Agricultural Surfactants Market Outlook:

Agricultural Surfactants Market size was over USD 1.78 Billion in 2025 and is poised to exceed USD 3.16 Billion by 2035, witnessing over 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agricultural surfactants is estimated at USD 1.87 Billion.

The growth of the market can be attributed to the rising demand for food and higher cases of death related to hunger and undernourishment. Around 3 million children die each year as a result of malnutrition and hunger. That represents over half of all fatalities among kids under the age of five. Moreover, nearly 113 million of the world's 822 million undernourished people are suffering from acute hunger, meaning they have a desperate need for food and nutrition.

In addition to these, factors that are believed to fuel the market growth of agricultural surfactants include the rising investment in agriculture-related research and development. An increase in R&D initiatives to produce new products and goods is estimated to promote the growth of the market. As per Economic Research Service 2019, the total public agricultural R&D spending in the U.S was USD 5.16 billion. Besides this, the growing demand for non-ionic surfactants is estimated to boost market growth. The use of surfactants decreases surface tension thereby increasing the efficiency of irrigation through increasing moisture retention. The application of non-ionic surfactants increased the irrigation profit by 20%.

Key Agricultural Surfactants Market Insights Summary:

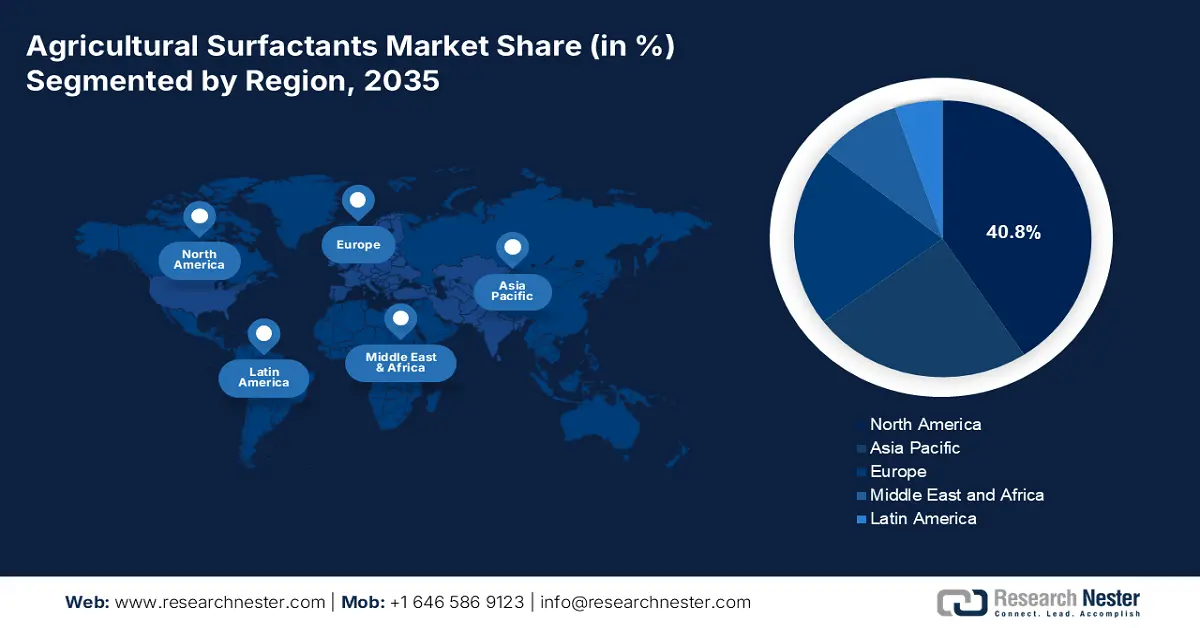

Regional Highlights:

- North America agricultural surfactants market will hold over 40.8% share by 2035, attributed to government initiatives to increase crop yield and fertilizer production.

- Asia Pacific market will capture a significant revenue share by 2035, driven by increasing food demand and growing urban food planning needs.

Segment Insights:

- The herbicides segment in the agricultural surfactants market is anticipated to achieve the largest share by 2035, fueled by the improvement of spray droplet absorption and penetration of active contents into plant foliage.

- The fruits & vegetables segment in the agricultural surfactants market is expected to hold a significant share by 2035, attributed to the rising need to produce more fruits and vegetables.

Key Growth Trends:

- Elevating Demand for Food

- Scarcity of Agricultural Land

Major Challenges:

- Limited Use of Chemicals and Pesticides

- Use of Genetically Modified Seeds

Key Players: BASF SE, AkzoNobel N.V., Solvay Group, Wilbur-Ellis Holdings, Inc., Croda International Plc., The DOW Chemical Company, Evonik Industries AG, Huntsman Corporation, Nufarm Limited, Helena Agri-Enterprises, LLC.

Global Agricultural Surfactants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.78 Billion

- 2026 Market Size: USD 1.87 Billion

- Projected Market Size: USD 3.16 Billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Brazil

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Agricultural Surfactants Market Growth Drivers and Challenges:

Growth Drivers

-

Elevating Demand for Food – The agricultural surfactants increased the efficiency of the soil and improves the water penetration into the land, which in turn improves the allover production of food. The increasing population across the world is rising the shortage of farming land, thereby elevating the demand for food. It is estimated that global demand for food will reach 60%-100% by 2050.

-

Scarcity of Agricultural Land – The scarcity of land has been increasing, therefore to improve the fertility of leftover land is important. The number of lands for agriculture in the U.S reached 2,012,050 farms in 2021, with a decrease of 6,950 farms from 2020 as per the estimations.

-

Increase of Various Crop Diseases – surfactants are used as a microbial and pathogen elimination in plants and increase the availability of nutrient for them. As per the Food and Agriculture Organization of the United Nations, 20-40% of the crop across the world is lost to pests each year.

-

Offers Low Toxicity to Plants – Agricultural surfactants have low concentrations of toxicity, that preserve the nutrients of plants, and are not harmful to humans and animals on consumption. Bio-surfactants are proved to be safe at concentrations equal to or less than 0.25 mg/ml.

-

Increasing Production of Bio-Surfactants – The rising production of bio-surfactants is likely to boost the market growth. The sales of bio-surfactants in 2018 were USD 2 billion with about 440 thousand tons and are estimated to reach USD 3 billion in 2023.

Challenges

- Limited Use of Chemicals and Pesticides- on using chemicals for a longer period, it gets accumulated in the body of the consumer. The exposure to these chemicals can cause fertility defects, skin problems, genetic changes, blood disorder, and in some cases, even death. Therefore, the harmful effects of these chemical usages are likely to hamper the market growth.

- Use of Genetically Modified Seeds

- High Demand for Green Solutions

Agricultural Surfactants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 1.78 Billion |

|

Forecast Year Market Size (2035) |

USD 3.16 Billion |

|

Regional Scope |

|

Agricultural Surfactants Market Segmentation:

Crop Type Segment Analysis

The global agricultural surfactants market is also segmented and analyzed for demand and supply by crop type into cereals & grains, and fruits & vegetables. Amongst these two segments, the fruits and vegetables segment is expected to garner a significant share at the end of 2035. The growth of the segment is attributed to the rising need to produce more fruits and vegetables. At this time, the globe produces too many grains, fats, and sugars while producing insufficient amounts of fruits, vegetables, and protein to meet the nutritional needs of the population. Moreover, the world needs to boost the production of fruits and vegetables by 3 times, in order to compete the growing demand. On the other hand, low consumption of fruits and vegetables leads to various health problems that also boost the need for fruit and vegetables. Eating too little fruit and vegetables contributes to roughly 14% of all deaths from gastrointestinal cancer worldwide, 11% of deaths from ischemic heart disease, and 9% of deaths from stroke.

Application Segment Analysis

The global agricultural surfactants market is segmented and analyzed for demand and supply by application into herbicides and fungicides. Out of which, the herbicides segment is anticipated to hold the largest market size by the end of 2035 on the back of the improvement of spray droplet absorption and penetration of active contents into the plant foliage is estimated to fuel the market growth. The addition of adjuvants such as surfactants to the spray solution will change the density and viscosity of droplets thus improving the penetration and wettability of the plants which directly impacts the evaporation rate of droplets. As per the observations, the density of glyphosate solution is increased by 2% with the addition of synthetic adjuvant when compared to glyphosate alone.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By Substrate Type |

|

|

By Crop Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agricultural Surfactants Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 40.8% market share by 2035, attributed to government initiatives to increase crop yield and fertilizer production. It is observed that 40% of corn from the U.S ends up in the production of biofuel. Besides this, proactive government efforts to boost the production of fertilizers is also expected to augment the market growth. Tom Vilsack, secretary of the U.S. Department of Agriculture (USDA), announced that the Biden-Harris Administration allocated USD 500 million in grants available to boost fertilizer production in the United States in an effort to encourage competition and reduce price increases for American farmers brought on by the conflict in Ukraine.

APAC Market Insights

The Asia Pacific agricultural surfactants market, amongst the market in all the other regions, is projected to hold the significant market share by the end of 2035. The market growth in the region is attributed to rising need for more food production in the region. India is ranked 107th out of 121 countries in the 2022 World Hunger Index, six places lower than its previous position and below countries like Ethiopia, Bangladesh, and Pakistan. Moreover, the few elements that are anticipated to raise the demand for food in the future are the confluence of an increase in low-income settlements, growing food prices, and the necessity of building an urban food agenda.

Agricultural Surfactants Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AkzoNobel N.V.

- Solvay Group

- Wilbur-Ellis Holdings, Inc.

- Croda International Plc.

- The DOW Chemical Company

- Evonik Industries AG

- Huntsman Corporation

- Nufarm Limited

- Helena Agri-Enterprises, LLC

Recent Developments

-

BASF SE signed two partnerships to strengthen its place in bio-surfactants and actives market. The alliance made with Allied Carbon Solutions Co., Ltd helped BASF to increase consumer demand for safe natural products and Holiferm Ltd will help BASF to develop various glycolipids with fermentation-derived ingredients.

-

Wilbur-Ellis Holdings, Inc. introduced EMBRECE-EA, a unique combination of surfactants developed to improve the efficiency of fungicides, insecticides, and miticides. This will provide cultivators a premium coverage and high wetting of spray material on the leaf surface.

- Report ID: 4525

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agricultural Surfactants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.