Antimicrobial Barrier Silver Dressing Market Outlook:

Antimicrobial Barrier Silver Dressing Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 2.5 billion by the end of 2035, rising at a CAGR of approximately 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of antimicrobial barrier silver dressing is evaluated at USD 1.6 billion.

The antimicrobial barrier silver dressing market is poised for extensive growth, highly supported by increasing awareness of infection control and wound care management in healthcare settings. Also, the rising prevalence of chronic wounds and surgical procedures further contributes to the demand in this field. Testifying to this, the NLM in December 2023 reported that chronic wounds affect around 10.5 million Medicare beneficiaries in the U.S., which remarkably increased by 2.3 million over the last decade. The report also stated that the condition impacts nearly 2.5% of the total U.S. population, hence denoting a positive market outlook.

Furthermore, the International Journal of Nursing Studies Advances in June 2025 observed that in a span of three years, chronic wound management in primary care in southern Barcelona reported a total expenditure of around €35 million (USD 39.5 million). Besides the treatment materials, which accounted for about €8.46 million (USD 9.56 million), increasing by 18.5% over the period, consultation costs totaled around €26.5 million (USD 29.9 million). Therefore, these findings underscore the growing economic burden of chronic wounds on healthcare systems.

Key Antimicrobial Barrier Silver Dressing Market Insights Summary:

Regional Highlights:

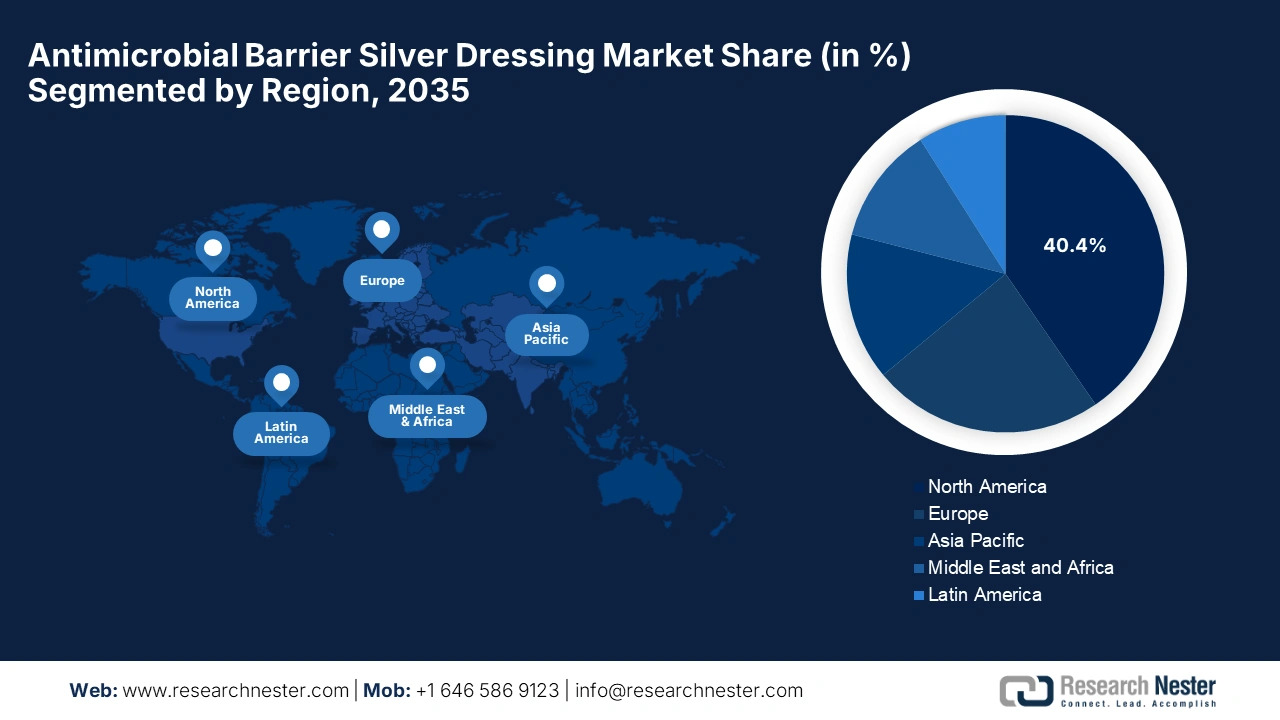

- North America is projected to secure the largest 40.4% revenue share by 2035 in the Antimicrobial Barrier Silver Dressing Market, attributed to mature healthcare infrastructure, significant medical technology investments, and a strong focus on infection control in wound management.

- Europe is expected to maintain its position as the second-largest regional contributor by 2035, supported by robust healthcare systems, an aging population, and the increasing prevalence of chronic wounds.

Segment Insights:

- The hospitals & clinics segment is expected to command a 52.5% share by 2035 in the Antimicrobial Barrier Silver Dressing Market, propelled by the increasing prevalence of complex surgical procedures and hospital-acquired pressure injuries.

- The chronic wounds segment is anticipated to hold a 45.4% share by 2035, fueled by the growing incidence of diabetic foot ulcers requiring advanced antimicrobial dressings.

Key Growth Trends:

- Technological advancements

- Increasing instances of hospital-acquired infections

Major Challenges:

- Rising concern over silver resistance

- Environmental & safety concerns

Key Players: Smith & Nephew plc, Mölnlycke Health Care AB, ConvaTec Group PLC, 3M Company, Coloplast Corp., Cardinal Health, Medline Industries, LP, PAUL HARTMANN AG, BSN medical GmbH, Johnson & Johnson, Hollister Incorporated, DermaRite Industries, LLC, Laboratoires Urgo, MIMEDX Group, Inc., Integra LifeSciences, MiMedx Group, Inc., Lohmann & Rauscher, Advancis Medical, Sumitomo Pharma Co., Ltd., Covalon Technologies Ltd.

Global Antimicrobial Barrier Silver Dressing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 6 October, 2025

Antimicrobial Barrier Silver Dressing Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements: Innovations in terms of wound care technologies are the primary driving factor for the market. Researchers at the National Graphene Institute in July 2025 reported that they have developed a graphene oxide-based membrane that enables slow, controlled release of silver ions, thereby offering long-lasting antibacterial protection. Also, this nanoscale membrane acts as a precise filter, thereby improving safety and efficacy, especially in wound care and medical implants, and is hence suitable for standard market growth.

- Increasing instances of hospital-acquired infections: The rise in these infections during surgical procedures is providing an encouraging opportunity for the pioneers in this field since there is an increased need for advanced wound care products that can prevent infections. The data from the CDC in November 2024 revealed that one in 31 hospital patients is affected with at least one healthcare-associated infection on a given day. It also stated that between 2022 and 2023, the infection types, such as surgical site infections after abdominal hysterectomy, increased, denoting the huge necessity.

- Favorable reimbursement policies: The presence of supportive reimbursement policies for wound care products creates an optimistic opportunity for healthcare providers to adopt advanced treatments, thereby driving business in this sector. As of the July 2025 report from the government of Australia, the chronic wound consumables scheme supports people with diabetes and chronic wounds by enabling complete coverage to wound care products such as bandages and dressings, delivered directly to eligible patients’ homes.

Country-wise Surgical Procedure Rates per 100,000 Population

|

Country/Region |

2022 |

|

Bhutan |

2,909 |

|

Estonia |

14,832 |

|

Finland |

15,870 |

|

Germany |

19,124 |

|

Mauritius |

4,051 |

|

Sweden |

14,380 |

Challenges

- Rising concern over silver resistance: This concern has skewed growth in the antimicrobial barrier silver dressing market since there has been a growing concern about the potential development of microbial resistance to silver-based dressings. Also, the overuse or improper utilization of silver dressings can contribute to bacteria adapting, which can reduce the long-term efficacy of these products. Therefore, this challenge encourages manufacturers and healthcare providers to use silver dressings judiciously.

- Environmental & safety concerns: The disposal procedure of silver-containing medical waste raises significant environmental concerns owing to the toxicity to aquatic life and accumulation in ecosystems. On the other hand, the safety issues associated with silver exposure can affect patient acceptance in this field. Hence, these environmental and safety considerations prompt stricter guidelines, posing a challenge to the antimicrobial barrier silver dressing market upliftment.

Antimicrobial Barrier Silver Dressing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Antimicrobial Barrier Silver Dressing Market Segmentation:

End user Segment Analysis

Based on end user hospitals & clinics segment, it is predicted to garner the largest revenue share of 52.5% in the antimicrobial barrier silver dressing market during the forecast timeline. The high volume of complex surgical procedures and inpatient-acquired pressure injuries are the key factors behind this dominance. Also, numerous prominent organizations have emphasized the clinical and economic burden of hospital-acquired conditions, thereby creating a strong institutional demand for proven barrier dressings, hence denoting a wider market scope.

Application Segment Analysis

In terms of application, the chronic wounds segment is projected to attain a share of 45.4% in the antimicrobial barrier silver dressing market by the end of 2035. The growth in the segment is highly subject to the rise in diabetic foot ulcers, which have a high risk of infection & necessitate advanced antimicrobial dressings. As per the December 2022 NIH article, diabetic foot ulcers affect 19% to 34% of the estimated 537 million people living with diabetes across all nations. Besides, these ulcers carry a high risk of morbidity, wherein nearly 20% of individuals with DFUs require lower-extremity amputations.

Product Type Segment Analysis

Based on product type, the silver alginate dressings segment is likely to capture a significant share of 28.5% in the antimicrobial barrier silver dressing market during the analyzed timeframe. Their superior efficacy in highly exudating wounds, which is a common characteristic of dominant chronic wounds, positions the subtype as the gold standard to generate revenue in this field. A meta-analysis by NIH in December 2023 found that silver alginate dressings significantly improve early wound healing and reduce scar formation compared to standard gauze in triple-negative breast cancer patients after mastectomy, thereby encouraging wider adoption.

Our in-depth analysis of the antimicrobial barrier silver dressing market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antimicrobial Barrier Silver Dressing Market - Regional Analysis

North America Market Insights

North America in the antimicrobial barrier silver dressing market is expected to capture the largest revenue share of 40.4% by the end of 2035. The region’s upliftment in this field is effectively subject to the mature healthcare systems, high investment in medical technologies, and a growing emphasis on infection control in wound care. In July 2025, Plasmacure reported that it had secured over USD 10 million in U.S. market financing to expand its cold plasma therapy, PLASOMA, for complex wound care, which is backed by a strategic consortium led by Venture Medical.

The U.S. is the influential landscape of the regional antimicrobial barrier silver dressing market, which has extremely benefited from the rising instances of chronic conditions such as diabetes and obesity, the prevalence of surgical and traumatic wounds, and stringent infection control mandates in hospitals. For instance, in June 2022, Bravida Medical, a leader in silver-based antimicrobial wound care, announced the acquisition of Anacapa Technologies’ wound cleansers, gels, and irrigation products to strengthen its product portfolio, including Silverlon silver-plated dressings and TheraBond 3D products for wound, surgical site, and burn care.

Canada in the antimicrobial barrier silver dressing market is remarkably growing on account of provincial health care systems, which are gradually integrating advanced wound care into formularies with considerable funding grants. In this regard, the Ontario government in January 2025 announced a USD 9 million investment to improve skin and wound care in long-term care homes. Also, the funding supports both training and diagnostic equipment as part of the Your Health plan to reduce unnecessary emergency room visits and hospitalizations, thereby positively impacting market progression.

Chronic Wound and Pressure Ulcer Burden: Key U.S. Statistics 2022

|

Category |

Statistic / Information |

|

Chronic Wounds |

10.5 million U.S. Medicare beneficiaries affected (up 2.3 million from 2014) |

|

Population Affected |

~2.5% of the total U.S. population (higher in the elderly) |

|

Pressure Ulcer (PU) Annual U.S. Cost |

>USD 26.8 billion (hospital-acquired cases) |

|

PU Individual Care Cost |

USD 20,900 - USD 151,700 per patient; +USD 43,180/year in non-medical expenses |

Source: NIH

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the antimicrobial barrier silver dressing market during the forecast period. This high pace of progress in the region is productively led by rising surgical interventions and a growing geriatric population that is more vulnerable to infections. Also, governments and healthcare systems across the region are placing greater emphasis on infection prevention, advanced wound care, and upgrading hospital infrastructure, which are fueling adoption in this field.

China remains the key contributor to growth in the antimicrobial barrier silver dressing market in the upcoming years, owing to the expanding healthcare investments, including improvements in hospital capacity and access. In December 2022, the U.S. FDA notified that Winner Medical Co., Ltd.'s extra silver gelling fiber dressing received FDA 510(k) clearance (K221720), thereby confirming it is substantially equivalent to a legally marketed predicate device. Hence, this reflects the presence of a huge manufacturing base and a strong capital influx, benefiting this sector.

India in the antimicrobial barrier silver dressing market is continuously evolving since there is greater support from the private & government sectors to make advanced wound care more affordable and accessible. Researchers at BITS Pilani Hyderabad in July 2025 have developed a smart bandage that kills infection-causing bacteria utilizing silver-coated fibers and visually signals infection through a color-changing gel layer, all without traditional antibiotics. Besides, the bandage detects bacterial enzymes that are released during infection, giving a clear, visible signal to caregivers or the patient.

Europe Market Insights

Europe is likely to retain its position as the second-largest stakeholder in the antimicrobial barrier silver dressing market by the end of 2035. The region’s progress in this field is effectively propelled by strong healthcare infrastructures, aging populations, and a higher incidence of chronic wounds. In December 2024, Nanordica Medical reported that it had launched a major clinical trial to evaluate its advanced antibacterial wound dressing for diabetic foot ulcers involving 170 patients across five clinical centers, denoting the presence of a strong research ecosystem in this field.

Germany is maintaining a strong position in the antimicrobial barrier silver dressing market owing to a strong focus on quality, safety, and innovation. Besides, most of the country’s healthcare facilities are increasingly preferring dressings that deliver enhanced antimicrobial performance and align with strict regulatory and reimbursement criteria. Also, there has been a shift towards silver dressing products that offer more advanced features such as sustainable materials, better patient comfort, and carefully controlled silver release.

The U.K. represents one of the most prominent landscapes for the antimicrobial barrier silver dressing market in Europe, which is extremely benefited from the NHS’s procurement policies, national guidelines, and evidence-based support for reducing complications. In May 2024, Convatec announced its clinical results from a multinational randomized controlled trial demonstrating the effectiveness of its AQUACEL Ag+ Extra dressing in treating venous leg ulcers, which showcased significantly better healing outcomes compared to standard dressings.

Key Antimicrobial Barrier Silver Dressing Market Players:

- Smith & Nephew plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- 3M Company

- Coloplast Corp.

- Cardinal Health

- Medline Industries, LP

- PAUL HARTMANN AG

- BSN medical GmbH

- Johnson & Johnson

- Hollister Incorporated

- DermaRite Industries, LLC

- Laboratoires Urgo

- MIMEDX Group, Inc.

- Integra LifeSciences

- MiMedx Group, Inc.

- Lohmann & Rauscher

- Advancis Medical

- Sumitomo Pharma Co., Ltd.

- Covalon Technologies Ltd.

The global antimicrobial barrier silver dressing market is extremely consolidated, wherein the top five players have captured nearly half of the revenue share. Also, the established medical device firms are leveraging extensive R&D capabilities and global distribution networks to maintain dominance. On the other hand, the continued product innovations to enhance patient outcomes are a few strategies implemented by the pioneers to elevate the market potential. Furthermore, the players are also progressively pursuing mergers & acquisitions to expand their footprint on the global market.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In November 2024, Imbed Biosciences reported that it received FDA 510(k) clearance for its Microlyte Ag/Lidocaine, which is the first antimicrobial wound dressing that combines silver with integrated lidocaine to manage painful wounds.

- In May 2024, Nanordica Medical reported that it raised €1.75 million (approximately USD 1.8 million) to launch its advanced antibacterial wound dressing that combines copper and silver nanoparticles, significantly enhancing antibacterial efficacy while promoting faster wound healing.

- Report ID: 7723

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antimicrobial Barrier Silver Dressing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.