Behavior Analytics Market Outlook:

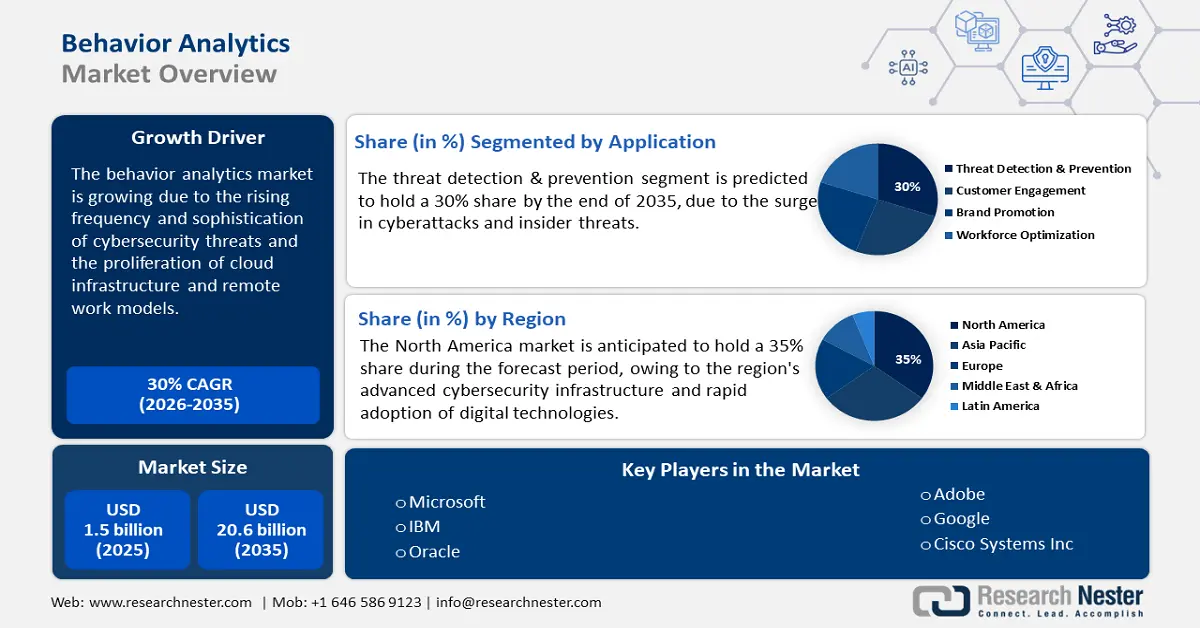

Behavior Analytics Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 20.6 billion by the end of 2035, rising at a CAGR of 30% during the forecast period, i.e., 2026-2035. In 2026, the industry size of behavior analytics is evaluated at USD 1.9 billion.

The rising frequency and sophistication of cybersecurity threats, especially insider risks and credential-based attacks, are key market drivers. Conventional security tools often fail to identify subtle, internal threats or misuse of legitimate credentials, leaving organizations vulnerable to breaches from within. Thus, behavior analytics addresses this gap by monitoring and analyzing user and entity behavior to detect anomalies that may indicate malicious intent. As insider threats continue to surge, corporations are increasingly adopting behavior analytics tools to enhance threat detection, minimize response time, and fulfill growing regulatory and compliance needs. The integration of these tools with large security ecosystems such as SIEM, SOAR, and cloud platforms further fuels their adoption, making behavior analytics a critical layer in modern cybersecurity strategies.

In May 2023, the European Union Agency for Cybersecurity (ENISA) reported that cybercriminals are constantly employing different ways to hack into systems through emails. For example, a harmful program called QBot, often used by criminals in ransomware attacks, is consistently evolving. During the same period, it was sent in ZIP folders with a special file (DLL) that exploits a weakness in Windows 10’s WordPad. To combat such challenges, the manufacturers are introducing next-gen behavior analytics solutions, and end users are also investing heavily in them.

Key Behavior Analytics Market Insights Summary:

Regional Insights:

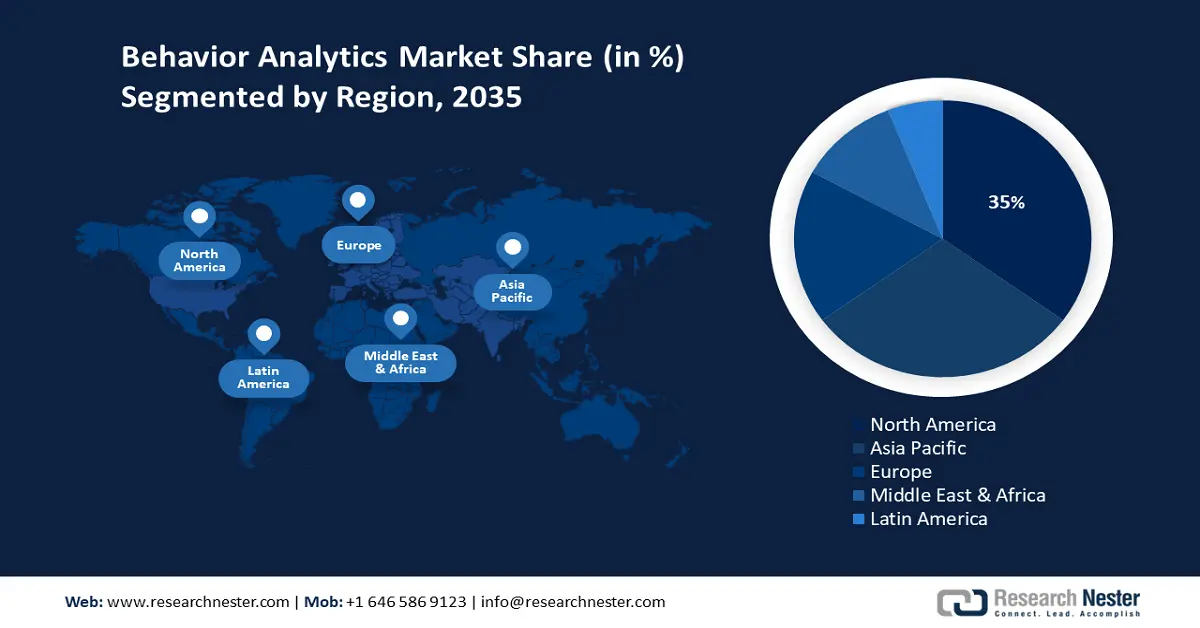

- The Behavior Analytics Market in North America is anticipated to hold a 35% share during the forecast period, owing to the region's advanced cybersecurity infrastructure and rapid adoption of digital technologies.

- The Asia Pacific behavior analytics market is projected to expand rapidly at a CAGR of 37% from 2026 to 2035, fueled by digital transformation initiatives, rising cybersecurity concerns, and government investments in the ICT sector.

Segment Insights:

- The threat detection & prevention segment in the Behavior Analytics Market is projected to hold a 30% share by 2035, impelled by the surge in cyberattacks and insider threats.

- The BFSI segment is anticipated to capture a 28.6% share during the forecast period, driven by high exposure to fraud, insider threats, and regulatory scrutiny.

Key Growth Trends:

- Rising inclination towards remote work and Bring Your Own Device (BYOD)

- Regulatory and compliance pressures

Major Challenges:

- Data protection regulations

- High implementation costs

Key Players: Varonis Systems, Inc., Niara Inc., Splunk Inc., Microsoft Corporation, Exabeam Inc., and others.

Global Behavior Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 20.6 billion by 2035

- Growth Forecasts: 30% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: India, China, Australia, Singapore, Japan

Last updated on : 2 September, 2025

Behavior Analytics Market - Growth Drivers and Challenges

Growth Drivers

- Rising inclination towards remote work and Bring Your Own Device (BYOD): The sudden shift towards remote work due to the COVID-19 pandemic has changed the way organizations operate. Employees now access sensitive systems from personal devices, home networks, and cloud-based apps, often breaching corporate firewalls and traditional endpoint protection. Behavior analytics provides the continuous, context-aware monitoring needed to manage security in this fluid digital workspace. Additionally, the rise of the BYOD approach expands the attack surface and adds new challenges, as personal devices are mostly less secure and highly vulnerable to compromise. As per the report by the National Institute of Standards and Technology (NIST) nearly 95% of companies allow their employees to use their own devices. Global enterprises are integrating behavior analytics into endpoint security systems to detect suspicious remote access patterns, such as multiple login attempts, unusual login patterns from geographically dispersed IPs within short time frames.

- Regulatory and compliance pressures: Stringent global regulations such as the General Data Protection Regulation (GDPR) in Europe, HIPAA in the U.S., and industry-specific mandatory regulations such as PCI DSS for financial services have led to a greater push for data privacy. Behavior analytics has emerged as a vital feature negating the pain point of security breaches, due to its ability to help organizations identify data leakage. Additionally, it provides a comprehensive audit trail to prove compliance. Another pain point impacting enterprises is the threat of major penalties, up to over € 20 million, for non-compliance with regulations such as GDPR. To avoid such an impediment, enterprises adopt a behavior analytics tool to monitor and record all user activity involving sensitive systems.

- Technological innovations in behavior analytics: The smart behavior analytics are gaining traction, owing to the integration of artificial intelligence (AI), the Internet of Things (IoT), and cloud technology. In August 2024, Hewlett Packard Enterprise (HPE) unveiled new security and AI-powered networking features for its HPE Aruba Networking Central platform. These include network detection and response (NDR) tools that use behavioral analytics to boost security, making it easier to spot and handle network threats. AI and ML are also transforming the behavior analytics technologies by speeding up product development and boosting operational efficiency. Companies use these technologies to cut costs, personalize offerings, and bring products to market faster. The long-term forecast estimates that technological innovations are set to boost the operations of end users and revenues of key players.

Challenges

- Data protection regulations: Data privacy and ethical concerns are among the most significant challenges faced by the market. As behavior analytics tools collect and analyze vast amounts of sensitive user data, such as browsing patterns, access logs, and interaction histories, there is a severe risk of violating data protection regulations such as GDPR, HIPAA, and CCPA. Organizations must differentiate the thin line between monitoring for security purposes and respecting user privacy. The failure to implement proper data governance, anonymization, and consent protocols leads to legal consequences, reputational damage, and degrades consumer trust. This challenge is particularly acute in sectors such as healthcare and finance, where data sensitivity is high and regulatory oversight is rigid.

- High implementation costs: The scaling of behavior analytics across an entire enterprise is a complex and cost-intensive process. The installation of advanced behavior analytics demands substantial upfront investment in infrastructure, system integration, and specialized talent. Many small and medium enterprises hesitate to invest in these technologies due to budgetary issues. Also, the price-sensitive markets are set to limit the sales of advanced behavior analytics solutions in the years ahead.

Behavior Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

30% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 20.6 billion |

|

Regional Scope |

|

Behavior Analytics Market Segmentation:

Application Segment Analysis

The threat detection & prevention segment is projected to hold a 30% of the global market share by 2035, due to the surge in cyberattacks and insider threats. Organizations are increasingly using behavioral insights to identify anomalies such as unauthorized access or suspicious activity. Unlike conventional security tools, behavior analytics allows the timely identification of known and unknown threats. The shift to remote work and cloud environments has expanded attack surfaces, heightening the need for continuous monitoring. As security becomes more proactive and intelligence-driven, this segment continues to experience strong growth.

End user Segment Analysis

The BFSI segment is anticipated to capture a 28.6% share during the forecast period, owing to its high exposure to fraud, insider threats, and regulatory scrutiny. Financial institutions are adopting behavior analytics to detect abnormal transaction patterns, prevent data breaches, and enhance risk management. The surge in digital banking and mobile transactions has strengthened the need for real-time user monitoring. Moreover, regulatory policies such as GDPR, PCI-DSS, and FFIEC guidelines push demand for compliance-ready analytics tools. As fraud tactics become more sophisticated, behavior analytics provides a proactive defense mechanism, fueling rapid growth in this segment.

Deployment Mode Segment Analysis

The cloud-based segment is projected to account for the largest market share through 2035. This deployment type is more popular due to its scalability, flexibility, and cost-effectiveness. Modern organizations generate massive volumes of behavioral data across devices, applications, and cloud services, which directly fuels the demand for advanced security solutions. Furthermore, deploying analytics on the cloud enables them to process large datasets in real time. Overall, the deployment of cloud-based behavioral analytics solutions is poised to register high growth in the years ahead.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Organization Size |

|

|

Deployment Mode |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Behavior Analytics Market - Regional Analysis

North America Market Insights

The behavior analytics market in North America is anticipated to hold a 35% share during the forecast period, due to the region's advanced cybersecurity infrastructure and rapid adoption of digital technologies. High-profile data breaches have pushed both public and private sectors to invest in smarter threat detection tools, with behavior analytics at the forefront. Enterprises are incorporating AI-driven analytics into their security operations to gain access to internal activity and reduce insider risks. Additionally, strict regulatory guidelines of HIPAA, SOX, and CCPA mandatorily demand advanced monitoring solutions to maintain compliance. The increasing reliance on cloud platforms and mobile applications further highlights the use of behavior-based threat detection.

The U.S. behavior analytics market is expanding rapidly as organizations emphasize risk prevention and data privacy. The proliferation of remote work and BYOD policies has increased the vulnerability across corporate networks, making traditional security models insufficient. Thus, U.S. companies are turning to user behavior analytics to gain real-time monitoring of potential threats and prevent breaches before they escalate. Furthermore, government initiatives and funding in cybersecurity innovation are intensifying the deployment of advanced analytics tools across industries. With rising concerns over identity theft, financial fraud, and healthcare data breaches, the demand for intelligent, adaptive security solutions continues to surge.

Asia Pacific Market Insights

The Asia Pacific behavior analytics is projected to expand rapidly at a CAGR of 37% from 2026 to 2035, owing to digital transformation initiatives across emerging economies, increased cybersecurity concerns, and substantial government investments in the ICT sector. Businesses in retail, telecommunications, and manufacturing sectors are incorporating behavior analytics to boost customer insights and bolster cybersecurity defenses. The increasing cases of cybercrime incidents and the expansion of e-commerce have created an urgent need for live anomaly detection and fraud prevention. Additionally, government regulations in Australia and India are encouraging organizations to adopt advanced security measures for the prevention of susceptible fraud. The region’s expanding internet users and increasing mobile penetration further fuel the demand for behavior-based analytics solutions.

The China market is projected to hold a dominant share during the forecast period as enterprises within the country focus on strengthening cybersecurity amidst rising digital threats. Additionally, the government has emphasized a strict requirement for data localization and data security via initiatives, including the cybersecurity law. These trends have ensured a greater scope of deployment for behavioral analytics. Another supportive trend is the greater adoption rates by large enterprises and financial institutions, while the growth of digital payment systems in the country has created an additional lucrative segment for deployment.

Europe Market Insights

The Europe behavior analytics market is expected to hold a significant revenue share throughout the study period. The escalating cyber risks and strict regulatory frameworks are propelling the sales of behavior analytics solutions. The swiftly expanding digital transformation initiatives are also contributing to the increasing demand for behavior analytics. Further, the General Data Protection Regulation (GDPR) continues to push enterprises toward advanced security solutions that provide real-time anomaly detection and insider threat monitoring. This is set to accelerate the deployment of behavior analytics in modern enterprises in the years ahead.

Germany is one of the leading markets for behavior analytics in Europe, owing to the strong presence of an advanced industrial base and rigorous approach to data security. The BFSI, manufacturing, and automotive enterprises are key end users of behavior analytics solutions. For instance, the Federal Office for Information Security reveals that in October 2023, nearly 72 municipal customers with around 20,000 municipal workstations witnessed ransomware attacks. The shift toward Industrie 4.0 has introduced new cybersecurity risks across IoT-enabled factories, creating a lucrative environment for behavior analytics companies.

Key Behavior Analytics Market Players:

- Microsoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM

- Cisco Systems Inc.

- Oracle

- Adobe

- Varonis Systems Inc.

- OpenText

- Zoho Corporation

- Smart Eye AB

- Nexthink

- Uniphore

- NTT Data Corporation

- AiQ Inc

- KPI Solutions

The global behavior analytics market is highly competitive, with the presence of major players and the increasing emergence of start-ups. Leading companies are focused on the introduction of advanced solutions to attract a wider consumer base. Mergers and acquisitions are employed by industry giants to boost their market positions. Leading firms are also broadening their global presence through regional expansion. They are entering into collaborations and partnerships to stay competitive. Given below is a table of the top players in the market with their respective shares.

Recent Developments

- In May 2025, Concentric AI introduced new features to its Semantic Intelligence™ data security platform. These features use smart behavior analytics to help companies spot unusual user activity, making it easier to keep data secure.

- In August 2024, Securonix, Inc., introduced two new features in its Securonix EON suite. These include the Data Pipeline Manager and Noise Canceling SIEM, which use AI to enhance security by better managing data and reducing unnecessary alerts.

- Report ID: 3195

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Behavior Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.