Automotive Ignition Coil Market Outlook:

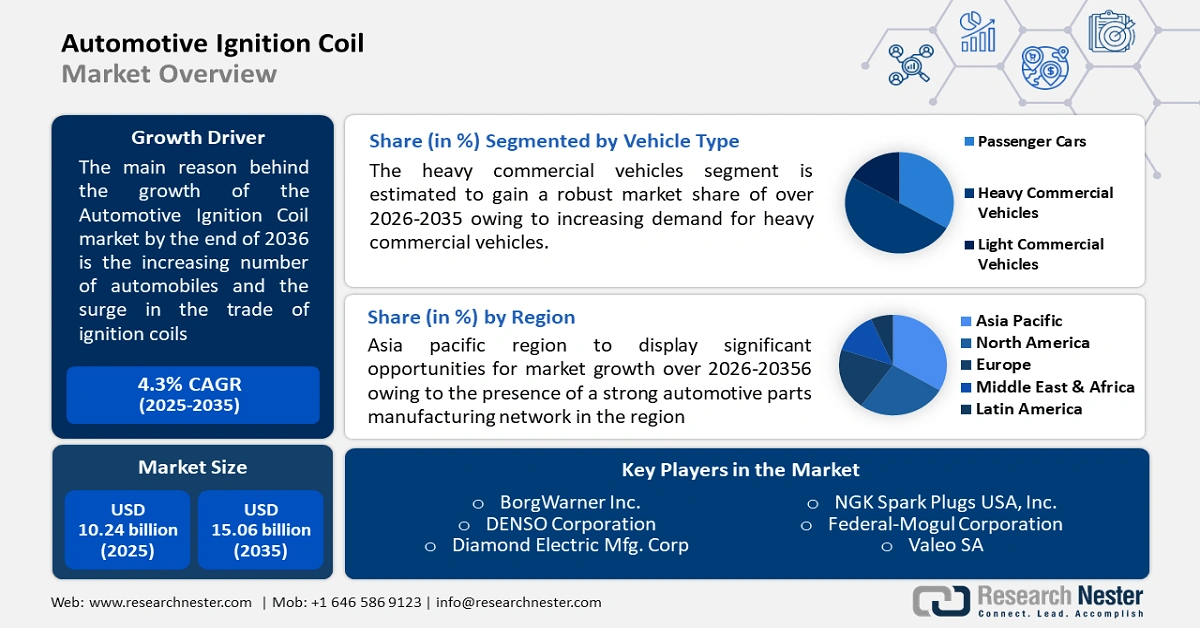

Automotive Ignition Coil Market size was over USD 10.24 billion in 2025 and is poised to exceed USD 15.6 billion by 2035, witnessing over 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive ignition coil is estimated at USD 10.64 billion.

The growth of the market can be attributed to the increasing number of automobiles and the surge in the trade of ignition coils, backed by the escalating demand for auto parts owing to the noteworthy surge in the production of automobiles. In modern times, each family owns some sort of automobile for multiple purposes, and this factor is estimated to hike the demand for ignition coils globally during the forecast period. For instance, it was found that distributors and ignition coils were the world's 1371st most traded products in 2020 across the globe, with a total trade value of more than USD 1.5 billion.

Global automotive ignition coil market trends such as, the growing demand for power transistors will escalate the demand for ignition coils too. For instance, in 2021, the sales of power transistors reached to approximately USD 15 billion. Also, the growth can be attributed to the recent advancements in the technique of direct ignition. While some coils depend on internal resistors, some depend on external resistors to limit the current flow in the coil. Today, most ignition coil systems use a power transistor to provide pulses to the ignition coil.

Key Automotive Ignition Coil Market Insights Summary:

Regional Highlights:

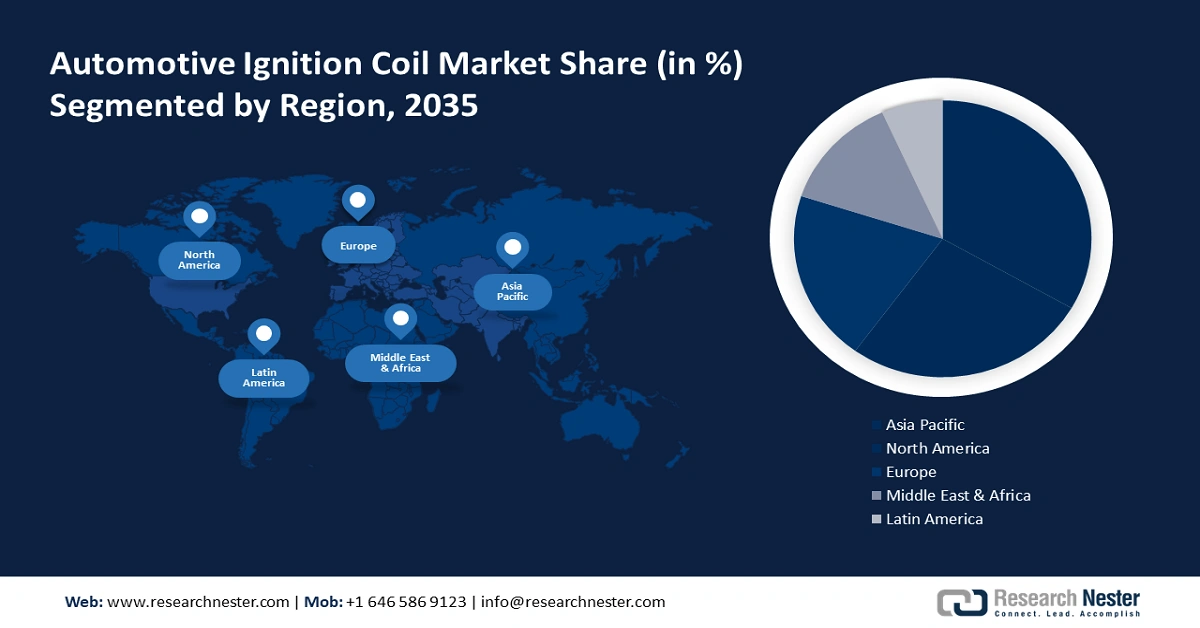

- Asia Pacific automotive ignition coil market will secure around 41% share by 2035, driven by a strong automotive parts manufacturing network, rising ignition coil exports, and supportive EV manufacturing regulations.

Segment Insights:

- The heavy commercial vehicles segment in the automotive ignition coil market is projected to hold the largest share by 2035, driven by rising demand for heavy-duty transport in the expanding logistics and commodities sector.

- The original equipment manufacturers (oems) segment in the automotive ignition coil market is projected to capture a significant share by 2035, driven by OEMs reducing manufacturing costs and producing durable, custom automotive parts.

Key Growth Trends:

- Increment in the Utilization of Power Transistors

- Increasing Sales and Production of Electric Vehicle

Major Challenges:

- Concern About a Malfunctioning Ignition Coil

- High Cost Involved in the Research & Development

Key Players: BorgWarner Inc., DENSO Corporation, Diamond Electric Mfg. Corp, Hitachi, Ltd., Mitsubishi Electric Corporation, Robert Bosch GmbH, NGK Spark Plugs USA, Inc., Federal-Mogul Corporation, Valeo SA.

Global Automotive Ignition Coil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.24 billion

- 2026 Market Size: USD 10.64 billion

- Projected Market Size: USD 15.6 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Automotive Ignition Coil Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Battery Replacement - It was found that nearly 100 million car batteries are replaced every year in the United States.

- The battery is a key component of the battery ignition system. The battery acts as a power source in this system. The battery ignition system is the primary system in automobiles to generate energy. Furthermore, the automotive battery is considered to be the heart of the electrical system of the vehicle. The rising demand for batteries is expected to propel the automotive ignition coil market in the forecasted period.

- Increment in the Utilization of Power Transistors – Power transistors are used to control higher current circuits at lower voltages, and it is anticipated to drive the global automotive ignition coils market. For instance, the global sales of power transistors amounted to around USD 17 billion in 2019.

- Increasing Sales and Production of Electric Vehicle – As of 2021, the global sales of electric light vehicles were expected to reach approximately 6 million units, up from 2 million units. Furthermore, approximately 12 million battery electric vehicles (BEVs) are expected to be produced by China in 2023.

- Growth in the Auto Components Industry to Boost the Production of Ignition Coils– The auto component industry is flourishing Y-O-Y owing to ongoing innovations and a surge in investment by multiple organizations and companies. For instance, in 2021-22, the turnover registered by the auto component industry in India was projected to be around USD 56 million.

- Escalation in the Number of Cars on the Road – As of 2022, around 1 billion cars were observed to be driven on the road. Additionally, 65 million automobiles were projected to be sold out across the globe.

Challenges

-

Concern About a Malfunctioning Ignition Coil – As it can cause the car to stall as a result of irregular sparks sent by the spark plug. Many modern engines have multiple ignition coils and if they have several bad ignition coils, it could result in faulty ignition and difficulty starting the engine.

- High Cost Involved in the Research & Development

- Stringent Government Regulations for Emission Norms

Automotive Ignition Coil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 10.24 billion |

|

Forecast Year Market Size (2035) |

USD 15.6 billion |

|

Regional Scope |

|

Automotive Ignition Coil Market Segmentation:

Vehicle Type Segment Analysis

The global automotive ignition coil market is segmented and analyzed for demand and supply by vehicle type into passenger cars, heavy commercial vehicles, and light commercial vehicles. Out of the three types of vehicles, the heavy commercial vehicles segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for heavy commercial vehicles, backed by the growth in the transportation sector. The heavy commercial vehicle division is projected to be a highly growing division in the commercial vehicle sector. HVCs are vehicles for above 40 tons GVW such as, trucks. These vehicles are used to transport commodities such as, fertilizers, grains, cement, metals, and others. For instance, in 2021, more than USD 2.5 trillion was exhibited by the automotive manufacturing industry where it produced approximately 20 million units of heavy commercial vehicles across the globe.

Distribution Channel Segment Analysis

The global automotive ignition coil market is also segmented and analyzed for demand and supply by distribution channel into original equipment manufacturers (OEMs), and aftermarket. Amongst these two segments, the original equipment manufacturers (OEMs) segment is expected to garner a significant share. Original equipment manufacturers have a significant role to play in the mobility and automotive industries. These manufacturers are known to reduce the cost of manufacturing automotive parts and are useful in making custom parts to meet the requirements of end-users. Moreover, parts made by original equipment manufacturers are robust and durable, which is essential to preventing any sort of accident on the roads. In 2020, more than 40,000 people lost their lives in car crashes.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Vehicle Type |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Ignition Coil Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 41% by 2035. The growth of the market can be attributed majorly to the presence of a strong automotive parts manufacturing network in the region, and the rising export of ignition coils from the region to the world, backed by the growing production of automotive parts and automobiles. For instance, the top exporters of ignition coils and distributors in 2020 were China and Japan, with a value of over USD 390 million and USD 2oo million, respectively. Asia Pacific has a robust infrastructure of the automotive industry that combines nearly 580 million people and a GDP of approximately USD 2 trillion. Furthermore, in India, approximately 300 million units of vehicles are observed to be in operation in India. In addition to this, the various regulations by the government of nations are promoting the manufacturing of electric vehicles to curb carbon emissions in the region. Hence, all these factors are estimated to influence the market growth positively in the region during the forecast period.

Automotive Ignition Coil Market Players:

-

Standard Motor Products, Inc.

-

Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

-

- BorgWarner Inc.

- DENSO Corporation

- Diamond Electric Mfg. Corp

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- NGK Spark Plugs USA, Inc.

- Federal-Mogul Corporation

- Valeo SA

Recent Developments

-

Standard Motor Products Inc. announced that it would continue to add to its ignition coil program. The program is working to facilitate above 800 coils capable of covering 99% coverage for both domestic and imported vehicles. The coil offered by the company is developed to provide prolonged service life and durability.

-

BorgWarner Inc. to supply its highly robust and modular 90mJ single spark ignition coil for Daimler’s in-line gasoline engines, M260 and M264 4-cylinder. These ignition coils are being supplied to the Chinese and European markets.

- Report ID: 4618

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Ignition Coil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.