Audio Communication Monitoring Market Outlook:

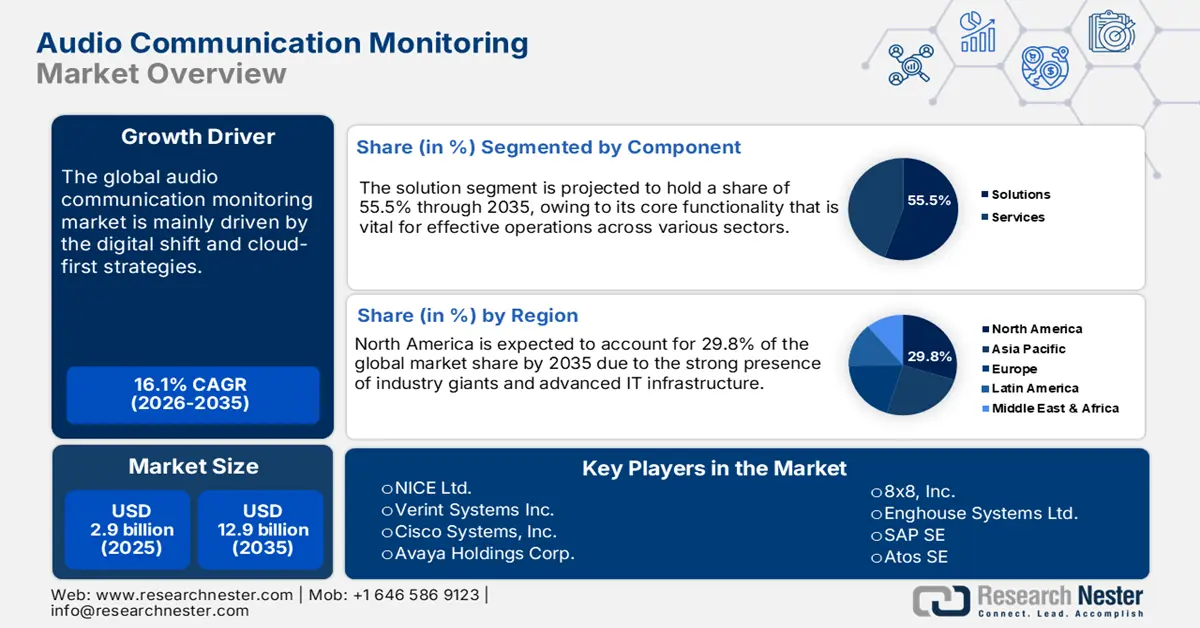

Audio Communication Monitoring Market size was USD 2.9 billion in 2025 and is estimated to reach USD 12.9 billion by the end of 2035, expanding at a CAGR of 16.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of audio communication monitoring is evaluated at USD 3.3 billion.

The rapid shift toward remote and hybrid work models is estimated to boost the demand for advanced audio communication monitoring solutions worldwide. The high use of VoIP calls, video conferencing, and unified communication platforms is directly fueling the sales of audio communication monitoring systems. As remote work environments introduce visibility gaps, the application of audio communication monitoring for productivity and compliance is likely to gain traction.

According to the Johnson Center for Philanthropy 2025 report, around 77% of private sector workers do all their work on-site. Roughly the same number work fully from home (11%) or in a hybrid model, mixing some on-site days with some remote ones (12%). The growth of hybrid work models is likely to fuel to sales of audio communication monitoring solutions. The switch between office and home creates a dispersed communication landscape, necessitating the demand for audio communication monitoring technologies.

Key Audio Communication Monitoring Market Insights Summary:

Regional Insights:

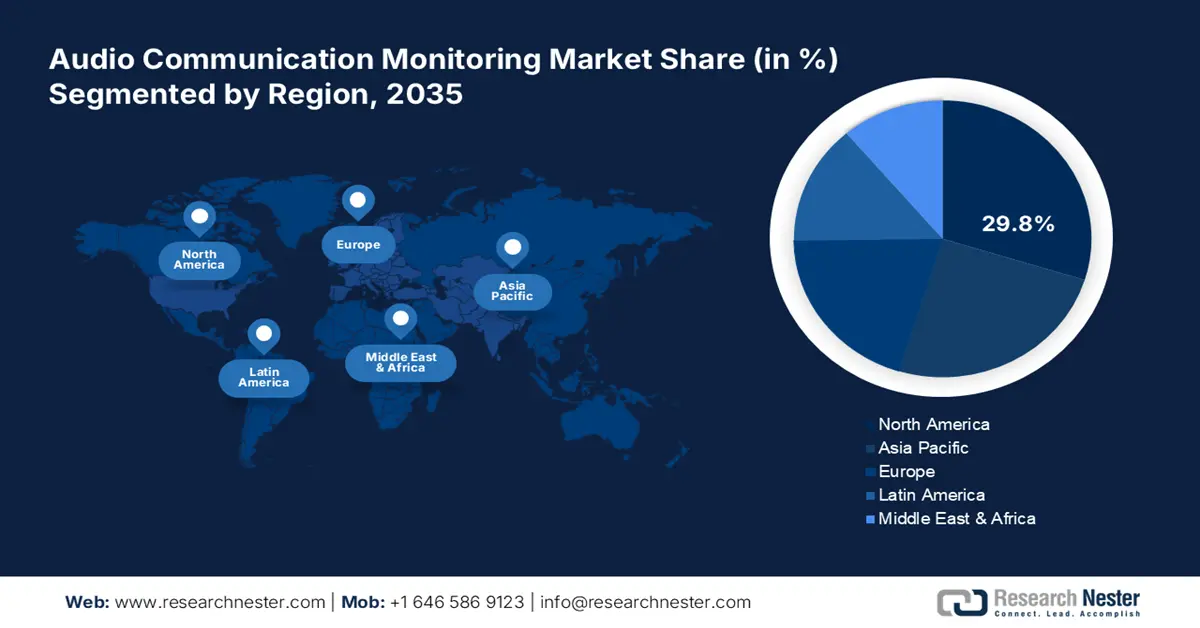

- The North America Audio Communication Monitoring Market is projected to account for 29.8% of the global revenue share by 2035, supported by the strong presence of industry giants and widespread adoption of cloud-based platforms.

- The Asia Pacific region is expected to secure the second-largest share during 2026–2035, fostered by rapid digitalization and the expansion of cloud-based communication platforms.

Segment Insights:

- The solution segment in the Audio Communication Monitoring Market is estimated to capture 55.5% of the global revenue share by 2035, propelled by enterprises’ growing preference for automated and scalable monitoring technologies.

- The BFSI sector is set to hold 37.5% of the global share through 2035, driven by increasing cyber threats and heightened data security demands.

Key Growth Trends:

- Multi-language and real-time translation capabilities

- AI and speech analytics integration

Major Challenges:

- High initial deployment costs

- Privacy and ethical concerns

Key Players: NICE Ltd., Verint Systems Inc., Cisco Systems, Inc., Genesys, Avaya Holdings Corp., 8x8, Inc., Enghouse Systems Ltd., SAP SE, Atos SE, Mitel Networks Corp., NEC Corporation, Fujitsu Ltd., Panasonic Corporation, NTT Communications Corporation, Hitachi, Ltd., Samsung SDS, Tata Communications Ltd., Tech Mahindra Ltd., Aculab Plc, MYOB Ltd.

Global Audio Communication Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.3 billion

- Projected Market Size: USD 12.9 billion by 2035

- Growth Forecasts: 16.1% CAGR (2026-2035)

Key Regional Dynamics:

• Largest Region: North America (29.8% Share by 2035)

• Fastest Growing Region: Europe

• Dominating Countries: United States, China, Japan, Germany, United Kingdom

• Emerging Countries: India, South Korea, Australia, Canada, Singapore

Last updated on : 7 October, 2025

Audio Communication Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Multi-language and real-time translation capabilities: The globalization of business is increasing the need for advanced communication technologies. The teams, customers, and partners spread across multiple countries have their own native language of communication, which is directly creating a high-earning environment for audio communication monitoring solution providers. The World Economic Forum's 2023 report shows that Papua New Guinea is the most multilingual country in the world, with people speaking 840 different languages. It's followed by Indonesia (711 languages), Nigeria (517), India (456), and the U.S. (328). Thus, as organizations expand internationally, the demand for multilingual audio communication monitoring solutions is set to gain traction in the years ahead.

- AI and speech analytics integration: The AI and speech analytics are estimated to transform audio communication monitoring in the coming years. Many companies are embedding natural language processing (NLP) and machine learning into monitoring platforms to attract a wiser consumer base. The majority of large enterprises are also investing in advanced audio communication monitoring technologies to enhance their efficiency and effectiveness. In April 2024, Coda Octopus Group, Inc. introduced the Voice HUB-4. It is a new AI-powered digital audio system for communication that greatly improves the performance of traditional underwater analog audio systems. Thus, it is understood that several key players in the audio communication monitoring market are continuously advancing their solutions to earn hefty returns.

- Cloud-first strategies: The cloud-based audio communication monitoring solutions are rapidly gaining traction owing to the long-term cost benefits and scalability. The cloud-first strategies employed by both he public and private sectors are accelerating the adoption of audio communication monitoring technologies. According to the World Bank report, Argentina wants to make better use of data to advance its digital changes. To do this, the country is adopting a cloud-first policy, with a goal to move around 80% of its national government's systems to cloud-based technology by 2027. Thus, cloud-based audio communication monitoring solution producers are likely to report higher gains in the years ahead.

Challenges

- High initial deployment costs: The high initial costs are hampering the deployment of audio communication monitoring solutions, particularly among SMEs and new companies. The integration of these advanced technologies with the existing infrastructure also adds to the costs, making it challenging for budget-constrained companies. Further, limited IT budgets and outdated infrastructure are expected to hinder the application of audio communication monitoring technologies in the price-sensitive markets.

- Privacy and ethical concerns: The privacy and ethical concerns are estimated to act as major challenges in the adoption of audio communication monitoring solutions. The collection of sensitive personal information and the unavailability of proper data security are likely to hinder the sales of audio communication monitoring technologies to some extent. The lack of global cyber regulations is also a key hampering factor for the audio communication monitoring solution trade.

Audio Communication Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.1% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 12.9 billion |

|

Regional Scope |

|

Audio Communication Monitoring Market Segmentation:

Solution Segment Analysis

The solution segment is estimated to capture 55.5% of the global revenue share throughout the study period. The solutions directly capture, analyze, and report on audio interactions, which makes them vital for effective operations across various sectors. Also, enterprises increasingly prioritize solutions over standalone services as they enable automation and scalability. The key players in the market are integrating advanced technologies such as AI analytics and machine learning into audio communication monitoring solutions to attract a wider customer base and boost their revenue shares.

Industry Vertical Segment Analysis

The BFSI sector is set to account for 37.5% of the global audio communication monitoring market share through 2035. The increasing cyber threat incidents and data security needs are propelling the demand for advanced audio communication monitoring solutions. The vast customer base and data management needs are also fueling the adoption of audio communication monitoring technologies. According to the International Trade Administration (ITA) in 2023, the finance and insurance sector made up around 7.3% of the U.S. gross domestic product (GDP). This indicates that the expanding BFSI sector is likely to accelerate the deployment of advanced audio communication monitoring technologies.

Enterprise Size Segment Analysis

The large enterprises are estimated to account for 61.3% of the global market share, due to their complex operational structures. The regulatory obligations and extensive communication networks are also key factors boosting the application of audio communication monitoring technologies in large enterprises. The robust digitalization and high volumes of customer interactions are further expected to boost the demand for advanced communication technologies in the years ahead.

Our in-depth analysis of the audio communication monitoring market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Industry Vertical |

|

|

Enterprise Size |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Audio Communication Monitoring Market - Regional Analysis

North America Market Insights

The North America audio communication monitoring market is projected to capture 29.8% of the global revenue share through 2035. The strong presence of industry giants and by widespread adoption of cloud-based platforms are boosting the trade of audio communication monitoring technologies. The stringent regulatory requirements in the BFSI, telecom, and data center sectors are also contributing to the increasing sales of audio communication monitoring systems. Furthermore, the supportive government policies and funding are poised to double the revenues of key players in the years ahead.

The U.S. holds a dominant position in the North America market, owing to its advanced technology infrastructure and swift digital transformation movement. The remote and hybrid work trends are also one of the leading factors boosting the audio communication monitoring solution sales. According to the Federal Reserve Bank of St. Louis study, just before the pandemic in February 2020, only 5% of workers were fully working from home in the American Community Survey (ACS), 7% in the Real-Time Population Survey (RPS), and 11% in the Survey of Income and Program Participation (SIPP). By June 2024, the RPS rate had risen to 12%, or 1.6 times higher than pre-pandemic levels. Also, the ACS and SIPP rates were above their 2020 figures based on the latest data from 2023 and 2022, respectively. This indicates that the WFH model is set to transform the trade of audio communication monitoring solutions.

The Canada audio communication monitoring market is estimated to be driven by the regulatory compliance needs and digital transformation initiatives. The cloud-first strategies in both the public and private sectors are projected to fuel the application of audio communication monitoring solutions. The BFSI, telecom, and healthcare sectors are further set to be the leading drivers of audio communication monitoring throughout the forecast period. The rising public investments in the advancement of the IT sector are also expected to contribute to the overall market growth.

APAC Market Insights

The Asia Pacific audio communication monitoring market is anticipated to capture the second-largest revenue share from 2026 to 2035. The rapid digitalization and expansion of cloud-based communication platforms are likely to boost the trade of audio communication monitoring solutions. The increasing need for regulatory compliance across the end-use industries, including BFSI, telecom, and healthcare, is poised to expand the audio communication monitoring platform production operations in the region. Furthermore, China, Japan, India, and South Korea are the most lucrative markets for key investors.

China leads the sales of audio communication monitoring solutions, owing to its digital-first strategies and hefty public investments. According to the National Data Administration, China's push to grow its digital economy and promote the Digital China idea is set to help it lead in key new technology areas and support worldwide security. As per the same source, in 2024, the core parts of the digital economy made up about 10% of the country’s GDP, and the total data created hit 41.06 zettabytes, a strong 25% jump from the year before. This highlights how lucrative the market is for audio communication monitoring companies.

The India audio communication monitoring market is anticipated to expand at the fastest CAGR between 2026 and 2035. The Digital India and Viksit Bharat initiatives are significantly supporting the growth of the ICT sector. The robust expansion of BFSI, telecom & IT, and media & entertainment sectors is creating a profitable environment for audio communication monitoring service providers. The India Brand Equity Foundation (IBEF) states that the Union Budget for 2025-26 has allocated nearly USD 232 million to speed up the use of AI and build better infrastructure. Thus, both the public and private investments in digitalization are expected to boost the position of the India market in the APAC space.

Europe Market Insights

The Europe audio communication monitoring market is projected to increase at the fastest CAGR from 2026 to 2035. The stringent regulatory requirements and the growing adoption of cloud-based platforms are boosting the trade of audio communication monitoring systems. The increasing importance of customer experience management is also driving continuous innovation in audio communication monitoring technologies. The rise of remote and hybrid work models is also accelerating the adoption of audio recording and tracking solutions.

Germany leads the sales of audio communication monitoring solutions, owing to the strong presence of industry giants. The know-how tactics of these companies are aiding them to earn lucrative shares in the global space. The robust digitalization of the BFSI sector has also accelerated the trade of advanced audio communication monitoring systems. The booming e-commerce and telecom sectors are also propelling the demand for advanced audio tracking and recording solutions.

The U.K. audio communication monitoring market is estimated to be driven by the increasing demand from tech-savvy customers and continuous technological innovations. The BFSI, telecom, and healthcare sectors are leading adopters of advanced audio communication monitoring solutions. The cloud-first strategies are also amplifying the importance of audio communication monitoring systems in the public and private sectors.

Key Audio Communication Monitoring Market Players:

- NICE Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Verint Systems Inc.

- Cisco Systems, Inc.

- Genesys

- Avaya Holdings Corp.

- 8x8, Inc.

- Enghouse Systems Ltd.

- SAP SE

- Atos SE

- Mitel Networks Corp.

- NEC Corporation

- Fujitsu Ltd.

- Panasonic Corporation

- NTT Communications Corporation

- Hitachi, Ltd.

- Samsung SDS

- Tata Communications Ltd.

- Tech Mahindra Ltd.

- Aculab Plc

- MYOB Ltd.

The global audio communication monitoring market is characterized by the strong presence of mature companies and an increasing number of new players. The industry giants are dominating the market through various organic and inorganic strategies. They are employing partnerships & collaborations, technological innovations, mergers & acquisitions, and digital marketing strategies to earn high returns. Some of the leading companies are also expanding their operations in the developing markets to earn lucrative gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Imagine Communications announced its plans to launch the Imagine Monitoring Solution (IMS) at IBC2025. This new tool, built from scratch to handle the special needs of video network monitoring, helps the company reach more customers.

- In June 2025, Akuvox launched two new innovative products, namely, the X937 Surveillance + Intercom AI Monitor and the X910 Single-Button Package Detection Door Phone. These models advance secure communication and surveillance, with easy setup, advanced features, and a great user experience for homes and businesses.

- Report ID: 8170

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.