Agricultural Adjuvants Market Outlook:

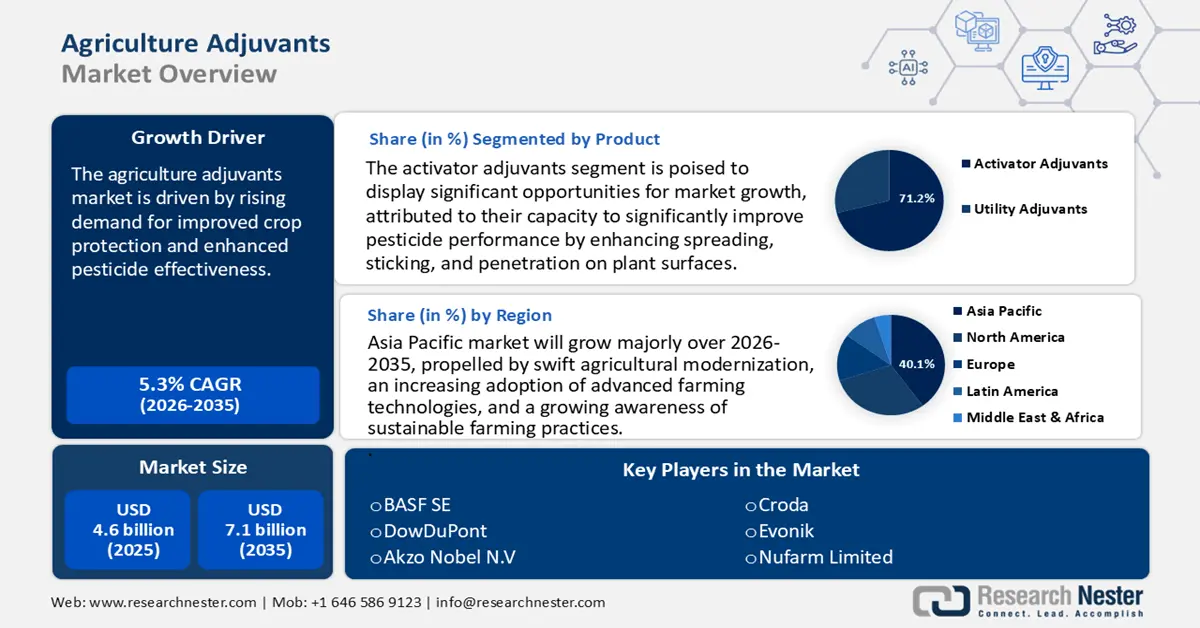

Agricultural Adjuvants Market size was USD 4.6 billion in 2025 and is estimated to reach USD 7.1 billion by the end of 2035, expanding at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of agricultural adjuvants is estimated at USD 4.8 billion.

The market is witnessing substantial growth, primarily fueled by the rising demand for improved crop protection and enhanced pesticide effectiveness. Adjuvants play a crucial role in optimizing the performance of herbicides, insecticides, and fungicides by enhancing their absorption, spreadability, and adhesion on plant surfaces. The increasing global food demand and the necessity to maximize crop yields while minimizing environmental impact are significant factors driving market expansion. Furthermore, stringent government regulations promoting sustainable farming practices and reduced chemical usage have resulted in the adoption of eco-friendly and bio-based adjuvants, which further stimulate market growth. A prominent player in this industry is Evonik Industries AG, which provides a comprehensive range of specialty adjuvants aimed at improving agrochemical formulations. As per Evonik's 2024 financial report, the company recorded total sales of €15.2 billion for the year. Their commitment to sustainable and efficient crop protection is in line with global trends towards precision agriculture, enabling farmers to achieve greater productivity while reducing their environmental footprint.

Key Agricultural Adjuvants Market Insights Summary:

Regional Highlights:

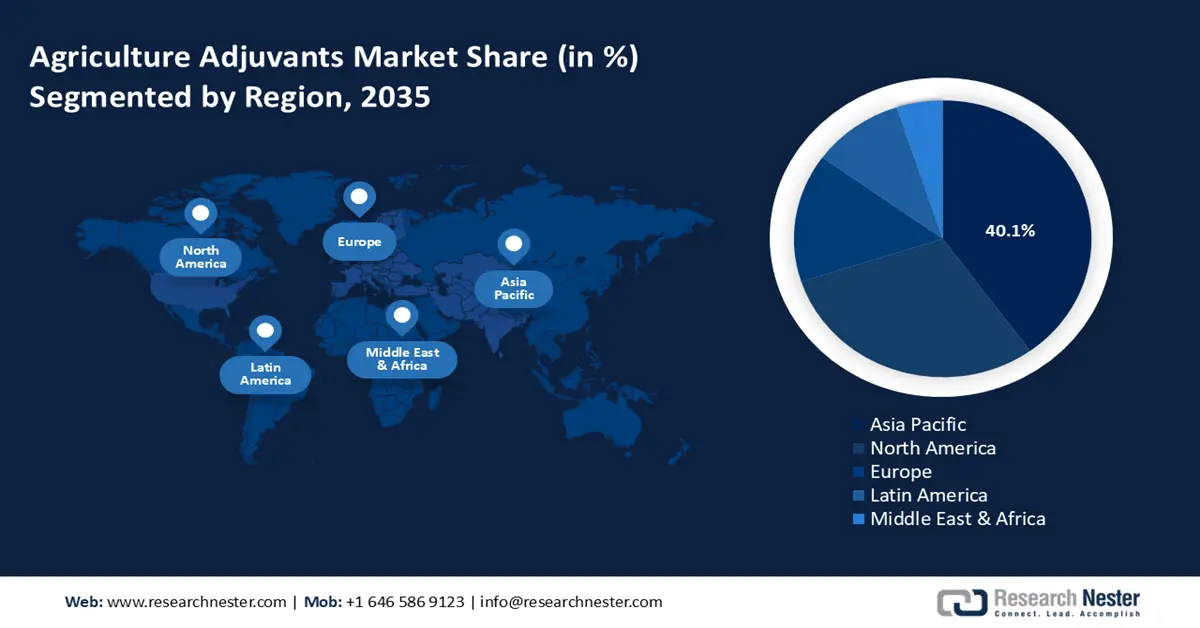

- By 2035, Asia Pacific is set to hold over 40.1% of the regional share, bolstered by swift agricultural modernization and the rising adoption of advanced farming technologies.

- By 2035, North America is positioned for notable expansion in the agricultural adjuvants market, underpinned by increasing demand for higher crop yields and the growing adoption of precision farming technologies

Segment Insights:

- By 2035, the activator adjuvants segment in the agricultural adjuvants market is projected to secure a 71.2% share, supported by their capability to enhance pesticide performance through improved spreading, adhesion, and penetration.

- By 2035, the herbicide application segment is anticipated to command a significant share, sustained by the widespread use of herbicides in extensive crop production and the pressing need to manage resistant weed species.

Key Growth Trends:

- Increasing adoption of precision agriculture

- Government regulations favoring eco-friendly solutions

Major Challenges:

- Regulatory compliance

- Environmental concerns

Key Players: BASF SE, Corteva Agriscience (DowDuPont), Akzo Nobel N.V., Croda International Plc, Evonik Industries AG, Nufarm Limited, Solvay S.A., Brandt Consolidated, Inc., Clariant AG, Wilbur-Ellis Company, UPL Limited, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Corporation, Nissan Chemical Corporation, Kumiai Chemical Industry Co., Ltd.

Global Agricultural Adjuvants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.6 billion

- 2026 Market Size: USD 4.8 billion

- Projected Market Size: USD 7.1 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Germany, Brazil

- Emerging Countries: Vietnam, Indonesia, Mexico, Argentina, Poland

Last updated on : 31 October, 2025

Agricultural Adjuvants Market - Growth Drivers and Challenges

Growth Drivers

- Increasing adoption of precision agriculture: The growing acceptance of precision agriculture methods is increasing the demand for agricultural adjuvants. These substances enhance the effectiveness of pesticides by improving their adherence and absorption, enabling farmers to utilize smaller quantities of chemicals while preserving their effectiveness. This movement fosters sustainable farming practices and financial savings. BASF’s one smart spray system, created in collaboration with Bosch, employs AI and cameras for accurate weed identification, facilitating selective herbicide application that can decrease chemical usage by as much as two-thirds. It works in conjunction with Xarvio FIELD MANAGER for optimized agricultural management.

- Government regulations favoring eco-friendly solutions: Stringent government regulations globally regarding pesticide residues and environmental safety promote the adoption of eco-friendly agricultural adjuvants. These regulations compel agrochemical producers to implement biodegradable and less harmful adjuvants to meet safety requirements. Corteva Agriscience allocates nearly $4 million each day to research and development, launching over 180 new crop protection products in 2022. Approximately 90% of these products align with its sustainability standards in accordance with the UN Sustainable Development Goals, highlighting its dedication to environmentally responsible agriculture.

- Rising demand for increased crop yields: As the global population continues to grow, the necessity for higher crop yields intensifies the demand for more effective crop protection methods. Agricultural adjuvants improve pesticide performance by enhancing spray coverage and penetration, resulting in superior pest control and increased productivity. Helena Agri-Enterprises provides a variety of advanced agricultural adjuvants aimed at boosting pesticide effectiveness by improving spray coverage, penetration, and minimizing evaporation. These formulations assist farmers in efficiently increasing crop yields while reducing chemical application, thereby supporting sustainable and effective crop protection practices.

Global Export Volume of Herbicides

The rise in global herbicide exports, particularly from major producers like the U.S. and China, is driving the demand for agricultural adjuvants that enhance spray coverage, absorption, and overall efficacy. Increasing international trade in herbicides necessitates the use of adjuvants to tailor formulations for diverse climatic and soil conditions. In addition, greater herbicide utilization across export markets boosts the need for compatibility agents and surfactants. This trend is fostering innovation and expanding adoption in the market, as stakeholders aim to optimize herbicide performance globally.

Export Volume of Herbicides in 2023

|

Leading Exporter |

Export Value ($) |

Global Share |

|

China |

5.37B |

33.8% |

|

U.S. |

1.78B |

11.2% |

|

France |

1.37B |

8.61% |

|

Germany |

1.21B |

7.64% |

|

Israel |

636M |

4% |

|

India |

606M |

3.81% |

Source: OEC

Challenges

- Regulatory compliance: The market for agricultural adjuvants encounters difficulties due to rigorous regulatory frameworks globally. Manufacturers are required to navigate intricate approval processes and diverse regulations across different regions, which can result in delays in product launches and heightened development expenses. Achieving compliance while ensuring product effectiveness necessitates substantial investment in research and testing, creating obstacles for market growth.

- Environmental concerns: The growing awareness of environmental impacts and sustainability challenges compels the adjuvants market to create eco-friendly formulations. Striking a balance between performance and biodegradability, along with low toxicity, presents difficulties, as certain effective chemicals may adversely affect non-target organisms or soil health. This increasing demand for greener products calls for innovation but may restrict the application of some conventional adjuvants.

Agricultural Adjuvants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 4.6 billion |

|

Forecast Year Market Size (2035) |

USD 7.1 billion |

|

Regional Scope |

|

Agricultural Adjuvants Market Segmentation:

Product Segment Analysis

The activator adjuvants segment is projected to lead the market, capturing a revenue share of 71.2% by 2035. This leadership is attributed to their ability to significantly enhance pesticide performance by improving spreading, adhesion, and penetration on plant surfaces. Their widespread use in herbicide applications, cost-effectiveness, and compatibility with diverse crop types make them indispensable in modern agriculture. In field trials conducted within California’s viticulture sector, Wilbur-Ellis’s adjuvant EMBRECE-EA achieved 78.9% spray coverage on leaf surfaces, outperforming conventional surfactants. Additionally, the company’s INFOLIUM-EA product demonstrated 98% uniform coverage, showcasing a substantial improvement in wetting and spreading efficiency compared to traditional formulations.

Application Segment Analysis

The herbicide application segment is expected to lead the global market with a significant share. This expansion is largely fueled by the prevalent use of herbicides in extensive crop production and the growing necessity to manage resistant weed species. Adjuvants enhance the effectiveness of herbicides by improving leaf surface coverage and the penetration of active ingredients. Nufarm’s CanDo adjuvant showcases improved efficiency with a minimal application rate of just 0.5% v/v, achieving performance levels comparable to conventional oil adjuvants that are typically used at 1% v/v, thus reducing input volumes without sacrificing efficacy. Additionally, Nufarm Australia’s Activator Surfactant contains 900 g/L of non-ionic surfactant, specifically designed to reduce foaming and enhance wetting, thereby ensuring optimal spray coverage and increased agrochemical effectiveness across diverse agricultural applications.

Source Segment Analysis

The petroleum-based segment has taken the lead in the market, securing the largest portion of total revenue owing to its affordability, widespread accessibility, and established effectiveness in improving pesticide performance. These adjuvants enhance spray retention, penetration, and uniformity, rendering them the preferred choice in numerous crop protection applications. Furthermore, their compatibility with a wide array of agrochemicals facilitates extensive use throughout global agriculture. For instance, Croda International Plc provides high-performance petroleum-based adjuvants that improve pesticide delivery while considering both environmental and economic factors, thereby reinforcing their leadership position in this segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Source |

|

|

Formulation |

|

|

Type by Crop |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agricultural Adjuvants Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific has emerged as the leading area with a revenue share exceeding 40.1% in 2035. This growth is propelled by swift agricultural modernization, an increasing adoption of advanced farming technologies, a rising demand for enhanced crop yields, and a growing awareness of sustainable farming practices. Furthermore, government initiatives that support the use of agrochemicals and the expansion of export opportunities further stimulate market growth in this region.

In Asia-Pacific, the growing trade volume of insecticides is significantly driving the demand for agricultural adjuvants. Major exporting countries such as China, India, and Japan are increasing insecticide production and exports, leading to a higher need for adjuvants that enhance product stability, spreading, and efficacy under diverse climatic and soil conditions. The region’s expanding agricultural base—especially in rice, cotton, and vegetable cultivation—further amplifies the demand for efficient pest control solutions. As a result, manufacturers and distributors are investing in innovative adjuvant formulations tailored to local farming practices, supporting the overall growth of the APAC market.

The agricultural adjuvants market in China is witnessing growth due to the heightened focus among growers on improving the effectiveness of crop protection products. This transition is motivated by the necessity to increase crop yields in the face of limited arable land and escalating food demand. Additionally, stricter environmental regulations promote the use of adjuvants to minimize chemical usage while enhancing pesticide efficiency. UPL Limited stands as a global leader in sustainable agriculture, providing over 1,344 crop protection products across 124 countries. With more than 14,000 product registrations and 27 formulation laboratories, UPL fosters innovation through advanced agricultural adjuvants such as Silwet Gold, a silicone-based super spreader that enhances crop protection efficiency. Their ‘NPP’ business unit underscores their dedication to expanding BioSolutions and supporting sustainable farming practices globally.

In India, the market for agricultural adjuvants is growing due to the increased adoption of modern farming techniques, a rising demand for higher crop yields, and an increasing awareness of sustainable agriculture. Favorable government policies and a thriving agrochemical industry further propel this growth. PI Industries offers over 147 agricultural adjuvant products, including Super Spreader, a silicone-based adjuvant that enhances pesticide efficacy. Their joint venture with Kumiai Chemical in 2017 strengthened the production of Bispyribac Sodium, showcasing PI’s commitment to innovation, sustainability, and enhancing farm productivity within India’s agricultural sector.

APAC’s Trade Volume of Insecticides in 2023

|

Top Exporter |

Global Share |

Top Importer |

Global Share |

|

China |

45.5% |

India |

18.3% |

|

India |

20.1% |

China |

9.14% |

|

Japan |

7.11% |

Thailand |

7% |

|

Singapore |

6.4% |

Indonesia |

6.89% |

|

Israel |

5.5% |

Turkey |

6.46% |

|

South Korea |

4.17% |

Japan |

4.28% |

Source: OEC

North America Market Insights

North America presents a significant growth opportunity for the agricultural adjuvants market, driven by increasing demand for higher crop yields, the adoption of precision farming technologies, and a growing emphasis on sustainable agriculture. Furthermore, stringent regulations regarding pesticide usage encourage the use of adjuvants to enhance efficacy and reduce chemical consumption.

The U.S. agricultural adjuvants market is at the forefront of developing innovative technologies that enhance pesticide performance, boost crop protection efficiency, and lessen environmental impact. The rising adoption of precision agriculture and sustainable farming practices propels the demand for advanced adjuvants. Corteva's commitment to innovation is further demonstrated by its annual investment of over $4 billion in research and development, resulting in the introduction of approximately 2,000 new products designed to enhance agricultural productivity and sustainability.

Canada's agricultural adjuvants market is witnessing substantial growth, driven by the increasing adoption of precision farming, a rising demand for sustainable crop protection solutions, and government incentives that promote eco-friendly agricultural practices. Additionally, challenges such as climate change necessitate the efficient use of pesticides through adjuvants. Loveland Products Canada, a division of Nutrien Ag Solutions, provides high-performance agricultural inputs, including adjuvants like LI 700 featuring LECI-TECH technology. They have recently introduced BLACKMAX WSG, Radiate Plus, and Prevade, innovative products that enhance nutrient uptake, root vigor, and herbicide performance, specifically designed for Canadian farming conditions.

Europe Market Insights

Europe is on the brink of substantial growth in the agricultural adjuvants market, propelled by a rising demand for sustainable farming, stringent environmental regulations, and an increasing adoption of precision agriculture. Innovations in eco-friendly adjuvants, along with government initiatives aimed at reducing chemical usage, further facilitate market expansion throughout the region during the forecast period.

The agricultural adjuvants market in Germany is anticipated to experience significant growth due to the escalating need to enhance crop protection efficiency, improve pesticide performance, and promote sustainable farming practices. Heightened regulatory pressures to minimize chemical residues also contribute to the demand for effective adjuvants. Clariant AG, a prominent player in specialty chemicals, holds a crucial position in Germany's agricultural adjuvants market. Their innovation center located in Frankfurt am Main is dedicated to developing state-of-the-art solutions for crop protection and plant health. Clariant's product range features advanced adjuvants such as Synergen DRT, a drift control agent that enhances drone-assisted pest management, and ADJUWEX™, a glufosinate adjuvant that improves weed control efficiency. These offerings exemplify Clariant's dedication to sustainable agriculture and precision farming in Germany.

The agricultural adjuvants market in the UK is witnessing growth, driven by the demand for improved crop protection in high-value fruits, vegetables, and specialty crops. An increasing emphasis on sustainable farming and precision agriculture is fueling this growth. Syngenta offers 3D Ninety nozzles, which provide a 90% reduction in drift compared to standard flat fan nozzles, thereby enhancing application precision and environmental safety. These innovations underscore Syngenta's commitment to fostering sustainable agricultural practices in the UK.

Key Agricultural Adjuvants Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CortevaAgriscience (DowDuPont)

- Akzo Nobel N.V.

- Croda International Plc

- Evonik Industries AG

- Nufarm Limited

- Solvay S.A.

- Brandt Consolidated, Inc.

- Clariant AG

- Wilbur-Ellis Company

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Mitsubishi Chemical Corporation

- Nissan Chemical Corporation

- Kumiai Chemical Industry Co., Ltd.

Key participants in the agricultural adjuvants sector are utilizing advanced technologies to sustain their competitive advantage. These innovations encompass the use of the Internet of Things (IoT) for precise applications, the creation of bio-based and environmentally friendly formulations, and the addition of drift control agents to improve spray efficiency. Furthermore, businesses are concentrating on developing crop-specific adjuvants to enhance the efficacy of pesticides and herbicides. The implementation of Integrated Pest Management (IPM) strategies also propels the need for specialized adjuvants, in accordance with sustainable agricultural practices.

Some of the major key players are listed below-

Recent Developments

- In September 2023, Croda launched Atlo BS-50, a groundbreaking delivery system tailored for the expanding biopesticide sector. This product boosts the performance of biopesticides by enhancing application efficiency and effectiveness, thereby promoting sustainable pest management solutions.

- In April 2023, Evonik unveiled BREAK-THRU® MSO MAX 522 and TEGO XP 11134, sophisticated adjuvants that enhance the effectiveness of pesticides while reducing drift during drone spraying. These cutting-edge formulations reflect Evonik’s commitment to precision agriculture and superior application performance.

- Report ID: 8202

- Published Date: Oct 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agricultural Adjuvants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.