Aerospace Adhesives & Sealants Market Outlook:

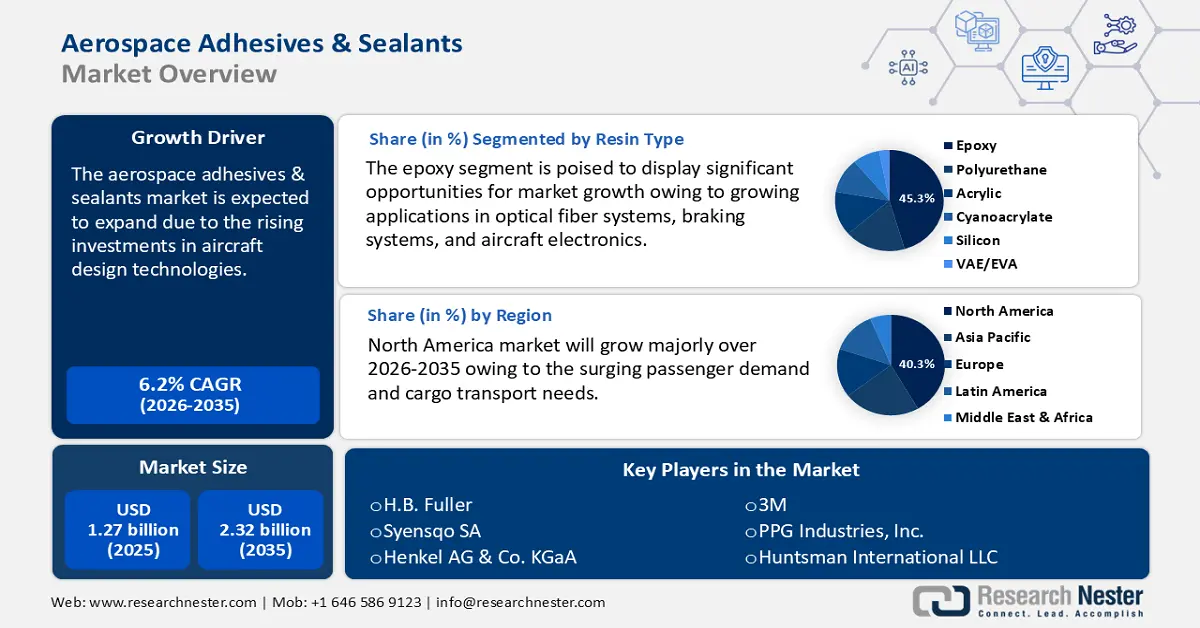

Aerospace Adhesives & Sealants Market size was over USD 1.27 billion in 2025 and is poised to exceed USD 2.32 billion by 2035, witnessing over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace adhesives & sealants is estimated at USD 1.34 billion.

The global aerospace adhesives & sealants market is experiencing substantial growth, primarily due to the increasing utilization of composite materials. This growth can be attributed to rising investments in aircraft design technologies, the expansion of airline fleets, and an upsurge in air traffic. The International Air Transport Association (IATA) reported that in terms of revenue passenger kilometers, or RPKs, total full-year traffic increased 10.4% in 2024 over 2023. Compared to pre-pandemic (2019) levels, this was 3.8% higher. In 2024, the total capacity, expressed in available seat kilometers (ASK), increased by 8.7%. For full-year traffic, the overall load factor hit a record of 83.5%.

The notable expansion of the aerospace industry significantly influences the demand for aerospace adhesives and sealants, which play a critical role in the assembly and maintenance of aircraft components. These specialized materials are essential for preventing corrosion, thereby ensuring the durability and longevity of aviation parts.

Furthermore, unlike traditional metal structures, composites require specialized adhesives and sealants for bonding, structural integrity, and protection against extreme environmental conditions. As aerospace manufacturers shift towards advanced materials such as carbon fiber-reinforced polymers (CFRPs) and thermoplastics, the demand for high-performance adhesives with superior thermal, chemical, and mechanical properties is rising. Additionally, the push for next-generation aircraft, including electric and unmanned aerial vehicles (UAVs), is further accelerating innovation in aerospace adhesives and sealants to ensure durability and safety while minimizing weight and assembly complexity.

Key Aerospace Adhesives & Sealants Market Insights Summary:

Regional Highlights:

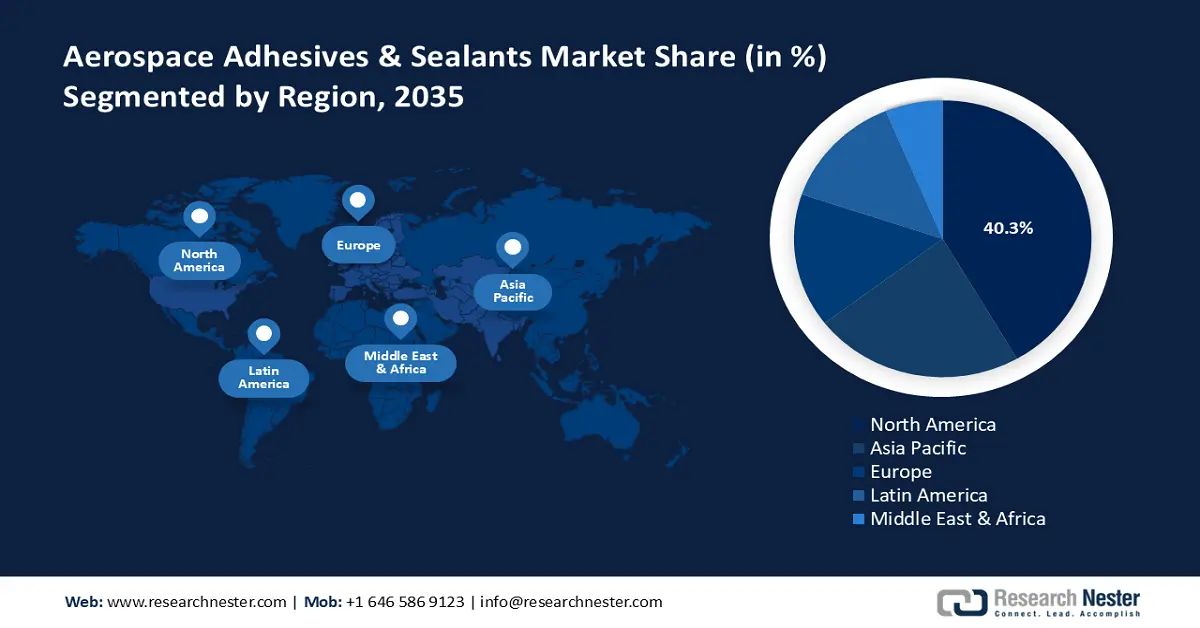

- North America dominates the Aerospace Adhesives & Sealants Market with a 40.3% share, driven by heightened U.S. military spending and investments in aerospace OEM production facilities, enhancing growth through 2035.

Segment Insights:

- The Epoxy resin segment is anticipated to hold a 45.3% share by 2035, driven by its exceptional structural qualities and adherence to diverse substrates.

- The UV Cured segment of the Aerospace Adhesives & Sealants Market is expected to hold a significant share by 2035, driven by its precise and high-strength bonding capabilities meeting stringent aircraft specifications.

Key Growth Trends:

- Increased focus on improving fuel efficiency

- Expansion of space exploration and satellite launches

Major Challenges:

- High cost of advanced materials

- Material incompatibility

- Key Players: H.B. Fuller, Syensqo SA, Henkel AG & Co. KGaA, 3M, PPG Industries, Inc., Huntsman International LLC, Solvay S.A., DuPont de Nemours, Inc., Bostik (Arkema), Scigrip Adhesives.

Global Aerospace Adhesives & Sealants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.27 billion

- 2026 Market Size: USD 1.34 billion

- Projected Market Size: USD 2.32 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 12 August, 2025

Aerospace Adhesives & Sealants Market Growth Drivers and Challenges:

Growth Drivers

- Increased focus on improving fuel efficiency: In light of the industry's strict safety regulations and efficiency demands, aviation maintenance has always been at the forefront of technological innovations. High-performance adhesives are one of the numerous advances that are essential to ensuring that contemporary airplanes keep their structural integrity and dependability while operating at maximum efficiency. These adhesives are becoming an essential component of maintenance procedures worldwide due to the growing desire for lighter, faster, and environmentally friendly aviation solutions.

Adhesives provide better aerodynamics, increase the distribution of stress over bonded joints, improve aesthetics, and prevent corrosion on airplane parts. Adhesives can also shorten production times and lower operating expenses. Adhesives are a lightweight substitute for mechanical bonding (such as screws and bolts) and are flame retardant. They eliminate the need to transport aircraft to a facility for repairs, allowing for in-field repairs in any setting. Therefore, airlines and defense sectors are prioritizing lightweight materials to improve fuel efficiency, making high-performance adhesives crucial for replacing traditional fasteners in composite structures, significantly accelerating the aerospace adhesives & sealants market. Additionally, global commercial manufacturers, boosted by strong revenue and profit margins, are reinvesting in innovation to enhance fuel efficiency – a priority that is driving demand for aerospace adhesives and sealants. - Expansion of space exploration and satellite launches: Specialized adhesives and sealants are becoming increasingly vital to maintain the integrity of spacecraft and satellites as private businesses such as SpaceX and major space organizations such as NASA increase their missions. Also, the World Economic Forum reported that with an average annual growth rate of 9%, the space economy is expected to reach USD 1.8 trillion by 2035, up from USD 630 billion in 2023 and much higher than the growth rate of the world GDP.

It is anticipated that the primary forces behind this expansion will be space-based and/or enabled technologies such as communications, location, navigation, and timing, as well as Earth observation services. Therefore, the expanding space economy is consequently driving aerospace adhesives & sealants market growth. Additionally, the demand for aerospace adhesives in commercial aviation has also increased as a result of the rise in international air travel, which has been aided by government programs such as the Federal Aviation Administration's (FAA) modernization program in the U.S.

Challenges

- High cost of advanced materials: The expense of creating and manufacturing these specialty materials rises in tandem with the need for high-performance, long-lasting, and lightweight adhesives. Significant research and development (R&D) expenditure is needed to produce high-performance adhesives, especially ones that can survive harsh aerospace environments and extremely high temperatures. This R&D process can be expensive and resource-intensive, especially for smaller businesses which can find it difficult to meet the need for creative solutions.

- Material incompatibility: One of the main obstacles preventing adhesives and sealants from being widely used in the aerospace sector is their relative weakness when joining large items with tiny bonding surface areas. This reduces their usefulness in some situations where stronger mechanical fasteners—like rivets or bolts—might still be favored. When exposed to high temperatures, several polymer-based adhesives have certain limits that may compromise their stability. The exception rather than the rule is that only certain silicon-based adhesives exhibit notable heat resistance. It can be challenging to separate bonded materials during testing or repair, which further complicates maintenance and repairs in the aircraft industry.

Aerospace Adhesives & Sealants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.27 billion |

|

Forecast Year Market Size (2035) |

USD 2.32 billion |

|

Regional Scope |

|

Aerospace Adhesives & Sealants Market Segmentation:

Resin Type (Epoxy, Polyurethane, Acrylic, Cyanoacrylate, Silicon, VAE/EVA)

Epoxy resin segment is expected to hold over 45.3% aerospace adhesives & sealants market share by the end of 2035. Its exceptional structural qualities and outstanding adherence to various substrates, such as metals, composites, and polymers, are responsible for the segment's dominant position. Aircraft epoxy adhesives are perfect for crucial aircraft applications owing to their exceptional strength and reduced shrinkage while curing. These adhesives have outstanding electrical insulating qualities and remarkable chemical and environmental harm resistance. Epoxy adhesives are widely utilized in optical fiber systems, braking systems, aircraft electronics, and many other structural applications where accuracy and dependability are critical due to their high tensile strength of up to 55 N/mm2 (8000 psi).

Technology (Hot Melt, Reactive, Sealants, Solvent-borne, UV Cured Adhesives, Water-borne)

The UV cured segment in aerospace adhesives & sealants market is expected to garner a significant share during the assessed period. The precise and high-strength bonding capabilities of this segment, which meet the exacting specifications of aircraft manufacturers, are contributing to its leadership position. One component is used by UV-cured adhesives, which solves pot-life issues and streamlines production timelines. Since there are no volatile losses during curing and these adhesives are 100% reactive, the procedure is non-polluting. The success of the technology is due to its special activation characteristics, which only activate when exposed to UV radiation with a wavelength of 250–350 nm. Its exceptional qualities, such as its wide application temperature range, high viscosity of up to 17 Pa.s., and precision bonding, are what propel the segment's expansion.

Our in-depth analysis of the global aerospace adhesives & sealants market includes the following segments:

|

Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Adhesives & Sealants Market Regional Analysis:

North America Market Statistics

North America aerospace adhesives & sealants market is poised to capture revenue share of around 40.3% by the end of 2035. This is primarily due to the U.S. government's heightened emphasis on bolstering its military. Therefore, over an extended period, contractors and their supply chains stand to gain greatly from higher defense spending. The aerospace adhesives & sealants market expansion can be attributed to the heightened investments in production facilities by aerospace original equipment manufacturers (OEMs) and component manufacturers. With commercial airlines expanding their fleets to meet surging passenger demand and cargo transport needs, manufacturers are shifting to high-performance adhesives to enhance fuel efficiency and structural integrity.

Additionally, the U.S. Department of Defense is heavily investing in next-generation military aircraft, further driving demand. In fiscal year 2022, the DOD spent more than USD 20 billion updating and recapitalizing its fixed-wing fighter and attack aircraft. Fighter and assault aircraft with fixed wings, known as tactical aircraft are piloted vehicles with electronic warfare, air-to-air, and air-to-ground capabilities. The shift towards lightweight composite materials in aircraft construction also boosts the need for specialized adhesives and sealants, replacing traditional mechanical fasteners.

Similarly, Canada is home to major aerospace manufacturers such as Bombardier and Airbus Canada, which require advanced adhesives and sealants for lightweight materials and structural integrity. The rise in aircraft maintenance, repair, and overhaul (MRO) activities further drives demand, as airlines prioritize efficiency and durability. Additionally, Canada’s push for sustainable aviation, including the adoption of composite and eco-friendly adhesives, contributed to aerospace adhesives & sealants market expansion. To promote Canada's new Initiative for Sustainable Aviation Technology (INSAT), which aims to accelerate the green industrial transformation of the aerospace industry, the Honourable François-Philippe Champagne, Minister of Innovation, Science, and Industry, announced a USD 350 million investment in June 2023. One of Canada's most inventive and export-oriented industries, the aerospace sector supports the country's economy with almost USD 27 billion and more than 210,000 jobs.

APAC Market Analysis

Asia Pacific aerospace adhesives & sealants market is expected to grow at a significant rate during the projected period. Due to rapid industrialization, urbanization, and financial adhesive in key countries such as China, India, Japan, and South Korea, the Asia Pacific adhesive and sealant market is one of the fastest-growing regions globally. Strong demand from companies in this area includes development, automotive, packaging, hardware, and healthcare. Favorable government policies, infrastructure projects, and a growing center course have accelerated the expansion of the aerospace adhesives & sealants market. In general, Asia Pacific's adhesive and sealant sector has grown alongside the mechanical advancements of the region. Initially reliant on imports, the region began developing its capacity to generate claims in the middle of the 20th century, with Japan spearheading creative advancements.

Furthermore, China’s expanding commercial aviation sector, led by COMAC’s C919 jetliner, is increasing demand for high-performance adhesives and sealants for structural bonding, insulation, and fuel system sealing. Additionally, the growth of the defense and space industries, including satellite and missile development, further boosts demand. With a strong push for localization and the presence of major international and domestic aerospace suppliers, China’s aerospace adhesives & sealants market is witnessing steady expansion. The Observatory of Economic Complexity revealed that China became the world's sixth-largest importer of aircraft and spacecraft in 2023, bringing in USD 11.8 billion in total. In that same year, China's 26th most imported product was aircraft and spacecraft. The main countries from which China imports aircraft and spacecraft are France (USD 3.41 billion), Germany (USD 3.23 billion), the U.S. (USD 2.49 billion), Ireland (USD 1.16 billion), and Canada (USD 433 million).

Similarly, with the Government of India’s push for self-reliance in aerospace and defense, companies including Hindustan Aeronautics Limited (HAL), and private players are boosting aircraft production and maintenance activities. According to the India Brand Equity Foundation (IBEF) approximately 69% of all aircraft traffic in South Asia is domestic, and by 2023, India's airport capacity is predicted to accommodate 1 billion journeys yearly. The air traffic flow in 2023 was 327.28 million, up from 188.89 million in 2022, indicating that the Indian aviation industry has largely recovered from the COVID-19 pandemic shock.

The increasing demand for commercial aircraft, driven by the surge in domestic air travel and regional connectivity schemes (UDAN), further fuels market growth. additionally. Technological advancements and the entry of global adhesive manufacturers also contribute to the sector’s expansion, making India a key emerging aerospace adhesives & sealants market in aerospace materials.

Key Aerospace Adhesives & Sealants Market Players:

- H.B. Fuller

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Syensqo SA

- Henkel AG & Co. KGaA

- 3M

- PPG Industries, Inc.

- Huntsman International LLC

- Solvay S.A.

- DuPont de Nemours, Inc.

- Bostik (Arkema)

- Scigrip Adhesives

The market for aviation adhesives and sealants is extremely consolidated, with the top five companies holding a sizable portion of the aerospace adhesives & sealants market. Global chemical conglomerates with a wide range of products and robust technological capabilities make up the majority of these market leaders. These companies leverage their extensive research facilities, established relationships with aerospace OEMs, and global manufacturing networks to maintain their market positions. The aerospace adhesives & sealants market is characterized by high entry barriers due to stringent quality requirements, extensive certification processes, and the need for long-term relationships with aerospace manufacturers.

Recent Developments

- In May 2024, Syensqo introduced AeroPaste 1003, a new grade of its epoxy-based structural paste adhesives, which joins AeroPaste 1006 and 1100. This aerospace glue not only improves part assembly efficiency but also provides excellent processing flexibility, making it appropriate for applications with high production rates such as Advanced Air Mobility, Commercial Aerospace, and Defense.

- In February 2024, PPG expanded its aerospace portfolio with two new adhesives: PPG PR-2940, an epoxy syntactic paste adhesive (ESPA) for bonding internal aircraft structures, and PPG PR-2936, an adhesive with shim and sealant properties for attaching an aircraft's outer skin to internal structures.

- Report ID: 7306

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.