Anodized Titanium Market Outlook:

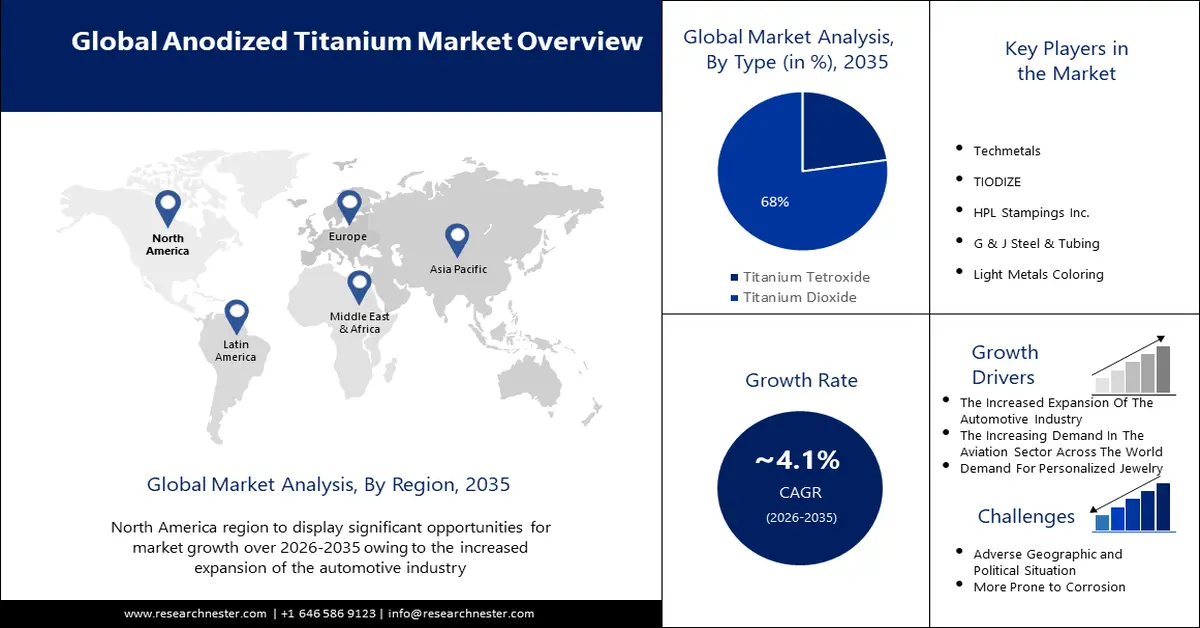

Anodized Titanium Market size was over USD 15.49 billion in 2025 and is poised to exceed USD 23.15 billion by 2035, witnessing over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anodized titanium is estimated at USD 16.06 billion.

The increased expansion of the automotive industry will propel the primary reason behind the growth of the market. As the macroeconomic prospect degenerates for the automotive industry, a modest return to expansion is anticipated for the latest clients and commercial vehicle sales in the next two years. It is projected that international vehicle sales will expand by 5.1% in 2023 and 3.6% in 2024. Moreover, automakers can project sales to come back to the 90 million+ high water mark in 2025.

Another reason that will propel the anodized titanium market by the end of 2036 is the increasing demand in the aviation sector across the world. Titanium prevails extravagantly in nature in several ores as a conversion metal. It gets the designation Ti on the Periodic Table and manages 22 protons in its nucleus. In its purified type, titanium types a silvery-white metal attributed to high power, low density, and grand corrosion impedance. It manages a much higher dissolving point than iron or steel, and concurrently, because of the complication of smelting it, titanium did not acquire a reputation before the 20th century. The implementation of titanium has gained more traction in different industries around the world, all thanks to its wonderful corrosion resistance and comparatively high strength-to-depth ratio. Having been adopted by aerospace industries for the growth of aircraft, titanium can still be exposed to corrosion under specific situations.

Key Anodized Titanium Market Market Insights Summary:

Regional Highlights:

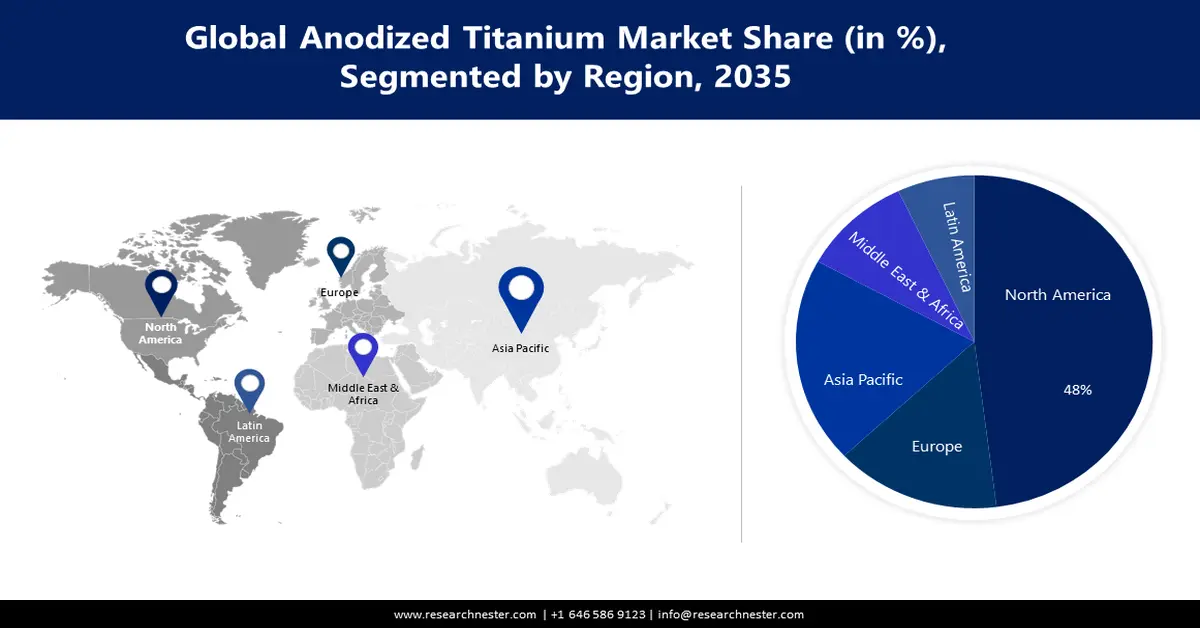

- North America anodized titanium market leads with a 48% share, driven by increasing development in aviation supported by U.S. government air mail contracts, forecast period 2026–2035.

- Europe market will hold the second largest share, fueled by the growing medical industry and rising investment in medical technology, forecast period 2026–2035.

Segment Insights:

- The titanium dioxide segment in the anodized titanium market is anticipated to hold a 68% share by 2035, driven by its extensive use in paints, cosmetics, and plastics demanding weather resilience.

- The aviation segment in the anodized titanium market is forecasted to witness lucrative growth through 2035, driven by titanium's strength-to-weight ratio and increasing aerospace industry demand.

Key Growth Trends:

- Developing End-User Demand for High-Performance and Lightweight Components

- Demand for Personalized Jewelry

Major Challenges:

- Adverse Geographic and Political Situation

- More Prone to Corrosion

Key Players: Techmetals, Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsTIODIZE, HPL Stampings Inc., G & J Steel & Tubing, Light Metals Coloring, Leatherwood Manufacturing, Aalberts Surface Technologies, AOTCO Metal Finishing, SIFCO ASC, Electrohio.

Global Anodized Titanium Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.49 billion

- 2026 Market Size: USD 16.06 billion

- Projected Market Size: USD 23.15 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Anodized Titanium Market Growth Drivers and Challenges:

Growth Drivers

- Developing End-User Demand for High-Performance and Lightweight Components - Lightweighting is the technique of making an object that weighs less without receiving its power or execution. This can be accomplished by substituting standard components with substitute lighter-weight components, like carbon-dependent composite components, that provide increased strength-to-weight ratios, or making basic design changes, like hollowing out solid areas of the object or utilizing lattice frameworks that can increase main execution indicators like pliability and influence resistance. Lightweight components typically offer performance advantages. For instance, utilizing lighter components in auto manufacturing modifies vehicle operability, speeding up, and strength. In aviation, the Boeing 787 was planned to be 20% lighter, which enhanced fuel economy by 10 percent to 12 percent. In the clientele space, sports gadgets made from carbon composites have modified strength-to-weight ratios and are lightweight and simpler to utilize, limiting tension.

- Demand for Personalized Jewelry - This makes up for the most apparent signal to track. In line with a report by Bain & Company, the international anodized titanium market for individual luxury goods, comprising jewelry, is projected to touch USD 320-330 billion by 2025. Custom-made services account for a substantial element of this expansion. Moreover, a survey by MVI Marketing noticed that 42% of millennials and 34% of Gen Z clients are interested in buying a personalized piece of jewelry. This trend is not restricted to younger clients. 28% of baby millennials also stated interest in tailor-made jewelry.

- Advancement in Anodizing Process - The growth of aluminum anodization technology characteristics many stages. With the story extending for almost a century, instead of uncomplicated-from the recent viewpoint-technology, increased into an iconic nanofabrication process. The inherent properties of alumina penetrable frameworks establish the wide utility in clear areas. Nanoporous anodic alumina can be a starting point for templates, photonic frameworks, skins, drug submission platforms or nanoparticles, and more. The recent state of the art would not be feasible without decades of sequential findings, during which, stage by stage, the process was more realized.

Challenges

- Adverse Geographic and Political Situation - Titanium is famous as one of the most corrosion-immune metals. However, it can endure corrosion attacks in some particular aggressive situations. To further raise its corrosion opposition, it is possible either to adjust its surface, tuning either density, composition, morphology, or framework of the oxide that impromptu forms on the metal, or to improve its bulk composition. Anodized titanium is corrosive and the corrosion of titanium concentrations on possible titanium treatments can raise corrosion defiance. Both surface treatments, like anodization or thermal or chemical oxidation, and bulk ailments, like alloying, are acknowledged, highlighting the benefits of every technique. To conquer this weakness, corrosion impedance–increasing treatments can be fulfilled, or exact alloying components may be added; the latter is the case with the assimilation of components that generate cathodic reactions, increasing the cathodic polarization curve above the critical active anodic curve at higher possibilities in the passive region, like with palladium.

- More Prone to Corrosion

- Lack of Knowledge in People

Anodized Titanium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 15.49 billion |

|

Forecast Year Market Size (2035) |

USD 23.15 billion |

|

Regional Scope |

|

Anodized Titanium Market Segmentation:

Type Segment Analysis

The titanium dioxide segment in the anodized titanium market will grow the most by the forecast period and will hold almost 68% because of its extensive use in industries like paint, cosmetics, and plastic followed by the white color and high opacity. The titanium dioxide for ordinary plastics usually does not experience surface treatment. Because titanium dioxide seasoned with inorganic substances like traditional hydrated alumina is utilized, when the comparative humidity is 60%, the adsorption balance water is about 1%. When the plastic is evicted at high temperatures, the dematerialization of water will cause pores on the smooth plastic to appear. With the constant growth of the application range of plastic materials, many outside plastic products, like plastic doors and windows, building components, and other outdoor plastic materials, also have high needs for weather resilience. Additionally, rutile titanium dioxide must be utilized, and surface treatment is needed. This type of surface treatment usually does not add zinc. Only silicon, aluminum, zirconium, etc. are increased. The silicon has a hydrophilic and dehumidifying impact, which can hinder pores caused by water dehydration when plastic is expelled at high temperatures.

Application Segment Analysis

The aviation segment in the anodized titanium market will have superior growth during the forecast period and will hold around 40% of the revenue share owing to the increasing use of anodized titanium in developing the body of aircraft. The components utilized in the sustainable aviation fuel industry must have an exceptional set of attributes. They are required to be powerful and lasting, even under the massive situations that airplanes and spacecraft endure. They should also be comparatively lightweight since this enhances the effectiveness of the aircraft. Due to these requirements, titanium has appeared as the leading metal utilized in the aerospace industry, as it’s both powerful and lightweight. Simply put, it has a top strength-to-weight ratio. Recently, the aerospace industry has been one of the world’s biggest buyers of titanium and titanium alloys. The aerospace sector fundamentally created the modern titanium industry.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Anodizing Type |

|

|

Titanium Type |

|

|

Titanium Product |

|

|

Application |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anodized Titanium Market Regional Analysis:

North American Market Insights

The anodized titanium market in the North America region will have the biggest growth during the forecast period with a revenue share of around 48%. This growth will be noticed owing to the increasing development in aviation. With the financial support given by air mail contracts from the U.S. government, four large aviation holding organizations soon appeared. William Boeing and Frederick Rentschler of Pratt & Whitney created the first and the biggest, United Aircraft and Transport Corporation. Clement Keys created North American Aviation and the Curtiss-Wright Corporation. Aerial photography pioneers Sherman Fairchild, Averill Harriman, and Robert Lehman developed The Aviation Corporation (AVCO). While these concentrations engaged greater effectiveness, airlines stayed ineffective without government assistance.

European Market Insights

The anodized titanium market in the Europe region will also encounter huge growth during the forecast period and will hold the second position owing to the expansion of the medical industry in this region. The medical network solutions in this region will grow in a superior way. In Europe, 7.6 percent of all healthcare expenses in 2021 were invested in medical technology. Germany has the biggest anodized titanium market share in the European medtech industry, trailed by France and the United Kingdom. Europe has always noticed a constant increase in the requirement for medical devices. That’s set to transform, as trade specialists project the ascending requirement curve to increase shortly. Homegrown medical devices may not be sufficient to catch on to the requirement. And they are already regarding signs of this. Titanium has a lot of helpful attribution, but these properties also make it demanding to work with.

Anodized Titanium Market Players:

- Techmetals

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TIODIZE

- HPL Stampings Inc.

- G & J Steel & Tubing

- Light Metals Coloring

- Leatherwood Manufacturing

- Aalberts Surface Technologies

- AOTCO Metal Finishing

- SIFCO ASC

- Electrohio

Recent Developments

Aalberts Surface Technologies, a leading international provider of technical thermal processing, surface therapy, and material coating solutions, declared that it is making transformations to its U.S. portfolio in reaction to the transforming market movement. Aalberts Surface Technologies has created investments in its Canton, OH facility, increasing austempering competencies which will give a structurally favorable choice to clients located in the Midwestern, Eastern, and Northeastern U.S. markets.

Aalberts Surface Technologies – Specialized Heat Treatment US and Aalberts Surface Technologies – Accurate Brazing declared that they have integrated into a single business unit. Specialized Heat Treatment US was created when Premier Thermal, Applied Process, and Ionic Technologies were changed to Aalberts Surface Technologies – Specialized Heat Treatment US in 2022.

- Report ID: 5742

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anodized Titanium Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.