Bioanalytical Testing Services Market Outlook:

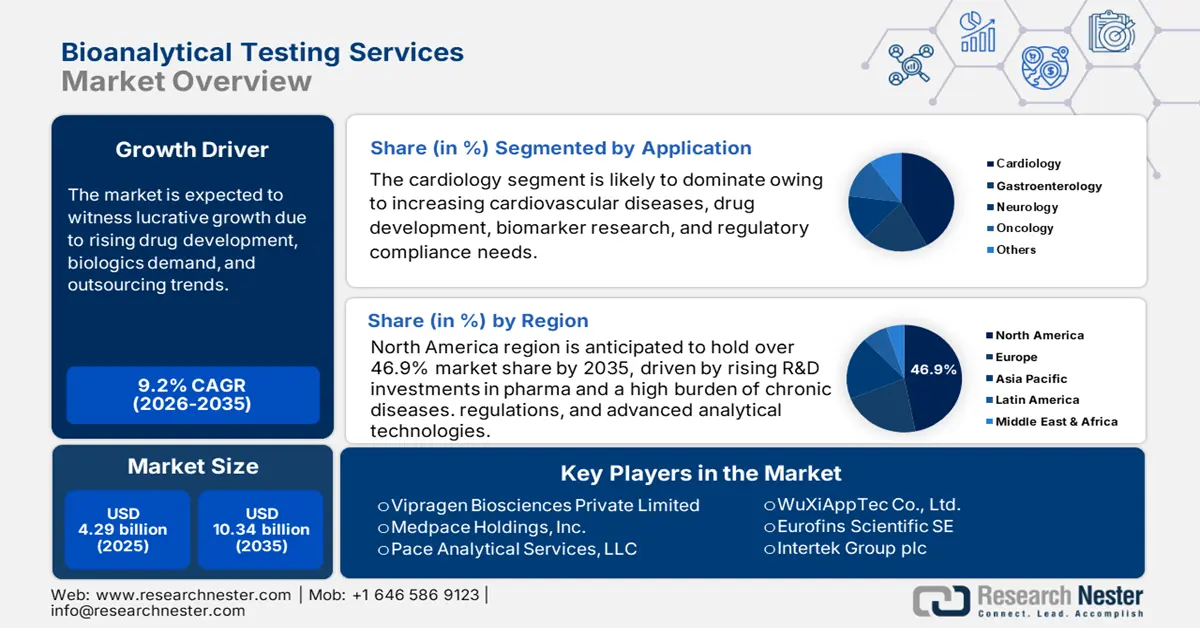

Bioanalytical Testing Services Market size was over USD 4.29 billion in 2025 and is poised to exceed USD 10.34 billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioanalytical testing services is estimated at USD 4.65 billion.

To treat a wide range of disorders, the pharmaceutical and biotechnology industries are continually trying to produce novel treatments and cures. This raises the need for bioanalytical services since it necessitates extensive testing and analysis of biological materials. As of 2020, around 550 new medicines were found to be under development in the USA while nearly 50 novel drugs received approval from the Center for Drug Evaluation and Research (CDER).

The growth of the market is primarily ascribed to the escalating development of novel drugs and therapies, the rising outsourcing of R&D activities by pharmaceutical companies, and the rising number of innovations and new product developments. Many bioanalytical tests have seen major developments, allowing for a more precise and effective study of biological materials. As a result, test findings are more accurate and test costs are falling. Global bioanalytical testing services market trends such as the increasing number of clinical, pre-clinical, and laboratory testing services, advancement of biosimilars, and combination products are anticipated to influence the growth of the market positively over the forecast period. For instance, the annual rate of laboratory tests performed in the USA is estimated to be around 6 billion.

Key Bioanalytical Testing Services Market Insights Summary:

Regional Highlights:

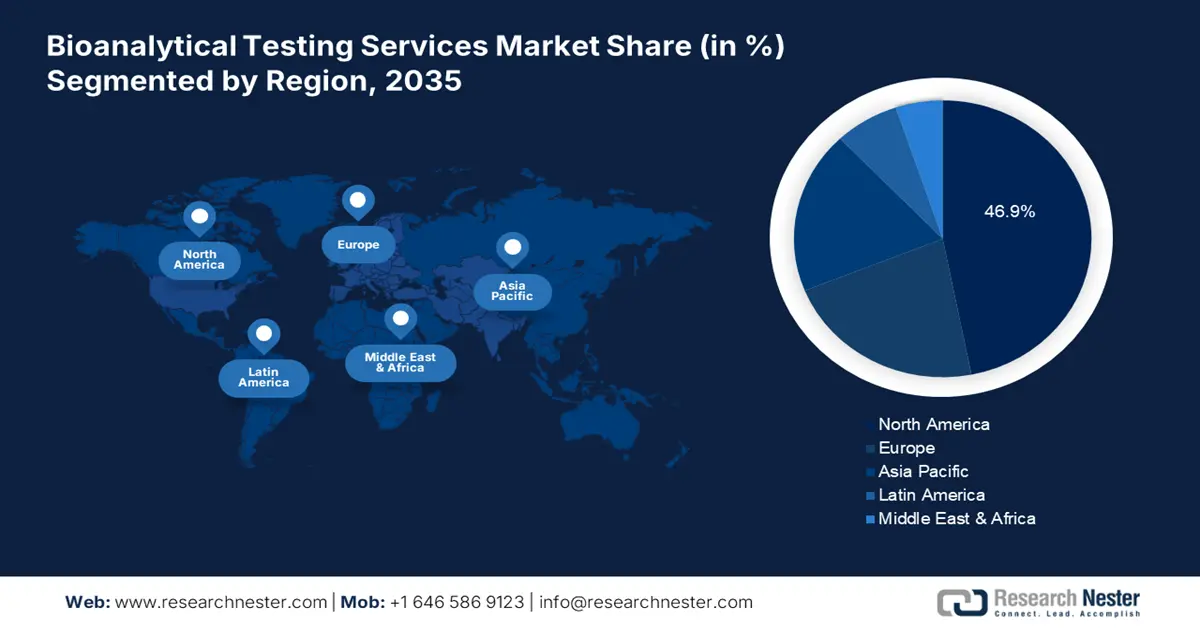

- North America bioanalytical testing services market will hold around 46.9% share by 2035, driven by rising R&D investments in pharma and a high burden of chronic diseases.

- Europe market grows rapidly by 2035, driven by increased pharmaceutical R&D funding and rise in cardiovascular diseases.

Segment Insights:

- The cardiology segment in the bioanalytical testing services market is expected to secure the largest share by 2035, driven by the rising incidence of cardiovascular diseases due to poor lifestyle habits.

- The small molecules segment in the bioanalytical testing services market is anticipated to hold the majority revenue share by 2035, fueled by demand for generic drug development and effectiveness of bioanalytical testing.

Key Growth Trends:

- Spiking Number of Medication Errors

- Significant Growth in Blood Donation

Major Challenges:

- Lack of Skilled Medical Professionals

- Requirement for Higher Initial Investment

Key Players: Charles River Laboratories, Inc.Vipragen Biosciences Private LimitedMedpace Holdings, Inc.Pace Analytical Services, LLCWuXiAppTec Co., Ltd.Eurofins Scientific SEIntertek Group plcSGS S.A.Almac GroupBioAgilytix Labs.

Global Bioanalytical Testing Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.29 billion

- 2026 Market Size: USD 4.65 billion

- Projected Market Size: USD 10.34 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Bioanalytical Testing Services Market Growth Drivers and Challenges:

Growth Drivers

-

Spiking Number of Medication Errors – The U.S. Food and Drug Administration stated to receive more than 100,000 medication errors annually. Medication error is a serious issue that occurs in the medical field, it is also estimated to cost someone his life. Henceforth, before making any new medical method, drug, therapy, and medicine available for the common people, proper research and testing are required. Such a demand for testing services is projected to hike the growth of the market over the forecast period.

-

Significant Growth in Blood Donation - The act of donating blood involves taking blood from a healthy person and using it to benefit others. Blood transfusion diagnostics and the maintenance of the blood supply depends on blood donation, and thus it needs to be properly assessed. As per the data provided by World Health Organization, it was stated that approximately 118.54 blood donations are collected worldwide and 40% of them come from developed countries.

-

Increasing Cases of Urinary Tract Infection (UTI) - There is a rising need for diagnosis, testing, and treatment of UTIs as the incidence of these illnesses rises. The fact that these services are utilized to identify UTIs is increasing the demand for bioanalytical testing services. As of 2019, It is observed that approximately 42% of women have UTIs and about 22% of them are above 65.

-

Higher Number of Ongoing Clinical Trials - Clinical trials are a crucial step in the development of novel medications and medical devices because they allow for the evaluation of their efficacy and safety. In mid-2021, around 425,000 studies were being conducted in about 220 countries.

-

Growing Healthcare Expenditure Across the Globe - The demand for bioanalytical testing services rises as a result of the increasing research on novel medications and treatments made possible by the increased expenditure. Based on the data provided by the World Bank, the healthcare expenditure of the world was stated to be 1,121.9 U.S. dollars per capita in 2019.

Challenges

- Lack of Skilled Medical Professionals - Bioanalytical testing requires skilled professionals to handle the equipment and the shortage of experienced people leads to the restraining of market growth. The number of students who graduated every year was believed to be one-third of the vacancies available for the clinical laboratory science program. The low number is a limiting factor to using new technologies and methods in the bioanalytical testing service impeding market growth.

- Requirement for Higher Initial Investment

- Complex and Long-Lasting Procedure of Bioanalytical Testing

Bioanalytical Testing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 4.29 billion |

|

Forecast Year Market Size (2035) |

USD 10.34 billion |

|

Regional Scope |

|

Bioanalytical Testing Services Market Segmentation:

The cardiology segment is estimated to attain the largest share of the bioanalytical testing services market over the forecast period. The growth of the segment can be accounted to the rising cases of cardiovascular diseases owing to unhealthy life choices, lack of exercise, and smoking habits. For instance, in 2020, approximately 600,000 people lost their lives in the United States as a result of cardiovascular disease.

The small molecules segment will dominate majority revenue share by 2035, owing to its crucial role in creating generic versions of branded medications, the small molecule testing services sub-segment is predicted to experience growth. The effectiveness of simulating generic medication release profiles with those of branded drugs has been demonstrated through bioanalytical testing, which has contributed to the segment's expansion.

Our in-depth analysis of the global bioanalytical testing services market includes the following segments:

|

By Type |

|

|

By Molecule Type |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioanalytical Testing Services Market Regional Analysis:

North America region is anticipated to hold over 46.9% market share by 2035. The growth of the market in the region is ascribed to the mounting investment in the R&D expenditure in the pharmaceutical industry. For instance, in 2019, the investment made by significant key players was valued at around USD 100 billion. Additionally, growing chronic diseases and the presence of well-developed healthcare infrastructure in the region are further anticipated to influence the growth of the market over the forecast period. For instance, 5 out of 10 adults in the USA have some sort of chronic disease. Chronic diseases such as stroke, cancer, heart disease, and diabetes are more prevalent in the region. All these factors are estimated to foster the growth of the market over the forecast period.

Additionally, the market in the Europe region is also projected to grow rapidly over the forecast period on the back of the increase in funding for pharmaceutical and biotechnology R&D operations. Also, the market in Europe is being driven by the rise in cardiovascular disease. For instance, 3.9 million fatalities in Europe were attributed to cardiovascular disease in 2017. High blood sugar contributes to 15% of cardiovascular fatalities in the area. Diabetes is very common in this area. In the past ten years, it has grown quickly, rising by more than 50% in a number of the region's countries. Hence, all these factors are estimated to hike the market growth over the forecast period.

Bioanalytical Testing Services Market Players:

- Charles River Laboratories, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vipragen Biosciences Private Limited

- Medpace Holdings, Inc.

- Pace Analytical Services, LLC

- WuXiAppTec Co., Ltd.

- Eurofins Scientific SE

- Intertek Group plc

- SGS S.A.

- Almac Group

- BioAgilytix Labs

Recent Developments

-

Pace Analytical Services, LLC to receive approval for its Pace, a method to detect dibenzofurans and dioxins with the assistance of technology called GCMS/MS.

-

Medpace Holdings, Inc. to elaborate on avoiding basic pitfalls in clinical trials associated with cell therapy. The experts of Medpace Holdings, Inc. bring light to strategies and challenges by including various range of topics such as the capacity of clinical trials, managing complex logistics, regulatory strategy, and others.

- Report ID: 4227

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.