Anomaly Detection Market Outlook:

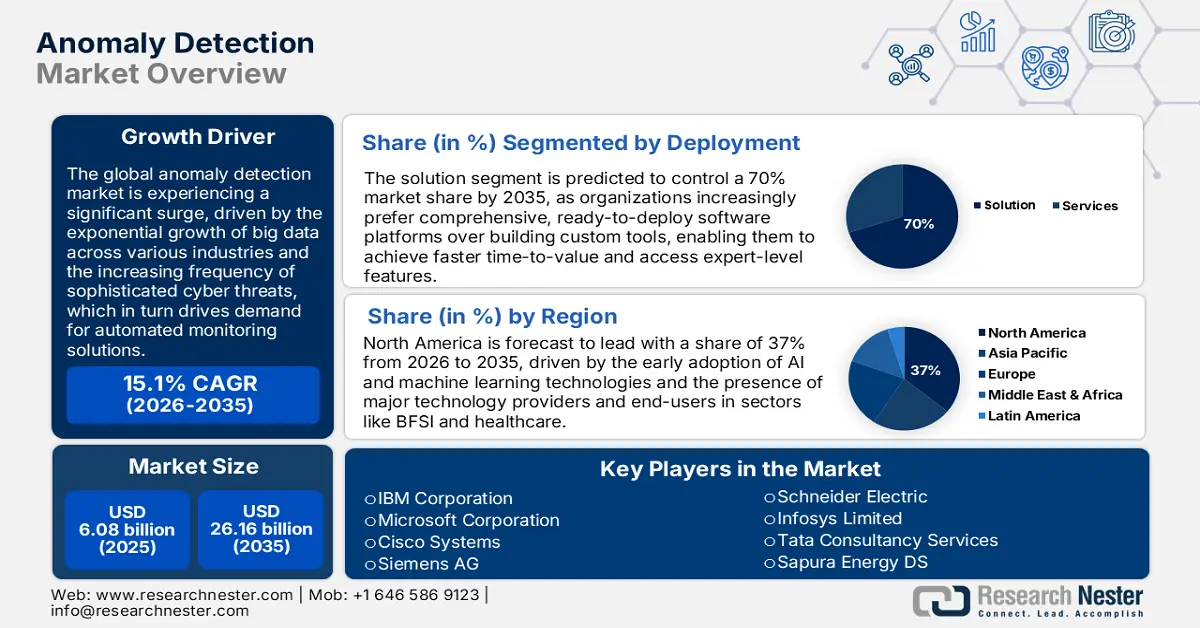

Anomaly Detection Market size was valued at approximately USD 6.08 billion in 2025 and is projected to reach around USD 26.16 billion by the end of 2035, rising at a CAGR of approximately 15.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of anomaly detection is assessed at USD 7.02 billion.

The research and development activities are playing a crucial role in forming the pathway for the anomaly detection market. A plethora of vendors are willing to invest in modern algorithms and deep learning to enhance learning models that can detect unprecedented anomalies without needing humongous volumes of data. Companies are directing investment toward amalgamating anomaly detection with AI, ML, and big data platforms to identify any cases of fraud detection and healthcare diagnostics. Also, the advancements in research and development are projected to eradicate the chances of false positives and expand the adoption of mission-critical applications.

The anomaly detection supply chain spans multiple industries, handling digital and tangible assets. Hardware for sensors and servers is acquired from specialist electronics manufacturers, with primary assembly stages in the U.S., China, and various parts of the EU. U.S. federal procurement is indicative of ongoing importation of advanced chips and sensors for public sector anomaly detection, with significant investments going into AI-driven supply chain monitoring software. Assembly line integration usually incorporates automated, AI-enabled quality assurance to confirm real-time performance, particularly in manufacturing and logistics industries where end-to-end visibility and product traceability are critical.

Key Anomaly Detection Market Insights Summary:

Regional Highlights:

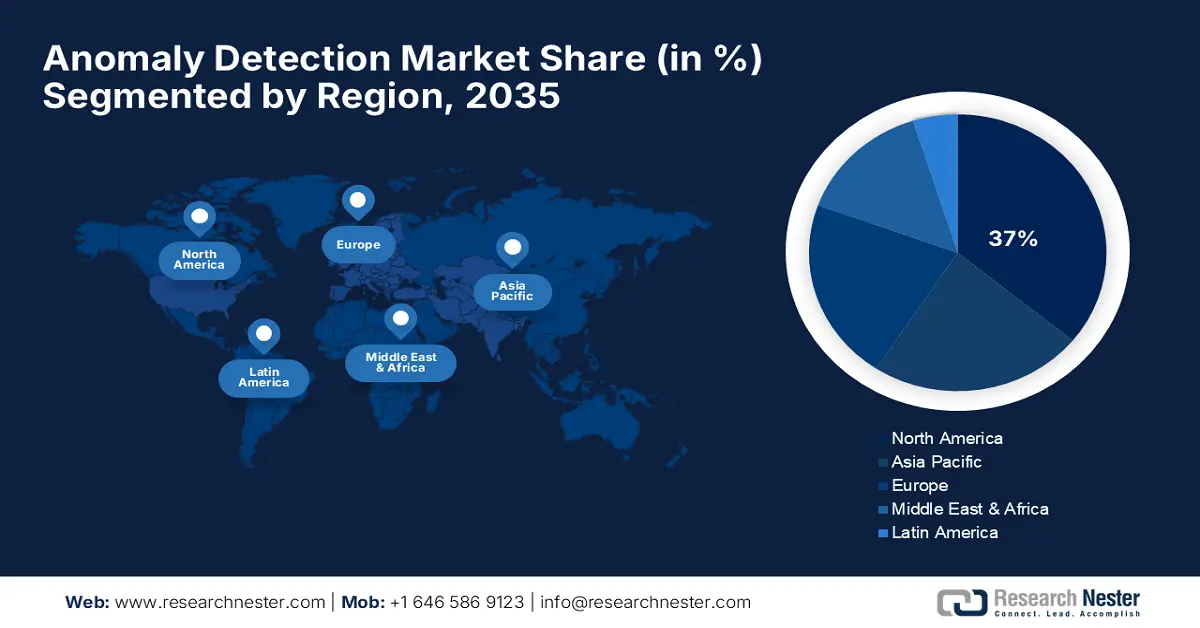

- North America is projected to command nearly 37% share of the anomaly detection market by 2035, underpinned by advanced IT infrastructure, strong cybersecurity focus, and extensive R&D investment.

- Europe is expected to witness notable expansion through 2026-2035, sustained by rising cyberattack sophistication and stringent data protection regulations.

Segment Insights:

- The cloud segment in the anomaly detection market is anticipated to hold a strong 69% share during 2026-2035, fueled by the scalability, flexibility, and cost-efficiency of cloud-based offerings.

- The solution segment is projected to capture a 70% share by 2035, propelled by rising demand for comprehensive anomaly detection platforms integrating advanced analytics and real-time alerting.

Key Growth Trends:

- Rising demand for predictive maintenance in production

- Proliferation of the IoT and edge devices

Major Challenges:

- Handling false positives and alert fatigue

- Integration with new and current IT/OT systems

Key Players: IBM Corporation, Microsoft Corporation, Cisco Systems, Siemens AG, Schneider Electric, Infosys Limited, Tata Consultancy Services, Sapura Energy, Telstra Corporation, Bosch Group.

Global Anomaly Detection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.08 billion

- 2026 Market Size: USD 7.02 billion

- Projected Market Size: USD 26.16 billion by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 7 October, 2025

Anomaly Detection Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for predictive maintenance in production: One of the most important growth drivers is the application of anomaly detection for predictive maintenance across industries, where it avoids costly equipment failure and downtime. In May 2025, Siemens AG introduced new versions of AI Anomaly Assistant, which deliver near real-time industrial anomaly alerts in process manufacturing. The company claims that the AI agent for industrial automation endeavors to raise productivity by 50% for the industries. By using such AI tools to vigil the operating data, industries can optimize maintenance schedules and improve overall asset performance.

- Proliferation of the IoT and edge devices: The swift deployment of the Internet of Things sensors across various industries, such as healthcare, manufacturing, etc, that produce a humongous volume of telemetry that needs near-real-time anomaly analysis. According to data published by the European Commission in 2021, 26% of the small enterprises and 48% of the large enterprises used IoT. These trends are driving the demand for impeccable anomaly detection models that are deployable at the edge architectures. Industrial use cases mainly favor anomaly detection methods to lower the unplanned downtime and optimize maintenance schedules.

- Enhancing threat detection and security: As the complexity of cyber threats continues to mushroom, organizations are investing significantly in adopting sophisticated anomaly detection technology to defend their mission-critical assets. The surge in frequency of advanced persistent threats is compelling companies to inculcate anomaly detection systems that can give real-time monitoring and prior warning capabilities. Also, in past years, there has been a rapid adoption of cloud technology, IoT ecosystem, and remote work environments that have widened the surface for attack and made companies more susceptible. Cumulatively, these factors are driving the demand for anomaly detection tools that can identify unusual patterns across diverse and distributed networks.

Top Organizational Cyber Risk Concerns in 2025

|

Organizational Cyber Risk Concern |

Percentage (%) |

|

Ransomware attack |

45% |

|

Cyber-enabled fraud (including phishing, business email compromise, vishing, etc.) |

20% |

|

Supply chain disruption |

17% |

|

Malicious insider |

7% |

|

Disinformation |

6% |

|

Denial of service (DoS) and distributed denial of service (DDoS) attacks |

6% |

Source: WEF

Challenges

- Handling false positives and alert fatigue: A significant barrier to anomaly detection in the market is the high rate of false positives from some systems, which may lead to alert fatigue and desensitize security and operations teams. This puts a spotlight on the need for more sophisticated, context-aware algorithms that can correctly distinguish between actual anomalies and expected deviations, a major area of research and development.

- Integration with new and current IT/OT systems: Another significant challenge is the difficulty in integrating modern anomaly detection solutions into existing IT and operational technology (OT) infrastructures, which are complex and not easily integrated. Industrial protocols and data formats are often heterogeneous and proprietary, which can make the implementation of a unified monitoring strategy difficult. While solutions are emerging to address this, they are costly and time-consuming, requiring significant customization and know-how, which can reduce adoption speed, particularly in sectors with deep legacy infrastructures.

Anomaly Detection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 6.08 billion |

|

Forecast Year Market Size (2035) |

USD 26.16 billion |

|

Regional Scope |

|

Anomaly Detection Market Segmentation:

Deployment Segment Analysis

The cloud segment is anticipated to command a strong 69% market share during the forecast period. The growth can be driven by cloud offerings' scalability, flexibility, and low cost. As data volumes balloon exponentially, organizations are turning to the cloud for hosting the computational burdens of sophisticated anomaly detection algorithms at a cost that does not necessitate the outlay on large on-premises infrastructure. The shift towards cloud deployment is also driven by increasing uptake of SaaS-based models, which offer a convenient avenue by which organizations can leverage sophisticated anomaly detection capabilities.

Component Segment Analysis

The solution segment is predicted to garner a 70% market share by 2035. The growth of the segment can be attributed to the robust demand for end-to-end anomaly detection platforms. Organizations are including solutions that have advanced analytics and real-time alerting all within a unified system. These types of platforms enable data analysts to analyze events across segments and garner actionable insights for any probable threat or inefficiencies in operations. The growth of the segment is further propelled by significant innovations to enhance specialized modules.

Technology Segment Analysis

The ML & AI segment is likely to maintain a market share of 63% through 2035, as these technologies are the key drivers of next-generation anomaly detection solutions. Machine learning and artificial intelligence-powered algorithms can automatically learn from sets of data, identify subtle anomalies that rule-based systems would overlook, and learn to adapt to changing situations over time. Such capability is required to counter the changing and complex nature of data environments today. The dominance of the ML & AI segment is also because it can reduce false positives and improve the accuracy of threat detection to a tremendous extent.

Our in-depth analysis of the anomaly detection market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Component |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anomaly Detection Market - Regional Analysis

North America Market Insights

North America is anticipated to hold around 37% market share during the forecast period. The leadership is driven by the advanced IT infrastructure of the region, the early adoption of advanced technologies like AI and machine learning, and the high density of big market players. The high priority being given to cybersecurity, particularly in large industries like finance, healthcare, and government, is a major growth driver for the market. The strong regulatory environment of the region and high R&D spending rates further make it an innovation hub.

The market in the U.S. is witnessing staggering growth on the back of increasing cybersecurity threats and the growth of the cloud and hybrid environments. Also, there are stricter regulations, such as HIPAA and SOX, that push companies to adequately detect unusual activities, further boosting the demand for anomaly detection solutions. According to data published by Privacy Rights Clearinghouse as of October 2025, the U.S. has witnessed more than 36,594 unique breach events, affecting more than 9.38 billion individuals. Other than this, advanced anomaly detection solutions are using AI and ML algorithms to track the patterns and potential breaches.

In Canada, the market growth is driven by the expansion of smart cities and advancements in AI and ML. Additionally, the increase in hybrid work models has widened the surface of attack, resulting in the organization actively deploying solutions to monitor queer user access patterns and eradicate breaches. Also, digital banking is thriving in the country, and institutions are adopting anomaly detection to find out fraudulent transactions and lower the financial losses. According to data published by the Government of Canada in 2022, 82% of the internet users in the country used online banking, which instills the need for impeccable solutions for fraud management.

Europe Market Insights

In Europe, the market is flourishing significantly on the back of the escalating sophistication of cyberattacks and the widespread expansion of the industrial IoT and various other operational technologies. According to data published by B2B Cyber Security in 2024, the top 15 nations in Europe witnessed a total of more than 130,000 data breaches. Also, there are stringent data protection regulations, such General Data Protection Regulation are being implemented in the region, compelling companies to opt for adequate solutions.

In the UK, the market growth is driven by the rising government support and strategies for combating data breaches. The country is strongly promoting the use of anomaly detection technology in the public and private sectors for greater efficiency and security. In May 2024, the UK National Data Strategy encouraged the use of solutions such as anomaly detection models in public sector audits to detect fraudulent procurement and errors before manual review. This government initiative is part of a broader movement toward using data analytics and AI to enhance governance and prevent financial loss, presenting a significant market opportunity for specialty anomaly detection solutions.

The market in Germany is quickly growing, with rising demand from companies to find out about unusual activities in the system. Stringent regulations and new, strict cybersecurity laws are compelling businesses to invest in such efficient tools to protect their data. Other than this, data published by the Association of Internet Industries in January 2024, 49.1% of households utilize more than 4 IoT devices. The significant usage of IoT devices in the country is instilling the need to adopt effective measures.

APAC Market Insights

The Asia Pacific market is driven by numerous interconnected growth factors, including a significant uptick in cloud computing and IoT deployment. Governments in the region are strengthening regulations for the protection of data and securing the crucial infrastructure. here is also a growing incidence of cyber threats—ransomware, fraud, insider threats—that demand real-time detection, behavior analytics, and automated alerting. The market in China is poised for significant growth, propelled by the rapid digital transformation. The rising sophisticated cyber-attacks are not only targeting government bodies, but also attacking the telecom and banking sectors. In June 2021, Harbour Plaza informed about a humongous data leakage of more than 1.2 million clients. These kinds of incidents are projected to push the market forward and achieve robust, significant growth in the forecasted period.

In India, the government is strengthening data protection laws and implementing initiatives to eradicate cases of data breaches. Also, the market growth is propelled by numerous organizations that are preferring the unified platforms that have threat intelligence as well as bundled anomaly detection tools. Prominent sectors such as transportation and energy are significantly adopting strategies to prevent failures of the equipment and lower the downtime. According to data published by the Internet Freedom Foundation, government allocation for the Cyber Security Projects witnessed more than a 143% hike and reached 7.82 billion, which further supports the market to thrive.

Key Anomaly Detection Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Cisco Systems

- Siemens AG

- Schneider Electric

- Infosys Limited

- Tata Consultancy Services

- Sapura Energy

- Telstra Corporation

- Bosch Group

The anomaly detection market is rapidly shifting and is highly competitive, with a wide range of global technology leaders, industry-specific software companies, and large IT service companies aggressively vying for market share. Key players include IBM Corporation, Microsoft Corporation, Cisco Systems, Siemens AG, Schneider Electric, Infosys Limited, Tata Consultancy Services, Sapura Energy, Telstra Corporation, and Bosch Group. Companies are competing on a daily basis through innovation in machine learning and AI, through collaborations, and through the development of bespoke solutions for specific industries and applications.

One of the most significant shifts in the competitive landscape is a greater emphasis on industry-specific application scenarios and concrete business results. For example, in August 2024, Sapura Energy started employing deep-learning anomaly detection to monitor subsea oil platforms, a step that lowered the risk of major equipment failure and helped lower equipment-related downtimes by 15%. This practical use of cutting-edge AI to address core industrial challenges is a prime example of how top companies are distinguishing themselves by providing quantifiable value and showcasing a deep understanding of their customers' operational requirements.

Here are some leading companies in the anomaly detection market:

Recent Developments

- In July 2025, IBM introduced Power11, the next generation of IBM Power servers. Redesigned with innovations across its processor, hardware architecture, and virtualization software stack, Power11 is designed to deliver the availability, resiliency, performance, and scalability enterprises demand, for seamless hybrid deployment on-premises or in IBM Cloud.

- In September 2025, Cisco launched Webex AI Agent and Cisco AI Assistant. These tools enhance customer service by scaling human agent capacity, providing improved, faster, and more personalized service.

- Report ID: 8169

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anomaly Detection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.