Urinary Incontinence Market Outlook:

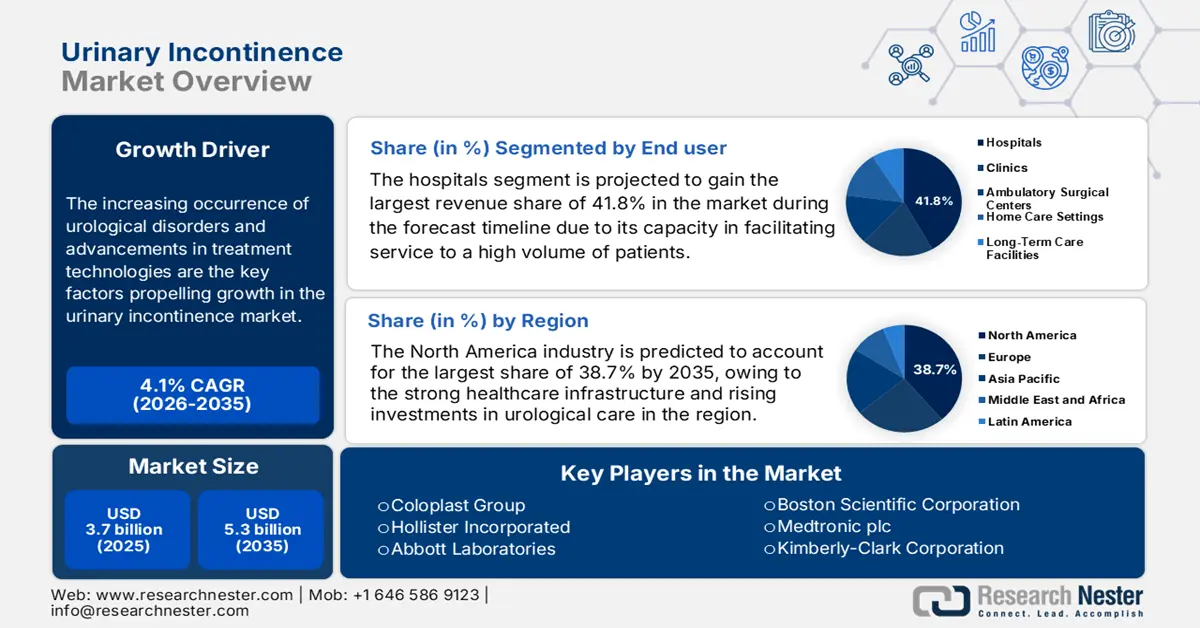

Urinary Incontinence Market size was valued at USD 3.7 billion in 2025 and is projected to reach USD 5.3 billion by the end of 2035, rising at a CAGR of approximately 4.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of urinary incontinence is estimated at USD 3.9 billion.

The increasing occurrence of urological disorders and advancements in treatment technologies are the key factors propelling growth in the market. In this regard, the report from AfPA in March 2022 revealed that one out of every 11 individuals in the U.S. deals with kidney stones, whereas about half of total women in the country are affected by urinary tract infections. The report further underscored that half of all men will experience an enlarged prostate by their 50s, hence positively influencing market growth.

Furthermore, the ever-increasing healthcare expenditure, supportive government initiatives, and increasing investments in urological care are also catalyzing the market’s development. This can be indicated by the article published by European Urology in August 2025 that states that in Europe economic burden of urinary incontinence was EUR €69.1 billion, which excludes caregiver costs, with women bearing four times higher costs than men. The average annual cost per patient was EUR €1,470.6, rising to EUR €1,700.0 when caregiver costs were included, increasing the total burden to EUR €80.0 billion.

Key Urinary Incontinence Market Insights Summary:

Regional Insights:

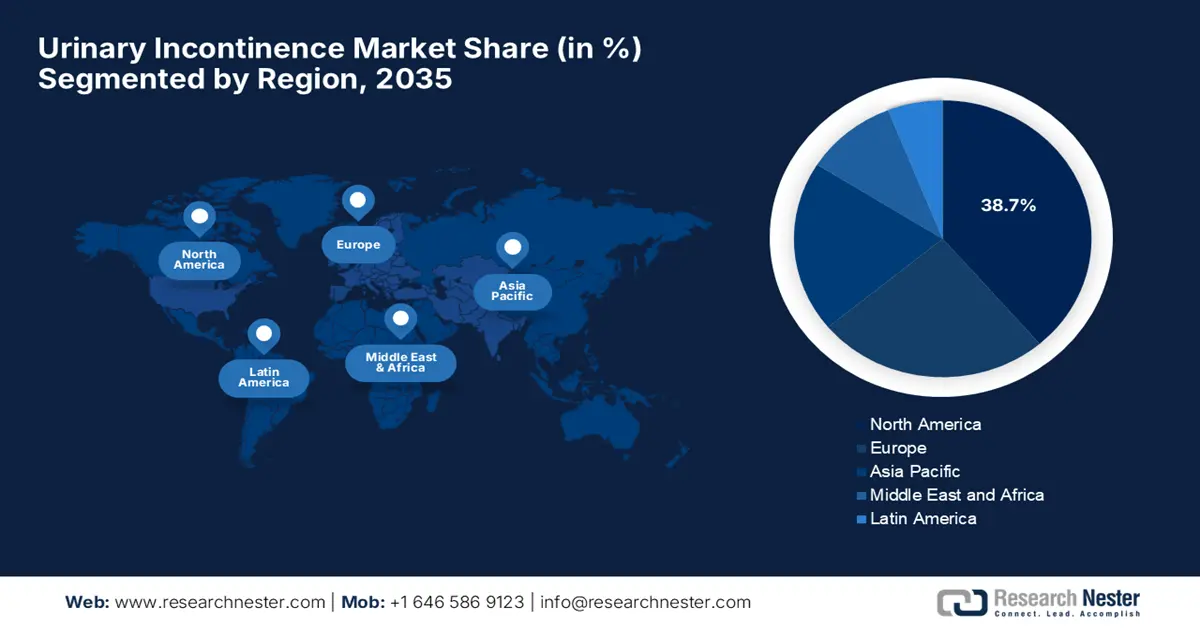

- By 2035, North America is projected to command a 38.7% share in the Urinary Incontinence Market, supported by robust healthcare infrastructure and increasing investments in urological care.

- Europe is estimated to remain the second-largest region in 2035, upheld by favorable healthcare infrastructure and reimbursement policies.

Segment Insights:

- The Hospitals segment in the Urinary Incontinence Market is expected to hold the largest revenue share of 41.8% by 2035, propelled by its role as the primary point of care from diagnosis to disease management for a high patient volume.

- The Urinary Catheters segment is projected to account for a 32.6% share by 2035, driven by the rising prevalence of benign prostatic hyperplasia and neurogenic bladder dysfunction.

Key Growth Trends:

- Rapidly aging demographics

- Increasing awareness of early diagnosis

Major Challenges:

- Social stigma

- Limited access to affordable therapies

Key Players: Coloplast Group, Hollister Incorporated, Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Kimberly-Clark Corporation, Procter & Gamble Co., ConvaTec Group PLC, B. Braun Melsungen AG, Ontex Group NV, Teleflex Incorporated, First Quality Enterprises, Inc., C. R. Bard, Inc. (BD), Wellspect HealthCare, Cure Medical.

Global Urinary Incontinence Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.7 billion

- 2026 Market Size: USD 3.9 billion

- Projected Market Size: USD 5.3 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Indonesia, Singapore

Last updated on : 5 September, 2025

Urinary Incontinence Market - Growth Drivers and Challenges

Growth Drivers

- Rapidly aging demographics: The continuously escalating elderly population contributes to the higher occurrence of urinary incontinence, thereby driving business in the market. As evidence, the report from the World Health Organization in February 2025 estimates that people aged 60 and older are expected to increase from 1.1 billion in 2023 to 1.4 billion by the end of 2030, especially in developing economies. Therefore, this is the evidence for a wider market scope in the upcoming years.

- Increasing awareness of early diagnosis: The enhanced awareness, education, and better diagnostic methods are providing an encouraging opportunity for the players involved in the market. For instance, in December 2024, Bright Uro reported that it had deliberately secured USD 23 million in Series A funding to pursue FDA clearance for its innovative urodynamics system. The company further stated that if approved, this wireless, catheter-free device will be the first of its kind on the market, which will simplify urodynamic monitoring for both providers and patients.

- Innovative treatment technologies: The discoveries in terms of minimally invasive surgeries, therapeutics, and advanced continence products remarkably enhance the development of the urinary incontinence market. In July 2025, Eisai Thailand announced that it had officially launched Beova Tablets (vibegron), a treatment for overactive bladder, which marks its first release in ASEAN countries under Eisai’s license from KYORIN Pharmaceutical, hence suitable for standard market growth.

Historic Trends in Urinary Health: BPH/LUTS Prevalence, Diagnostics, and Treatment Patterns (2012-2021)

|

Category |

Statistic |

|

BPH/LUTS Prevalence (Men aged 40-64, 2012-2021) |

5% - 6% annually |

|

BPH/LUTS Prevalence (Men aged 65+, 2012-2021) |

29% - 35% annually |

|

Diagnostic Testing (Men 65+ newly diagnosed, 2020) |

69% had urinalysis |

|

Prescription Use for BPH/LUTS (2021) |

44% (Men aged 40-64) |

|

Surgical Trend (2012-2021) |

Shift from laser prostatectomy to prostatic urethral lift |

Source: NIH

Urinary Incontinence Product Use and Costs by Demographic Variables 2023

|

Variable |

N (%) |

Mean Product/Day (SD) |

Mean Cost/Week (SD) |

|

White, non-Hispanic |

618 (88.3%) |

1.8 (2.1) |

$5.08 (8.08) |

|

Black, non-Hispanic |

36 (5.1%) |

2.7 (2.7) |

$8.39 (11.47) |

|

Hispanic |

14 (2.0%) |

1.4 (0.9) |

$7.29 (10.21) |

|

Asian |

6 (0.9%) |

2.0 (1.6) |

$5.83 (4.67) |

|

Multiracial |

14 (2.0%) |

2.7 (2.7) |

$8.21 (12.48) |

Source: NIH

Challenges

- Social stigma: Underreporting by patients and stigma are the major obstacles in the urinary incontinence market. The aspect of personal embarrassment, especially in the older and women population, leads to the avoidance of medical help, which causes underdiagnosis and untreated conditions. This embarrassment-driven pressure results in partial hindrance of the market expansion due to the incomplete data on prevalence and treatment outcomes.

- Limited access to affordable therapies: Despite the evolution of advanced therapies such as wireless urodynamic systems and newer generation medication, access in the urinary incontinence market still remains uneven. Besides the exacerbated costs, inadequate reimbursements impose restrictions on the availability of advanced treatments to patients from price-sensitive regions.

Urinary Incontinence Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 3.7 billion |

|

Forecast Year Market Size (2035) |

USD 5.3 billion |

|

Regional Scope |

|

Urinary Incontinence Market Segmentation:

End user Segment Analysis

The hospitals segment is projected to gain the largest revenue share of 41.8% in the urinary incontinence market during the forecast timeline. The subtype remains the primary point of care for diagnosis to disease management, facilitating service to a high volume of patients and complex procedures. In March 2025, the FUTURE Trial, which was presented at EAU 2025 and stated that it has studied 1,099 women with overactive bladder or urge incontinence unresponsive to initial treatments and found that CCA is sufficient for guiding treatment in most cases, allowing clinicians to avoid invasive testing for many patients.

Product Type Segment Analysis

The urinary catheters segment is expected to garner a share of 32.6% in the urinary incontinence market by the end of 2035. The increasing occurrence of benign prostatic hyperplasia and neurogenic bladder dysfunction is the key factor behind this leadership. In July 2022, Otsuka Pharmaceutical Factory Inc. reported that it had launched the OT-Balloon Catheter, an intermittent urological catheter, which is designed to support patients requiring bladder management, thereby enhancing urological care.

Incontinence Type Segment Analysis

The stress incontinence segment is predicted to capture a share of 28.5% in the market during the discussed timeframe. The growth in the segment originates from increasing occurrences coupled with increasing awareness and destigmatization, thereby leading to higher diagnosis rates. In December 2024, Sumitomo Pharma America announced that it received the U.S. FDA approval of GEMTESA (vibegron), which is a once-daily beta-3 adrenergic receptor agonist, for treating men with overactive bladder symptoms who are also receiving pharmacological therapy for benign prostatic hyperplasia, hence denoting a wider segment scope.

Our in-depth analysis of the urinary incontinence market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product Type |

|

|

Incontinence Type |

|

|

Distribution Channel |

|

|

Patient Gender |

|

|

Diagnosis |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urinary Incontinence Market - Regional Analysis

North America Market Insights

North America is predicted to garner the largest revenue share of 38.7% in the global urinary incontinence market by the end of 2035. The region benefits from a strong healthcare infrastructure and rising investments in urological care. In this regard, the report from UDA in April 2024 found that Medicare fee-for-service expenditures for urologic conditions among those aged 65 and older totaled USD 2.8 billion due to benign prostatic hyperplasia and lower urinary tract symptoms, urinary incontinence, and others.

The U.S. is the key contributor to growth in the regional urinary incontinence market, which is supported by the widespread adoption of advanced therapies, along with favorable reimbursement policies. As of the CMS article in January 2023, urological supplies, including urinary catheters and external collection devices, are covered under the Prosthetic Device benefit when used for permanent urinary incontinence or retention. The report also stated that the condition must be long-term, but doesn’t have to be irreversible, hence denoting a positive market outlook.

Canada is portraying a steady growth in the urinary incontinence market, supported by the country’s government and key players. Besides the efforts to improve patient quality of life and access to newer treatment modalities is also propelling growth in the country’s market. In September 2023, Caldera Medical finalized the acquisition of Atlantic Therapeutics, which strengthens its product portfolio by adding Innovo, which is an FDA-cleared, non-invasive, and commercial leader in first-line therapy for women with stress urinary incontinence.

Healthcare Visits and Costs by Insurance Type 2023

|

Insurance Type |

Count (%) |

Average Visits (SD) |

Average Cost ($) (SD) |

|

Medicaid |

57 (8.1%) |

3.2 (5.1) |

9.74 (15.47) |

|

Uninsured |

34 (4.8%) |

2.5 (2.5) |

8.00 (8.81) |

|

Private |

292 (41.6%) |

1.5 (1.1) |

4.53 (6.16) |

Source: NIH

APAC Market Insights

Asia Pacific is emerging as the fastest-growing region in the urinary incontinence market during the discussed timeframe. The growth in the region is readily propelled by the heightened demand for both therapeutic and device-based solutions. In March 2023, KYORIN and Sumitomo Pharma reported that they had entered a licensing agreement for the development, manufacturing, and commercialization of vibegron in Taiwan, Hong Kong, Singapore, Indonesia, and Vietnam. The product is a β3-adrenergic receptor agonist for overactive bladder, to alleviate symptoms such as urgency, frequency, and urge urinary incontinence.

China is productively displaying progress in the urinary incontinence market owing to the presence of a large and growing elderly population and increased healthcare investments. In March 2025, Fotona declared that it received approval from the NMPA (National Medical Products Administration) for the treatment of mild and moderate stress urinary incontinence using the IncontiLase protocol and its patented Fotona SMOOTH technology, which is a laser-based solution designed to strengthen vaginal tissue and improve bladder support.

India is gaining momentum in the regional urinary incontinence market, facilitated by the growing awareness, broader healthcare access, and greater acceptance of advanced treatments, such as slings, catheters, and electrical stimulation devices. In March 2023, MSN Labs announced the launch of Fesobig, which is the world’s first bioequivalent generic version of Fesoterodine Fumarate for the treatment of overactive bladder and urinary incontinence, hence strengthening the country’s captivity in this sector.

Europe Market Insights

Europe in the urinary incontinence market is expected to retain its position as the second largest stakeholder by the end of 2035. The region’s upliftment in this field is effectively attributed to factors such as healthcare infrastructure and reimbursement policies. In July 2022, Urovant Sciences and Pierre Fabre Médicament reported that they had entered into an exclusive license agreement for Pierre Fabre to register and commercialize vibegron for treating overactive bladder in the European Economic Area, the UK, Switzerland, and select territories, hence benefiting overall market growth.

The U.K. is remarkably empowering regional augmentation in the regional urinary incontinence market due to the policy shifts by the National Health Service (NHS) that prioritize patient experience and outcomes. In July 2024 the country’s government announced that the MHRA approved vibegron (Obgemsa), for treating symptoms of overactive bladder syndrome in adults, including urgency, frequent urination, and incontinece which is, a beta-3 adrenergic receptor agonist, works by relaxing bladder muscles and is prescribed as a 75 mg tablet taken once daily.

France is the key landscape for the urinary incontinence market in Europe, which is supported by the heightened demand for incontinence and ostomy care products. In July 2025, UroMems received clearance from the country’s ANSM to begin a pivotal clinical trial of its UroActive smart implant for treating stress urinary incontinence in men. Besides, the SOPHIA2 study will assess the safety and efficacy of the UroActive System, which is the first-ever smart, automated artificial urinary sphincter, thus making it suitable for standard market growth.

Key Statistics on Economic Burden and Prevalence (2023 & 2030 Projections)

|

Category |

Value/Estimate |

|

Prevalence |

Up to 40% of the population |

|

Economic Burden per Patient (2023) |

EUR €1470.6 (without caregivers), EUR €1700.0 (with caregivers) |

|

Economic Burden per Patient (2030 projected) |

EUR €1844.2 (without caregivers), EUR €2129.3 (with caregivers) |

|

Largest Country Economic Burden (2023) |

Germany: EUR €21.6 billion |

|

Economic Burden as % GDP (highest) |

Croatia: 0.67% (without caregivers), 0.76% (with caregivers) |

Source: European Urology

Key Urinary Incontinence Market Players:

- Coloplast Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hollister Incorporated

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic plc

- Kimberly-Clark Corporation

- Procter & Gamble Co.

- ConvaTec Group PLC

- B. Braun Melsungen AG

- Ontex Group NV

- Teleflex Incorporated

- First Quality Enterprises, Inc.

- C. R. Bard, Inc. (BD)

- Wellspect HealthCare

- Cure Medical

The global urinary incontinence market is extremely competitive, driven by the existence of established and emerging giants. These pioneers are pursuing distinct strategies to secure their global positions, which include R&D and development of minimally invasive devices such as sacral neuromodulation implants and connected catheters. Furthermore, the players are also focusing on direct-to-consumer marketing to destigmatize the condition and leveraging regulatory approvals to introduce new products in emerging markets.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, Sumitomo Pharma announced that it had received the U.S. FDA acceptance of them for vibegron (GEMTESA) to treat men with overactive bladder symptoms receiving treatment for benign prostatic hyperplasia, which showcased reductions in urinary urgency and frequency in Phase 3 studies.

- In July 2023, UroMems reported that it implanted a smart artificial urinary sphincter, UroActive, in a female patient, that makes utilization of microelectromechanical technology to provide adjustable, automated treatment for stress urinary incontinence.

- Report ID: 8062

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urinary Incontinence Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.