Acrylic Teeth Market Outlook:

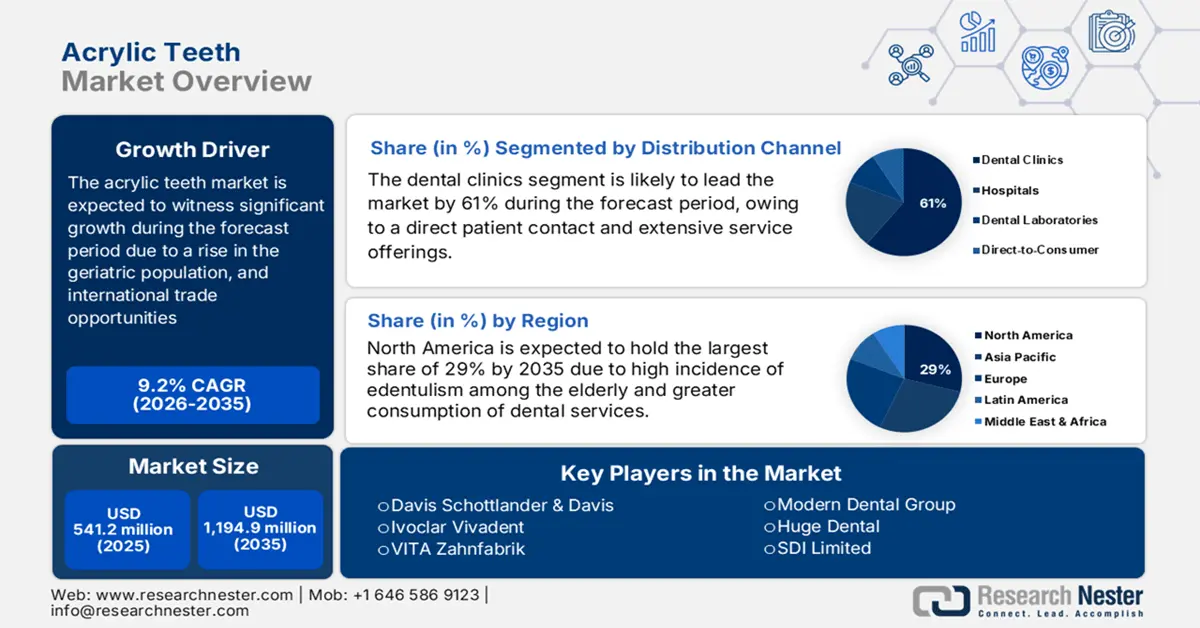

Acrylic Teeth Market size was valued at USD 541.2 million in 2025 and is projected to reach USD 1,194.9 million by the end of 2035, rising at a CAGR of 9.2% during the forecast period 2026-2035. In 2026, the industry size of acrylic teeth is assessed at USD 590.9 million.

The global patient pool of the acrylic teeth market is expanding with an increasing senior population and the prevalence of dental ailments on the rise. According to the World Health Organization (WHO) in March 2025, oral diseases affect nearly 3.7 billion people all over the world. The prosthetic demand was further increased due to the aging population, keeping a constant requirement for dentures. The estimated global average prevalence of complete tooth loss lies approximately at 7% for those over the age of 20 years. The incidence is globally estimated at 23% for those over 60 years of age. This supply chain for acrylic teeth depends heavily on polymethyl methacrylate (PMMA) resins, pigments, and specialized dental composites, with key suppliers for the raw material companies being Germany, China, and the U.S.

The medical equipment industry continues to evolve rapidly, driven by innovations and changing market forces. According to a report by the U.S. Bureau of Labor Statistics in August 2025, the PPI for medical or surgical materials was rising at an annual rate of 2.0%, in line with increasing manufacturing costs that benefit the market. Manufacturing lines for the acrylic teeth market are highly automated, and the production cost is mainly determined by the price of raw materials and labor. Investments in RDD continue toward biocompatible and high-strength acrylic formulations. Consequently, these advancements will increase the strength and aesthetics of acrylic teeth to meet the growing demand for high-quality dental prosthetics. Besides, manufacturers are increasingly involved in the establishment of processes for an environmentally friendly production environment from the viewpoint of supporting sustainability in the dental materials industry.

Key Acrylic Teeth Market Insights Summary:

Regional Insights:

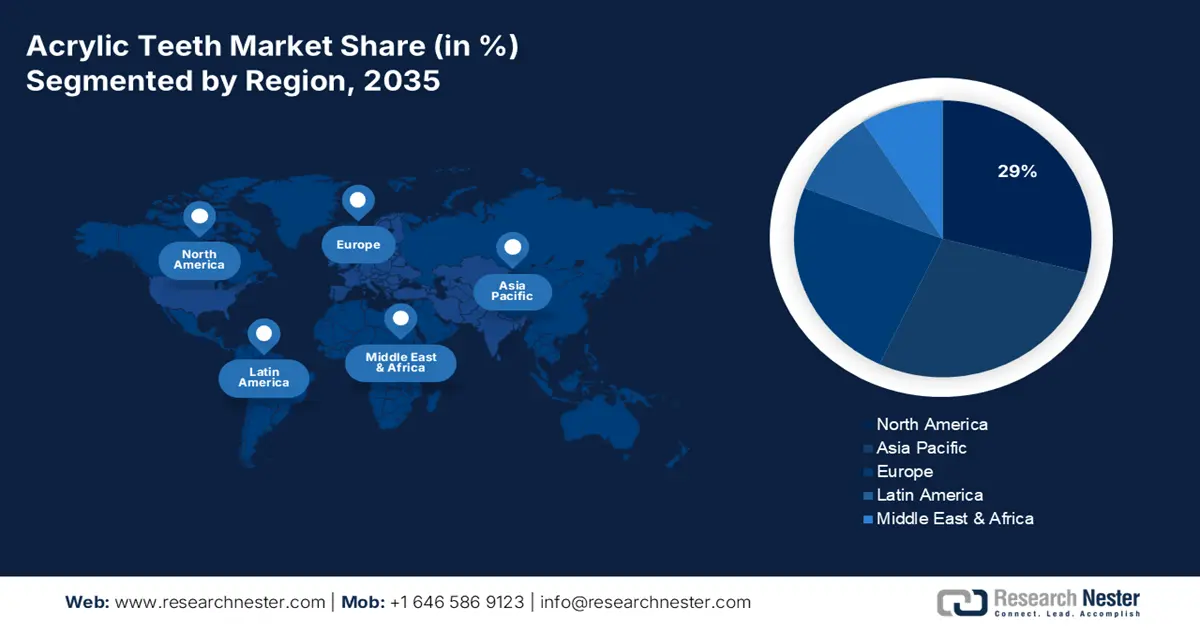

- North America is predicted to hold a 29% share by 2035 in the acrylic teeth market, driven by high incidence of edentulism among the elderly and greater consumption of dental services.

- Europe is anticipated to be the fastest-growing region by 2035, fueled by the increasing ratio of elderly citizens and adoption of digital dental technologies.

Segment Insights:

- Dental Clinics sub-segment is projected to account for 61% share by 2035 in the acrylic teeth market, owing to direct patient contact and extensive service offerings.

- Geriatric Patients sub-segment is expected to hold the highest acrylic teeth market share by 2035, impelled by the high prevalence of edentulism among the elderly population.

Key Growth Trends:

- Increasing prevalence of edentulism

- Advancements in dental technology

Major Challenges:

- Material durability and wear

- Limited awareness and accessibility

Key Players: Dentsply Sirona, Ivoclar Vivadent, VITA Zahnfabrik, Modern Dental Group, Huge Dental, SDI Limited, Davis Schottlander & Davis, New Stetic, Polident, Dental Manufacturing, Zhermack, Vertex Dental, Modern Dental Group Co. Ltd., SDI Limited, Zhermack SpA.

Global Acrylic Teeth Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 541.2 million

- 2026 Market Size: USD 590.9 million

- Projected Market Size: USD 1,194.9 million by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Canada, Australia

Last updated on : 3 October, 2025

Acrylic Teeth Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of edentulism: The global rise of elderly edentulism is viewed as a key factor for the acrylic teeth market. A report by the NLM in May 2024 stated that complete edentulism is significantly associated with having less than a high school education, smoking, being non-hispanic black, and having an annual household income below USD 75,000. It is also linked to chronic conditions such as diabetes, myocardial infarction, arthritis, depression, and stroke. The trend in demographics is likely to persist positively for the demand for cheap and durable dental prosthetics, such as acrylic teeth.

- Advancements in dental technology: Technological advances implemented in dental materials and steps have further augmented the attractiveness of acrylic teeth. 3D image and CAD technologies can now design dentures with improved precision and customization, thereby imbuing them with better fit and comfort for the patient. A study published by the NLM in June 2025 showed that by trial completion among selected individuals, 28 patients (70%) preferred their digital denture as the final prosthesis, whereas conventional dentures were chosen by 12 patients (30%). These advances thus give rise to the preference for the acrylic teeth market over other materials.

- Government initiatives and reimbursement policies: Government policies and reimbursement schemes drive the acrylic teeth market so that dental care can become affordable. Alongside furthering access to acrylic dentures for suitable recipients, the Centers for Medicare & Medicaid Services (CMS) in the U.S. also expanded coverage for dental prosthetics under specified conditions. As per a report by CMS in December 2023, U.S. health care spending went up 4.1% to reach USD 4.5 trillion in 2022, growing faster than the 3.2% that had been recorded. Such programs would encourage a larger number of people to go for dental prosthetic options, increasing the demand for acrylic teeth.

Investigations Assessing the Adhesion Between Artificial Teeth and Denture Base Substances (2024)

|

Type of Artificial Teeth |

Type of Denture Base Material |

Type of Chemical Treatment |

Type of Mechanical Treatment |

|

PMMA teeth |

Heat-polymerized resin, Auto-polymerized resin |

MMA, 180 s |

Using 120-grit sandpaper for grinding, create two grooves and a retention hole with a diameter of 1.5 mm, F = 10 MPa |

|

3D-printed teeth, Prefabricated acrylic teeth |

3D-printed denture resin, Heat-cured resin |

MMA, 3D-printed resin, Auto-polymerized acrylic resin |

400–1200-grit SiC paper, F = 10 MPa |

|

PMMA teeth, Composite teeth |

Heat-cured resin, CAD/CAM-milled |

DCM, PMMA-based bonding agent |

Roughening with bur 250 m Al2O3, 15 s, 4.8 bars, 10 mm, F = 10 MPa |

|

PMMA teeth |

Heat-cured resin |

MMA, DCM |

250 m Al2O3, 4.8 bars, 5 s, 5 mm x 5 mm, F = 10 MPa |

|

3D-printed teeth, Prefabricated composite teeth, Milled teeth |

Heat-cured resin, Milled PMMA resin, 3D-printed resin |

3D tooth conditioning agent, 4 min, 40°C + light-cured bonding agent |

N/A |

|

Acrylic teeth |

Heat-polymerized resin |

MMA |

50 mm Al2O3, 20 s Diatoric cavity 1.5 mm, F = 10 MPa |

|

Acrylic teeth |

Auto-polymerized resin |

Methyl methacrylate (MMA), 3 min Composite bonding agent, 37% phosphoric acid etchant + Methyl methacrylate MMA + composite bonding agent |

F = 10 MPa, Grinding at low speed (0.5 mm/s) |

Source: NLM, June 2024

Challenges

- Material durability and wear: The acrylic teeth market has encountered challenges regarding durability and wear due to aging. Acrylic resins, being inexpensive and readily available in many shades, may be less resistant to abrasion and fracture compared to other materials used in denture teeth, such as porcelain. This results in higher costs of frequent replacement or repair for a patient or a dental professional. Acrylic dentures may wear and discolor to the extent that they will affect patient satisfaction. Manufacturers always try to improve material properties, but the matter remains tricky in trying to balance cost, durability, and aesthetics.

- Limited awareness and accessibility: Lack of awareness and availability of advanced acrylic denture solutions in certain limited parts, especially low-income or rural areas, stands as a major barrier to the acrylic teeth market expansion. In many places, patients are not aware of newer advancements, such as digitally fabricated dentures, and still consider traditional ways. There is also a lack of capable dental practitioners who treat dentures in more advanced dentistry and thus offer access to the best quality prosthetics. Due to of economic constraints, many patients wait even longer to seek dental care, thereby delaying treatment even more.

Acrylic Teeth Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 541.2 million |

|

Forecast Year Market Size (2035) |

USD 1,194.9 million |

|

Regional Scope |

|

Acrylic Teeth Market Segmentation:

Distribution Channel Segment Analysis

The dental clinics sub-segment is expected to hold the highest share within the forecast period in the acrylic teeth market, with 61% in the distribution channel segment due to direct patient contact and extensive service offerings. They provide custom fittings, adjustments, and after-care services that build trust and satisfaction among patients. According to the Centers for Disease Control and Prevention (CDC) in April 2024, 63.7% of adults over 65 years of age had a dental visit in the past 12 months of 2022. Out of them, 62.3% were male and 64.9% were female, which highlights the importance of dental clinics in the provision of oral health care.

End user Demographics Segment Analysis

Geriatric patients sub-segment is expected to hold the highest acrylic teeth market share within the forecast period, as edentulism is highly prevalent in this age group. According to a report by the CDC in October 2024, 19.7% of adults aged 75 years or older are completely edentulous, which depicts considerable demand for denture solutions among the elderly population. These demographic increments, due to aging populations across the globe, drive the market growth.

Technology Segment Analysis

The CAD/CAM fabricated dentures sub-segment is expected to hold the highest market share within the technology segment for the acrylic teeth market within the forecast period, as precision is improving, and production times are becoming shorter. The digital workflow docks dentures with great precision, thereby increasing the fit and esthetic quality. A systematic review published by NLM in November 2022 highlighted that within a span of 25 years, a great increase has been observed in the use of CAD/CAM technology, significantly changing the methods of treatment and production of prostheses. This technological advancement is continuously helping in the increased acceptance of digitally fabricated dentures over traditional ones.

Our in-depth analysis of the global acrylic teeth market includes the following segments:

|

Segment |

Sub-Segments |

|

Product Type |

|

|

Denture Type |

|

|

Technology |

|

|

End user Demographics |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrylic Teeth Market - Regional Analysis

North America Market Insight

North America is expected to hold the highest acrylic teeth market share of 29% within the forecast period, mostly due to a high incidence of edentulism among the elderly and greater consumption of dental services, thereby demanding denture products, including acrylic teeth. The U.S. 2024 Oral Health Surveillance Report from the CDC in October 2024 shows that with an increase in age, the prevalence of edentulism among adults shoots in percentages, 11.4% for an increase in age between 65 and 74 are in need of either a full or partial denture constitute a large market, with many having access to dental services, thus putting forth a huge share for this market.

The acrylic teeth market in the U.S. is growing due to factors such as the demographic aging of the population, persisting edentulism, and the rise in preventive and restorative dental care. As per a report by the CDC in April 2024, a higher proportion, almost 69.6% of older adults with dental insurance had dental visits as compared to those without dental insurance, almost 56.4% in the U.S. These data indicate that this elderly population suffers extensively from the need for dental prostheses in areas of edentulism and tooth loss, while also receiving dental care in sufficient numbers; this acts as the driving force behind the demand for acrylic teeth, especially considering the demand for economically priced dentures.

The acrylic teeth market in Canada is expanding as oral health surveys show that dental services are being procured much more often, thus providing sustenance to the acrylic teeth market with edentulism among seniors. As per a report by Statistics Canada in March 2025, an estimated three out of four people aged 12 and above in Canada, almost 72.3%, reported seeking the services of an oral health professional between November 2023 and March 2024. This consistent engagement with dental care increases the likelihood of early prosthetic interventions, driving steady demand for acrylic dentures.

Europe Market Insight

Europe is expected to hold the fastest-growing acrylic teeth market within the forecast period as the increasing ratio of elderly citizens motivates a heightened demand for denture types, including acrylic teeth. According to Eurostat in February 2025, the population of Europe was 449.3 million, and almost 21.6% of it was aged 65 years and older. The region also has a good healthcare infrastructure and insurance coverage in several countries that provide access to dental prosthetics. In addition, the rising acceptance of digital dental technologies in Europe is speeding up denture and prosthesis replacement or upgrades even further.

The acrylic teeth market in the UK is growing due to enhanced treatments, which imply an increased engagement in dental health care. According to the NHSBSA report in August 2025, 35 million courses of treatment (COTs) were provided, an increase of 4% from 2023 and 2024. For the year 2024 and 2025, the COTs of adult patients rose by 2% to 23 million and by a larger 7% for pediatric patients to stand at 12 million. Among many treatments given are restorations, extractions, and prosthetics for adults, which all give rise to acrylic teeth. There is a very large number of adult patients (within two years) of about 18 million, and this highlights the continuing use of dental services by the older and middle-aged populations.

The acrylic teeth market in Germany is growing owing to the decline in full edentulism among seniors in Germany and a generally high use of dental services. According to the 6th Oral Health Study mentioned in NLM March 2025, edentulism had decreased to about 5.0% for younger seniors aged 65 to 74. Many seniors still have some natural teeth, but many will need partial or full acrylic dentures to help them eat and look good. Furthermore, the study finds fixed and implant-supported dentures on the rise, but removable dentures are still commonly used in the older age groups, the latter typically being acrylic.

Artificial Teeth Export and Import in Countries of Europe (2023):

|

Export Country |

Export Value (USD) |

Import Country |

Import Value (USD) |

|

Germany |

10 million |

Germany |

1.3 million |

|

France |

6.3 million |

Italy |

437,000 |

|

Norway |

3.6 million |

UK |

268,000 |

|

UK |

3.5 million |

Spain |

216,000 |

|

Ireland |

3.1 million |

Netherlands |

199,00 |

|

Russia |

2.3 million |

France |

55,500 |

Source: OEC

Asia Pacific Market Insight

Asia Pacific acrylic teeth market is expected to grow steadily within the forecast period as the region is witnessing trends such as rapid improvements in dental-care access, increasing disposable incomes, and heightened awareness regarding oral health-first in emerging markets. Furthermore, the aging populations of the PRC, India, Japan, and South Korea establish a growing base population for denture users. For example, the World Health Organization’s report in October 2022 estimated that, among untreated dental caries, severe periodontal diseases, and edentulism, an estimated 900 million cases were prevalent. All these dynamics will operate to create an even stronger demand for acrylic teeth across the Asia Pacific.

The acrylic teeth market in China is growing as the burgeoning middle class and growing dental care coverage, prosthetic dental solutions are in increasing demand. The NLM March 2025 report shows that none of the basic medical insurance schemes cover the cost of dentures, and only 63.2% of China-based elderly population with missing teeth wear dentures, indicating more retention of natural teeth but still a need for prosthetic replacement. This situation indicates that, as natural tooth loss continues, more partial and full dentures will be required. Additionally, further advances in rural dental services and awareness are reducing disparities and further giving patients the choice for their dentures.

The acrylic teeth market in India is growing as the Indian government has increasingly prioritized and incorporated it into several schemes under the national health programs for dental care, which in turn helps improve access to dental services. Pursuant to the National Oral Health Program under India’s Ministry of Health, the purpose is to develop oral health services in the districts and primary health centers. Implementation of these programs leads to the earlier detection of tooth loss and referral for prosthetic intervention. Meanwhile, in the urban and semi-urban zones, public and private dental clinics providing dentures are on the rise. With an increasing number of people going for routine dental check-ups, the unmet prosthetic dental need converts proportionally into increased demand for acrylic teeth in India.

Key Acrylic Teeth Market Players:

- Dentsply Sirona

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ivoclar Vivadent

- VITA Zahnfabrik

- Modern Dental Group

- Huge Dental

- SDI Limited

- Davis Schottlander & Davis

- New Stetic

- Polident

- Dental Manufacturing

- Zhermack

- Vertex Dental

- Modern Dental Group Co. Ltd.

- SDI Limited

- Zhermack SpA

The acrylic teeth market comprises leading organizations, which are determined to undertake strategies to make their presence felt in the market. For instance, Ivoclar Vivadent and Dentsply Sirona both dominate the global market revenue through the implementation of CAD/CAM patents. In addition, Asia-specific companies such as GC Corporation and SHOFU leverage government-aided research and development funds to ensure competition. Besides, organizations in Europe focus on initiating automation that helps in diminishing costs , making it suitable for uplifting the market across different nations.

Here is a list of key players operating in the market:

Recent Developments

- In April 2024, Formlabs introduced newest resin 3D printer designed especially for dental professionals, named Form 4B. This new printer works with our updated library of over 15 dental resins, along with improved accessories and post-processing tools.

- In December 2023, Zahn Dental announced that it will be the exclusive distributor of the new Trusana Premium Denture System from Myerson. Trusana was developed by a team of experts, and it uses special patented materials that give dentures great flexibility, strength, and resistance to wear.

- In October 2022, Ivoclar announced that they are collaborating with Ivotion Denture System to take digital denture production to the next level. This system helps dental labs to create full dentures digitally from a single disc in one milling cycle.

- In April 2022, Dentsply Sirona launched its new software named inLab Software 22.0, which will be helpful for dental labs to design and manufacture dental restorations more easily and flexibly. This software includes more design options, such as full-over-natural dentures (single arch dentures) and better gum (gingiva) design.

- Report ID: 7692

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrylic Teeth Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.