Automotive Dealer Management System Market Outlook:

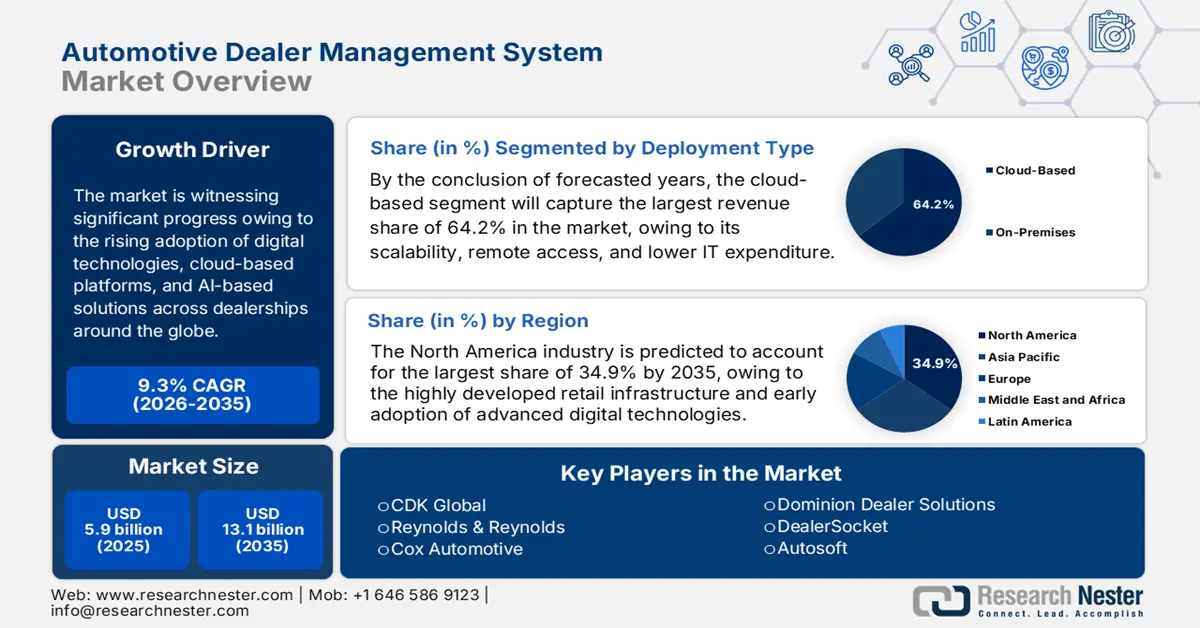

Automotive Dealer Management System Market size was valued at USD 5.9 billion in 2025 and is projected to reach USD 13.1 billion by the end of 2035, rising at a CAGR of 9.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive dealer management system is assessed at USD 6.4 billion.

The automotive dealer management system market is witnessing significant progress owing to the rising adoption of digital technologies, cloud-based platforms, and AI-based solutions in dealerships across the globe. According to the article published by Gitnux in December 2025, the U.S. car dealership industry, which was valued at over USD 1 trillion and employed 1.1 million people, is mostly digital-first, with 86% of buyers researching online and visiting only two dealerships on average. The study also observed that the fixed operations and finance & insurance currently contribute nearly half of dealer profits, wherein 95% of dealerships utilize dealer management systems to streamline operations, manage inventory, and handle digital leads. In addition to consumer behavior, high sales staff turnover, i.e., 67%, and rising online engagement are readily driving greater DMS adoption to improve both efficiency and profitability.

Furthermore, the automotive dealer management system market is rapidly evolving, in which AI and digital solutions are creating more personalized and efficient experiences, prompting more players to make investments in this field. For instance, in November 2025, Impel announced a strategic investment in Automotive Ventures Mobility Fund II, which focuses on early-stage AutoTech startups developing innovations in connectivity, robotics, urban mobility, and new energy solutions. Besides, the firm’s expertise and global scale will help these startups implement real-world solutions across thousands of dealerships. Hence, the partnership strengthens the ecosystem for dealers, OEMs, and technology providers, driving measurable improvements in performance and customer satisfaction. In addition, by supporting next-generation automotive technologies, this initiative is expected to accelerate automotive dealer management system market growth and redefine the future of automotive retail.

Key Automotive Dealer Management System Market Insights Summary:

Regional Highlights:

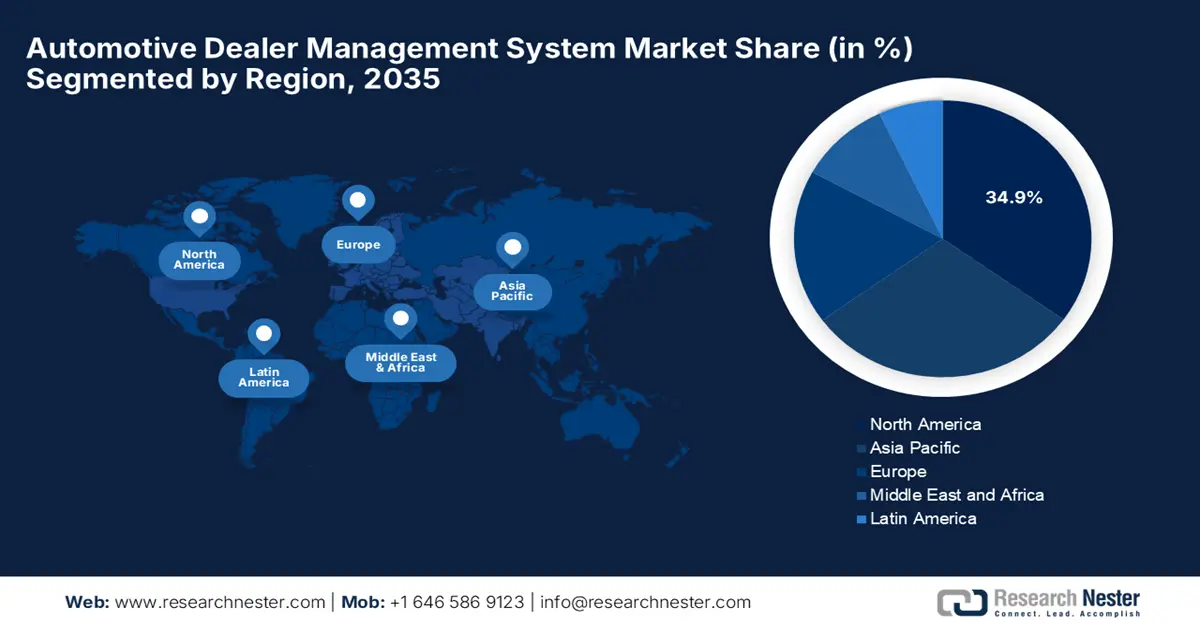

- By 2035, North America is anticipated to account for a 34.9% revenue share in the automotive dealer management system market, supported by mature retail infrastructure and rapid uptake of cloud-based and AI-driven dealer platforms enhancing CRM and predictive operations.

- •Across 2026–2035, Asia Pacific is projected to emerge as the fastest-growing region, stimulated by accelerating automotive sales and widespread digitalization of dealership networks in major economies.

Segment Insights:

- By 2035, the Cloud-Based Deployment segment is projected to secure a 64.2% revenue share in the automotive dealer management system market, underpinned by scalable architectures, remote accessibility, integrated digital retail capabilities, and AI-enabled automation strengthening dealership efficiency.

- Over the forecast period 2026–2035, the Automotive Dealer Management Solutions segment is expected to command a lucrative revenue share, driven by rising demand for integrated platforms that unify sales, inventory, CRM, finance, and service operations.

Key Growth Trends:

- Digital transformation of dealership operations

- Adoption of cloud-based and SaaS solutions

Major Challenges:

- Data security & privacy concerns

- Resistance to technological change

Key Players: CDK Global, Reynolds & Reynolds, Cox Automotive, Dominion Dealer Solutions, DealerSocket, Autosoft.

Global Automotive Dealer Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.4 billion

- Projected Market Size: USD 13.1 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, China

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 19 December, 2025

Automotive Dealer Management System Market - Growth Drivers and Challenges

Growth Drivers

- Digital transformation of dealership operations: This is one of the important growth drivers for the automotive dealer management system market since the dealerships are rapidly making a shift from manual or legacy systems to advanced digital platforms. In June 2025, Force Motors announced that it had partnered with Zoho Corporation to implement an advanced CRM and dealer management system as part of its Project DigiForce, thereby aiming to modernize its dealer operations and enhance customer experience. Besides, the cloud-based solution, featuring AI-powered applications, will replace legacy systems across Force Motors’ network of more than 200 dealerships, 70 service centers, and 30 parts centers in India and abroad. Furthermore, this digital transformation is expected to streamline sales, service, thereby enabling more efficient, data-driven operations and improved overall satisfaction.

- Adoption of cloud-based and SaaS solutions: The cloud deployment models are being preferred since they offer scalability, remote access, and lower IT costs, which allow dealers of almost all sizes can adopt systems without heavy infrastructure. In December 2022, Oracle announced that Tata Motors had migrated its entire dealer management system to Oracle Cloud Infrastructure to enhance operational efficiency and collaboration across its dealer network of around 60,000 users. Besides, the cloud-based system enables faster access to information, scalable operations, and improved management of both electric and conventional vehicles, which also includes capacity and spare parts. In addition, this modernization supports Tata Motors’ digital transformation, providing greater flexibility and cost optimization by enhancing customer experience across sales and after-sales touchpoints, thus benefiting the overall automotive dealer management system market.

- Growing automotive sales & dealership expansion: The ever-increasing vehicle sales internationally, especially in emerging economies, readily expand dealership networks, which in turn increase demand for integrated management systems to handle multi-location operations. In July 2025, VinFast Auto India announced that it had partnered with 13 leading dealer groups to launch 32 dealerships across 27 cities, thereby aiming to expand to 35 by the end of 2025, as part of its strategic plan to establish a robust 3S (sales, service, spares) network. Besides, the selected locations, which include major urban and emerging EV markets, ensure wide accessibility and seamless customer support for upcoming models such as the VF 6 and VF 7. Furthermore, this expansion, supported by strategic ecosystem partnerships for charging, roadside assistance, and battery recycling, contributes to the automotive dealer management system market growth.

Challenges

- Data security & privacy concerns: The automotive dealer management system market is facing a major obstacle of data security since it leverages cloud-based and AI-driven solutions. Also, the DMS platforms store sensitive customer information, payment details, and operational data, making them highly vulnerable to cyberattacks. In this regard, any breach or data loss can lead to financial penalties, legal liabilities, and reputational damage as well. Therefore, compliance with data protection regulations, such as GDPR or local automotive data laws, necessitates continuous monitoring and secure access protocols. Most of the dealerships lack dedicated cybersecurity expertise, making it extremely challenging to maintain robust protections, hence hindering the adoption of cloud-based DMS solutions.

- Resistance to technological change: Resistance from dealership staff and management to adopt new technologies presents a significant challenge for the upliftment of the automotive dealer management system market. Besides, many dealerships rely on manual processes or legacy systems and may perceive modern DMS solutions as a very complex solution. Also, staff training, adaptation to new workflows, and change management require time, effort, and resources, which some dealerships may not be able to invest in. Therefore, without proper onboarding and support, the system may be underutilized, thereby reducing the expected operational and customer service benefits. Furthermore, cultural barriers and, lack of digital literacy exacerbate resistance, making it difficult for OEMs and software vendors to achieve smooth adoption of dealer management platforms.

Automotive Dealer Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 13.1 billion |

|

Regional Scope |

|

Automotive Dealer Management System Market Segmentation:

Deployment Type Segment Analysis

By the conclusion of forecasted years, the cloud-based segment will capture the largest revenue share of 64.2% in the automotive dealer management system market. Their scalability, remote access, lower IT expenditure, and real-time multi-location data access are critical for modern dealer networks; are they factors propelling this dominance? Besides, the cloud systems also support integration with CRM, analytics, and digital retail solutions, thereby allowing a unified workflow and data consistency. Meanwhile, the future adoption of this subtype is highly fueled by the consistent need for remote operations and digital retailing. In addition, the ever-increasing cybersecurity advancements and compliance standards are strengthening trust in cloud-based dealer management systems. Furthermore, the growing adoption of AI-based insights and automation within cloud platforms also enhances operational efficiency and customer experience.

Solution Type Segment Analysis

The automotive dealer management solutions will lead the segment with a lucrative revenue share in the automotive dealer management system market over the analyzed timeframe. The subtype is the core of DMS offering that integrates sales, inventory, CRM, finance, and service modules. Besides, the demand for integrated solutions that unify dealership operations, automate routine tasks, and improve operational visibility drives their revenue share. In May 2023, Tekion announced that it entered into a strategic DMS partnership with Hyundai Auto Canada, thereby enabling Hyundai and Genesis dealers nationwide to adopt Tekion’s automotive retail cloud as their dealer management system. Besides, ARC is a fully cloud-native DMS that integrates all core dealership functions, modernizing the end-to-end automotive retail journey and improving operational efficiency. Hence, this partnership highlights how integrated, cloud-based DMS platforms enhance communication, enable paperless service processes across dealer networks, benefiting the automotive dealer management system market.

Application Segment Analysis

In the application segment, customer relationship management will grow at a considerable rate in the automotive dealer management system market by the end of 2035. The segment emerges as a top application because customer engagement and retention are highly essential in competitive automotive retail. Also, these CRM modules help track leads and improve conversion rates, translating into strong revenue contributions within DMS suites. In December 2025, Cerence AI announced the launch of two new conversational AI agents at CES, thus expanding its capabilities beyond in-vehicle systems into dealership and OEM operations. This dealer assist agent integrates with CRM and DMS platforms to automate lead management, test drive bookings, and help dealerships improve response times and customer engagement. Furthermore, the ownership companion agent provides drivers with proactive, in-car service and maintenance support, hence enabling OEMs to deliver always-available experiences across the entire vehicle ownership journey.

Our in-depth analysis of the automotive dealer management system market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Solution Type |

|

|

Application |

|

|

End use Industry |

|

|

Dealer Type |

|

|

Dealership Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Dealer Management System Market - Regional Analysis

North America Market Insights

North America is expected to lead the automotive dealer management system market, capturing the largest revenue share of 34.9% over the forecasted years. The region benefits from a highly developed retail infrastructure and early adoption of advanced digital technologies. Besides, dealerships in this region are opting for cloud-based and AI-enabled DMS platforms to enhance CRM, inventory oversight, and predictive service features. In this regard, FPT Corporation December 2025, announced that it has launched the smart showroom accelerator, which is an AI-based solution that integrates existing dealer systems, computer vision, and real-time CRM data to optimize sales-to-conversion and enhance customer loyalty. In addition, the platform captures license plate data to identify vehicle details and cross-references prior interactions, trade-in potential, and buying patterns, enabling sales teams to make informed recommendations within seconds of a customer arriving. Furthermore, by unifying tools without replacing core systems, FPT provides dealerships with an intelligence-driven experience.

The U.S. represents one of the largest and most influential landscapes for the Automotive Dealer Management System Market, efficiently propelled by high investments in integrated software solutions that unify sales, service, and finance modules. The country’s market also benefits from digital retailing trends and EV infrastructure tracking, which are prompting dealers to adopt systems that are capable of managing complex workflows across both traditional and electric vehicle portfolios. In December 2025, AutoRaptor announced its AI-powered automotive CRM, which is designed to capture after-hours leads and prevent revenue loss caused by delayed responses. The firm also mentioned that this platform delivers 24/7 AI-based engagement across voice, SMS, web chat, and email from a single unified system, thereby enabling dealerships to achieve complete lead follow-up and improved sales conversion. Hence, such instances are strengthening dealership operations by automating lead management and maximizing sales opportunities in a digital automotive retail environment.

Canada, in the automotive dealer management system market, has gained momentum owing to the modernization of dealership operations and increased adoption of cloud platforms that facilitate remote support and data visibility in multiple locations. Simultaneously, the country’s automotive dealer management system market also benefits from an emphasis on secure solutions, prompting a profitable business environment. In September 2025, Keyloop announced that it had launched a fusion automotive retail platform in the country, which offers a cloud-based, end-to-end solution to manage vehicle sales, post-sales, and customer ownership as well. Besides, this fusion integrates four key domains, such as demand, supply, ownership, and operation, hence leveraging AI, CRM, and dealer management system capabilities to streamline operations and increase profitability. Furthermore, the platform’s scalable, experience-first approach allows dealerships in Canada to optimize every touchpoint across sales, inventory, and services.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the automotive dealer management system market owing to the expansion of automotive sales in key countries and the digitalization of dealer networks. Besides, China’s vast dealership ecosystem and India’s burgeoning multi-brand showrooms are opting for scalable DMS platforms to support inventory and service automation. For instance, in February 2023, Sojitz Corporation announced that it had entered the EV industry in Japan by becoming an authorized dealer for BYD Auto Japan by launching operations through Sojitz Auto Group Japan and Sojitz Auto Group Tokai. Also, the dealerships, opening in Kanagawa and Aichi prefectures, will sell BYD’s ATTO 3 e-SUV and expand the company’s EV offerings while supporting local communities and sustainability goals. Hence, this partnership will strengthen the firm’s automotive retail presence and contribute to wider automotive dealer management system market expansion in the region.

China is the key growth contributor for the regional automotive dealer management system market, which is primarily fueled by the proliferation of authorized dealerships and a strong push toward digital transformation. The country is reflecting a broader automotive technology adoption curve and OEM support for dealer IT modernization. In January 2022, Cango Inc. reported that its B2B WeChat mini program, Cango Haoche, is efficiently driving auto sales by providing dealers with a new vehicle display function. The company also mentioned that this feature offers dealers a variety of display vehicles at low prices with free shipping, improving sales volume and customer retention. Furthermore, over 6,000 dealer partners across 283 cities and 31 provinces, the company has significantly boosted its reputation, amassing over 2 million clicks since its launch in May 2021, hence indicating a greater market potential.

India has a strong scope to witness expansion in the automotive dealer management system market, facilitated by rapid digital adoption among dealers who are looking to improve operational visibility and customer engagement. The country’s market is also supported by rising vehicle sales, ever-increasing dealerships, and a heightened demand for real-time data access. In this regard, Mahindra in September 2023 announced that it had rolled out the innovative CRM platform, Cerebro, across around 439 dealerships in the country, thereby connecting more than 21,000 dealership users to streamline operations and boost the deal closures. Besides, the platform, enhanced by the custom app SalesGenie Nxt, which enables proper management of enquiries and follow-ups on a single unified system. Hence, this digital transformation strengthens dealers with insights and improved customer experiences, thus driving growth in the firm’s dealer network.

Europe Market Insights

Europe has gained a prominent position in the international automotive dealer management system market, primarily fueled by stringent data protection and regulatory compliance requirements, which then prompts dealers to adopt secure, integrated DMS platforms. The region’s market deeply emphasizes sustainability, wherein the digital systems are helping reduce paper use and support omnichannel retail experiences. Audev BV in October 2025 announced that it has appointed CarIT Dealer Systems GmbH as its distribution partner for Germany, with a prime focus on strengthening customer support. Besides, the partnership leverages CarIT’s knowledge in terms of DMS technology to enhance existing installations, support digital transformation, and efficiently expand offerings for brands such as Ford, Volvo, and Jaguar Land Rover. Furthermore, this collaboration ensures reliable, modern, and future-proof dealer management solutions for dealerships in Germany, hence broadening Audev’s reach across Europe.

Germany is exponentially progressing in the automotive dealer management system market owing to the automotive industry and dense network of both OEM-owned and independent dealerships, which are prioritizing high-performance DMS solutions. The country’s market is witnessing increased adoption of predictive maintenance and telematics features. In September 2025, CARYA announced that it had acquired Dagosoft GmbH to enhance its position as a leading provider of integrated IT and data-driven solutions for the automotive sector in the region. Besides, Dagosoft’s expertise in DMS, CRM, and business analytics, including its KPI dashboard for more than 1,500 dealer locations, strengthens the firm’s capabilities in data integration and operational insights. Furthermore, the acquisition expands CARYA’s presence in Germany, supports its digital transformation offerings, and accelerates its growth strategy.

The U.K. is solidifying its position in the regional automotive dealer management system market due to robust digital transformation initiatives among dealerships that are aiming to enhance CRM capabilities. Simultaneously, the cloud-based deployments in the country are rising, supported by dealers’ efforts to integrate retail-to-service processes into single platforms for operational efficiency. In 2025, Pinewood Technologies, which is formerly part of Pendragon plc, announced that it had completed a major rollout of its software across five of the top 20 UK dealer groups, thereby growing its user base to more than 35,000 and driving revenue growth. The company is currently focused on expanding its DMS offerings both nationally and internationally, which includes strategic contracts and joint ventures that are aimed at scaling its platform. Furthermore, this development underscores strong demand for modern dealer management solutions that enhance operational efficiency and support digital transformation in the country.

Key Automotive Dealer Management System Market Players:

- CDK Global (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Reynolds & Reynolds (U.S.)

- Cox Automotive (U.S.) - incl. Dealertrack

- Dominion Dealer Solutions (U.S.)

- DealerSocket (U.S.)

- Autosoft (U.S.)

- Incadea (Germany)

- PBS Systems (U.S.)

- Auto/Mate (U.S.)

- T‑Systems (Germany)

- NEC Corporation (Japan)

- Pinewood Technologies (U.K.)

- Yonyou (China)

- Tekion (U.S.)

- Oracle Corporation (U.S.)

- CDK Global is one of the leading providers of software and technology solutions for automotive dealerships, serving thousands of dealers across the globe. The company offers an integrated DMS platform by covers sales, service, parts, accounting, and customer management. Besides, CDK has made strong investments in cloud-based solutions and embedded payment systems to streamline operations and enhance customer experiences, hence reinforcing its dominance in mature markets.

- Reynolds & Reynolds is a veteran DMS provider that has a robust suite of dealership management software and services. The company efficiently emphasizes operational credibility and dealership productivity through tools such as service price guides, technician dispatch, and its Spark AI unified data layer. Further, Reynolds continues to expand by maintaining strong ties with franchised dealerships, focusing on automation, digital communication tools, and advanced analytics

- Cox Automotive, including its Dealertrack, provides a e ecosystem for dealer management, retail, and finance operations. The firm’s solutions span DMS, inventory management, CRM, and digital retailing, emphasizing proper integration with financial institutions and OEMs. In addition, Cox Automotive’s prime strategy includes expanding cloud capabilities, AI analytics, and connected retail solutions to streamline dealer operations.

- Tekion is a cloud-native disruptor in the market, which is offering the automotive retail cloud platform that integrates all dealership functions, including sales, service, parts, accounting, and customer engagement. Besides, the company emphasizes real-time analytics and modern consumer experiences. Moreover, Tekion’s strategic initiatives include rapid geographic expansion, partnerships with major OEMs, and the adoption of cloud-first architectures that attract the digitally forward dealerships.

- DealerSocket is one of the prominent providers of cloud-based DMS, CRM, and inventory solutions that are suitable for automotive dealerships. The firm’s platform focuses on sales and marketing automation, customer retention, and business intelligence. In addition, strategic steps opted by DealerSocket include enhancing AI-driven analytics, integrating omnichannel retail capabilities, and offering modular solutions that allow dealerships to scale efficiently.

Below is the list of some prominent players operating in the global automotive dealer management system market:

The automotive dealer management system market is characterized by a combination of well-established vendors and emerging cloud‑native players. The key players, such as CDK Global and Reynolds & Reynolds, are maintaining their leadership with franchised dealerships and broad functionality, whereas the emerging entities, such as Tekion and Pinewood Technologies, are leveraging cloud architectures and modern APIs. In November 2024, Reynolds and Reynolds announced that it had partnered with Skaivision to integrate AI-powered video technology into automotive dealerships, thereby enhancing service department efficiency and transparency. Besides, the collaboration leverages the firm’s smart space computer vision software to monitor vehicle movement, identify bottlenecks, and optimize workflow, all within Reynolds’ unified AI data layer, Spark AI, hence driving both profitability and streamlined service operations.

Corporate Landscape of the Automotive Dealer Management System Market:

Recent Developments

- In September 2025, Hartwell Automotive Group partnered with Tekion to implement its AI-powered automotive retail cloud across 11 UK locations, which integrates all DMS functionalities with advanced AI and automation, streamlining operations across sales, service, parts, accounting, and customer management.

- In August 2025, CDK announced the launch of SimplePay, which is a fully embedded, cloud-based payment solution that is designed to streamline transactions for dealerships and enhance the consumer experience.

- Report ID: 3759

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Dealer Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.