Asphalt Additives Market Outlook:

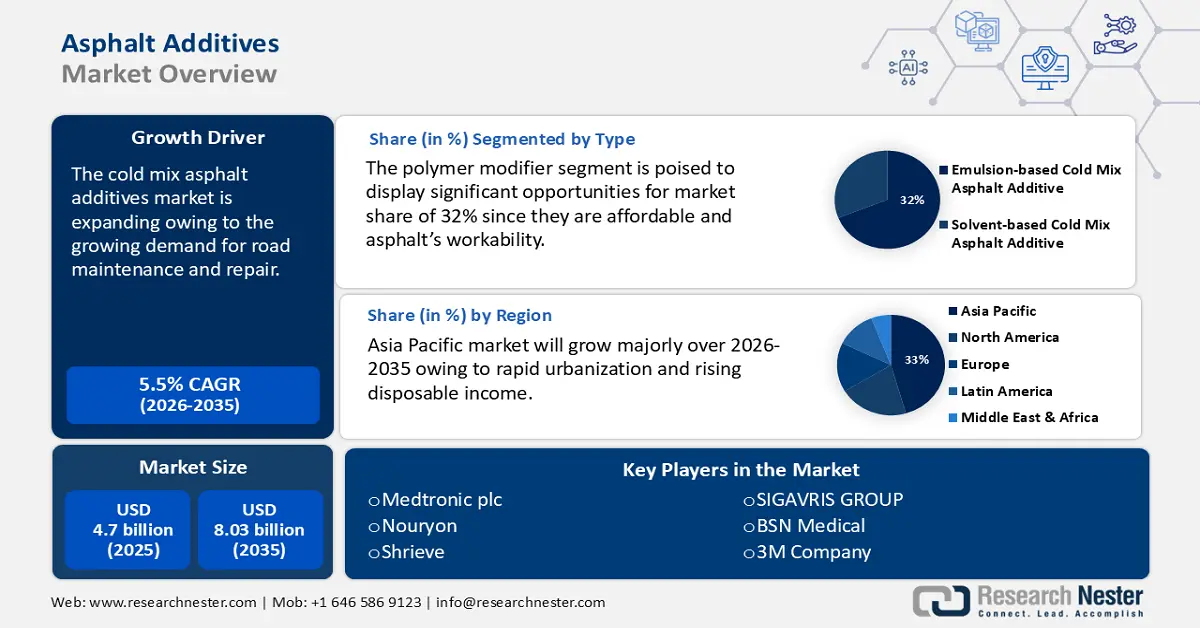

Asphalt Additives Market size was over USD 4.7 billion in 2025 and is poised to exceed USD 8.03 billion by 2035, growing at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of asphalt additives is estimated at USD 4.93 billion.

Due to rapid urbanization, demand for bio-based additives is growing progressively as these materials promote sustainability by reducing the use of natural resources, driving the asphalt additives market growth. As per the World Bank, around 56% of the global population which is 4.4 billion inhabitants are living in cities. This population size will double more than its recent size by 2050, at which point nearly 7 of 10 people will live in cities.

Key Asphalt Additives Market Insights Summary:

Regional Highlights:

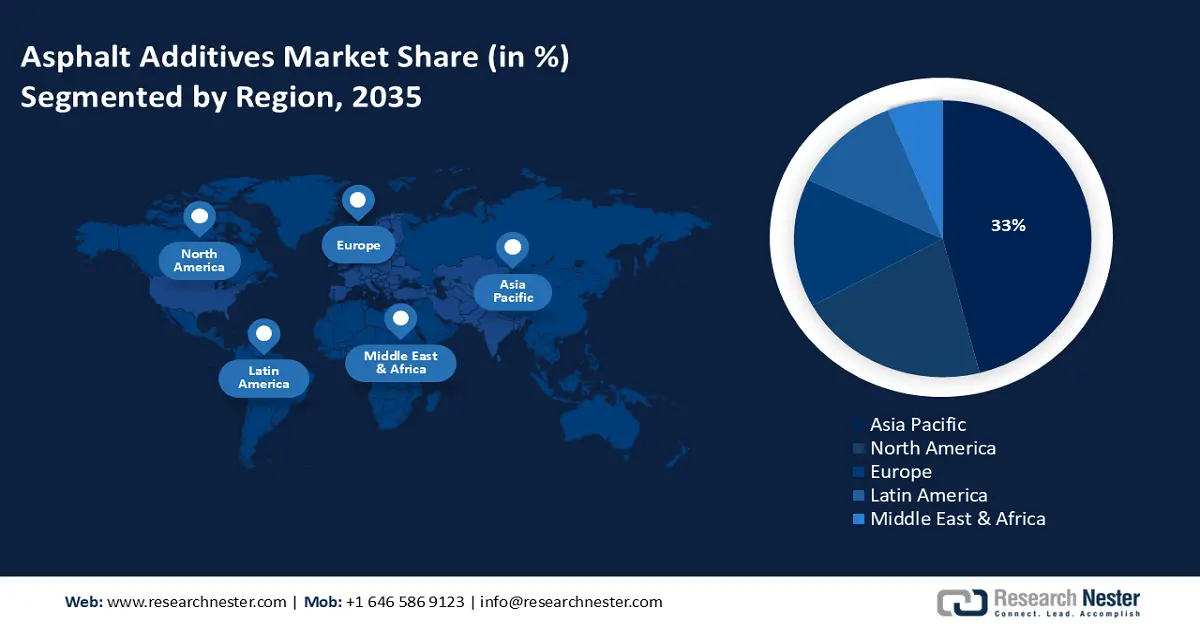

- Asia Pacific asphalt additives market is expected to capture 33% share by 2035, driven by rising airport construction projects and expansion of industrial and commercial sectors.

- North America market will exhibit significant CAGR during 2026-2035, fueled by growing industrialization and need for efficient road haulage.

Segment Insights:

- The hot mix segment in the asphalt additives market is projected to experience significant growth till 2035, driven by its customization for climate, traffic, and load capacity optimizing performance.

- The polymeric modifiers segment in the asphalt additives market is projected to see robust growth till 2035, driven by growing traffic volume and increased heavy truck movement.

Key Growth Trends:

- High demand for road construction

- Growing consumption of warm mix asphalt

Major Challenges:

- Lack of standardization

Key Players: ARKEMA Group, Akzo Nobel N.V., Evonik Industries AG, Honeywell International Inc., Huntsman International LLC, Ingevity, KAO Corporation, Nouryon, SASOL, Tri-Chem Specialty Chemicals, LLC.

Global Asphalt Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.7 billion

- 2026 Market Size: USD 4.93 billion

- Projected Market Size: USD 8.03 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Asphalt Additives Market Growth Drivers and Challenges:

Growth Drivers

-

High demand for road construction - The demand for industrial and residential infrastructure is growing with the increasing population across the world due to which demand for new houses and roads is growing in a parallel manner. As per recent data, new road-building projects worldwide are worth around USD 3.4 trillion, while major ongoing road upgrades are worth USD 0.7 trillion. In addition, the government started investing in road upgrade projects in developing nations as there are high chances of road accidents on worn-out roads. For this, concrete resurfacer is used in construction activities to upgrade worn-out surfaces.

-

Growing consumption of warm mix asphalt - Warm mix asphalt technology is becoming popular because the level of heat at which asphalt and stone aggregate are combined and used to build roads can be lowered using this technique. Due to its ability to reduce fuel emissions and enhance worker safety at asphalt pavement building sites, this technique is considered environmentally friendly

Warm mix technology makes asphalt a better option than concrete and gypsum. According to the European Asphalt Pavement Association with the help of lower mixing and paving temperatures, obtained by the use of warm mix asphalt reduce the fumes or gases by around 50% for each 12 °C reduction in temperature.

Challenges

-

Lack of awareness among builders - By reducing rutting, cracking, and stripping, asphalt additives can greatly extend the operational life of asphalt pavements. This causes asphalt road pavements to require less upkeep. Many contractors and road builders may not be aware of the various types of asphalt additives that are available, their benefits, or the proper way to incorporate them into asphalt mixtures.

This ignorance could lead to the underuse or incorrect application of asphalt additives, which would impair the efficiency of the asphalt pavement. Therefore, a significant obstacle in the asphalt additives industry is the lack of knowledge about asphalt additives between contractors and road builders. - Lack of standardization - There are no proper testing methods and regulations set for asphalt additives which create limitations on the asphalt additives market expansion.

Asphalt Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 4.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.03 billion |

|

Regional Scope |

|

Asphalt Additives Market Segmentation:

Type Segment Analysis

Polymeric modifiers segment is set to capture asphalt additives market share of over 32% by 2035. The segment growth is associated with the growing traffic volume and increased movement of heavy trucks. Polymer modifier-type asphalt additives are widely used in road construction, pavements, airport runways, and parking lots with various techniques such as hot mix, cold mix, and warm mix.

According to WHO, around 92% of the world’s deaths take place in low- and middle-income countries and these countries have around 60% of the world's vehicles. Around 1.19 million people die every year as a result of road traffic. Therefore, with the increase in road traffic, demand for the polymer modifier segment is expected to increase and the asphalt additives market size will expand during the forecast period.

Technology Segment Analysis

Hot mix segment in the asphalt additives market is set to showcase over 40% share through 2035. The reason behind the segment growth is that the hot mix segment can be customized and formulated to specific project specifications, taking into account factors such as climate, traffic, and load capacity.

This flexibility allows optimization of pavement performance and ensures long service life in various environmental conditions. According to the National Asphalt Pavement Association, total warm-mix asphalt tonnage has increased to over 164 million tons in 2019. Additionally, advances in hot mix technology such as warm mix asphalt (WMA) have expanded the applications and benefits of the hot mix segment.

Application Segment Analysis

In asphalt additives market, road construction segment is estimated to showcase over 25% share till 2035. This growth can be impelled by the growing demand for asphalt additives for road construction purposes, worldwide. As per a recent report, the construction of about 90% of the world’s paved roads use asphalt mixture for improving strength and longevity.

The construction chemicals used in road construction are polymer bonding agents and surface retarders to increase the life span and durability of roads. Authorities that have taken charge of construction have initiated various road development projects by using supreme quality construction materials such as asphalt.

Our in-depth analysis of the asphalt additives market includes the following segments:

|

Type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Asphalt Additives Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 33% by 2035. Demand for airport construction is rising in the region due to various factors such as increasing mobility of people and goods. Airports connect people from places where it’s impossible to reach by other transportation means. These projects will increase demand for polymer modifiers, emulsifiers, chemical modifiers, and asphalt additives rejuvenators.

According to the Centre for Aviation, there are around 228 known infrastructure projects of airport construction listed in Asia Pacific which are valued at USD 227 billion. Additionally, rapid growth in the industrial and commercial sectors has increased the need for robust road infrastructure, further propelling the market. These combined factors have solidified Asia Pacific's position as the leader in the asphalt additives market.

The concrete performance with low pavement rutting and moisture-induced damage is improved by using asphalt additives during construction in China. According to a recent report, the country has exported USD 31.2 million Bitumen and asphalt in 2022.

Japan’s government started making huge investments in the construction of national highways and expressways. For instance, the total investments made in public roads for construction and maintenance was around USD 42,88,12,65,070 in 2019.

North American Market Insights

The asphalt additives market in North America is anticipated to grow significantly by the end of 2035. As a result of growing industrialization, which enables rapid transport of raw materials and finished goods, the need for efficient road haulage has increased. According to Cencus.gov, around USD 483.1 billion was spent in March for public construction in the region. The demand for asphalt additives will be driven by the need to make roads and highways more efficient.

Government organizations that support these additions, such as the Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA), have put in place a number of rules and regulations that have aided in the expansion. These factors are predicted to drive the growth of the asphalt additives market.

The demand for improved characteristics of traditionally constructed materials in the United States is increasing with a view to improving their durability.

The market in Canada is growing as a result of rising automotive ownership and government spending on infrastructure construction. According to Statistique Canada, the total number of road motor vehicles registered in 2022 in Canada was 26.3 million, edging up 0.3% from 2021.

Asphalt Additives Market Players:

- ARKEMA Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- Evonik Industries AG

- Honeywell International Inc.

- Huntsman International LLC

- Ingevity

- KAO Corporation

- Nouryon

- SASOL

- Tri-Chem Specialty Chemicals, LLC

The major players in the asphalt additives market are offering a detailed portfolio of demand for asphalt and its derivates. These companies are developing and delivering high-quality asphalt and derived products which are used in road construction.

Recent Developments

- Sasol partnered to explore potential projects for Sasol's Sustainability Center in Lake Charles, Louisiana. The partnership aims to identify sustainable initiatives and innovative solutions that are in line with Sasol's commitment to environmental and social responsibility. Through this collaboration, Sasol aims to have a positive impact on the community and environment while advancing sustainability goals at its Lake Charles facility.

- Evonik Industries AG has started offering carbon-neutral hydrogen peroxide to customers in Europe. This hydrogen peroxide helps customers reduce Scope 3 emissions in their value chain. In return, the purchase of these certificates supports the ongoing sustainable transformation of Evonik’s peroxide production.

- Report ID: 6108

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Asphalt Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.