Digital Agriculture Market Outlook:

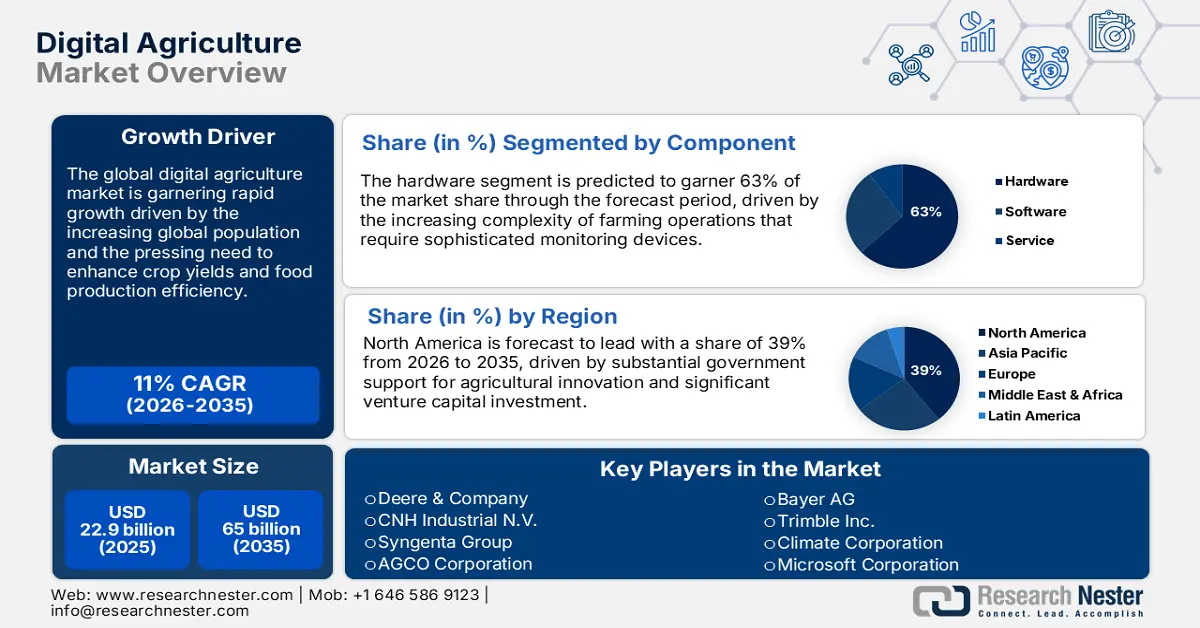

Digital Agriculture Market size is valued at USD 22.9 billion in 2025 and is projected to reach a valuation of USD 65 billion by the end of 2035, rising at a CAGR of 11% during the forecast period, i.e., 2026-2035. In 2026, the industry size of digital agriculture is estimated at USD 25.4 billion.

The global digital agriculture market is garnering rapid growth driven by the adoption of precision farming technology and data-driven solutions. Additionally, government programs worldwide are promoting the adoption of digital agriculture through targeted funding and strategic policy frameworks. For instance, the UK government offers notable support in the form of the £90 million Transforming Food Production Challenge, investing more than £22.4 million in smart farming initiatives. In September 2024, the Government of India sanctioned the Digital Agriculture Mission, with a significant financial allocation of around USD 1.9 billion from central government funds, marking a revolutionary step for the agriculture industry.

Latest agricultural operations increasingly use IoT sensors, AI analytics, and automated systems to become more productive and sustainable. The market reflects high growth prospects, with companies worldwide investing in comprehensive digital transformation programs. Farmonaut released an analysis in July 2025, predicting up to 20% increases in crop yields by 2025, based on holistic datasets from the USDA and widespread IoT installations across agriculture. Manufacturers are developing enhanced solutions that integrate hardware, software, and advisory services. These innovations help solve pressing agricultural issues in promoting global food security goals.

Key Digital Agriculture Market Insights Summary:

Regional Highlights:

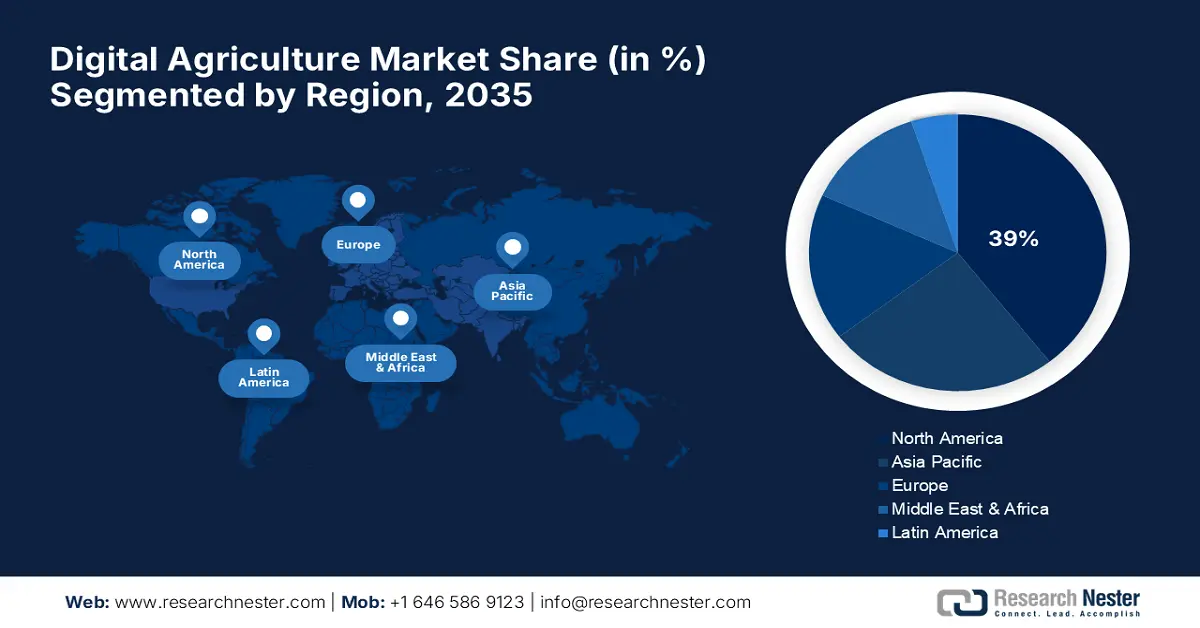

- North America is projected to secure a 39% share of the digital agriculture market by 2035, supported by advanced technology infrastructure, substantial government investments, and the widespread use of precision farming solutions across the agricultural value chain.

- Asia Pacific is forecast to grow at a 10% CAGR during 2026–2035, fueled by rapid technological uptake, government-backed digital agriculture programs, and expanding rural connectivity that boosts access to data-driven farming tools.

Segment Insights:

- The hardware segment is expected to command around 63% share of the digital agriculture market by 2035, underpinned by rising deployment of IoT sensors, drones, and autonomous equipment that enhance field-level data acquisition and operational efficiency.

- The precision farming and farm management segment is projected to capture a 46% share by 2035 as integrated IoT, AI, and analytics platforms streamline decision-making and optimize end-to-end farm operations.

Key Growth Trends:

- Advanced hardware integration transforms farming operations

- AI-powered advisory services improve decision making

Major Challenges:

- High technology investment barriers constrain adoption

- Data standardization and integration complexities

Key Players: CNH Industrial N.V., Syngenta Group, AGCO Corporation, Bayer AG, Trimble Inc., Climate Corporation, Microsoft Corporation, IBM Corporation, Samsung SDS Co. Ltd.

Global Digital Agriculture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.9 billion

- 2026 Market Size: USD 25.4 billion

- Projected Market Size: USD 65 billion by 2035

- Growth Forecasts: 11% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Australia, South Korea, Indonesia

Last updated on : 3 September, 2025

Digital Agriculture Market - Growth Drivers and Challenges

Growth Drivers

-

Advanced hardware integration transforms farming operations: Smart farming equipment integration enables intelligent farming through the integration of smart farming equipment that provides real-time monitoring and automated decision-making functionalities. IoT sensors, aerial drones, and robotic farm aids deliver farmers in-depth field intelligence to manage resources in the most optimized way. Data-driven insights from networked devices facilitate enhanced crop health monitoring and yield optimization measures. In October 2023, Zuari FarmHub launched its strategic collaboration with CropX Technologies to transform the farming practice in India through real-time monitoring technology and data-driven decision support. The alliance launched pilots of CropX's hardware-based system at Zuari Agri Innovation Centre in Solapur and chosen farmer fields. This collaboration enables farmers to optimize production, prevent wastage of resources, and promote sustainable farming practices through cutting-edge agri-tech solutions.

-

AI-powered advisory services improve decision making: Artificial intelligence platforms provide tailored agricultural advice using in-depth data analysis and forecasting modeling capabilities. Farmers receive actionable advice on crop care, pest management, and resource utilization tailored to their actual field conditions. Sophisticated analytics facilitate anticipatory decision-making, enhancing productivity and minimizing environmental footprint and operating expenses. In January 2024, AGRIVI unveiled its 2023 product overview, presenting end-to-end digital agriculture solutions for the entire value chain. The company marked 10 years of AgTech innovations with notable advancements, including the new Fertigation Management Module for greenhouse farming and the AGRIVI Spray Advisor, which provides the optimal time for crop spraying. The AI-based farm advisor is pioneering innovation, facilitating agri-food companies globally to shift towards more efficient and profitable production systems.

-

Government-led digital infrastructure development: National digital agriculture programs create a critical foundation for large-scale technology adoption and farmer empowerment initiatives. Comprehensive policy structures facilitate ecosystem growth through financing, capacity building, and infrastructure investments in agricultural communities. Official support ensures sustainable market development in the face of technology access issues for various farmer groups. In April 2025, the Government of India provided detailed information on the progress of the Digital Agriculture Mission, highlighting the development of a robust digital agriculture ecosystem that drives innovative, farmer-led solutions. The mission aims to provide timely and credible crop-related information through robust Digital Public Infrastructure, such as AgriStack and Krishi Decision Support System. The government has designed 'Kisan e-Mitra,' an AI-based chatbot that helps farmers with inquiries related to the PM Kisan Samman Nidhi Scheme.

U.S. Family Farm Typology & Targeted Digital Agriculture Solutions

The stark contrast between the number of small family farms (85%) and the production output of large-scale family farms (51%) means a one-size-fits-all technology approach will fail. Solutions must be tailored to the specific needs, financial capacity, and scale of each segment.

|

Farm Classification |

Gross Cash Farm Income (GCFI) |

% of all U.S. Farms |

Key Characteristic |

Targeted Digital Agriculture Solutions |

|

Small Family Farms |

< $350,000 |

85% |

High volume, low individual revenue, limited capital |

Low-Cost SaaS & Mobile Apps: Farm management software, basic drone imagery for scouting, commodity price tracking apps, digital marketplaces for direct sales |

|

Midsize Family Farms |

$350,000 - $999,999 |

~11% |

Transitional scale, investing for efficiency and growth |

Precision Ag Starter Kits: Guidance systems, variable rate technology (VRT) for seeding/fertilizer, subscription-based data analytics, herd health monitoring sensors |

|

Large-Scale Family Farms |

≥ $1,000,000 |

<4% |

High output, business-oriented, focused on ROI and scalability |

Integrated High-Tech Systems: Autonomous equipment, AI & IoT sensor networks, advanced data analytics platforms, supply chain automation software, drone-based spraying |

Source: FAO

Challenges

-

High technology investment barriers constrain adoption: Heavy initial investment in digital agriculture technologies poses serious adoption barriers for small- and resource-poor farmers. High-tech gear, software licenses, and connectivity infrastructure require significant capital investments that many farm operations cannot afford. Constrained access to funding alternatives further limits the deployment of technology, generating inequality in digital agriculture advantage among various segments of farmers. In February 2023, the USDA released detailed reports documenting U.S. farm sector adoption patterns, which revealed significant gaps in adoption between major and minor operations. The report provides evidence that cost considerations continue to rank as the most important factor affecting farmer adoption decisions for technology. The cost barrier highlights the need for support mechanisms that provide a level playing field for access to digital agriculture opportunities.

-

Data standardization and integration complexities: Disaggregated data systems and inharmonious technology platforms pose significant operational challenges to the effective implementation of digital agriculture. Varied hardware and software standards pose challenges to the effective aggregation of data and real-time analysis among various agricultural technology vendors. Inconsistent data formats and limited interoperability hinder the efficiency of integrated farm management systems and decision-making capabilities. In November 2023, CNH Industrial announced its plan to bring nearly all precision technology solutions in-house by 2025, highlighting industry pitfalls associated with technology integration. The company has been executing this plan since 2019 to mitigate integration complexities and maintain total control over its technology offerings.

Digital Agriculture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 22.9 billion |

|

Forecast Year Market Size (2035) |

USD 65 billion |

|

Regional Scope |

|

Digital Agriculture Market Segmentation:

Component Segment Analysis

The hardware segment is expected to retain around 63% of the digital agriculture market share through the forecast period, driven by the demand for sensor technologies and agricultural equipment. Sophisticated equipment such as IoT sensors, drones, and robot systems is the basis for precision agriculture activities in worldwide markets. Investments in hardware enable comprehensive data collection and autonomous field operations, maximizing farm productivity and resource utilization. In November 2023, John Deere introduced new innovations at Agritechnica 2023, including improved AutoPath full-field guidance line functionality that is more applicable and offers new crop applications. The system is a 24/7 application capable of best-in-class precision digital tools and agronomic knowledge, offering outstanding performance. The precision agronomics offering represents a breakthrough in helping farmers achieve a minimal environmental footprint while increasing production.

Application Segment Analysis

The precision farming and farm management segment is projected to hold a 46% digital agriculture market share by 2035, reflecting an increase in demand for comprehensive agricultural solutions. End-to-end farm management platforms integrate various technologies, including IoT, AI, and data analytics, to automate processes from planning to harvest. The solutions allow farmers to maximize resource utilization, crop monitoring, and overall operational effectiveness using data-driven solutions. In November 2023, Syngenta Group and CNH Industrial joined forces to integrate Syngenta's Cropwise platform with Case IH and New Holland Agriculture's digital platforms, enhancing support for farmers. The collaboration facilitates seamless data sharing between Syngenta's crop protection analytics and CNH's machinery management systems, thereby easing decision-making.

Offerings Segment Analysis

The advisory services segment is predicted to account for a 39% digital agriculture market share by 2035, with growing farmer interest in specialized advice and personalized recommendations. Online advisory platforms analyze comprehensive agricultural data to provide tailored advice on crop management, resource allocation, and sustainable practices. Advisory services fill knowledge gaps and enable informed decision-making across various agricultural operations and geographical locations. In November 2023, Bayer AG presented end-to-end digital agriculture innovations at Agritechnica 2023, underscoring its continued support for digital solutions in the transition to regenerative agriculture. Bayer's digital flagship FieldView already covers more than 220 million acres worldwide and is recognized as the industry leader's digital agriculture platform. This continued growth in advisory services is crucial for enhancing agricultural productivity and sustainability globally.

Our in-depth analysis of the digital agriculture market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

Offerings |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Agriculture Market - Regional Analysis

North America Market Insights

North America is expected to maintain a 39% digital agriculture market share throughout the forecast period, positioning the region as a global leader in digital agriculture adoption. The region is supported by advanced technology infrastructure, substantial government spending, and widespread adoption of precision farming solutions among farmers. Sophisticated data analytics platforms, pervasive IoT sensor networks, and AI applications enable holistic farm management across a wide range of agricultural operations. Effective regulatory systems promote innovation while ensuring food safety and environmental protection along the agricultural value chain. Interactions among technology firms, agricultural associations, and government institutions propel ongoing market evolution and technological innovation.

The U.S. digital agriculture market is leading in digital agriculture development through overall government backing and widespread technology deployment in key agricultural areas. Federal partners team with private sector collaborators to create innovative farming solutions that increase productivity and sustainability results. In February 2023, the USDA released detailed documentation of U.S. farm sector adoption patterns for digital agriculture technology. The report indicates the widespread adoption of yield maps, soil maps, and variable-rate technologies on corn and soybean land. Automated guidance systems have been implemented on more than 50% of acres for large crops, including corn, cotton, rice, sorghum, soybeans, and winter wheat. Key driving factors for adoption include pricing considerations, soil variability, USDA program effects, and labor-saving advantages.

Canada digital agriculture market exhibit continuous growth, underpinned by government initiatives that promote innovation and sustainability in the agricultural industry. Agriculture and Agri-Food Canada's Agricultural Climate Solutions program provides $4 billion over 10 years for the promotion of clean technologies and farm practices. The program funds projects such as Living Labs and the On-Farm Climate Action program, facilitating co-innovation and real-world implementation of precision agriculture technologies. This program aligns with national efforts to mitigate the effects of climate change and enhance agricultural productivity through the deployment of high-tech technologies. Farmers benefit from improved advisory services, as well as sophisticated machinery equipped with AI and IoT, to optimize resource utilization. Synergy between governments, academia, and the industry supports the sustainable growth of digital agriculture in Canada.

Europe Market Insights

Europe digital agriculture market is set to experience substantial growth from 2026 to 2035, driven by European Union policies promoting precision agriculture and sustainable farming technologies. The region focuses on investment in research and development through public-private partnerships to develop innovative agricultural technology and implement it at a high level. Stringent regulatory structures facilitate the uptake of technology while preserving environmental conservation and food safety levels in member countries. Digital literacy initiatives and dedicated funding for smart agriculture efforts hasten the uptake of technology among European farmers. Cross-border knowledge exchange programs and collaborative research initiatives enhance the development of comprehensive agricultural technology solutions.

The digital agriculture market in the UK receives significant government support through innovation challenges and technology accelerator programs, which enhance farm productivity. Strategic investments channel funds into AI-powered advisory platforms, data convergence services, and precision agriculture research programs through collaborations between academia and industry. In 2025, the UK government heavily increased its support for agricultural innovation through the £90 million Transforming Food Production Challenge, channeling more than £22.4 million into smart farming initiatives through the Farming Innovation Programme. DEFRA and UK Research & Innovation have partnered to boost agricultural innovation with funds dedicated to businesses that improve environmental sustainability. Government efforts cover technology adoption grants, research grant funding to agricultural institutions, and digital skills development training programs.

Germany is emphasizing digital farm development through a concerted national policy that involves experimental research support alongside commercial technology implementation. Agri-research institutes collaborate closely with technology producers to develop sophisticated sensor networks, robot-based systems, and artificial intelligence-driven farm management platforms. Between 2019 and 2023, the German Federal Ministry of Food and Agriculture (BMEL) initiated the Digital Experimental Fields project to facilitate digitization within German agriculture through 14 research projects. Germany promotes farm digitalization through various R&D funding initiatives, offering a maximum of 70% of the costs. The BMEL's Investment and Future Program in Agriculture has a budget of EUR 816 million. The federal government's Energy Efficiency Program invites agribusiness firms that invest in farm digitalization and AI applications, satisfying energy-efficiency criteria.

APAC Market Insights

Asia Pacific digital agriculture market is projected to achieve a CAGR of 10% during the forecast period, fueled by fast technology uptake and government initiatives in emerging economies. Governments in the region are introducing comprehensive digital agriculture policies, while innovation in the private sector further propels technology development and adoption in various farming systems. Improved rural connectivity and digital infrastructure upgrades further facilitate greater access to precision agriculture technology and data-driven farming solutions.

China's growth in digital agriculture market is driven by multidimensional government programs that facilitate AI integration, big data analysis, and the deployment of precision farming technology. Technology standardization is fostered by national programs while promoting innovation through the private sector and international cooperation in the development of agricultural technology. In October 2024, China's Ministry of Agriculture and Rural Affairs released the Smart Agriculture Action Plan 2024-2028, which elaborates on the previous Rural and Agricultural Digitalization Development Plan 2019-2025 to drive strategic smart agriculture actions forward. Three key objectives are outlined in the action plan, which are strengthening public service capabilities, expanding applications in critical fields, and achieving tangible results through leadership examples.

India's digitalization of agriculture is gaining speed through the government-approved Digital Agriculture Mission, which is backed by considerable financial resources and an all-encompassing plan of action. The scheme equips millions of farmers with data-driven advisory services, decision-making support driven by AI, and remote sensing across agricultural activities. In December 2023, Mitsubishi Electric India commissioned a new Rs. 2,200 million manufacturing facility for advanced factory automation systems in the Talegaon Industrial area of Maharashtra. The 40,000 sq.m manufacturing facility supports Mitsubishi Electric's strategy to bolster its Indian business and cater to increased global demand for automation solutions. The factory automation systems cater to various industries, including automotive, food & beverages, pharmaceuticals, and agricultural mechanization, in India.

Key Digital Agriculture Market Players:

- Deere & Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CNH Industrial N.V.

- Syngenta Group

- AGCO Corporation

- Bayer AG

- Trimble Inc.

- Climate Corporation

- Microsoft Corporation

- IBM Corporation

- Samsung SDS Co., Ltd.

The digital agriculture market faces fierce competition among established technology providers, including Deere & Company, CNH Industrial N.V., Syngenta Group, AGCO Corporation, and Bayer AG. These players utilize extensive research and development capabilities to offer comprehensive agricultural solutions that integrate hardware, software, and advisory services. Advanced data analytics and cloud computing platforms are provided by technology giants such as Microsoft Corporation, IBM Corporation, and Samsung SDS Co., Ltd. Asian players such as Kubota Corporation, Yanmar Co., Ltd., and Mitsubishi Electric Corporation offer precision equipment and automation technologies. Competition fuels non-stop innovation in AI, IoT, and robotics solutions for greater agricultural productivity and sustainability.

Strategic alliances and technology integration projects continue to reshape competitive dynamics as firms seek to expand their market presence and capabilities. Market leaders drive collaborative innovation while new players target niche applications and innovative agricultural technologies. In August 2024, Microsoft showcased how AI technologies such as Copilot are driving more intelligent farming with Azure Data Manager for Agriculture and generative AI capabilities. Companies are collaborating with partners, such as ITC, to extend their services in agriculture, delivering AI-driven tools for data-driven agricultural decision-making.

Here are some leading companies in the digital agriculture market:

Recent Developments

- In March 2025, Trimble and PTx Trimble announced today the availability of Trimble IonoGuard for the precision agriculture industry. IonoGuard is a next-generation technology engineered to enhance RTK GNSS signal tracking and hardware positioning performance.

- In October 2024, Deere & Company announced partnerships with Sweden-based DeLaval on the Milk Sustainability Center and Norway-based Yara for fertilizer data integration with John Deere's Operations Center. The Milk Sustainability Center is a cloud-based dairy application allowing farmers to monitor nutrient use efficiency of nitrogen, phosphorus, potassium and carbon dioxide equivalents for entire farms, fields, or herds.

- Report ID: 3786

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Agriculture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.