Automotive Data Cables Market Outlook:

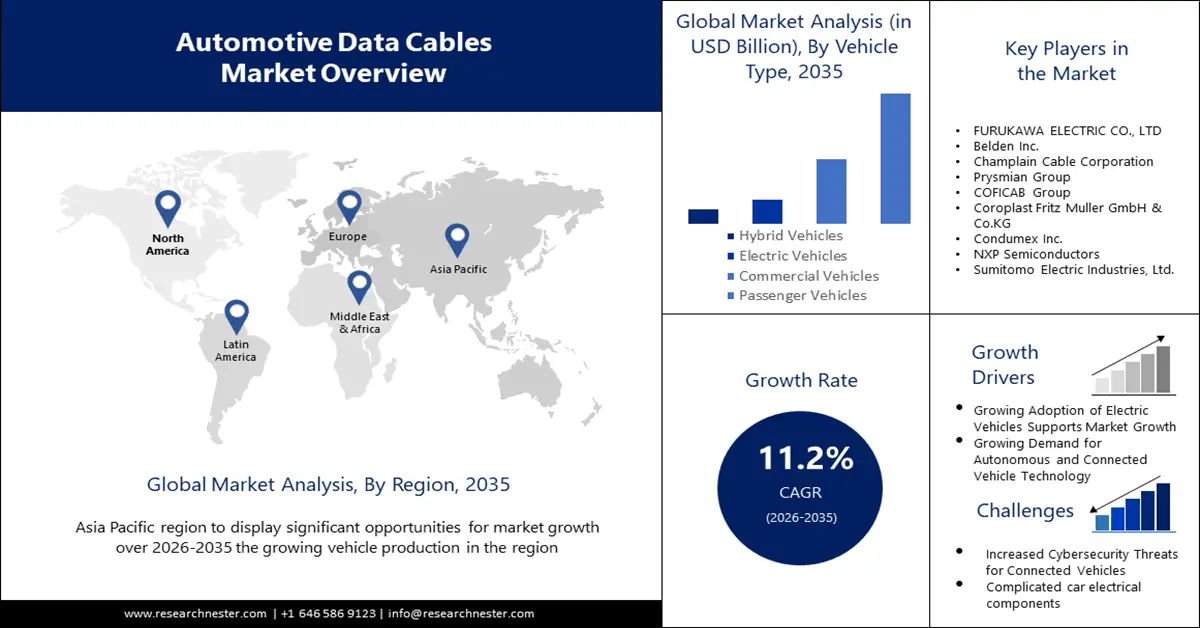

Automotive Data Cables Market size was valued at USD 9.81 billion in 2025 and is likely to cross USD 28.36 billion by 2035, registering more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive data cables is assessed at USD 10.8 billion.

The growing requirement for automotive cables across a range of vehicle types and the modern car's increasing need for economy and lower energy usage are driving the automotive data cables market expansion. Electronic control unit (ECU) communication has gotten more complex due to increased software capabilities in cars, and network throughput has increased bandwidth. An Ethernet-based connection offers more flexibility and capacity for combining consumer goods and cloud services. Moreover, there is an increasing demand for autos to be energy-efficient. Increases in engine and transmission efficiency, as well as improvements in material and aerodynamic design, have the potential to greatly increase the average fuel economy of the US car fleet. Various estimates suggest that a full adoption of currently available technology might yield benefits of up to 40%.

In addition to these, the primary companies in the automotive data cables market are developing more innovative and high-quality car data cable products, which is driving the industry's growth. For example, it was announced in 2021 that NXP Semiconductors' TJA146x CAN Signal Enhancement Capability (CAN SIC) transceivers will be productively ramped up into Changan's newest car platform. With NXP's may SIC technology, CAN FD networks may operate in larger, more complex networks and continuously improve the CAN signal to boost data rates. This expands the promise and adaptability of CAN FD as an affordable networking solution that can handle the challenges posed by next-generation automobiles. The first car manufacturer to use NXP's CAN SIC technology for commercialization is Changan Automotive.

Key Automotive Data Cables Market Insights Summary:

Regional Highlights:

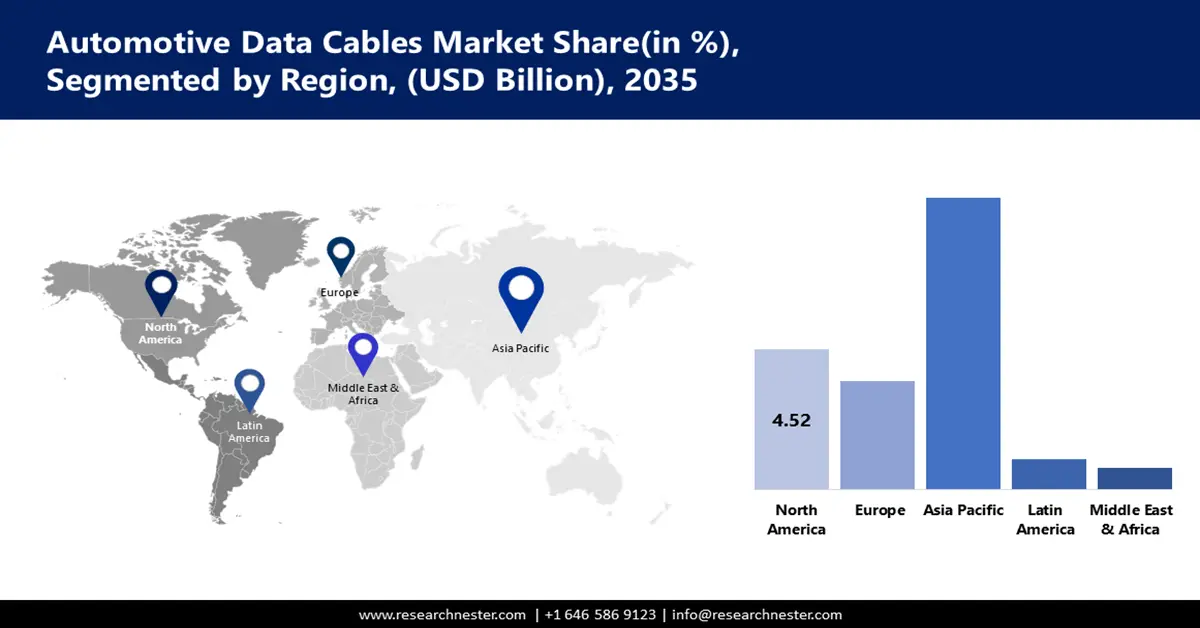

- Asia Pacific automotive data cables market will dominate more than 49% share by 2035, driven by growing vehicle production and increased electric vehicle registrations.

- North America market will attain a 24% share by 2035, driven by shifts in consumer preferences and rising electric vehicle manufacturing.

Segment Insights:

- The passenger vehicles segment in the automotive data cables market is forecasted to capture a 55% share by 2035, fueled by increased passenger car sales and demand for automotive data cables.

- The powertrain system segment in the automotive data cables market is expected to capture a 31% share by 2035, attributed to the essential role of powertrain systems in vehicle propulsion and data transmission.

Key Growth Trends:

- Growing Adoption of Electric Vehicles Supports Automotive Data Cables Market Growth

- Growing Demand for Autonomous and Connected Vehicle Technology

Major Challenges:

- Growing Adoption of Electric Vehicles Supports Automotive Data Cables Market Growth

- Growing Demand for Autonomous and Connected Vehicle Technology

Key Players: FURUKAWA ELECTRIC CO., LTD, Belden Inc., Champlain Cable Corporation, Prysmian Group, COFICAB Group, Coroplast Fritz Muller GmbH & Co.KG, Condumex Inc., NXP Semiconductors, Sumitomo Electric Industries, Ltd.

Global Automotive Data Cables Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.81 billion

- 2026 Market Size: USD 10.8 billion

- Projected Market Size: USD 28.36 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Data Cables Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Adoption of Electric Vehicles Supports Automotive Data Cables Market Growth- It is impossible to overstate the significance of cables in the thousands of hours that power and data transfer across electric and hybrid cars requires. Mechanical stresses, heat requirements, chemical tolerances, EMI levels, and other factors must be considered when choosing and determining cable demands, though. The key technology for decarbonizing road transportation which contributes to almost 15% of global energy-related emissions is electric automobiles. The last few years have seen an exponential increase in the sales of electric cars because of their improved efficiency, increased range, and wider model availability. The IEA projects that by 2023, passenger electric cars will account for roughly 18% of all new car sales. Passenger electric vehicles are growing in popularity. In the anticipated year, there will likely be a rise in demand for automobile data connections due to the growing popularity of electric vehicles.

-

Growing Demand for Autonomous and Connected Vehicle Technology- The way autonomous cars operate is by using lidar and other remote sensing technologies like radar, GPS, and cameras which generate and display a three-dimensional map of their environment. Road signs, traffic signals, pedestrians, other cars, and street infrastructure may all be seen on this three-dimensional map. As sensors provide ever-changing information about the car's surroundings, powerful computer systems analyze the data gathered and make decisions about how the vehicle should operate, continuously modifying the steering, braking, acceleration, and cruise control. Safety and support systems that are adept at navigating traffic are essential for self-driving cars. Both signal transmission and sensors are essential for this. There must be several functions and a redundant system for each system to serve as a backup.

- The Rising Popularity of Vehicle Telematics Presents A Significant Growth Opportunity- The field of vehicle telematics is interdisciplinary, combining knowledge from informatics, computer science, electrical engineering, telecommunications, and vehicular expertise to create a system that collects and interprets vehicle telematics data, ultimately enhancing the overall driver experience in terms of productivity and safety. GPS systems, wireless telematics devices, onboard diagnostics, and black box technologies are all used in automobile telematics to record and transfer vehicle data, such as location, speed, maintenance needs, and keep requirements, and then cross-reference this data with the internal performance of the vehicle. This data can be used for real-time analysis to improve commercial vehicle performance, lower expenses, and increase overall driver safety. Depending on the location in which the system will be installed, telematics typically requires a specific set of connections. These connectors have standardized pin layouts and buildings to enable interchange. The number of calculating requirements has increased as cars have evolved more progressively, combining more ECUs and sensor devices into vehicles.

Challenges

- Increased Cybersecurity Threats for Connected Vehicles Hinder Automotive Data Cables Market Growth- Automobile manufacturers and their distributors must consider the implications of linked automobiles for customer security and confidentiality, even though they present many options for consumers. Malicious hackers can exploit software exposures that arise as more connected cars crash into the road. They can do this by leveraging hardline connections, Wi-Fi, and cellular networks. The increasing interconnectedness of automotive components presents a distinct set of cybersecurity challenges for manufacturers. Cars are getting more and more linked, which allows them to gather data from many sources such as weather reports, security alerts, and the volume of extra traffic. Every stage of this data journey, from the engineering floor to the road, needs to be secured.

- Complicated car electrical components could impede automotive data cables market expansion.

- High CAN and CAN-FD cable costs could prevent the market from expanding.

Automotive Data Cables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 9.81 billion |

|

Forecast Year Market Size (2035) |

USD 28.36 billion |

|

Regional Scope |

|

Automotive Data Cables Market Segmentation:

Vehicle Type

The passenger vehicles segment in the automotive data cables market is expected to reach 55% share by 2035. This covers on-demand, tourist, and regular passenger transportation services. It is transportation for passengers for employment or reward. Automotive data cables are essential parts of modern cars that facilitate the transmission of commands and information between various electrical parts. They are used in many different applications, including infotainment systems, advanced driving assistance systems (ADAS), and powertrain systems. Sales of passenger cars increased by 23% in India in the fiscal year 2023, despite major manufacturers experiencing sporadic disruptions in their supply chains related to electronics and semiconductors. Approximately 3.6 million passenger cars were sold in the nation of south Asia in the same year.

Application

The powertrain system segment share in the automotive data cables market is expected to surpass 31% by 2035. An automobile may move by transferring energy from the engine to the wheels through a series of processes called the powertrain. The engine produces power that is subsequently transferred to the wheels by a number of components that are grouped together in the powertrain to propel an automobile forward. Although the terms "powertrain" and "drivetrain" are sometimes used interchangeably, "drivetrain" simply refers to the parts of the powertrain that are not attached to the engine.

Our in-depth analysis of the global automotive data cables market includes the following segments:

|

Cable Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Data Cables Market Regional Analysis:

APAC Market Insights

The Asia Pacific automotive data cables market share is projected to be the largest with revenue share of 49% by 2035. Growing vehicle production, an increase in connected automobiles, and a supportive regulatory environment for electric vehicles are driving the automotive data cables market expansion in the region. The need for automotive data connections for electric vehicles is increasing due to the rise in the number of electric vehicle registrations. China will register almost 60% of all new electric car registrations globally in 2022, predicts the IEA. In China, the proportion of domestic automobile sales that were electric rose to 29% in 2022 from 16% in 2021, well in advance of the government's target of 20% sales share for so-called renewable energy vehicles (NEVs) by 2025. Consequently, the market for car data cables is growing.

North American Market Insights

The North America automotive data cables market is estimated to acount for 24% share by 2035. The automotive data cables market in the region is expanding due to factors such as consumer preference shifts, increased use in the manufacturing of electric automobiles, and rising consumption of electric vehicles. The Inflation Reduction Act (IRA) in the US has reportedly spurred multinational electromobility companies to build US manufacturing sites, according to the IEA. Important EV and battery manufacturers announced between August 2022 and March 2023 total post-IRA investments of USD 52 billion in North American EV supply networks, of which approximately 20% each is allocated to EV manufacturing and battery components and 50% to battery production. Thus, enhancing the demand for automobile data cables.

Automotive Data Cables Market Players:

- ACOME GROUPE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FURUKAWA ELECTRIC CO., LTD

- Belden Inc.

- Champlain Cable Corporation

- Prysmian Group

- COFICAB Group

- Coroplast Fritz Muller GmbH & Co.KG

- Condumex Inc.

- NXP Semiconductors

- Sumitomo Electric Industries, Ltd.

Recent Developments

- Belden Inc. announced innovative products and updates that are planned to continue connectivity in rough environments and guarantee uptime. The latest Lumberg Automation LioN-X Digital I/O Modules provide profitable flexibility and fast arrangement, data transfer, and data security for automation applications consuming digital sensors and actuators. The modules provide integration in PLC and cloud environments, making them an appropriate fit for nearly all industrial usages. The new Lumberg Automation M12 Circular Connector Automotive Line is manufactured to survive harsh environments, recognized as the new PUR construction, which stops damage initiated by welding sparks, crushing, and shearing.

- NXP Introduces the Next Generation of Automotive Ultra-Wideband ICs Combining Secure Ranging and Short-Range Radar. NXP’s next-generation single-chip Ultra-Wideband (UWB) solution, TrimensionTM NCJ29D6B, delivers secure and precise real-time localization improvements for secure car access, with enhanced system performance, reduced system cost and higher security compared to previous generations. Trimension NCJ29D6A is the first monolithic UWB chip for automotive markets that combines secure localization and short-range radar with an integrated MCU, allowing OEMs to utilize one UWB system for multiple use cases ranging from child presence detection to secure car access

- Report ID: 4732

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Data Cables Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.