Animal Therapeutics and Diagnostics Market Outlook:

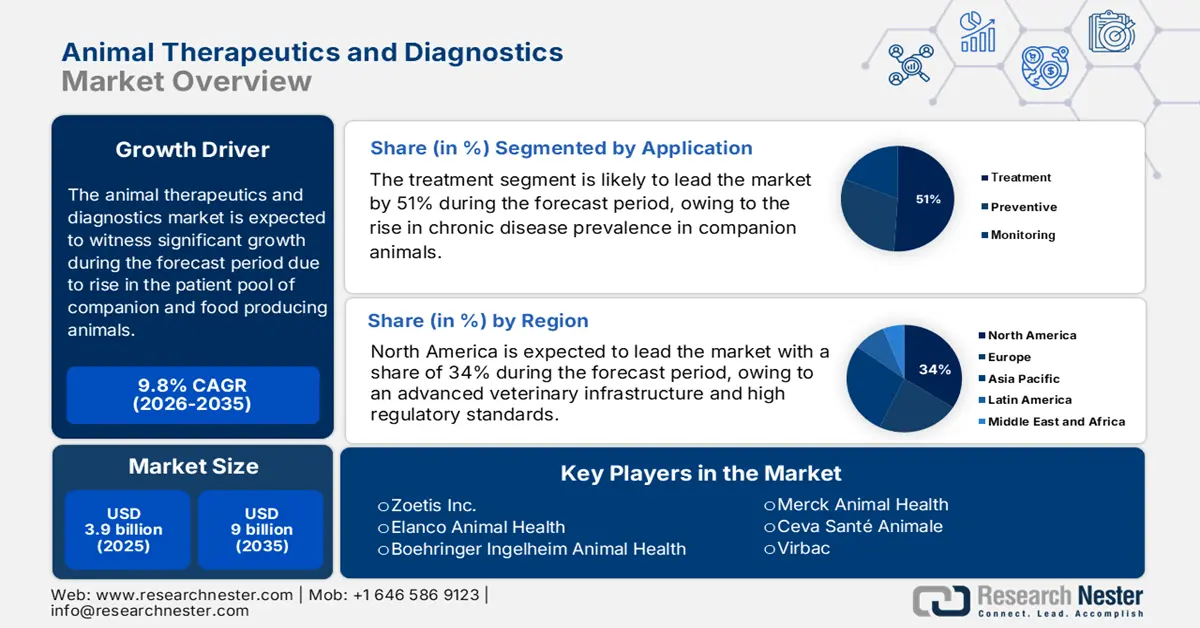

Animal Therapeutics and Diagnostics Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 9 billion by the end of 2035, rising at a CAGR of 9.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of animal therapeutics and diagnostics at USD 4.2 billion.

The global animal therapeutics and diagnostics market is emerging with the rise in the patient pool of companion and food-producing animals. Based on the USDA report in May 2025, in 2024, U.S. cattle production accounted for nearly 22% of total cash receipts for agricultural commodities worth USD 515 billion, providing a strong demand base for livestock healthcare. On the other hand, the AVMA supports that pet ownership is increasing worldwide, especially in developed nations, thus supporting a continuous demand for animal health solutions and companions. This rising pool has become a demand for pharmaceuticals, biologicals, and diagnostics. On the supply end, the value chain includes upstream API synthesis, intermediate formulation, and downstream packaging and manufacturing in the market.

The pressure on margins is mounting in the market due to inflation, raw material scarcity, and labor constraints, elevating input costs. Such pressures act on manufacturing, and cascading effects take place in logistics, regulatory compliance, or R&D. As per a report by the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) in May 2024, the agency awarded USD 22.2 million in 2024 to fund 81 new projects for improving disease preparedness, diagnostics, and response capabilities. Such a public investment indicates that diagnostics and therapeutics are both highly costly, disputed technological undertakings and national security issues concerning animal health in the market.

Key Animal Therapeutics and Diagnostics Market Insights Summary:

Regional Insights:

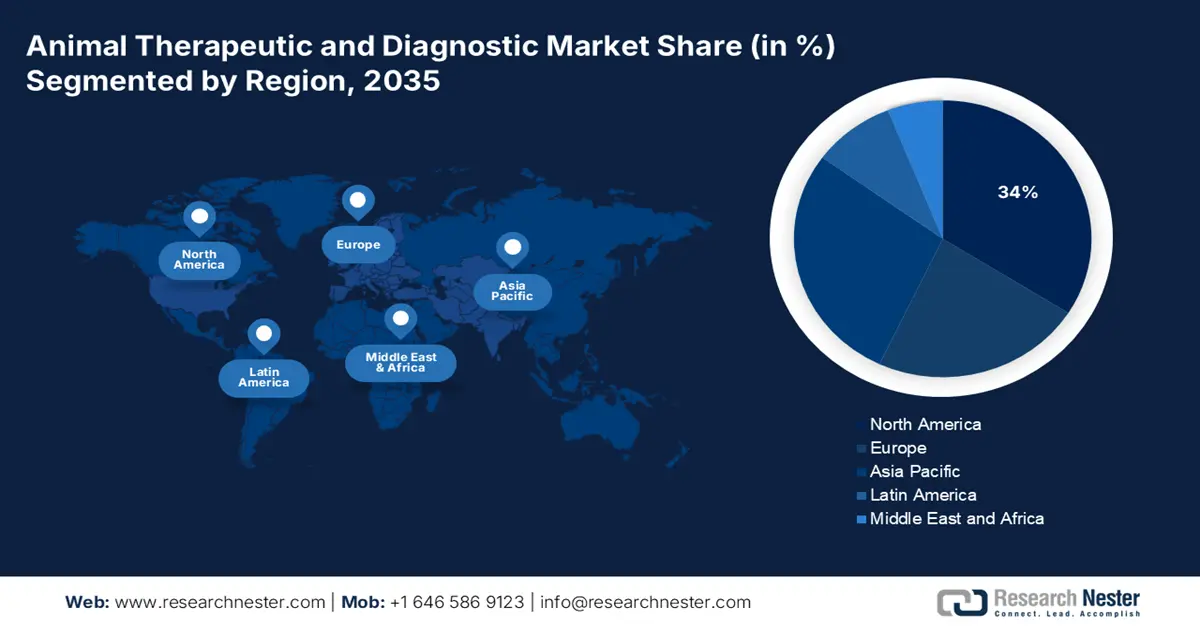

- The Animal Therapeutics and Diagnostics Market in North America is projected to secure the largest 34% share by 2035, attributed to strong companion animal ownership, advanced veterinary infrastructure, and stringent regulatory standards.

- Europe is expected to emerge as the fastest-growing region by 2035, driven by regulatory harmonization and a rapidly expanding companion animal population across EU nations.

Segment Insights:

- The treatment sub-segment within the application segment is projected to account for nearly 51% share by 2035 in the Animal Therapeutics and Diagnostics Market, propelled by the sustained need to address acute infections, parasitic infestations, and chronic diseases in animals.

- The veterinary clinics and hospitals segment is anticipated to command the largest end-user revenue share by 2035, owing to their integrated capabilities in diagnostics, treatment, surgery, and preventive care delivery.

Key Growth Trends:

- Increased government funding for animal disease preparedness and diagnostics

- Prioritization of research and tools for chronic animal diseases

Major Challenges:

- Supply chain vulnerabilities and raw material constraints

- Regulatory and market fragmentation across regions

Key Players: Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim Animal Health, Merck Animal Health, Ceva Santé Animale, Virbac, Bayer Animal Health (Now Elanco), IDEXX Laboratories, Vetoquinol, Phibro Animal Health Corporation, Neogen Corporation, Australian Animal Health Laboratory, Biogénesis Bagó, Inovet, Biomin (DSM).

Global Animal Therapeutics and Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.2 billion

- Projected Market Size: USD 9 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: China, India, Indonesia, Brazil, Mexico

Last updated on : 13 October, 2025

Animal Therapeutics and Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Increased government funding for animal disease preparedness and diagnostics: Public sector investment is the primary motive, with governments responding to threats from emerging diseases and zoonoses are helping in the growth of the market. As per a report by the USDA in May 2024, the USDA announced emergency funding of USD 824 million for livestock health protection against diagnostic support, surveillance, field response activities, and vaccine development against Highly Pathogenic Avian Influenza (H5N1) in cattle, poultry, pigs, and goats for the year 2024. This level of funding builds capacity for diagnostics and therapeutics R&D, enhances laboratory infrastructure, and facilitates the rapid deployment of countermeasures during outbreak situations in the animal therapeutics and diagnostics market.

- Prioritization of research and tools for chronic animal diseases: Diagnostic innovation is being pushed by long-term infectious or degenerative animal diseases affecting livestock or wildlife. As per a report by USDA, October 2024, the USDA APHIS provided more than USD 12 million to States, Tribal Governments, research institutions, and universities for the control and prevention of CWD in wild and farmed cervids by funding projects conducting surveillance, testing, management, and response activities, including novel diagnostic and prevention tools. Developments such as these tend to create demands for improved diagnostic assays, early detection technologies, and therapeutics designed to slow down or halt the spread of the disease in the market.

- Expansion of animal health laboratory networks & vaccine/countermeasure stockpiling: Building and upgrading networks of national labs and stockpiles of diagnostics, vaccines, and countermeasures assures readiness both for endemic and emerging threats. In FY 2025, a report in August 2024 from USDA stated that its APHIS announced up to USD 16.5 million in new funding through the National Animal Disease Preparedness and Response Program (NADPRP) to procure projects working on prevention, detection, preparedness, and response (with enhanced diagnostics and vaccine countermeasures) for foreign or emerging animal diseases in the market. Some grow from these investments by growing capacity, fostering innovation in diagnostics and vaccine development, and shortening time to response in the market.

Exporters And Importers of Pharmaceutical Animal Products in 2023

|

Exporters (2023) |

Export Value (USD) |

Importers (2023) |

Import Value (USD) |

|

U.S. |

40.6 million |

U.S. |

25.8 million |

|

Canada |

8.1 million |

Canada |

8.4 million |

|

Spain |

38.1 million |

Germany |

46.8 million |

|

Belgium |

15.2 million |

Spain |

20.5 million |

|

Brazil |

231 million |

Hong Kong |

251 million |

|

Hong Kong |

23.5 million |

Japan |

44.1 million |

|

Australia |

23 million |

New Zealand |

17.1 million |

|

New Zealand |

12.4 million |

Brazil |

30.7 million |

Source: OEC

Challenges

- Supply chain vulnerabilities and raw material constraints: Animal health sector markets continue bearing the brunt of a global supply chain disruption, especially when it comes to the innate level of materials such as biological reagents, active pharmaceutical ingredients, and diagnostic components in the market. Dependency on imported materials can cause a delay in production, and the cost volatility may increase during events of a global nature or geographical trade restrictions. Other requirements needed to be set for vaccines and biologics-including cold-chain logistics-make things more complicated and expensive. To avoid shortages that delay timely disease responses, manufacturers may have to maintain substantial stockpiles or face backorders in animal therapeutics and diagnostics market.

- Regulatory and market fragmentation across regions: In different countries, the lack of harmonization of regulatory standards complicates the approval and commercialization of market. Test requirements, documentation processes, and timelines vary, creating high barriers to entry and discouraging innovation, especially for small to mid-sized companies. In fact, even large markets such as the U.S. and Europe have often unresolved overlaps in agency responsibilities (e.g., the USDA, FDA, EMA), thus delaying the approvals. Where diagnostics are concerned, classification of products as veterinary devices or laboratory reagents is far from clear, thus slowing the way to the market.

Animal Therapeutics and Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 9 billion |

|

Regional Scope |

|

Animal Therapeutics and Diagnostics Market Segmentation:

Application Segment Analysis

The treatment sub-segment in the application segment is expected to hold almost 51% market share by 2035 in the market, as the disease management interventions will be only slightly more dominant than preventive care and monitoring. This suggests that present and acute conditions (infections, parasitic infestations, injuries, chronic diseases) will continue to consume most of the spending rather than preventive measures or pure monitoring services. As per a report by the Health for Animals in 2022, vaccines and parasiticides increased from 56.7% to 62.8% of the product portfolio, while antimicrobials fell from 20.9% to 12.7%. The need to treat outbreaks in livestock and emergencies in companion animals ensures a steady demand of the animal therapeutics and diagnostics market.

End user Segment Analysis

The veterinary clinics and hospitals segment is expected to hold the greatest share of the end user segment revenue by 2035 in the market. Central to these settings are considerations of diagnostics, treatments, surgery, and preventive services, among others, being provided under one establishment. Clinics or hospitals tend to be the first point of contact in emergencies, follow through with care services, and have the resources to deliver costly treatments. As per a report by Health for Animals in September 2022, in the U.S., 41,000 veterinarians will be needed in 2030 to meet the pet care needs; however, the profession stands to be 15,000 short of that figure. As diagnostics become quicker and portable, most of these will be used within clinics or hospitals, thus fetching more value to capture in the animal therapeutics and diagnostics market.

Animal Type Segment Analysis

The companion animals segment, such as dogs and cats, among others, is expected to hold the largest share of revenue in 2035 under the animal type segmentation in the market. Companion animals frequently receive more expensive per animal care (diagnosis, specialized treatments, surgeries, chronic care) than production/farm animals in the developed economies. The increased ownership of pets, humanization of pets, pet insurance, and expectation of quality treatments form the driving factors for higher expenditure per animal. Additionally, according to a report by the Health for Animals in September 2022 in the UK, 52.6% of people working in the veterinary sector work at a small animal practice, as opposed to 3.2% who work with farm animals in the UK.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Animal Type |

|

|

Application |

|

|

Diagnostic Type |

|

|

End user |

|

|

Disease |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animal Therapeutics and Diagnostics Market - Regional Analysis

North America Market Insight

The animal therapeutics and diagnostics market in North America is expected to hold the highest market share of 34% within the forecast period due to a combination of impressive companion animal ownership, an advanced veterinary infrastructure, and high regulatory standards. Pet humanization and the increasing spending on pet health are making diagnostics, vaccines, specialized pharmaceuticals, and treatment modalities more and more in demand. As per a report by the USDA in July 2025, U.S. cattle inventory was 94.2 million head of cattle and calves on U.S. farms. This big livestock base supports a heavy requirement for veterinary therapeutics and diagnostics for disease detection, management, and vaccination. The mature markets in the U.S. and Canada have very widespread adoption already for the market.

U.S. market is expected to grow due to an increase in the awareness of pet owners to invest in the health of their animals, regulatory pressure, and zoonotic-disease-control expenditure, which has thrust the development of the market, coupled with advances in diagnostic technologies. Companion animals continue to receive more frequent and sophisticated care for their chronic diseases, diagnostics, and preventative medicine. According to the American Pet Products Association (APPA) National Pet Owners Survey in March 2023, there are roughly 86.9 million pet-owning households, of which 66% are in the U.S. It is disease outbreaks and stringent welfare and food safety regulations that push the use of therapeutic solutions, vaccines, and anti-infectives.

The veterinary therapeutics and diagnostics sector in Canada is growing due to increasing companion animal population, growing expenditures per pet on diagnostics and therapeutics, and encouragement by governmental regulators. As per a report by Made in Canada in December 2024, in Canada, 77% of domestic households have one or two particular types of pets. There exist 2,538 pet stores in the country with an employee base exceeding 22,000. Molecular diagnostic technologies and diagnostic consumables and kits are consciously finding their way in the Canada market for advanced detection and monitoring of diseases. Further, the emerging threats of diseases, such as the infectious diseases in livestock or pets, will support the growth, along with consumer willingness to spend on quality veterinary care (including diagnostics).

Europe Market Insight

The animal therapeutics and diagnostics market in Europe is anticipated to take the fastest-growing market share, hinging on the EU's regulatory modernization and harmonization of animal health rules. As per a report by NLM in September 2024 the number of dogs in citizens' households was close to 106 million, while cats numbered about 129 million. There are 44% of European citizens owning companion animals, and almost 74% of those surveyed endorsed the setting of rules so that there is better protection for the welfare of pet animals in their respective countries. The growing pet population energizes the market for advanced veterinary therapeutics and diagnostics, especially in companion animal care.

The market in the UK are increasing due to early diagnostics, along with policy considerations about antimicrobial use. As per a report by the UK Government in August 2025, the total number of cattle and calves in England stood at 4.9 million as of June 2025, down by 1.4%. The small decrease is indicative of a paradigm shift in farming operations toward intensive and managed farming with due attention to animal health that depends mainly on diagnostics and targeted therapeutics. The UK's Veterinary Medicines Directorate (VMD) has brought about stricter controls on antimicrobial prescriptions, hence pushing further toward preventive health.

Total Breeding and Laying Flock in England (June, 2025)

|

Year |

Hens and Pullets Laying Eggs for Eating |

Breeding Flock |

Total Number of Birds |

|

2021 |

24,924,306 |

8,518,660 |

33,442,966 |

|

2022 |

24,050,604 |

8,507,703 |

32,558,307 |

|

2023 |

23,006,783 |

9,196,620 |

32,203,403 |

|

2024 |

23,344,182 |

8,816,080 |

32,160,262 |

|

2025 |

22,192,780 |

7,942,552 |

30,135,332 |

Source: Government of the UK

The animal therapeutics and diagnostics market is growing in Germany due to a strong livestock sector and the need for food safety. Governments stress traceability and food quality, which aids the veterinary technologies with investments. Besides this, the German adoption of the regional legislation on antimicrobial resistance supports the early diagnostics and preventive therapeutics further. Growing demand occurs in this country under the companion animal camp due to mounting pet ownership and awareness of animal welfare. These are stimulating innovation in animal health diagnostics and treatments via public funding and private R&D incentives.

Key European Regulations and Directives Related to Pet Welfare and Animal Movement (2024)

|

Regulation / Directive |

Date |

Purpose / Key Points |

|

Council Regulation (EC) N. 1/2005 |

22 December 2004 |

Protection of animals during transport and related operations; amends earlier directives and regulations |

|

Regulation (EC) No. 1523/2007 |

11 December 2007 |

Bans placing on the market, import, and export of cat and dog fur and products containing such fur |

|

Directive 2010/63/EU |

2010 |

Regulates keeping, breeding, and supply of animals for scientific purposes, including dogs and cats |

|

Regulation (EU) No. 576/2013 |

12 June 2013 |

Governs the non-commercial movement of pet animals; repeals previous Regulation (EC) No 998/2003 |

|

Commission Implementing Regulation (EU) No. 577/2013 |

28 June 2013 |

Sets model identification documents for non-commercial movement of dogs, cats, and ferrets; establishes lists of territories and countries; details format and language requirements for declarations |

Source: NLM

Asia Pacific Market Insight

Asia Pacific market is expected to witness steady growth throughout the forecast period, alongside growing animal husbandry, pet ownership, and awareness of animal health and zoonotic diseases. The country's animal mindset is getting altered with increased urbanization and disposable income, raising the level of companion animal healthcare expenditure in countries such as China, India, and Indonesia. Furthermore, different government programs aimed at improving the infrastructure around animal health and disease surveillance also act favorably for market growth. On top of that, an increase in veterinary clinics and laboratories across the region is giving parameters for the increased facility of high-tech diagnostics.

There exists a growing trend in China's animal therapeutics and diagnostics market, owing to increasing food safety concerns, government efforts in disease control, and an increasing population of pets in some urban regions, all of which attract investment in veterinary healthcare facilities. As per a report by the State Council Information Office (SCIO) of the People's Republic of China in April 2025, over 17.0 million individuals in China are maintaining exotic pets with a market size that is close to 10 billion yuan (about 1.3 billion U.S. dollars). Moreover, consistent attempts to control livestock diseases and enhance the welfare standards of animals are driving further growth within the market for both agricultural and companion animal industries.

The animal therapeutics and diagnostics marketplace in India is witnessing growth on account of the burgeoning livestock population, government schemes backing animal abidance, and a rising awareness among the farmer or pet owner for disease prevention and modern veterinary care. Strengthening measures in disease surveillance and vaccination under the National Animal Disease Control Programme (NADCP) are assessed to lessen infectious diseases to some extent. Higher consumption of dairy and meat products from the rising consumer base is motivating farmers to employ modern diagnostics and therapeutics to boost productivity.

Key Animal Therapeutics and Diagnostics Market Players:

- Zoetis Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- Merck Animal Health

- Ceva Santé Animale

- Virbac

- Bayer Animal Health (Now Elanco)

- IDEXX Laboratories

- Vetoquinol

- Phibro Animal Health Corporation

- Neogen Corporation

- Australian Animal Health Laboratory

- Biogénesis Bagó

- Inovet

- Biomin (DSM)

The market globally is highly on the upside, owing to various factors-in-research, investment, mergers and acquisitions activity, and an evolving mindset toward veterinary digital platforms. However, a couple of companies, such as Zoetis, Merck, and Elanco, make just around 50% of the revenue from this sector globally. Some notable innovative moves in AI-driven diagnostics, expansion into emerging markets, and enhancement of biologics portfolios give the players a further advantage in the regional competitive landscape. On the international scale, multinational players are working hand-in-hand within One Health frameworks and with governments to enhance access and scale.

Recent Developments

- In September 2025, Elanco Animal Health announced big success with its new pet health products, Credelio Quattro and Zenrelia. Credelio Quattro became a blockbuster product by reaching USD 100 million in sales in less than eight months, making it the fastest-growing product in Elanco’s history.

- In August 2023, Zoetis introduced Vetscan Mastigram+, which is a quick test that farmers can use right on the farm to detect a common dairy cow illness called mastitis. Mastitis is an inflammation in a cow’s udder caused by injury or infection, which can lower milk production and spoil some milk.

- Report ID: 7750

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animal Therapeutics and Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.