Airborne Lightning Detection System Market Outlook:

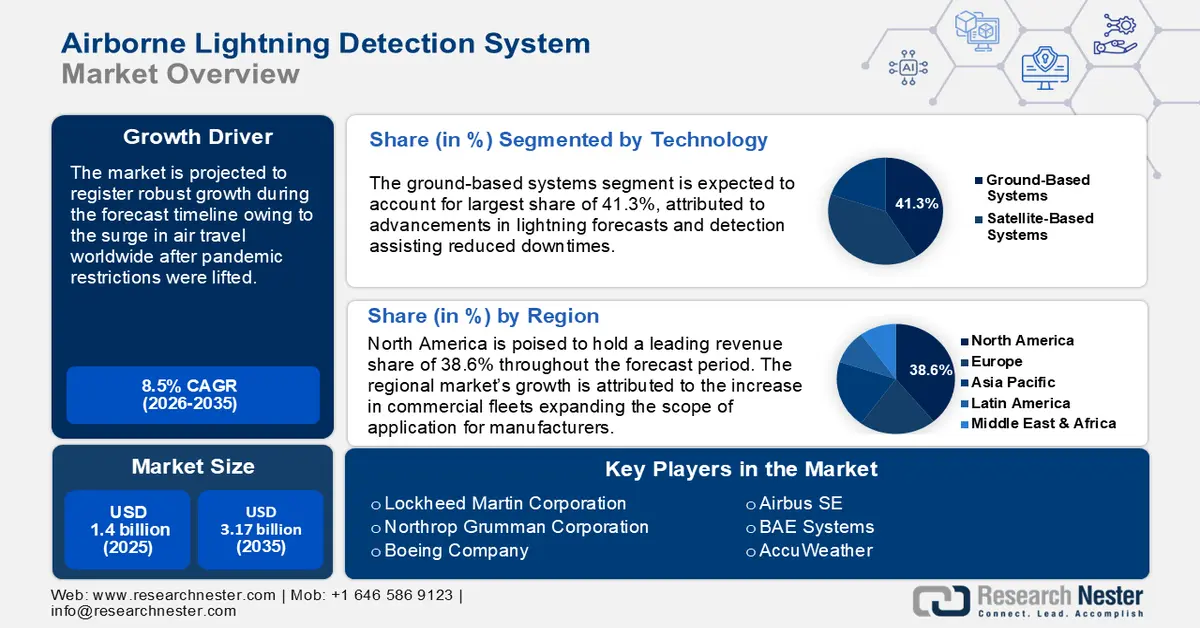

Airborne Lightning Detection System Market size was over USD 1.4 billion in 2025 and is projected to reach USD 3.17 billion by 2035, growing at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airborne lightning detection system is evaluated at USD 1.51 billion.

The airborne lightning detection system market is projected to grow rapidly due to the rising demand for improved aviation safety and the requirement to mitigate risks associated with in-flight lightning strikes. The airborne lightning detection system deployed on commercial and military aircraft utilizes advanced sensor technologies to monitor electrical activity in real time. Furthermore, the surge in air travel is set to be a leading driver of the market’s expansion. The table below highlights the growth in global air travel.

Global Air Travel Demand

|

Particulars |

Details |

|

Air Traffic in 2024 |

10.4% increase in comparison to 2023 |

|

Air Traffic in 2024 in comparison to pre-pandemic levels |

3.8% increase from pre-pandemic levels (2019) |

|

Air Traffic in December 2024 |

8.6% year-on-year increase, international demand increased by 10.6%, and the December load factor was a record 84%. |

Source: International Air Transport Association (IATA)

The rapid recovery of air travel to pre-pandemic levels has added to opportunities for the integration of airborne lightning detection systems in expanding fleets. Moreover, stringent compliance standards, such as the FAA Advisory Circular 20-155A highlight the integration of lightning detection systems into aircraft certification processes. Innovations in sensor miniaturization and AI-driven analytics have improved lightning detection capabilities. In August 2022, Inside Climate News reported that lightning strikes have increased due to climate change. The increasing frequency is expected to impact the airborne lightning detection system market by converging with the rising air travel adding to the risks of lightning strikes on airplanes. The National Weather Services reported that commercial planes are struck by lightning at an average of one or two times a year with a majority of strikes occurring during the descent.

Key Airborne Lightning Detection System Market Insights Summary:

Regional Highlights:

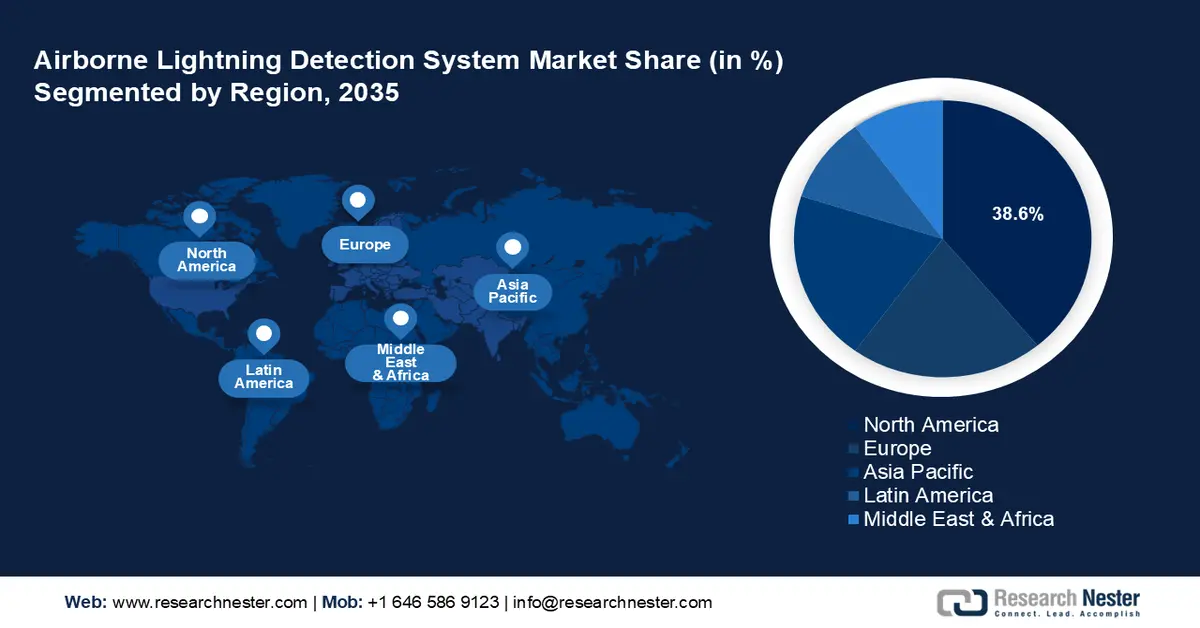

- North America is projected to hold the largest 38.6% share of the airborne lightning detection system market, supported by the escalating operational density of commercial and military aircraft that necessitates enhanced real-time weather integration.

- Through 2026–2035, Europe is expected to grow rapidly as its strong aviation-safety initiatives and weather-resilient avionics programs stimulate wider adoption of airborne lightning detection technologies.

Segment Insights:

- Ground-Based Systems segment is anticipated to capture over 41.3% share of the airborne lightning detection system market, reinforced by advancements in data fusion technologies that elevate real-time lightning tracking accuracy.

- Over 2026–2035, the Civil Aviation segment is expected to retain the largest end-user share as rising global air traffic and strengthened weather-safety mandates amplify the adoption of airborne lightning detection technologies.

Key Growth Trends:

- Increasing integration of satellite based lightning data with airborne systems

- Rising demand for unmanned aerial vehicles (UAVs)

Major Challenges:

- Complexity in detection precision and environmental interference

- Integration barriers with legacy avionics systems

Key Players: Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing Company, Airbus SE, Honeywell International Inc., BAE Systems, Elbit Systems, Aselsan, AccuWeather, Leonardo S.p.A., Garmin Ltd., Mitsubishi Electric Corporation.

Global Airborne Lightning Detection System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.51 billion

- Projected Market Size: USD 3.17 billion by 2035

- Growth Forecasts: 8.5%

Key Regional Dynamics:

- Largest Region: North America (38.6% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries:India, South Korea, Brazil, Singapore, Australia

Last updated on : 3 December, 2025

Airborne Lightning Detection System Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing integration of satellite-based lightning data with airborne systems: The integration of satellite-derived lightning data with airborne detection systems is a major driver of the airborne lightning detection system market. NASA’s Geostationary Lightning Mapper (GLM) aboard the GOES-R series satellites provides real-time and high-resolution lightning activity data. The data is fed into onboard diagnostics systems for improved accuracy. Furthermore, the European Organization for the Exploitation of Meteorological Satellites (EUMETSAT) has highlighted the role of Meteosat Third Generation (MTG) satellites in improving lightning detection across Europe and Africa. The synergy between space-based and airborne systems has enabled airlines to optimize flight paths across corridors of high lightning activity to reduce downtime.

-

Rising demand for unmanned aerial vehicles (UAVs): The expansion of UAVs and urban air mobility (UAM) platforms, including drones and air taxis, has driven the demand for compact, lightweight lightning detection systems. The FAA’s Advanced Air Mobility Implementation Plan announced in 2023 aims to enable advanced air mobility operations via the Innovate28 plan by 2028, which is predicted to drive the integration of airborne lightning detection systems. Companies such as Archer Aviation and Joby Aviation are merging eVTOL (electric vehicle takeoff and landing) designs to comply with safety standards. Additionally, the U.S. Department of Defense’s (DoD) Unmanned Systems Roadmap 2005 to 2030 is poised to bolster the deployment of UAVs for surveillance and logistics, creating sustained applications of airborne lightning detection systems.

- Advancements in predictive lightning analytics: The incorporation of machine learning (ML) and artificial intelligence (AI) has improved the predictive capabilities for lightning strikes. AI trained in relevant data sets is able to forecast lighting strikes early, which assists in formulating flight routes to avoid strikes. The advancements reduce downtimes in flight, and the global AI race has heightened improvements in datasets, which has the potential to bolster the accuracy of predictive lightning analytics. For instance, in September 2023, FLASH Weather AI and SmartSky announced a collaboration to introduce the FLASH predictive lightning data suite to aviation. Such advancements open opportunities for new entrants to provide predictive lightning suits to the commercial and military aerospace sectors.

Challenges

-

Complexity in detection precision and environmental interference: Airborne lightning detection systems rely on electromagnetic signals, but challenges occur of interference by onboard electronics, atmospheric noise, etc., which can negatively impact accuracy. Moreover, systems can struggle to differentiate intra-cloud and cloud-to-ground lightning in real time. To navigate the challenge, businesses must provide lightning detection suites that minimize false alarms.

-

Integration barriers with legacy avionics systems: A considerable percentage of aircraft fleets have legacy avionics that are unable to operate with modern airborne lightning detection systems. Retrofitting older aircraft requires considerable modifications for seamless compatibility which can add to operational costs. Additionally, fleets that rely on analog systems face compatibility challenges which can reduce the scope of application for airborne lightning detection system market players.

Airborne Lightning Detection System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 3.17 billion |

|

Regional Scope |

|

Airborne Lightning Detection System Market Segmentation:

Technology Segment Analysis

Ground-based systems segment is predicted to dominate airborne lightning detection system market share of over 41.3% by 2035. The advancements in data fusion technologies are boosting real-time lightning tracking for aviation safety, which has emerged as a primary driver of the segment’s expansion. Networks such as the U.S. National Lightning Detection Network (NLDN) employs high-speed interferometry with time-of-arrival sensors to achieve close to perfect rate of detection efficiencies. Furthermore, the application of ground-based systems is set to exceed in regions with densely populated flight corridors.

The satellite-based systems segment is positioned to expand during the forecast period. Satellite-based systems are able to provide wide-area lightning detection which adds to adoption rates. Moreover, the rising demand for advanced lightning detection suits in remote and oceanic regions where ground-based networks can face limitations presents opportunities for the key players within the sector. The launch of next-gen satellites, such as Europe’s MTG and China’s FY-4B has led to continuous hemisphere-wide lightning monitoring capabilities boosting investment opportunities within the segment.

End-use Segment Analysis

The civil aviation segment of the airborne lightning detection system market is projected to remain the largest end user throughout the forecast period. A major reason for the segment’s profitability is due to the increase in global air traffic. Moreover, airport authorities’ operators prioritizing weather safety measures to minimize flight disruptions drive the demand for airborne lightning detection systems in commercial flights. Regulatory bodies such as the International Civil Aviation Organization, the Federal Aviation Administration, etc., have emphasized the importance of advanced lightning detection technologies in commercial aircraft.

Our in-depth analysis of the global airborne lightning detection system market includes the following segments:

|

Solution |

|

|

End use |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airborne Lightning Detection System Market - Regional Analysis

North America Market Insights

North America airborne lightning detection system market is predicted to account for the largest revenue share of 38.6% during the forecast period owing to rising demand for density of commercial and military aircraft. The FAA’s NextGen program prioritizes integrating real-time weather data into aviation systems. Moreover, lightning-related delays and disruptions prove to be costly for commercial operators, leading to burgeoning opportunities to integrate systems with greater predicting capacities.

The U.S. airborne lightning detection system market is poised to exhibit lucrative growth throughout the estimated timeframe. Regulatory guidelines, such as FAA’s Advisory Circular 20-155A mandates lightning detection systems on new commercial aircraft. Furthermore, the U.S. military seeks to maintain its dominance in next-generation aircraft, with the growing manufacturing of sixth-generation fighters offering lucrative defense contracts to supply advanced airborne lightning detection systems. For instance, the DoD reported that Northrop Grumman’s prototype sensors had achieved more than 95% detection rates in trail in 2024.

The Canada airborne lightning detection system market is set to expand during the stipulated period. Transport Canada, the premier civil aviation authority, enforces rigorous safety standards, driving opportunities for the integration of lightning detection suites in fleets. The frequent thunderstorms in summer necessitate reliable detection technology. Key trends include Canada’s collaboration with the ESA on the Arctic Weather Satellite constellation, set to be launched in 2025 with the potential to improve lightning monitoring in data-sparse regions.

Europe Market Insights

Europe is expected to register rapid growth during the forecast period. The region’s commitment to aviation safety has created lucrative opportunities for the integration of airborne lightning detection systems. The Single European Sky initiative by the EU emphasizes weather-resilient avionics, with the SESAR Joint Undertaking funding projects such as the Lightning Resilience for European Aviation (LIREA) which integrated ground and satellite-based lightning data into flight management systems. Germany, France, and the UK are expected to hold leading revenue shares in Europe.

The Germany airborne lightning detection system market is forecasted to account for a considerable revenue share during the forecast period. Germany’s high air traffic volumes and innovations in aerospace have positioned the market to exhibit lucrative growth. Stakeholders in the airborne lightning detection system market are prioritizing the integration of state-of-the-art lightning detection systems to improve flight safety and comply with EASA regulations. Moreover, the military aviation sector of Germany is poised to be a steady end user of airborne lightning detection systems by the end of 2035.

The France airborne lightning detection system sector is poised to exhibit growth during the forecast timeline. The French Civil Aviation Authority (DGAC) has aligned with EASA’s 2024 safety mandates, which bolsters the scope of application for airborne lightning-detecting systems. The Pyrenees region and the Mediterranean coastline of France are hotspots for convective storms, which increases the risk of lightning strikes. Additionally, the EU’s Clean Sky 2 initiative has spurred innovation in energy-efficient detection systems aligning with the global decarbonization goals.

Airborne Lightning Detection System Market Players:

- Lockheed Martin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Northrop Grumman Corporation

- Boeing Company

- Airbus SE

- Honeywell International Inc.

- BAE Systems

- Elbit Systems

- Aselsan

- FLASH Weather AI

- AccuWeather

- Leonardo S.p.A.

- Garmin Ltd.

- Mitsubishi Electric Corporation

The airborne lightning detection system market is projected to expand during the forecast period. Leading companies are driving innovation in AI-driven lightning prediction algorithms that integrate satellite and ground-based data. Moreover, opportunities are rife in the major players providing miniaturized sensor technology, enabling lightweight systems for next-generation UAVs. The companies able to provide systems with faster response times with greater accuracy are set to expand revenue shares in the competitive airborne lightning detection system market.

Here are some key players in the market:

Recent Developments

- In July 2025, the Aerospace Corporation and Google Public Sector announced a collaboration to transform space weather forecasting. Leveraging AI and high-performance computing is poised to improve the prediction of geomagnetic storms days in advance with heightened accuracy.

- In January 2024, AccuWeather announced the acquisition of TOA Systems, Inc. The acquisition is poised to bolster the new AccuWeather Lightning Network to improve global lightning detection capabilities by combining the state-of-the-art hardware network of TOA with AccuWeather’s accuracy.

- Report ID: 7286

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airborne Lightning Detection System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.