Bone-Cutting Technologies Market Outlook:

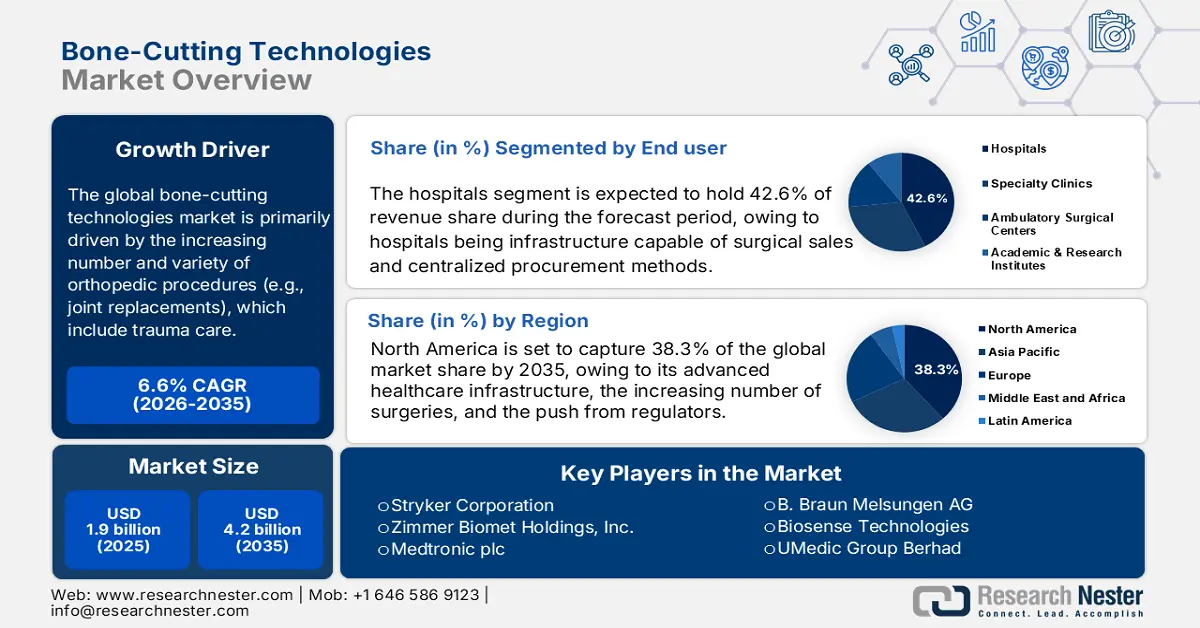

Bone-Cutting Technologies Market size was estimated at USD 1.9 billion in 2025 and is expected to surpass USD 4.2 billion by the end of 2035, rising at a CAGR of 6.6% during the forecast period, i.e., 2025-2035. In 2026, the industry size of bone-cutting technologies is estimated at USD 2 billion.

The global bone-cutting technologies market is driven by the growing patient pool and mainly driven by the aging population and prevalence of musculoskeletal conditions. According to the World Health Organization report in July 2022, the prevalence of musculoskeletal conditions affects more than 1.71 billion globally. These patients experience conditions such as osteoarthritis, which is a leading cause of disability and the main driver demanding the market. Further, it creates a consistent demand for orthopedic procedures requiring bone-cutting technologies, such as joint replacements and spinal fusions.

Investment in research, development, and deployment is the major criterion for advancements in this sector. The public funding from entities such as the National Institutes of Health supports foundational research to improve surgical techniques and biomaterials. According to the National Institute of Arthritis and Musculoskeletal and Skin Diseases report in August 2024, had a budget of USD 685,465,000 in 2024, a portion of which is directly funded to the research related to surgical innovations. The deployment of these technologies is further influenced by international trade dynamics, surging the bone-cutting technologies market demand.

Key Bone-Cutting Technologies Market Insights Summary:

Regional Highlights:

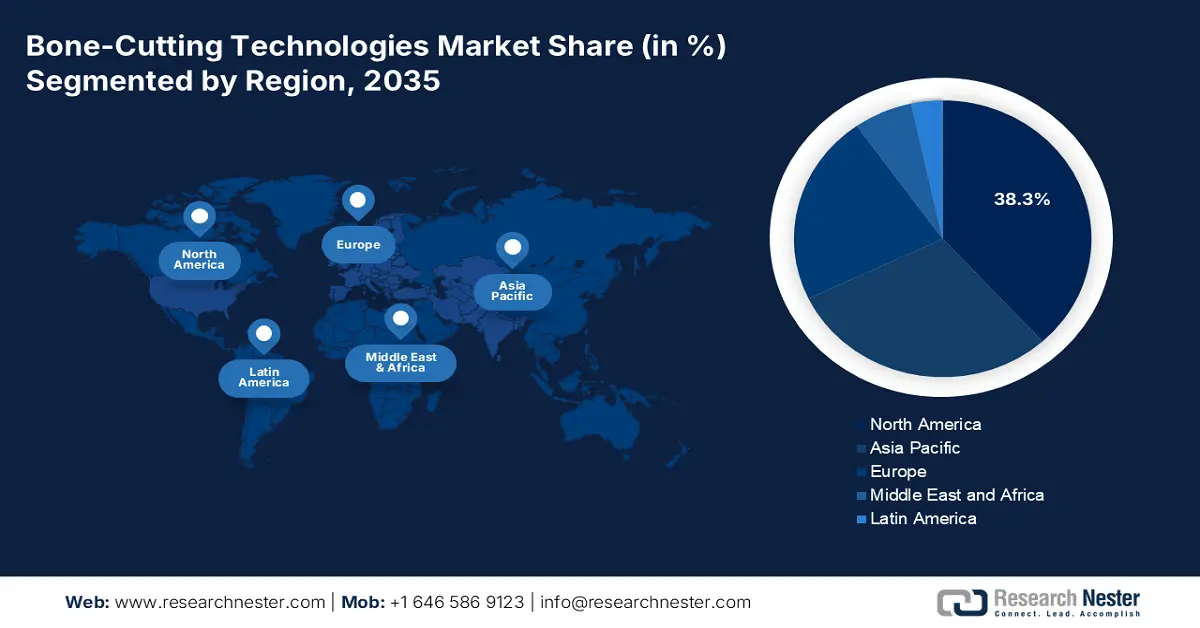

- North America is projected to hold 38.3% share of the bone-cutting technologies market by 2035, owing to advanced healthcare infrastructure, rising surgical volumes, and the adoption of robotic-assisted tools.

- Asia Pacific is expected to witness the fastest growth during 2026–2035, supported by an aging population, rising orthopedic surgical procedures, and investment in advanced bone-cutting systems such as ultrasonic and laser technologies.

Segment Insights:

- The hospital segment is projected to secure 42.6% share in the bone-cutting technologies market by 2035, driven by high surgical volumes, robust infrastructure, and investments in smart minimally invasive surgical technologies.

- The orthopedic surgery segment is expected to record the highest growth by 2035, owing to the rising prevalence of osteoarthritis, rheumatoid arthritis, and traumatic injuries worldwide.

Key Growth Trends:

- Technological advancements in surgical tools

- Rise in orthopedic disorders and joint replacements

Major Challenges:

- Regulatory approval delays & fragmented standards

- High R&D costs for advanced technologies

Key Players: Medtronic plc (Ireland), Johnson & Johnson (DePuy Synthes) (USA), Stryker Corporation (USA), Zimmer Biomet Holdings, Inc. (USA), Smith & Nephew plc (United Kingdom), B. Braun Melsungen AG (Germany), Integer Holdings Corporation (Greatbatch Medical) (USA), Nuvasive, Inc. (USA), Globus Medical, Inc. (USA), Aesculap, Inc. (B. Braun) (USA), KLS Martin Group (Germany), Dentsply Sirona (USA), Orthofix Medical Inc. (USA), MicroAire Surgical Instruments (USA), Bone Support AB (Sweden), Arthrex, Inc. (USA), Olympus Corporation (Japan), Jeil Medical Corporation (South Korea), Surgival (India), MSC Medical Sdn Bhd (Malaysia)

Global Bone-Cutting Technologies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 20 October, 2025

Bone-Cutting Technologies Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements in surgical tools: Operating rooms are slowly transforming due to modern technology, such as ultrasonic scalpels and robot-assisted bone-surgical equipment. These tools assist patients in healing faster and make neat cuts, and save nearby muscle. According to a July 2023 NIH study, nearly 11 million robotic surgeries were performed worldwide. These surgeries are rising and are mostly used for niche bone-cutting devices, especially those coated for long life in delicate, minimally invasive orthopedic and neurosurgery.

- Rise in orthopedic disorders and joint replacements: Rising orthopedic disorders among patient aged above 60 have surged to get joint replacement for the betterment of their health. According to the American Academy of Orthopaedic Surgeons, till date, more than 4 million hip and knee arthroplasty procedures have been performed, mirroring similar forecasts worldwide. This rising number of cases is expected to drive the global joint-replacement market to surge. Further, hospitals are working for tough, high-performance cutters that stay sharp, safe, and accurate even under heavy surgical traffic.

- Favorable government reimbursement policies and healthcare funding: Reimbursement codes from the U.S. Medicare and Medicaid services for robotic assisted procedures are the main driver for adopting advanced technologies. When these advanced technologies are covered with insurance, the provider adoption rate also increases significantly. Further, the market success is tied to securing favorable reimbursement codes for computer assisted procedures and supports the bone-cutting technologies market growth directly by reducing the hospital cost concerns.

Bone Cutting Technologies in 2023 and Their Outcomes

|

Technology |

Key Outcomes |

Advantages |

|

Ultrasonic Bone Cutting |

35% shorter surgery, 21% less blood loss, 40% reduced analgesic consumption |

Precision cutting, less pain, fewer complications |

|

Laser-Based Bone Cutting |

Less postoperative swelling and pain; longer cutting time (5 to 9 min) |

Reduced trauma, favorable tissue response |

|

Conventional Rotary Drill |

Longer operative time, more blood loss, more tissue trauma |

Established technique, widely available |

Source: NLM August 2025, NLM December 2023

Challenges

- Regulatory approval delays & fragmented standards: As the requirements vary across various regions, such as the U.S., EU, and Asia, companies are required to conduct multiple clinical trials. Hence, this becomes a major constraint for small innovators abandoning projects due to complexity. For instance, robotic bone cutters face a time issue for global approvals, delaying revenue streams. The lack of harmonized standards confines sales to North America/Europe, stifling growth in emerging markets. These barriers cost make the growth slow in the industry.

- High R&D costs for advanced technologies: Developing advanced systems such as robotic-assisted platforms, requires more investment in engineering, validation studies, and software. This creates a high barrier to entry. Further, various companies have spent million in R&D to compete with the key players. For a new entrant, it is difficult as the initial capital may exceed more before the sales are made, favouring large, well-funded incumbents and creating a significant financial roadblock.

Bone-Cutting Technologies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Bone-Cutting Technologies Market Segmentation:

End user Segment Analysis

The hospital segment is predicted to gain the largest bone-cutting technologies market share of 42.6% during the projected period by 2035. Hospitals have the infrastructure to support surgical sales, a high volume of surgical cases, and organized procurement techniques. The NLM study in February 2024 stated that nearly 3,149,042 hip and knee arthroplasty procedures have been performed over the past decade in hospitals, highlighting the importance and demand for the hospitals to perform these procedures. The Agency for Healthcare Research and Quality has suggested institutional. Further, the investment in smart surgical technologies for minimally invasive surgery aims to enhance recovery time and improve patient throughput. Within the relative public health campaigns to ameliorate healthcare access, strengthen the regulatory clinical base in clinical environments.

Application Segment Analysis

The orthopedic surgery segment is anticipated to constitute the most significant growth by 2035, mainly due to the increasing global prevalence of osteoarthritis, rheumatoid arthritis, and traumatic injuries is resulting in more orthopedic surgeries around the globe. By 2040, the Centers for Disease Control and Prevention report in February 2024 estimates that nearly arthritis among people aged above 75 has increased by 53.9%. Based on population growth, aging of the population, and more sports-related injuries, there is an increasing demand for new bone-cutting tools that allow precision bone cutting, reduced operating time, and tissue damage. The National Institute of Health (NIH) has significant funding available to incentivize R&D in orthopedic biology and instrumentation, which includes bone-cutting devices.

Product Segment Analysis

Powered bone cutting devices are leading the segment and are expected to hold a considerable share by 2035. Devices such as oscillating and reciprocating saws are the most prevalent products as they offer greater efficiency, accuracy, and control than manual devices in large volume procedures like joint arthroplasty. They are used due to their requirement in minimizing surgical time and enhancing patient outcomes. The NIH points out that powered devices are the gold standard in orthopedic surgery, with continuous R&D aimed at improving their safety and cutting efficiency, especially in advanced spinal and trauma procedures, where accuracy is paramount

Our in-depth analysis of the bone-cutting technologies market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Product |

|

|

Saw Type |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bone-Cutting Technologies Market - Regional Analysis

North America Market Insights

North America is expected to hold 38.3% of the bone-cutting technologies market by 2035. The region is benefiting from its advanced healthcare infrastructure, the increasing number of surgeries, and the push from regulators. These regulators, such as the EPA or OSHA, can benefit technologically small companies that are trying to use safer and sustainable technologies in both government and private procedures. Similarly, the development of robotic-assisted tools instead of traditional tools is becoming more common in orthopedic surgery and trauma, more generally.

The U.S. has a considerable advantage over the regional bone-cutting technologies market share, reflecting the rise of orthopedic surgery and federal support. For instance, according to the NLM study in February 2024, 3.2 million hip and knee procedures were conducted in 2023. Further, the research-based innovation funding support has surged between 2021 and 2023, demonstrating the resilience of the industry, but naturally recording a 2021 to 2023 record-breaking figure. This increasing surgery volume and funds for research reflect the increasing uptake of sophisticated technologies, solidifying market opportunities in the U.S.

The Canada bone-cutting technologies market is expected to expand swiftly and is led by an aging population and increased orthopedic surgeries. According to the Statistique Canada report in April 2022, the aging population in Canada is approximately 861,000 individuals aged 85 years and older. This increasing aging population demands specialized orthopedic and trauma care, which directly elevates the demand for advanced bone-cutting technologies in surgical interventions. In addition, efforts by the government to enhance surgical facilities and the utilization of precision-driven medical devices are driving market expansion throughout the nation.

Trade Data on Medical Devices in 2023

|

Country |

TradeFlow |

Product Description |

Trade Value 1000USD |

|

U.S. |

Export |

Medical Diagnostic Test instruments and apparatus |

64,346.28 |

|

Canada |

Export |

Medical Diagnostic Test instruments and apparatus |

3,271.83 |

|

U.S. |

Import |

Instruments and appliances used in medical |

19,524,852.48 |

|

Canada |

Import |

Instruments and appliances used in medical |

1,706,884.72 |

Source: WITS, 2023

Asia Pacific Market Insights

APAC's bone-cutting technologies market is expanding rapidly and is expected to grow at a CAGR of 7.8% during the forecast period. The market is influenced by an aging population, increased orthopedic surgical procedures requiring complex bone division, and significant investment in more sophisticated cutting tools such as ultrasonic and laser cutting systems. Growth will continue in emerging economies as end-users poorly adapted to using these precision technologies start using them to support larger surgical volumes consistent with surgical demand.

China is expected to hold the biggest bone-cutting technologies market in APAC owing to several hospitals upgrading operating rooms in most provinces, pursuing green chemistry production and supply policies that encourage green manufacturing/facilitation policies in laser-assisted bone surgeries from both public and private spheres. According to the NLM analysis in March 2025, 70 million osteoporosis patients are enrolled in China, requiring innovative orthopedic procedures and minimally invasive surgical treatments. This, in turn, boosts the uptake of precision-based and energy-effective cutting technologies for bones among large healthcare facilities in the nation.

Japan is also leading the bone-cutting technologies market due to its aging population. As per the World Economic Forum report in September 2023, 1 in 10 people of the population aged 80 and above are driving high demand for joint replacements and orthopedic care. Further, the Japan market is more mature with technologically advanced equipment and is defined by the rapid adoption of robotic-assisted surgical systems in major hospitals. AI with surgical robots enhances the precision and ensures better outcomes for elderly people and improving the healthcare systems.

Europe Market Insights

The bone-cutting technologies market in Europe is a mature and consistently expanding market, with advanced healthcare infrastructure, a large number of orthopedic interventions, and an accelerating aging population. Major drivers are the increasing incidence of age-related diseases such as osteoporosis and osteoarthritis, requiring joint replacement and spinal fusion operations. One of the prominent trends is the fast-rising adoption of robotic surgical systems and patient-specific instruments, enhancing the accuracy of surgery and shortening recovery periods.

Germany is leading the bone-cutting technologies market in Europe and is driven by its aging population, rising healthcare spending, and early adoption of robotic surgery systems. The Destatis report of December 2022 depicts that there are 4 million people over 67 in Germany, highlighting a consistent demand for joint replacements. Further, the German Medical Association actively develops certain guidelines and integrates advanced technologies into standard care, hence creating a receptive environment for innovation and solidifying its market leadership.

France is also leading the bone cutting technology market in Europe due to the strong investment in hospital modernization and the high volume of orthopedic procedures. The French National Authority for Health highlights that the evaluation and reimbursement of advanced medical devices that demonstrate enhanced clinical outcomes. Further, the data from Ministry of Solidarity and Health states that there is a consistent rise in the spending on advanced surgical equipment. This approach adopts cost effective technologies combined with rising procedure rates in knee and hip arthroplasty positions, making a stable market.

Key Bone-Cutting Technologies Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (DePuy Synthes) (USA)

- Stryker Corporation (USA)

- Zimmer Biomet Holdings, Inc. (USA)

- Smith & Nephew plc (United Kingdom)

- B. Braun Melsungen AG (Germany)

- Integer Holdings Corporation (Greatbatch Medical) (USA)

- Nuvasive, Inc. (USA)

- Globus Medical, Inc. (USA)

- Aesculap, Inc. (B. Braun) (USA)

- KLS Martin Group (Germany)

- Dentsply Sirona (USA)

- Orthofix Medical Inc. (USA)

- MicroAire Surgical Instruments (USA)

- Bone Support AB (Sweden)

- Arthrex, Inc. (USA)

- Olympus Corporation (Japan)

- Jeil Medical Corporation (South Korea)

- Surgival (India)

- MSC Medical Sdn Bhd (Malaysia)

- Medtronic leads in robotic and navigated bone cutting with systems such as Mazor X and StealthStation. These technologies provide surgeons with real-time, 3D-guided precision for spinal and orthopedic procedures, enabling minimally invasive techniques that improve accuracy and patient outcomes in the competitive surgical robotics market. Further, the company has spent USD 2.7 billion in R&D in 2024 to drive the demand and meet patients’ needs.

- DePuy Synthes advances bone cutting via its VELYS Digital Surgery platform. This platform combines robotic-assisted technology with intelligent instruments and patient-specific guides to provide an accurate bone resection for joint replacements, driving a strategic shift towards connected, data-driven orthopedic surgery.

- Stryker Corporation is also a player in the bone-cutting technologies market. The company has shown a significant rise, as the global sales reached USD 22.6 billion in 2024. Its Mako SmartRobotics system uses a CT-based 3D surgical plan to aid a robotic arm to perform highly precise and personalized bone resections for joint arthroplasty. This platform focuses on haptic-guided cutting and has set a new standard for accuracy.

- Zimmer Biomet dominates the bone-cutting technologies market by integrating robotics and smart implants to advance bone cutting. Its ROSA Robotics platform is combined with specialized instrumentation to provide a data-driven bone resection based on personalized surgical plans. This strategic initiative provides a precise intraoperative cutting to long-term patient outcomes, optimizing performance.

- Smith & Nephew champions versatility in bone cutting with its CORI Surgical System. This handheld, robotics-assisted platform uses intraoperative imaging for precise bone resections in knee and hip replacements, offering a compact and efficient alternative to larger consoles and promoting faster, more flexible surgical workflows.

Below is the list of some prominent players operating in the global bone-cutting technologies market:

The global bone-cutting technologies market has established competition, with the majority of players coming from the U.S. and Europe, and they take up over one-third of the overall market. These large players invest in research and development as well as digital elements of surgery (robotics, AI-assisted surgery, etc.) and strategic acquisitions to maintain their position of leadership. For instance, in July 2025, Xtant Medical announced a definitive agreement for the sale of its spinal implants, such as Coflex and CoFix, all OUS businesses to Companion Spine. As competition increases, the global players continue to invest in the emerging markets in healthcare, expand their surgical portfolios of options, while also aligning themselves to the trends in minimally invasive and patient-specific surgical elements.

Corporate Landscape of the Bone-Cutting Technologies Market:

Recent Developments

- In October 2025, Zimmer Biomet Holdings, Inc. completes its acquisition of Monogram Technologies, which is an AI-driven, next-generation orthopedic robotics company. The acquisition expands the company’s extensive suite of orthopedic robotics by enabling analytics and solutions to address the requirements of surgeons pre-, intra-, and post-operatively

- In May 2025, Surgify Medical plans to expand its research and other operations in Europe and the U.S. with its bone cutting technology, which protects soft tissue in neck, head and spine procedures.

- In March 2025, Johnson & Johnson MedTech, a global leader in orthopaedic technologies and solutions has highlighted its latest innovation in digital orthopaedics at the American Academy of Orthopaedic Surgeons 2025 Annual Meeting in San Diego, California.

- Report ID: 7785

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bone-Cutting Technologies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.