradore (Finland)

- JumpCloud (US)

- Microsoft Corporation leads the entire BYOD and enterprise mobility industry through its Microsoft Endpoint Manager, Intune, and Enterprise Mobility + Security suite. The company offers a wide range of solutions catered to device management, security, and identity, thereby enabling organizations to support BYOD policies by maintaining compliance. Microsoft is also focused on seamless integration with its Office 365 and Azure ecosystems, providing unified endpoint management and AI-driven threat protection.

- Cisco Systems, Inc. is readily strengthening its enterprise mobility presence through secure networking, endpoint security, and cloud solutions. The company’s offerings are encouraging organizations to monitor, manage, and secure personal and corporate devices in hybrid workplaces. In addition, Cisco’s strategic initiatives are focused on integrating security, networking, and observability into a unified platform, thereby providing enterprises with real-time insights and protection for mobile endpoints, applications, and networks.

- IBM Corporation is the central player in this field, leveraging its MaaS360 platform and AI-driven security solutions to offer enterprise mobility and BYOD management. The firm’s focus lies around hybrid cloud integration, AI-enabled threat detection, and advanced analytics, helping enterprises secure data on personal and corporate devices. Furthermore, the company’s strategic approach includes partnerships, continuous innovation in AI security, and expansion of cloud-based management solutions.

- VMware, Inc. has ONE platform, which is a leading UEM solution that enables secure device management, mobile application delivery, and BYOD support across multiple operating systems. The company is deliberately emphasizing integration between devices, applications, and corporate networks, ensuring secure and productive mobile workflows. Furthermore, VMware’s solutions are helping organizations to enforce security policies, monitor mobile endpoints in hybrid work environments.

- Google LLC is one of the most popular brand names in this field, which offers enterprise mobility solutions through Android Enterprise, Google Workspace, and endpoint management tools. The company’s focus lies around secure device enrollment, application management, and policy enforcement for BYOD and corporate-owned devices. Furthermore, Google emphasizes cloud-first mobility solutions, integration with Android devices, and AI-driven security features.

Below is the list of some prominent players operating in the global BYOD and enterprise mobility market:

The BYOD and enterprise mobility market is considered to be extremely competitive, which is dominated by global technology giants. Key pioneers such as Microsoft, IBM, Google, and Cisco are leveraging extensive R&D capabilities to innovate mobile device management, security, and cloud-based solutions. Mergers and acquisitions to expand service portfolios, partnerships to enhance integration across platforms, are a few strategies implemented by the players to uplift the market potential internationally. In March 2024, Cisco announced that it had completed the USD 28 billion acquisition of Splunk, creating one of the largest software companies globally. Also, this strategic move combines Cisco’s networking and security expertise with Splunk’s data analytics and observability capabilities, thereby enabling visibility and protection across an organization’s digital footprint. Hence, it strengthens security and management and helps BYOD environments that involve corporate data.

Corporate Landscape of the BYOD and enterprise mobility market:

Recent Developments

- In October 2025, SOTI announced major upgrades to its SOTI ONE Platform at SOTI SYNC 25 by introducing new security, automation, and device-management capabilities, which are aimed at streamlining enterprise mobility operations.

- In October 2025, JumpCloud introduced mobile device trust, enabling organizations to secure both corporate-owned and BYOD mobile devices without reducing employee productivity. The feature uses phishing-resistant credentials through JumpCloud Go and the Protect app to ensure only trusted, compliant devices access company resources.

- Report ID: 8299

- Published Date: Dec 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

BYOD and Enterprise Mobility Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.