Biodiesel Filter Market Outlook:

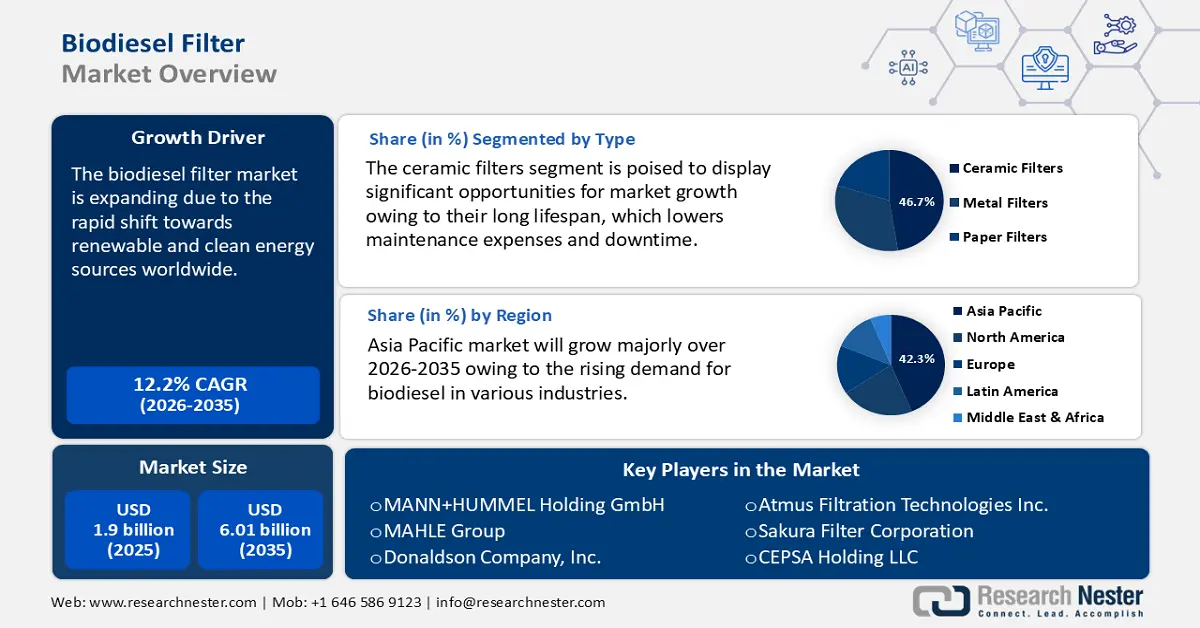

Biodiesel Filter Market size was valued at USD 1.9 billion in 2025 and is expected to reach USD 6.01 billion by 2035, registering around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biodiesel filter is evaluated at USD 2.11 billion.

The global biodiesel filter market is anticipated to expand due to the rapid shift towards renewable and clean energy sources worldwide. The International Energy Agency (IEA) reported that the use of renewable energy in the transportation, heating, and electricity sectors will rise by almost 60% between 2024 and 2030. With this increase, the proportion of renewable energy in total energy consumption will rise from 13% in 2023 to about 20% by 2030.

To ensure the quality and purity of biodiesel produced, there is an increasing need for efficient filtration systems when setting up new biodiesel plants. Biodiesel filters are essential for removing contaminants, impurities, and water from fuel so that they do not endanger engines or guarantee optimal fuel efficiency. Several factors, including government incentives, environmental legislation, and growing awareness about the need for sustainable energy solutions, are contributing to this expansion. As more biodiesel plants are constructed, the demand for biodiesel filters is anticipated to rise, creating a significant market development opportunity.

As biodiesel production expands globally, driven by environmental regulation and the push for renewable energy, the need for high-performance filters in refining, storage, and engine applications rises. The European Biodiesel Board released a statistical report in 2023 stating that nearly 52 million tons of biodiesel were produced worldwide in 2022, with the European Union (except the UK) producing the most, with 13.7 million tons, or about 25% of the entire output.

|

Country |

Production Capacity of Biodiesel (in million tons) |

|

Europe |

13.7 |

|

U.S. |

10.2 |

|

Indonesia |

9.7 |

|

Brazil |

5.4 |

|

China |

2.2 |

Source: AMI, Oil World

Key Biodiesel Filter Market Insights Summary:

Regional Highlights:

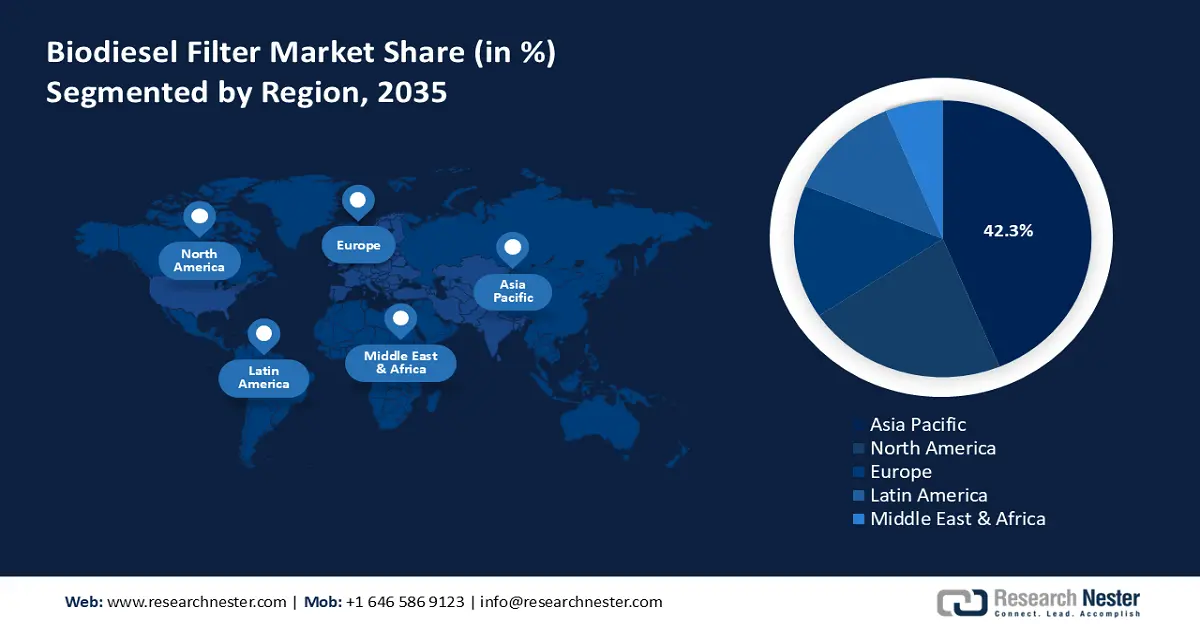

- By 2035, Asia Pacific is anticipated to capture over 42.3% share of the biodiesel filter market as biodiesel production accelerates across major economies owing to rising demand for biodiesel across industries.

- Through 2026-2035, North America is projected to grow at a considerable pace, supported by expanding biodiesel applications impelled by increasing government regulations promoting renewable fuels.

Segment Insights:

- By 2035, the ceramic segment is expected to secure over 46.7% share in the biodiesel filter market, supported by its capacity to enhance fuel purity propelled by high filtration capabilities.

- Across 2026-2035, the automotive segment is set to witness notable growth as industries shift toward biodiesel as a practical replacement for petroleum fuels owing to the environmental sustainability of biodiesel.

Key Growth Trends:

- Rising government support for biodiesel adoption

- Growing global commerce in biodiesel and its mixtures

Major Challenges:

- Compatibility issues with derivatives

- Increasing prices of palm oil

Key Players: MANN+HUMMEL Holding GmbH, MAHLE Group, Donaldson Company, Inc., Atmus Filtration Technologies Inc., Sakura Filter Corporation, CEPSA Holding LLC, Alfa Laval AB, Baldwin Filters, Inc., ACDelco, Purolator Inc.

Global Biodiesel Filter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2.11 billion

- Projected Market Size: USD 6.01 billion by 2035

- Growth Forecasts: 12.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, India, Brazil

- Emerging Countries: Indonesia, Malaysia, Thailand, Vietnam, Mexico

Last updated on : 3 December, 2025

Biodiesel Filter Market - Growth Drivers and Challenges

Growth Drivers

- Rising government support for biodiesel adoption: The production of biodiesel not only requires less energy compared to conventional fossil fuels, but it also utilizes renewable materials like vegetable and animal fats, making it a more sustainable option. One of the significant advantages of biodiesel is its ability to mitigate environmental damage; in the event of a spill, biodiesel breaks down much faster than diesel fuel, minimizing its ecological impact. As a result, the rising production of biodiesel contributes to lower carbon emissions, aligning with global efforts to combat climate change.

To ensure the highest quality of biodiesel, it is essential to reduce and eliminate contaminants through effective biodiesel filtration. This filtration process has become increasingly recognized as necessary by both businesses and consumers who aim to meet quality standards. Consequently, the market for biodiesel filters is experiencing growth, driven by government initiatives and pollution regulations that support and promote the use of biodiesel as an alternative fuel source.

In the U.S., major incentives for biodiesel producers and blenders include the Biodiesel Income Tax Credit, the Biodiesel Mixture Excise Tax Credit, and the U.S. Renewable Fuel Standard Program. Biodiesel accounted for almost 9% of the total amount of biofuels produced and used in the U.S. in 2022. Similarly, the European Commission declared that EU nations must either lower the emissions intensity of transportation fuels by 14.5% or reach a share of 29% renewable energy in transportation by 2030. Additionally, they must meet a joint sub-target of 5.5% for advanced biofuels and renewable hydrogen. - Growing global commerce in biodiesel and its mixtures: As biodiesel production and exports rise, the need for quality and purity of biodiesel becomes more critical. Biodiesel plays a vital role in removing contaminants, such as water, sediment, and particulate matter, which can compromise the fuel’s performance and stability. As a result, manufacturers and suppliers of biodiesel filters are experiencing growing demand for their products, driving the expansion of the biodiesel filter market.

The Observatory of Economic Complexity revealed that with USD 36.6 billion in worldwide trade, biodiesel and its derivatives ranked 129th worldwide in 2022. Exports of biodiesel and its derivatives increased 42.9%—from USD 25.6 billion to USD 36.6 billion—between 2021 and 2022. 0.15% of global trade is made up of biodiesel and its derivatives.

The following table illustrates the export and import of biodiesel and its mixtures globally:

|

Country |

Export Value of Biodiesel and its Mixtures (in USD billion) |

Country |

Import Value of Biodiesel and its Mixtures (in USD billion) |

|

Netherlands |

7.22 |

Netherlands |

9.5 |

|

Belgium |

4.6 |

Belgium |

3.61 |

|

Germany |

4.31 |

France |

3.27 |

|

Spain |

3.38 |

Germany |

3.02 |

|

China |

2.41 |

Italy |

2.58 |

Source: OEC

Challenges

- Compatibility issues with derivatives: The compatibility of various biodiesel blends presents a significant challenge that may adversely affect the market growth of biodiesel filters. Biodiesel can be produced from a diverse array of feedstocks, including soybean oil, rapeseed oil, used cooking oils, and animal fats. Each of these sources results in distinct biodiesel blends, characterized by unique chemical compositions. The variations in viscosity, acidity, and other characteristics complicate the responsibilities of filter manufacturers.

Filters designed for biodiesel must be developed with careful consideration of the differing mixture ratios, ensuring that they do not disrupt the chemical integrity of the biodiesel. A filter that performs effectively with one specific blend may not yield the same results with another. Consequently, it is essential to conduct in-depth research and development, as well as comprehensive testing of filter materials, designs, and filtration mechanisms, to guarantee compatibility across a wide range of biodiesel blends. - Increasing prices of palm oil: Palm oil is a feedstock for biodiesel production, and rising prices make biodiesel production more expensive. This increase in production costs may lead to a decrease in biodiesel production, which in turn can reduce the demand for biodiesel filters. Over the past two years, palm oil prices have fluctuated at previously unheard-of levels. In 2022, they reached many record high prices, hitting USD 1,126–1,576 per ton, before decelerating in 2023 to 20% below the average price levels of the previous year. Before 2022, the price of a ton of palm oil fluctuated from USD 450 to less than USD 1,126. While the two biggest producers of palm oil, Indonesia and Malaysia, continue to account for about 85% of the world's supply, palm oil production has been stagnating in recent years due to lower yield rates and negative growth in oil palm planted regions. Therefore, the higher palm oil prices may impact the demand for biodiesel filters, impeding the market growth.

Biodiesel Filter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.01 billion |

|

Regional Scope |

|

Biodiesel Filter Market Segmentation:

Type Segment Analysis

Ceramic segment is estimated to capture biodiesel filter market share of over 46.7% by 2035. The remarkable filtration effectiveness of ceramic filters is well-known. As a result of their fine porosity, pollutants, impurities, and particle matter can be effectively removed from biodiesel. Ceramic filters' high filtration capabilities are a key driver propelling market expansion as the biodiesel industry places a premium on fuel purity to maintain optimal engine performance. Ceramic filters are also very durable and resistant to chemical corrosion, which makes them ideal for the harsh conditions in biodiesel systems. Moreover, since biodiesel is a special fuel with its own set of problems, it needs filters that can survive the corrosive properties of biofuels. Ceramic filters are used in the biodiesel sector due to their long lifespan, which lowers maintenance expenses and downtime.

Application Segment Analysis

The automotive segment in biodiesel filter market is expected to grow at a significant rate during the projected period. The limited availability of gasoline is likely to enhance the appeal of renewable energy sources. Utilizing alternative fuels represents a pragmatic approach to address this growing demand. Among the available options for diesel engines, biodiesel stands out as the most effective alternative to conventional diesel fuels. The primary advantage of biodiesel over gasoline and petroleum diesel is its environmental sustainability. Due to its reduced contaminant levels, biodiesel combusts like petroleum diesel.

Nevertheless, it is noteworthy that biodiesel exhibits superior efficiency compared to gasoline. This fuel demonstrates excellent performance in compression-ignition engines and can effectively replace diesel fuel when derived from vegetable oils. Currently, biodiesel production predominantly utilizes soybean, rapeseed, and palm oils as feedstocks. This has increased the use of filtered biodiesel in the automotive sector, consequently driving the market.

Our in-depth analysis of the biodiesel filter market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biodiesel Filter Market - Regional Analysis

APAC Market Insights

Asia Pacific biodiesel filter market is anticipated to hold revenue share of more than 42.3% by 2035. The manufacture of biodiesel is encouraged by the availability of plentiful and reasonably priced feedstocks. The necessity for dependable filtering systems to guarantee the fuel's quality and purity has expanded along with the manufacturing of biodiesel. Major countries' governments are initiating numerous programs to lessen reliance on fossil fuels, cut greenhouse gas emissions, and boost the domestic palm oil sector. The market for biodiesel filters is expanding as a result of rising demand for biodiesel in various industries.

In India, there’s a growing focus on renewable energy, government initiatives promoting biofuels, and rising environmental awareness are escalating the biodiesel filter market. The Indian government has implemented policies such as the National Bio-Energy Mission and Biodiesel Blending Program, encouraging the use of biodiesel as an alternative to fossil fuels. The IEA reported that India launched its National Policy on Biofuels in 2018, including feedstock requirements for various fuels, blending targets for ethanol (20% blending by 2030), and the roles of 11 ministries in coordinating government efforts. Furthermore, the government has already set a 5% biodiesel target by 2030, which will need nearly 4.5 billion liters of biodiesel annually. With the expansion of the automotive, industrial, and agricultural sectors, there is a greater demand for clean and efficient fuel, necessitating high-quality biodiesel filtration systems.

Furthermore, China is home to the largest automobile fleet, the second-largest market for gasoline, and the third-largest market for diesel worldwide. China's industrialization process is still ongoing, the country's greenhouse gas emissions are still rising, and transportation is playing a bigger role. Macroeconomic variables, the rate at which new energy vehicles—such as electric automobiles and advanced fuel vehicles—are adopted, and the execution of China's ambitious new push to meet national biofuel targets all affect the country's transportation fuel demand prospects. With increasing investments in clean energy infrastructure and growing awareness of sustainable fuel solutions, the biodiesel filter market in China is poised for significant growth.

North America Market Insights

North America biodiesel filter market is expected to grow at a significant rate during the projected period. The market's expansion can be primarily ascribed to the increasing government regulations promoting renewable fuels, rising environmental awareness, and advancements in biodiesel production technology. The U.S. and Canada have implemented policies such as the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standard (LCFS), which encourage biodiesel adoption. Additionally, the expansion of the transportation and agricultural sectors, where biodiesel is widely used, is driving demand for advanced filtration systems to improve fuel quality and engine performance. Furthermore, the rising production of biodiesel from sources such as used cooking oil and soybean oil further boosts the demand for biodiesel filters in the region.

Additionally, prices increased steadily at the end of December 2024, rising 4% from quarter to quarter, indicating a strong and resilient market. The main causes of this increase were ongoing supply chain issues that restricted availability and growing production costs, particularly as a result of higher feedstock prices such as soybean oil. Market dynamics were also significantly influenced by the regulatory environment, which included changing laws such as the Biodiesel Tax Credit Extension Act.

In September 2024, the price of biodiesel in the U.S. hit 1,475 USD/MT. Government regulations and steady feedstock availability assist the market expansion. The U.S. Energy Information Administration reported that in December 2020, 1,176 million pounds of feedstocks were utilized to make biodiesel. With 744 million pounds used in December 2020, soybean oil continued to be the most popular feedstock for biodiesel. Furthermore, biodiesel filter demand was supported by the transportation sector's drive for reduced emissions. Large-scale oilseed farming and regulations such as the Renewable Fuel Standard guaranteed strong supply chains and a favorable market trajectory despite production cost concerns. Furthermore, the rise in sustainability and energy security concerns resulted in a rapid shift towards cleaner fuels, further boosting the biodiesel filter market.

Biodiesel Filter Market Players:

- MANN+HUMMEL Holding GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MAHLE Group

- Donaldson Company, Inc.

- Atmus Filtration Technologies Inc.

- Sakura Filter Corporation

- CEPSA Holding LLC

- Alfa Laval AB

- Baldwin Filters, Inc.

- ACDelco

- Purolator Inc.

To expand their customer base, major players in the biodiesel filter market are implementing organic growth tactics such as process optimization and new product offerings. Furthermore, these businesses use tactics including mergers and acquisitions to increase their market share and clientele. To meet the demands of various consumer categories, they are concentrating on R&D and the creation of new products.

Recent Developments

- In February 2024, Cepsa and Bio-Oils, an Apical subsidiary, started the construction for southern Europe's largest second-generation biofuels factory. This plant will produce 500,000 tons of sustainable aviation fuel (SAF) and renewable diesel (hydrogenated vegetable oil or HVO) per year and enable the joint venture formed by both corporations to double its existing production capacity.

- In January 2023, Alfa Laval developed the marine industry's first biofuel-ready separators by modifying both internal bowl components and separator software. This simplifies the setup for HVO, FAME blends, and conventional fuels.

- Report ID: 7155

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biodiesel Filter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.