Automotive Keyless Entry System Market Outlook:

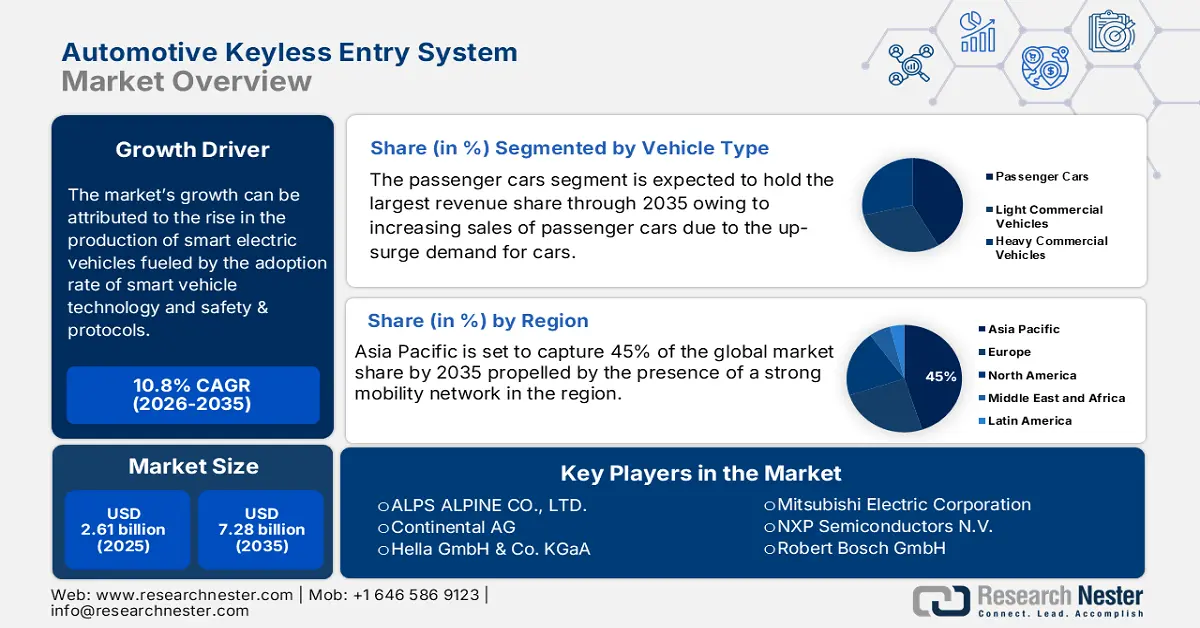

Automotive Keyless Entry System Market size was over USD 2.61 billion in 2025 and is projected to reach USD 7.28 billion by 2035, witnessing around 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive keyless entry system is evaluated at USD 2.86 billion.

The growth of the market can be attributed to the up-surged production of smart electric vehicles, backed by the higher adoption rate of smart vehicle technology and safety & protocols. The automotive keyless entry system is a basic need in the upcoming models of cars when automobiles are getting smarter Y-O-Y. For instance, in 2021, approximately 6 million units of electric vehicles (EVs) were sold out across the globe and it was further projected that in every 200 cars on the road, 1 of them is the smart electric vehicle.

An automotive keyless entry system is used to remotely lock, unlock, and start a car’s engine without using a mechanical key, using radio frequency (RF) signals. Nowadays, most keyless entry systems use a transmitter fob to generate the lock and unlock signals. Modern keyless entry systems use a key fob with two or more buttons to control the locks, trunk, or windows, sending a radio frequency signal to a receiver unit within the car, usually from a range of about 15 to 45 feet, when one of the buttons is pushed. With the increasing advancements in technology as well as rising demand for vehicles, the demand for keyless entry systems is on the rise among automobile users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive keyless entry system market during the forecast period. For instance, as per the data released in 2022 by the Federation of Automobile Dealers Associations (FADA), there was an increase in total vehicle retail, 204%, and 278% in passenger vehicles (PV) and commercial vehicles (CV) respectively in India.

Key Automotive Keyless Entry System Market Insights Summary:

Regional Highlights:

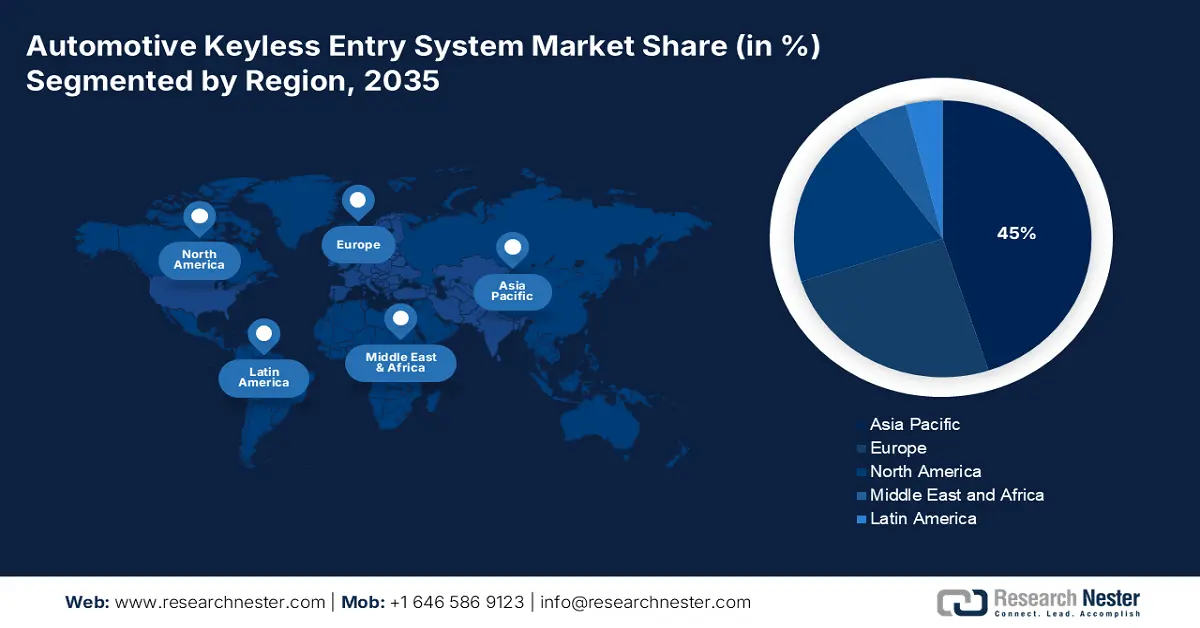

- Asia Pacific automotive keyless entry system market is predicted to capture 45% share by 2035, driven by rising demand for advanced technologies in vehicles.

Segment Insights:

- The oem (original equipment manufacturer) segment in the automotive keyless entry system market is forecasted to experience significant growth during 2026-2035, driven by the credibility and authenticity of OEM systems.

- The passenger cars segment in the automotive keyless entry system market is expected to maintain the largest share by 2035, driven by the surge in passenger car sales and production worldwide.

Key Growth Trends:

- Growing Penetration of Vehicles with Keyless Ignition

- Rising Trend of Remote Keyless Car Central Locking Systems

Major Challenges:

- Concern about Hacking & Stealing

- Concern about Connected Technologies and Their Implications

Key Players: Continental AG, HELLA GmbH & Co. KGaA, Mitsubishi Electric Corporation, NXP Semiconductors N.V., Robert Bosch GmbH, Microchip Technology Inc., DENSO Corporation, VALEO, Honda Motor Co., Ltd.

Global Automotive Keyless Entry System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.61 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 7.28 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Keyless Entry System Market Growth Drivers and Challenges:

Growth Drivers

- Growing Penetration of Vehicles with Keyless Ignition – and new methods of unlocking vehicles as technology continues to progress. Moreover, automotive keyless entry system is a part of automotive vehicle to everything, that included wireless connectivity of car with the devices in order to open the vehicles without a key. Moreover, with the rising demand for vehicles with keyless ignition, the global automotive keyless entry system market is expected to escalate in the forecasted period. It was found that in 2014, nearly 70% of new vehicles in the United States had keyless ignition as part of their optional equipment, while the rate jumped to over 90% in 2019.

- Rising Trend of Remote Keyless Car Central Locking Systems – which in 2018, came as standard or as an option in about 70% of cars worldwide. The notion of a car central locking system is also flourishing with the growth in awareness of such technologies across the globe. Moreover, there has been increasing demand for remote keyless car central locking system in the autonomous cars that is further anticipated to drive the market’s growth.

- Upsurge in the Demand for Smart Vehicles – according to the 2022 data, of all smart vehicles with different levels of automation sold till now across the world, more than 56% were sold in China.

- Increasing Volume of Connected Vehicles – for instance, of all passenger cars sold in the United States, 91% were connected, making it just a little more than 13 million connected vehicles sold in 2020.

Challenges

- Concern about Hacking & Stealing

- The major concern associated with the higher adoption of automotive keyless entry systems is that they can be easily hacked. To hack the system, cybercriminals clone the encrypted radio signals to unlock the car. Furthermore, it can also be broken by implementing DoS attacks. Such vulnerability to these third-party attacks leads to higher cases of car theft. For instance, in 2020, nearly 800,000 cars were stolen across the globe.

- Concern about Connected Technologies and Their Implications

- High Cost of Production and Related Costs

Automotive Keyless Entry System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 2.61 billion |

|

Forecast Year Market Size (2035) |

USD 7.28 billion |

|

Regional Scope |

|

Automotive Keyless Entry System Market Segmentation:

Vehicle Type Segment Analysis

The global automotive keyless entry system market is segmented and analyzed for demand and supply by vehicle type segment into passenger cars, light commercial vehicles, and heavy commercial vehicles. Amongst these segments, the passenger cars segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing number of cars along with the surge in the sale of passenger cars worldwide. Automotive keyless entry systems can be installed separately on these cars with some sort of additional assistance. For instance, the global unit sales of passenger cars are expected to reach around 70,000,000 vehicles in 2026. Hence, the escalation in production and sales volume of these cars is associated with the higher demand for automotive keyless entry systems.

Sales Channel Segment Analysis

The global automotive keyless entry system market is also segmented and analyzed for demand and supply by sales channel into original equipment manufacturer (OEM) and aftermarket. Out of these sub-segments, original equipment manufacturer (OEM) is estimated to witness significant growth globally over the forecast period. The growth of the segment is ascribed to the need for the credibility of automotive keyless entry systems since original equipment manufacturers are more authentic than aftermarket sellers. Purchasing automotive keyless entry systems from original equipment manufacturers also prevents the possibility of pre-installed bugs that can compromise the safety of the car.

Our in-depth analysis of the global market includes the following segments:

|

|

|

|

By Sales Channel |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Keyless Entry System Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 45% by 2035. The growth of the market can be attributed majorly to the presence of a strong mobility network in the region, the growing number of vehicles, as well as the rising demand for advanced technologies amongst vehicle owners. For instance, it was found that more than 2.5 million passenger vehicles in China were sold with driving-assist functions in the first half of 2022. Furthermore, China was stated to be the largest country to produce automobile units which were evaluated to be around 30% of the global vehicle production at the annual rate. Hence, such a higher production is projected to boost the demand for automotive keyless entry system market in the region. The main factor for the largest share of China in the automotive industry is ascribed to the working skills and the number of innovations taking place in the country. Furthermore, the sales volume of automobiles is also very high in the Asia Pacific backed by the growing inclination of population toward the luxurious cars and escalated requirements for passenger vehicles. For instance, in 2021, nearly 34 million units of passenger cars were sold out across Asia pacific.

Automotive Keyless Entry System Market Players:

-

·ALPS ALPINE CO. LTD.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- HELLA GmbH & Co. KGaA

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Microchip Technology Inc.

- DENSO Corporation

- VALEO

- Honda Motor Co., Ltd.

Recent Developments

-

ALPS ALPINE CO. LTD. to develop a wireless digital key system in the collaboration with well-known security technology group, Giesecke+Devrient (G+D). The system is developed for the upcoming vehicle model for 2050 and the technology is based on the Car Connectivity Consortium (CCC) specification.

-

Continental AG to launch its key as a service to commercial vehicles. The launch of this service was announced by the company at one of its virtual press events. This key service allows the vehicle owner to start the engine via a smartphone or Bluetooth card.

- Report ID: 4636

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.