Genitourinary Drugs Market Outlook:

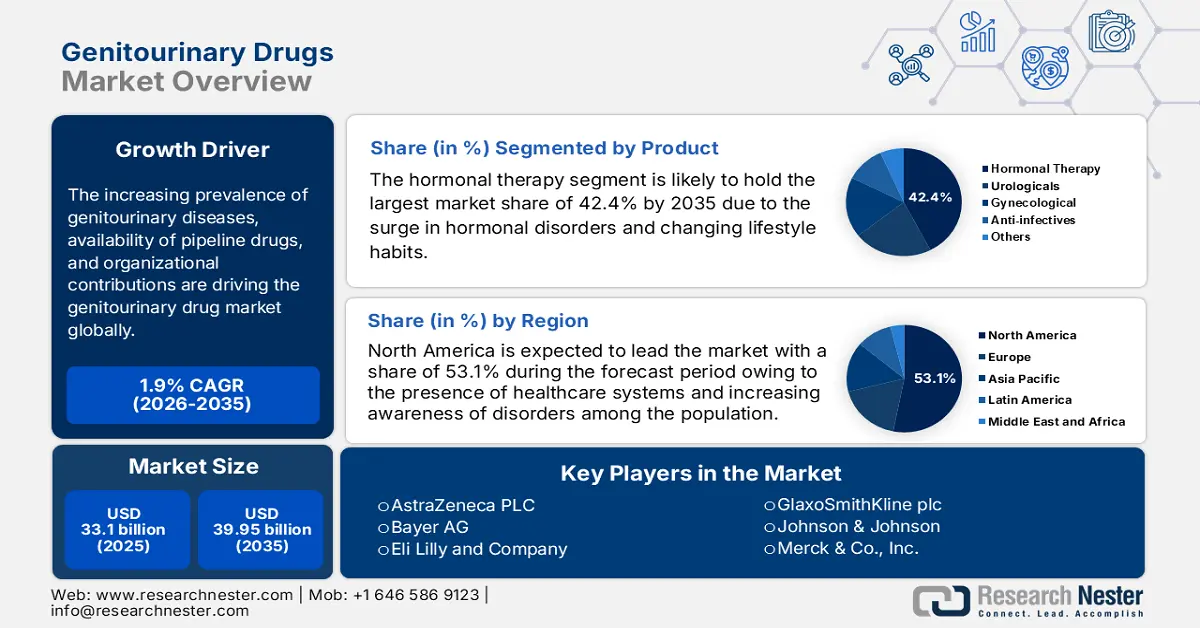

Genitourinary Drugs Market size was over USD 33.1 billion in 2025 and is anticipated to cross USD 39.95 billion by 2035, witnessing more than 1.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of genitourinary drugs is assessed at USD 33.67 billion.

Genitourinary drugs are a distinctive part of pharmaceuticals that tackle disorders catering to the reproductive and urinary systems. These drugs play a pivotal role in the effective management of health conditions, urinary infections, prostate disorders, and erectile dysfunction. Besides, effective research and development by organizations towards the manufacturing of the latest medications is also positively driving the genitourinary drugs market. For instance, in April 2023, GSK plc released constructive results from the EAGLE-2 and EAGLE-3 phase III trials for gepotidacin, a first-in-class oral antibiotic with an innovative mechanism of action for uncomplicated urinary tract infections (uUTI) in female adults and adolescents.

The expansion of the genitourinary drugs market is subjected to provide medical solutions and overcome the different types of cancer-related disorders. Based on this, a cost-effective analytical study was conducted in January 2023 by NLM, wherein the payer’s pricing of immunotherapy-based regimens and sunitinib in metastatic renal cell carcinoma was evaluated. The study denoted that sunitinib was the least expensive treatment, accounting for USD 357,948 to USD 656,100 and the combination of lenvatinib and pembrolizumab or pembrolizumab and axitinib ranged between USD 959,302 to USD 1,403,671. Therefore, sunitinib being the most cost-effective solution for renal cancer positively bolsters the market expansion globally.

Key Genitourinary Drugs Market Insights Summary:

Regional Highlights:

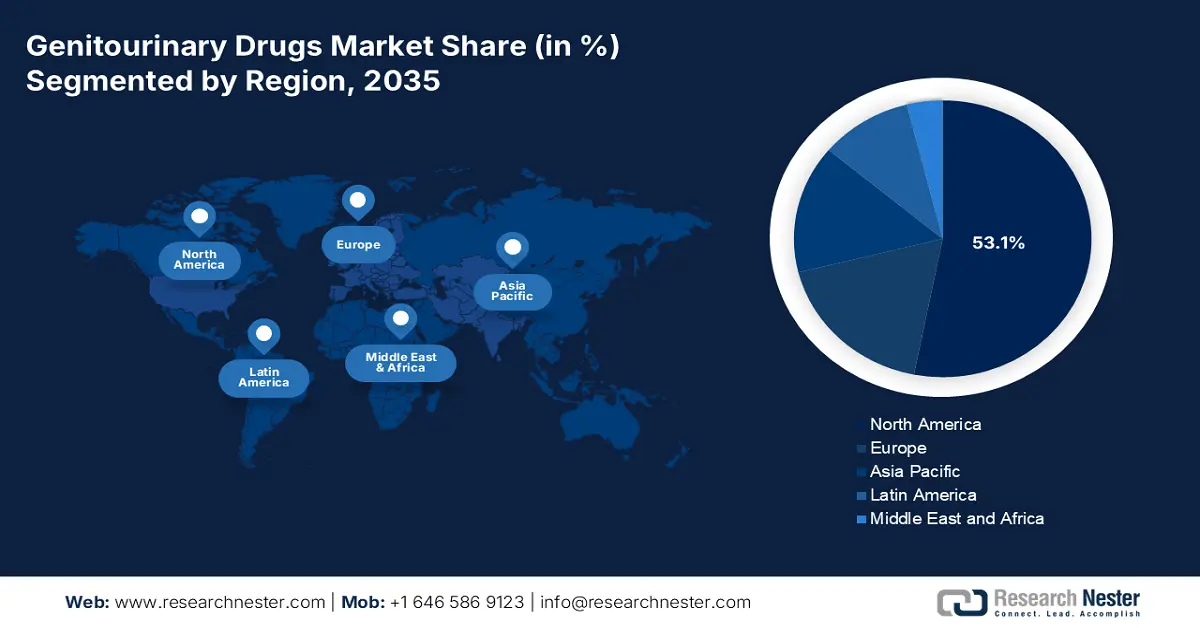

- North America dominates the Genitourinary Drugs Market with a 53.1% share, fueled by increased pharmaceutical development for genitourinary disorders and supportive regulatory frameworks, positioning it as a market leader through 2026–2035.

- The Genitourinary Drugs Market in Asia Pacific is expected to see the fastest growth by 2035, attributed to diverse populations, increasing health awareness, and growing investments in research and development.

Segment Insights:

- The Hormonal Therapy segment is expected to achieve 42.4% market share by 2035, driven by the effectiveness of vaginal hormone therapies in treating genitourinary syndrome.

- The Prostate Cancer segment is projected to hold 32.20% market share by 2035, driven by precision therapies and hormonal interventions.

Key Growth Trends:

- Governmental support

- Enhanced healthcare awareness

Major Challenges:

- High cost of drug development

- Strict regulatory approval processes

- Key Players: Pfizer Inc., GlaxoSmithKline plc, Johnson & Johnson, Novartis AG.

Global Genitourinary Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33.1 billion

- 2026 Market Size: USD 33.67 billion

- Projected Market Size: USD 39.95 billion by 2035

- Growth Forecasts: 1.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Genitourinary Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Governmental support: The focus of administrative bodies on reproductive-based health is positively driving the growth of the genitourinary drugs market internationally. For instance, in August 2023, the Government of India implemented Surakshit Matritva Aashwasan (SUMAN), Janani Suraksha Yojana (JSY), LaQshya, and IEC/BCC campaigns catering to expected women. All these initiatives constitute zero-cost healthcare solutions, promote institutional delivery and quality antenatal checks, ensure manpower and blood storage units, and upgrade medical facilities, especially in rural areas of the country.

- Enhanced healthcare awareness: The genitourinary drugs market is highly driven by the increasing awareness of the adoption of healthy lifestyles. According to the 2025 World Economic Forum report, there has been a reduction of common-cause mortality risk by 27% owing to the habit of moderate-intensity exercise. Additionally, the risk has diminished by 38% among people of 45 to 64 years of age and by 52% for those over 65 years of age. Therefore, the impact of healthy habits on patients is most effective owing to the need to maintain a balanced lifestyle for rapid recovery, thus a positive impact for the market.

Challenges

- High cost of drug development: An extension in the conduction of clinical trials results in a huge cost of drugs, which in turn is a huge challenge for the genitourinary drugs market to boost. This high-cost aspect makes treatments too expensive, especially in low-income nations, restricting market penetration. Additionally, side effects and drug adherence issues including erotic dysfunction with finasteride and cognitive complications with anticholinergics, hamper treatment effectiveness and patient compliance, thus a negative impact on the market growth.

- Strict regulatory approval processes: Stringent regulatory processes along with social stigma, both act as restraints for the genitourinary drugs market. The adoption of rigorous and extensive procedures for approvals causes delays in the launch of the latest drugs in the market internationally. Also, prolonged timelines and severe criteria create barriers for healthcare companies in terms of deliberate innovation and limited availability of precise treatment facilities. Besides, stigmatization discourages patients from undertaking medical assistance which further hinders the market expansion globally.

Genitourinary Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

1.9% |

|

Base Year Market Size (2025) |

USD 33.1 billion |

|

Forecast Year Market Size (2035) |

USD 39.95 billion |

|

Regional Scope |

|

Genitourinary Drugs Market Segmentation:

Product (Hormonal Therapy, Urologicals, Gynecological, Anti-infectives)

Based on the product, the hormonal therapy segment is projected to dominate genitourinary drugs market share of around 42.4% by the end of 2035. This therapy is usually utilized to aid conditions such as hormonal disorders and erectile dysfunction, and the implementation of genitourinary drugs assists in restoring the hormonal balance. As per an article published by NLM in March 2024, genitourinary syndrome of menopause is a common chronic condition requiring long-term treatment. Therefore, vaginal hormone therapies including intravaginal dehydroepiandrostenedione and vaginal estrogen are effective, safe, and help in improving symptoms, thus driving the segment’s growth positively.

Indication (Prostate, Ovarian, Bladder, Cervical, Renal Cancers, Erectile Dysfunction, Urinary Tract Infections, Urinary Incontinence & Overactive Bladder, Sexually Transmitted Diseases, Interstitial Cystitis, Haematuria, Benign Prostatic Hyperplasia)

In genitourinary drugs market, prostate cancer segment is expected to dominate revenue share of around 32.2% by the end of 2035. The growing focus on precision therapies, immunomodulatory treatments, and hormonal interventions to enhance effectiveness are factors boosting the segment’s growth. According to the World Cancer Research Fund, the prevalence of prostate cancer globally comprises 1,467,854 new cases in 2022. However, to overcome the cancer type, there has been a surge in the demand for innovative medications such as lutetium Lu 177 vipivotide tetraxetan has a five-year survival rate of 35% for metastatic castrate-resistant prostate cancer, as stated by The Lancet Regional Health - Southeast Asia in November 2024.

Age-standardized Rates of Prostate Cancer

|

Country |

2022 Cases |

ASR |

|

France, Guadeloupe |

660 |

157.5 |

|

Lithuania |

3,208 |

135.0 |

|

France, Martinique |

610 |

134.3 |

|

Norway |

6,276 |

109.9 |

|

Sweden |

11,732 |

104.3 |

Source: World Cancer Research 2022

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Genitourinary Drugs Market Regional Analysis:

North America Market Analysis

North America genitourinary drugs market is poised to capture revenue share of around 53.1% by the end of 2035. The region is subjected to increased pharmaceutical organizations, making relevant development of genitourinary drugs to aid urinary-based infections and disorders. In January 2021, Urovant Sciences (acquired by Sumitomo Pharma) announced the U.S. FDA approval of GEMTESA (vibegron) 75 mg tablets, a beta-3 (β3) adrenergic receptor agonist, for the treatment of overactive bladder (OAB) with symptoms of urge urinary incontinence (UUI), urgency, and urinary frequency in adults. Thereby, the role of pharmaceutical firms and administrative bodies is readily uplifting the market.

The stimulated urge in the U.S. genitourinary drugs market is due to the occurrence of urinary retention for excessive use of different medications including amlodipine, quetiapine, tiotropium, and mirabegron. However, a joint analytical study was conducted by the US FDA in December 2024, wherein it was identified that 50.1% of patients aged below 65 years and 49.9% aged over 65 years readily suffer from this condition owing to the intake of these drugs. Therefore, this effortlessly denotes the increasing need for the implementation of genitourinary drugs under the recommendation of physicians, thus driving the market expansion in the country.

The male population in Canada readily suffers from lower urinary tract symptoms (LUTS) including overactive bladder (OAB) and benign prostatic hyperplasia (BPH), which is amplifying the genitourinary drugs market. As per a retrospective study conducted by Urology in October 2023, a study was conducted to evaluate the success rates of different treatments to combat LUTS among regional men. The implementation of antimuscarinics constituted 78.1% and alpha-blockers 86.4% which successfully initiated therapeutic changes in both categories. Based on these, there was a rise in healthcare expenditures ranging between USD 12,354 and USD 11,497 as well as USD 14,423 and USD 12,852 for both pre and post-index.

APAC Market Statistics

Asia Pacific is expected to emerge as the fastest-growing nation in the genitourinary drugs market during the forecast timeline. Factors including diverse population, genitourinary disorders, increasing health awareness, and growing investments in research and development are readily driving the market expansion. As per the November 2021 WHO report, an estimated 63% of health expenditure in Fiji is financed publicly which represents 2.7% of the GDP. This funding provision caters to the diagnosis and treatment of chronic diseases which is highly prevalent in the region. As per an article published by NLM in January 2022, the prevalence of chronic kidney disease in the region ranges between 7.0% to 34.3%, thus driving the market demand.

India is subjected to a huge demand for the upliftment of the genitourinary drugs market due to the prevalence of healthcare-based bloodstream infections and urinary tract infections along with the pathogens that cause them often display high levels of antimicrobial resistance. According to a surveillance study conducted by Lancet Global Health in September 2022, 26 network hospitals in the country recorded 2,622 healthcare-associated bloodstream infections and 737 healthcare-associated UTIs from 89 intensive care units. The bloodstream infection rates were over 20 per 1000 central line days and UTI rates were 4·5 per 1000 urinary catheter days, thereby denoting an increasing requirement of genitourinary drugs.

The genitourinary drugs market in China is gaining more traction owing to the wide application of antibiotics to get rid of microbial infections. As per a cross-sectional study conducted by the Science of The Total Environment in October 2022, four types of antibiotics including chloramphenicols, quinolones, sulfonamides, and imidazoles were evaluated in urine samples from 1,170 adult residents in Shenzhen. These antibiotics were detected in 30.8% of overall urine samples ranging between <LOD to 3517 μg/mL. Besides, the presence of antibiotics in urine is linked with obesity and being overweight, especially among the adult population in the country which is driving the market demand.

Key Genitourinary Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc

- Johnson & Johnson

- Novartis AG

- Eli Lilly and Company

- AstraZeneca PLC

- Bayer AG

- Sanofi S.A.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- AbbVie Inc.

- F. Hoffmann-La Roche Ltd.

- Eisai

- Iterum Therapeutics plc

- Novartis

The increased focus on undertaking growth strategies in the form of acquisitions, development of the latest devices, and technological innovation is the most effective reason for global companies to dominate the genitourinary drugs market. For instance, in December 2023, Pfizer Inc. notified its successful acquisition of Seagen Inc. for USD 229 in cash per share, for a total enterprise value of approximately USD 43 billion. The purpose of this was to provide cancer diagnosis and drastically improve the lives of patients suffering from this disorder. Additionally, the organization is set to ensure the provision of transformative therapies to aid genitourinary cancer, thus an effective investment towards the expansion and upliftment of the genitourinary drugs market.

Here's the list of some key players:

Recent Developments

- In October 2024, Iterum Therapeutics plc notified the US FDA approval of its latest drug application for ORLYNVAH (sulopenem etzadroxil and probenecid) for the treatment of uncomplicated urinary tract infections (uUTIs) caused by the designated microorganisms Escherichia coli, Klebsiella pneumoniae, or Proteus mirabilis.

- In January 2024, Eisai declared its objective to make advancements in genitourinary cancer treatment with its latest research on renal cell carcinoma (RCC) during the 2024 American Society of Clinical Oncology (ASCO) Genitourinary Cancers Symposium (GU24).

- In March 2022, Novartis stated that Pluvicto (lutetium Lu 177 vipivotide tetraxetan) has been approved by the US FDA, suitable for the treatment of adult patients with advanced cancer called prostate-specific membrane antigen–positive metastatic castration-resistant prostate cancer (PSMA-positive mCRPC) that has spread to other parts of the body.

- Report ID: 7299

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Genitourinary Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.