Artificial Intelligence in Agriculture Market Outlook:

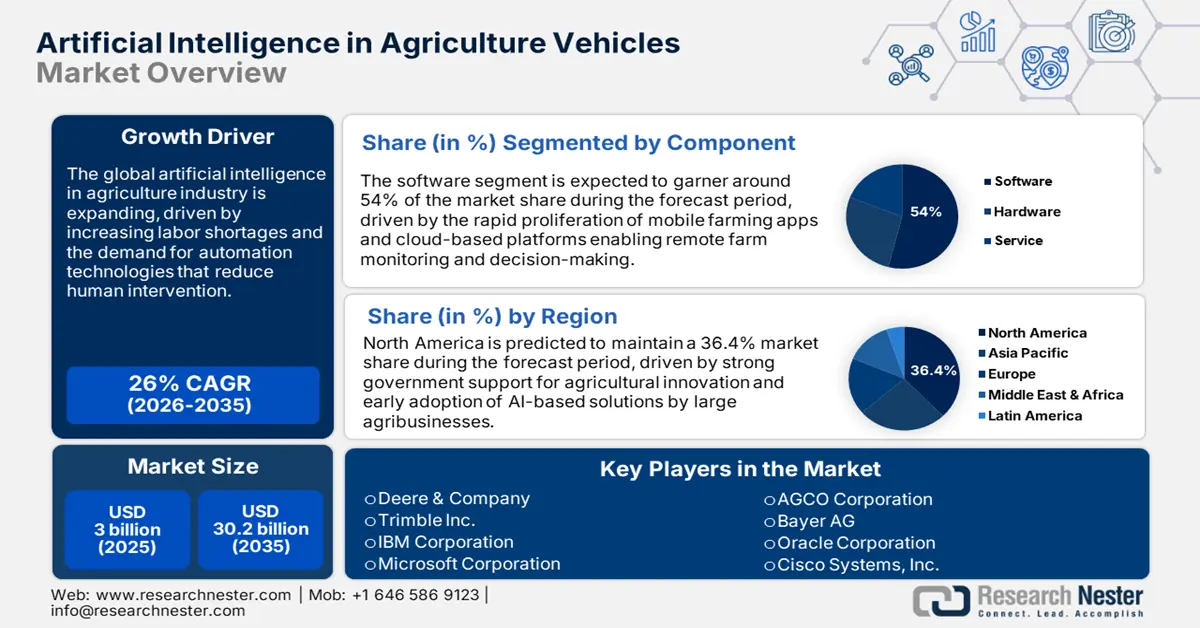

Artificial Intelligence in Agriculture Market size is valued at USD 3 billion in 2025 and is projected to reach a valuation of USD 30.2 billion by the end of 2035, rising at a CAGR of 26% during the forecast period, i.e., 2026-2035. In 2026, the industry size of artificial intelligence in agriculture is assessed at USD 3.7 billion.

The global artificial intelligence in agriculture industry is expanding driven by the embracement of advanced technologies, such as machine learning, computer vision, and predictive analytics, into traditional farming. Government initiatives worldwide promote the embracement of AI with funding programs, technical assistance, and policy driving digital change in the agriculture sector. Japan's National Agriculture and Food Research Organization (NARO) in October 2024 developed Japan's first agriculture-specific generative AI with expertise on agricultural knowledge, starting experimental research at Mie Prefecture, indicating 40% more accuracy than general-purpose AI for agricultural-related questions. This initiative is for sustainable farm development and addresses the issue of the ageing farm population through technological knowledge transfer.

Market-driven technology innovators, such as Deere & Company, Microsoft Corporation, Bayer AG, and IBM Corporation, drive market innovation through the formation of strategic alliances, investments in research, and the creation of integrated platforms. These firms collaborate with farming communities and agricultural research institutes to develop tailored AI solutions appropriate for diverse crop management requirements. In June 2023, Deere & Company revolutionized precision farming by integrating space technology, artificial intelligence (AI), and advanced data analysis to provide farmers with actionable information. Through the use of satellite imagery, the firm can monitor crops more effectively, assess field conditions, and optimize the distribution of resources to deliver higher yields.

Key Artificial Intelligence in Agriculture Market Insights Summary:

Regional Insights:

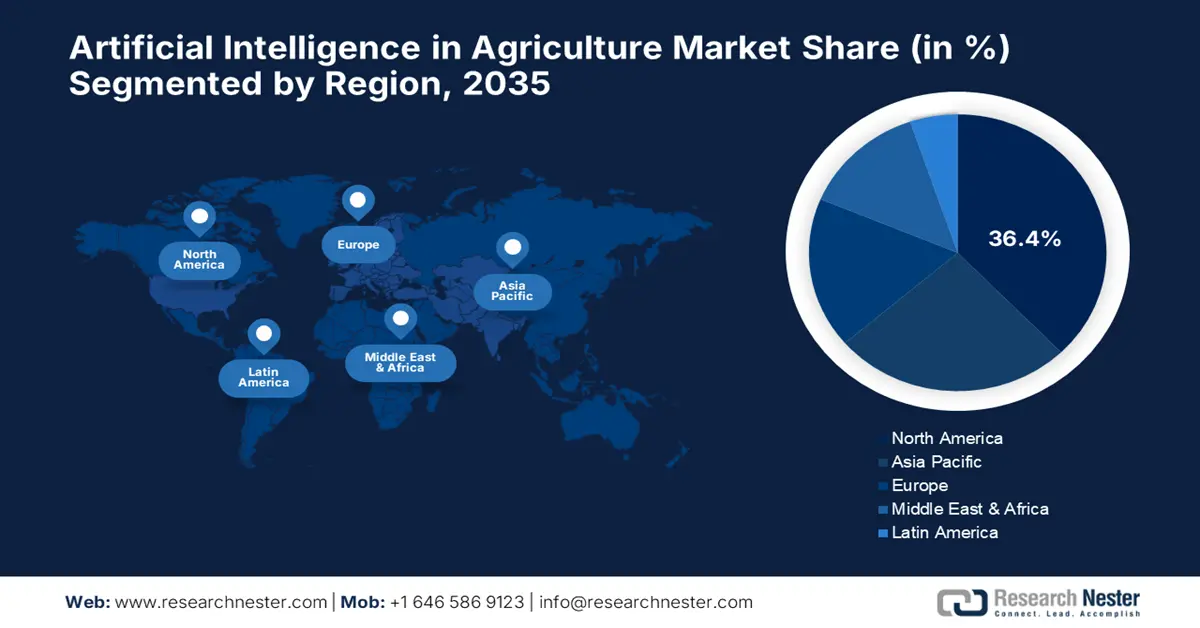

- North America is predicted to maintain a 36.4% market share by 2035, supported by advanced technology infrastructure, high R&D investments, and robust government programs fostering AI adoption in agriculture.

- Asia Pacific artificial intelligence in agriculture market is likely to register a CAGR of 21% from 2026 to 2035, impelled by rapid digitalization initiatives, government support programs, and increasing adoption of smart farming technologies.

Segment Insights:

- Software segment is projected to command 54% of the market share by 2035, propelled by rising demand for AI-based analytics platforms, machine learning algorithms, and data management systems in the Artificial Intelligence in Agriculture Market.

- Machine Learning & Deep Learning segment is forecasted to account for 45% market share by 2035, owing to the crucial role of advanced algorithms in breaking down complex agricultural data and producing actionable insights.

Key Growth Trends:

- High-tech precision farming solutions enhance crop management effectiveness

- Government investment initiatives drive technology uptake

Major Challenges:

- Technical complexity of technology integration hinders mass adoption

- Technology adoption gets hindered by data security and privacy concerns

Key Players: Deere & Company, Trimble Inc., IBM Corporation, Microsoft Corporation, AGCO Corporation, Bayer AG, Oracle Corporation, Cisco Systems, Inc., Siemens AG, Samsung Electronics Co., Ltd.

Global Artificial Intelligence in Agriculture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 billion

- 2026 Market Size: USD 3.7 billion

- Projected Market Size: USD 30.2 billion by 2035

- Growth Forecasts: 26% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, France, Japan

- Emerging Countries: China, India, Brazil, Australia, South Korea

Last updated on : 12 September, 2025

Artificial Intelligence in Agriculture Market - Growth Drivers and Challenges

Growth Drivers

- High-tech precision farming solutions enhance crop management effectiveness: Premium AI-driven precision agriculture solutions enable farmers to optimize the use of resources such as water, pesticides, and fertilizers through real-time analysis and automated decision-making. Sophisticated systems can implement variable rate application technologies that adjust inputs according to field variation and crop requirements during planting seasons. In December 2024, AGCO Corporation demonstrated a groundbreaking suite of precision agriculture solutions through the PTx brand, empowering farmers to drive outcomes and improve productivity, as the sole company to successfully retrofit virtually any make or model of equipment with Precision Planting and PTx Trimble technology to produce more with less. The retrofit-first methodology maximizes total addressable market and accelerates technology adoption, providing more profitable farmers.

- Government investment initiatives drive technology uptake: Global government funding programs and policy frameworks support the mass adoption of AI in the agricultural sector through grants, subsidies, and technical assistance plans. Strategic public-private partnerships enable knowledge sharing and technology transfer, making it available to diverse farming operations, such as smallholder farmers. In August 2025, the United States National Science Foundation launched AI-ENGAGE (Advancing Innovations for Empowering NextGen AGriculturE) Initiative with the support of Japan Science and Technology Agency (JST), Indian Council of Agricultural Research (ICAR), and Commonwealth Scientific and Industrial Research Organization of Australia (CSIRO). The initiative anticipates farmers using apps backed by affordable sensors, robots, and artificial intelligence to access precise real-time information regarding water, fertilizer, and pest needs.

- Data-driven decision-making transforms farm operations: Artificial intelligence-powered analytics software consumes massive amounts of farm data from diverse inputs like weather stations, soil sensors, and crop monitoring systems to provide actionable recommendations for ideal farm decisions. In October 2023, DigiFarm's cloud-native precision agriculture software was supported by Oracle Corporation on Oracle Cloud Infrastructure, which enabled farmers and agribusinesses to automatically identify field boundaries from high-resolution satellite imagery and employ neural network models to compute seeded field acreage boundaries. Predictive algorithms continuously improve prediction accuracy while providing real-time suggestions for changes in operations and optimizing resources.

Accuracy of AI Models in Plant Disease and Pest Detection

|

AI Model / System Name |

Crop / Scope |

Reported Accuracy (%) |

Key Technology |

|

CNN Model |

25 different plants |

99.53% |

Convolutional Neural Network (CNN) |

|

ResNet-50 |

General plant disease & pest |

95.61% |

ResNet-50 (Deep Residual Network) |

|

PlantDoc |

13 plant species |

- |

Computer Vision / Deep Learning |

|

Agpest Expert System |

Wheat & Rice |

- |

ANN, Genetic Algorithm, Computer Vision |

|

Alternative Diagnostic Methods |

General |

~75% |

Traditional lab/visual analysis |

Source: PMC

Development and Deployment of AI Technologies in Agriculture

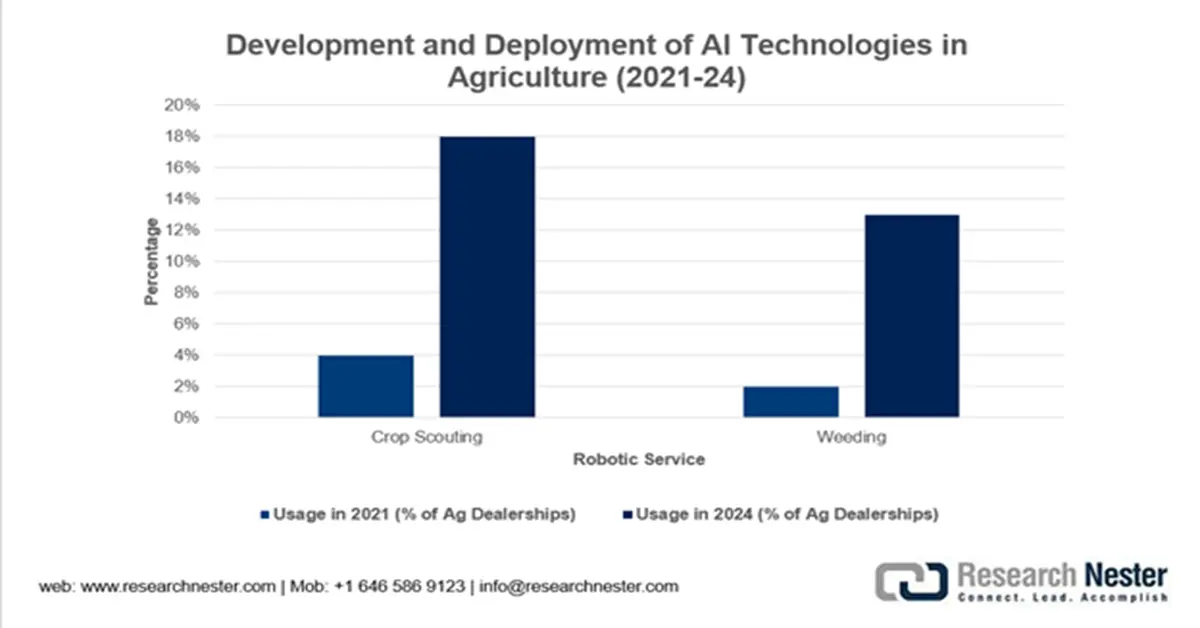

The adoption of robotic and digital technologies in agriculture is rapidly advancing, moving from research and limited trials toward broader commercialization. While technologies like GPS-guided machinery are now widespread, autonomous field robots for tasks such as weeding and crop scouting are currently used by only 2–4% of agricultural input dealerships. However, significant growth is anticipated, with nearly one-fifth of dealers offered robotic crop scouting services in 2024, signaling a major shift toward automated and precision farming solutions.

Source: DOI

Challenges

- Technical complexity of technology integration hinders mass adoption: Sophisticated AI models require sophisticated technical infrastructure and specialized expertise for effective implementation and maintenance across various types of agricultural operations. The majority of farming operations lack the necessary technical capabilities and infrastructure to effectively incorporate advanced AI systems within the current equipment and management systems. Rural communities of farmers often suffer from poor connectivity and inadequate technical support services, which hinder the effective deployment and implementation of AI. This results in significant investment for training and education programs to provide farmers with the necessary knowledge to unlock the potential of AI. Furthermore, a more accessible and adaptable set of AI solutions needs to be developed for widespread adoption in agriculture.

- Technology adoption gets hindered by data security and privacy concerns: Farming AI solutions gather huge amounts of personalized farm data like field settings, crop yields, and agricultural practices that pose grave issues regarding farmers' privacy and data security. Security issues breaching agricultural data and control systems threaten agricultural practices and food security infrastructure even further. In July 2023, the National Institute of Standards and Technology (NIST) published guidelines on establishing a national test-farm Internet of Things (IoT) network to enhance agricultural production while promoting sustainable practices. Specific application areas include yield prediction, pest management, disease management, irrigation scheduling, and supply chain optimization.

Artificial Intelligence in Agriculture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

26% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 30.2 billion |

|

Regional Scope |

|

Artificial Intelligence in Agriculture Market Segmentation:

Component Segment Analysis

The software segment is predicted to command 54% of the market share during the forecast period, driven by rising demand for AI-based analytics platforms, machine learning algorithms, and data management systems. Software solutions provide the foundation for processing agricultural data, developing predictive analytics, and enabling automated decision-making for different farming applications. Advanced software platforms integrate various data streams, including satellite data, sensor networks, and weather data, to deliver comprehensive end-to-end farm management. For instance, AGCO Corporation integrated artificial intelligence-based weed and crop recognition in November 2023 using a modular design, enabling easy tuning to different farming conditions and crops. The company's sustainability report focused on precision agriculture solutions, providing targeted solutions at each stage of the crop cycle to enable farmers to reduce fertilizers, pesticides, and other inputs while maintaining healthy fields and achieving maximum yields.

Technology Segment Analysis

The Machine Learning & Deep Learning segment is projected to account for a 45% market share owing to the crucial role that strong algorithms play in breaking down complex agriculture data and producing actionable insights. These technologies enable more sophisticated pattern recognition, predictive analysis, and automated decision-making capabilities, transforming traditional farming practices into data-driven operations. Machine learning models learn to improve over time through data processing and feedback loops and continuously offer increasingly accurate recommendations for crop management and resource optimization. Trimble Inc. transformed crop protection with AI and plant-level spraying technology acquired from Paris-based startup Bilberry in October 2023. The technology demonstrates the significant control of machine learning algorithms over optimizing the application of inputs for agriculture, while also enhancing crop protection effectiveness.

Application Segment Analysis

The precision farming area is anticipated to hold a 38% market share by 2035, driven by the widespread application of site-specific crop management methods that optimize resource utilization and returns. Precision agriculture solutions utilize AI technology to translate field variability and provide tailored advice on fertilization, irrigation, and pest management based on precise crop and soil conditions. Microsoft Corporation, in March 2023, emphasized the role of AI in supporting farmers to stay up to speed with sustainable food production by developing their capabilities and intelligence through data and AI, enabling them to make informed decisions that maximize production with minimal resource U.S.ge, such as water and fertilizer. The company's vision is to remove guesswork and replace it with data and AI, recognizing that despite farmers possessing unique knowledge developed over decades or generations, much of the decision-making around whether and where to fertilize still relies on crude estimates.

Our in-depth analysis of the artificial intelligence in agriculture market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Intelligence in Agriculture Market - Regional Analysis

North America Market Insights

North America is predicted to maintain a 36.4% market share during the forecast period, solidifying the region as a leader in artificial intelligence adoption in agriculture. The region is blessed with advanced technology infrastructure, high levels of research and development investments, and highly developed government support programs for fostering the digitalization of agriculture. Major technology companies collaborate with agriculture institutions to design cutting-edge AI solutions that address numerous problems in agriculture, like precision crop management, autonomous farm equipment, and predictive analytics.

The U.S. artificial intelligence in agriculture market drives global growth through comprehensive government support from the USDA, NSF, and the federal government, which provides substantial funding for research, development, and technology implementation programs. U.S. companies, such as Microsoft Corporation, IBM Corporation, and Oracle Corporation, make significant investments in agricultural AI platforms serving both domestic and international markets. In 2023, the USDA's National Institute of Food and Agriculture (NIFA) funded various AI initiatives, including the Agriculture and Food Research Initiative (AFRI), in agricultural system research focused on AI, with a focus on autonomous robot development and smart sensing.

Canada artificial intelligence in agriculture market shows steady growth with government efforts promoting technology, research collaborations, and innovation network formations across different regions of agriculture. Provincial and national plans provide finance for AI adoption, prioritizing sustainable agricultural practices and yield increase. In June 2025, the Government of Canada launched the AI for Productivity Challenge program through the National Research Council (NRC) to accelerate the adoption of AI in Canada's clean tech, agriculture, and manufacturing sectors, aiming to enhance productivity, efficiency, and profitability. The program is focused on bringing advanced technology readiness level (TRL) projects to market with artificial intelligence (AI)-based prototypes validated in live operating conditions.

APAC Market Insights

Asia Pacific artificial intelligence in agriculture market is likely to register a CAGR of 21% from 2026 to 2035, driven by rapid digitalization initiatives, government support programs, and increasing adoption of smart farming technologies in diverse regional economies. The region has a massive government spend on the modernization of farming, building technology infrastructure, and upskilling farmers for AI adoption. Mass agricultural operations and emerging agricultural economies generate tremendous demand for AI-driven solutions to crop management, resource efficiency, and supply chain optimization problems.

China artificial intelligence in agriculture market is rising through comprehensive government planning to promote the cultivation of intelligent agriculture, as well as significant investments in agricultural technology infrastructure and research programs. In March 2025, China's Guiyang Municipal Government announced that State-owned Guiyang Agricultural Investment Group (GAIG) upgraded its Smart Agriculture Investment platform by integrating the DeepSeek AI model to provide farmers with accurate, effective, and convenient farming production guidance. The platform offers AI-powered applications in manufacturing and operational data governance, intelligent legal search, and multimodal visual interaction, driving deeper technological innovation and integration with industrial growth.

India artificial intelligence in agriculture market shows rapid growth with government-led digital transformation efforts and strategic investments in agri-tech growth and farmer assistance programs. The government of India promotes AI adoption through massive funding programs, infrastructural growth, and collaborative research programs for end-to-end agricultural issues like precision agriculture, crop monitoring, and supply chain management. The Government of India launched the AgriTech Innovation Hub in Meerut in July 2025 with the support of the Union Minister and IIT Ropar's Artificial Intelligence Centre of Excellence (AI COE) for Agriculture: Annam AI. It is equipped with IoT-enabled sensors, intelligent irrigation systems, automation technology, and a real-time analytics platform, enabling precision agriculture and sustainable farming practices.

Europe Market Insights

Europe is projected to experience sustained development from 2026 to 2035, driven by integrated regulatory frameworks that support sustainable agriculture, extensive research and development, and strategic processes in support of digital transformation across all areas of agriculture. The European Union's Common Agricultural Policy provides funding for high levels of technology adoption while promoting environmental sustainability and precision farming methods. Integrated supply chains, state-of-the-art manufacturing facilities, and progressive regulatory frameworks support technology integration and data exchange programs that benefit the market.

The UK artificial intelligence in agriculture market is experiencing substantial growth, largely driven by extensive government programs that support innovation, sustainability, and development in all farming practices. Strategic policy interventions include investments in tech development, research collaborations, and farmer training schemes that promote bulk AI adoption. In April 2024, the UK Government launched the Scaling Agriculture Investment in Digital, AI, and Innovation (SAIDAI) program to scale and support digital agriculture innovations with transformational potential, generating evidence on what works, where, and for whom. The program encourages more integrated, sustainable, and resilient agri-food systems in developing countries to deliver healthy and safe food through improved yields, reduced post-harvest loss, and better supply chains.

Germany agricultural industry artificial intelligence is backed by sophisticated production capabilities, large research facilities, and strong government support for agricultural technology innovation and development initiatives. German research institutes collaborate closely with technology companies to develop highly advanced AI solutions for precision farming, automation, and sustainable agriculture requirements. In August 2025, the German Federal Ministry supported a collaborative research project, From the Ground Up: Farmers' Perspectives on AI in Agriculture, through joint collaboration with Hebrew University of JerU.S.lem (HUJI) and Technical University of Munich (TUM). The project examines how farmers perceive and utilize AI technology, and how their views influence adoption and governance expectations, with significant implications for global food security.

Key Artificial Intelligence in Agriculture Market Players:

- Deere & Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trimble Inc.

- IBM Corporation

- Microsoft Corporation

- AGCO Corporation

- Bayer AG

- Oracle Corporation

- Cisco Systems, Inc.

- Siemens AG

- Samsung Electronics Co., Ltd.

The artificial intelligence in agriculture market is marked by intense competition among established technology giants like Deere & Company, Microsoft Corporation, IBM Corporation, Bayer AG, AGCO Corporation, and technology giants like Oracle Corporation and Cisco Systems Inc. Companies compete on ongoing innovation in machine learning algorithms, data analytics platforms, and comprehensive agricultural management systems that offer end-to-end farm solutions. Strategic collaborations, mergers, and collaborative research programs strengthen technology foundations while establishing a market presence and customer bases across various agricultural sectors.

Latest market trends indicate robust innovation activities and strategic collaborations that are driving artificial intelligence capabilities and expanding market opportunities in a wide array of agricultural applications. Industry leaders continue to develop innovative products and forge alliances to propel technological capabilities and consolidate competitive positions. In July 2025, Bayer AG partnered with AWS to create a next-gen MLOps service that governs large-scale data science operations for the farming analytics needs underpinning the mission to increase crop production by 50% by 2050. The partnership supports sustainable farming principles, improving soil health by adopting natural methods to create healthy ecosystems while producing more food and rebuilding the environment through the integration of end-to-end data science innovation and AI-based agriculture solutions.

Here are some leading companies in the artificial intelligence in agriculture market:

Recent Developments

- In January 2025, Deere & Company expanded AI-powered equipment capabilities through advanced computer vision and sensor fusion systems that autonomously adjust equipment settings based on live analysis. Modern John Deere tractors and combines detect and respond to variations in soil conditions and crop health while providing in-cab and remote guidance through intuitive platform dashboards.

- In May 2024, Microsoft Corporation announced a strategic partnership with Royal Thai Government to boost Thailand's agri-tech sector, including the establishment of new datacenter and AI training programs. Microsoft's AI technologies enhance agricultural efficiency through precision agriculture, automated machinery, predictive models, and optimized resource management with regional impact across APAC including Malaysia, Indonesia, Vietnam, Japan, Australia, Singapore, and Taiwan.

- Report ID: 3642

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Intelligence in Agriculture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.