Finasteride Market Outlook:

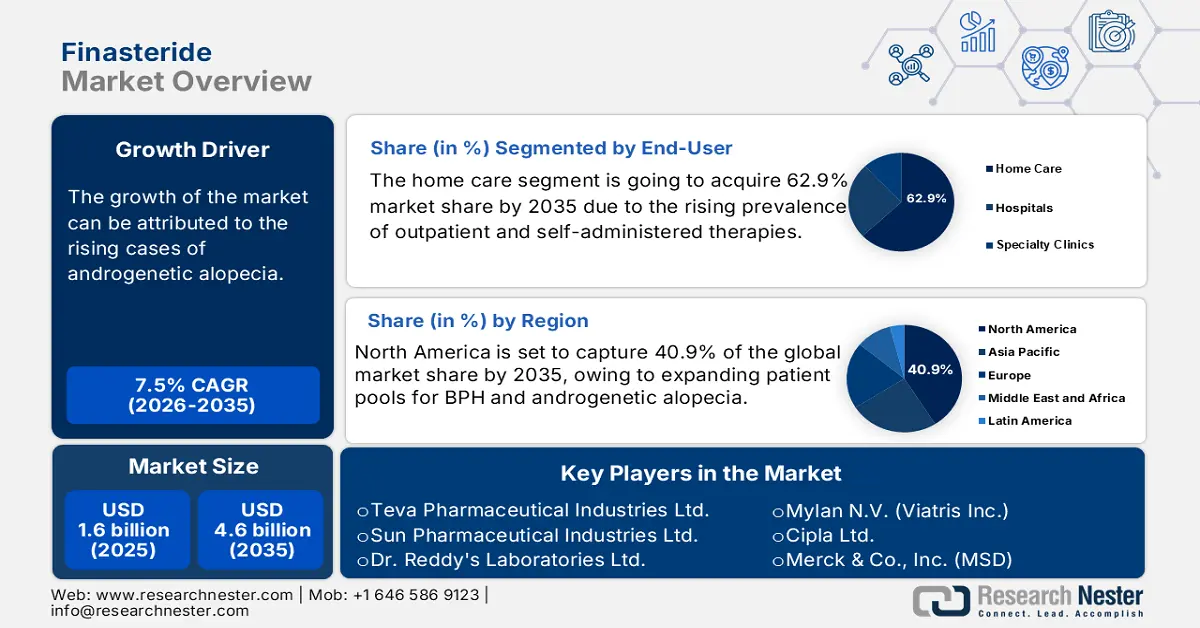

Finasteride Market size was valued at approximately USD 1.6 billion in 2025 and is projected to reach around USD 4.6 billion by the end of 2035, rising at a CAGR of approximately 7.5% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of finasteride is estimated at USD 1.7 billion in size.

The research and development in the market are mainly focused on increasing the efficacy and patient compliance with the help of innovative approaches. Prominent trends in the R&D incorporate the development of the advanced drug delivery system that renders sustained therapeutic effects. Moreover, researchers are scrutinizing various mechanisms of action that include protein degraders focused on hair loss. These efforts emphasize the development of a customized medicine strategy to provide tailored treatment on the basis of the individual genetic profiles.

On the production side, finasteride's active pharmaceutical ingredient is manufactured in India and China, while final product assembly and quality checking are executed in the U.S. and Europe under GMP-environmental conditions. The cost and supply of finasteride are generally affected by overall production costs and economic factors. Companies are taking various measures to maintain the supply chain dynamics for sustained growth. Some of the prominent steps are diversification of the supply chain and expanding the production capacity. Also, companies are focusing on exploring personalized medicine approaches to garner the attention of a large patient base.

Key Finasteride Market Insights Summary:

Regional Highlights:

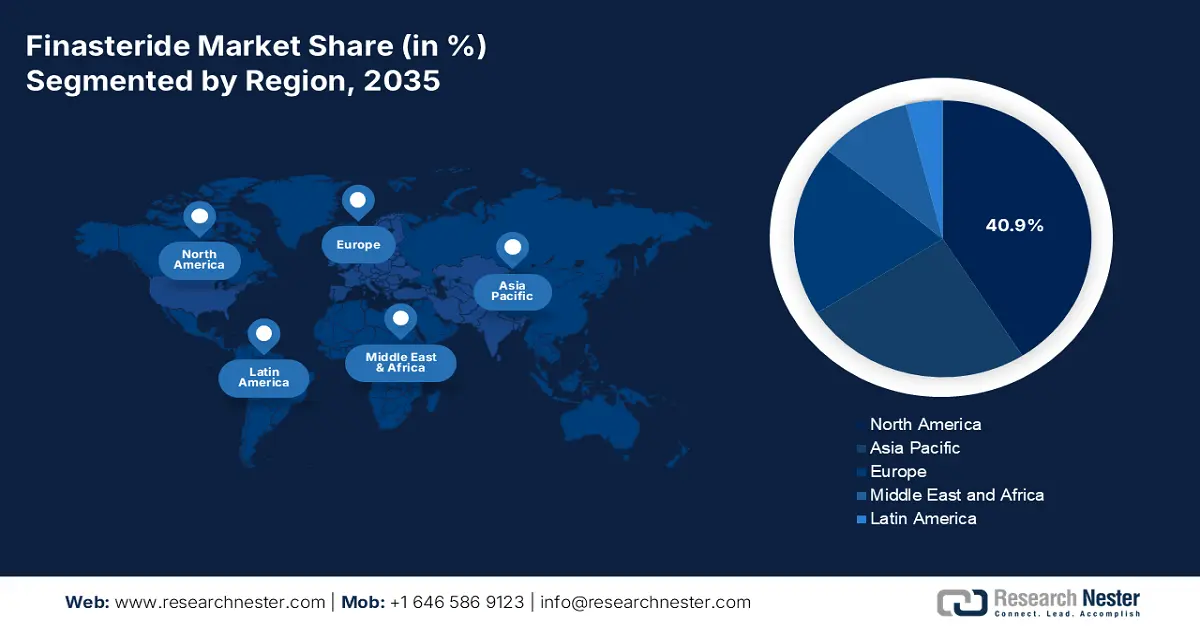

- North America is projected to hold a dominant 40.9% share of the finasteride market by 2035, owing to expanded reimbursement frameworks, high generic penetration, and the rise of telemedicine and e-pharmacy models.

- The APAC region is anticipated to witness the fastest growth by 2034, impelled by a growing patient base, enhanced healthcare accessibility, and increasing public expenditure on dermatology treatments.

Segment Insights:

- The home care segment in the finasteride market is projected to account for 62.9% share by 2035, propelled by the increasing adoption of self-administered therapies and rising online prescription refills.

- The androgenetic alopecia segment is expected to capture 58.7% share by 2035, driven by the growing prevalence of male hair loss and wider access to FDA-approved oral treatments.

Key Growth Trends:

- Increasing prevalence of the androgenetic alopecia

- Growing incidences of Benign Prostatic Hyperplasia

Major Challenges:

- Lack of health prioritization for males in national policies

Key Players: Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Mylan N.V. (Viatris Inc.), Cipla Ltd., Merck & Co., Inc. (MSD), Aurobindo Pharma Ltd., Lupin Ltd., Torrent Pharmaceuticals Ltd., Hikma Pharmaceuticals, Sandoz (Novartis Generics Division), Glenmark Pharmaceuticals, Zydus Lifesciences Ltd., Towa Pharmaceutical Co. Ltd., Apotex Inc., Daewoong Pharmaceutical, Biocon Ltd., Abbott Laboratories, Duopharma Biotech Berhad, Aspen Pharmacare

Global Finasteride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 9 September, 2025

Finasteride Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of the androgenetic alopecia: The incidence of the conditions treated by finasteride, i.e., BPH and androgenetic alopecia, is on the rise steadily. This increasing patient base points to the growing clinical demand for finasteride-based treatments throughout aging male populations within developed healthcare systems. According to data published by the government in July 2023, the androgenetic alopecia condition affects 50 million men and 30 million women in the U.S. As awareness of hair loss treatments grows, the demand for clinically proven solutions like Finasteride rises.

- Growing incidences of Benign Prostatic Hyperplasia: The demand for finasteride is rising with the rising occurrence of benign prostatic hyperplasia. According to the American Academy of Family Physicians in 2023, lower urinary tract symptoms from BPH were affecting nearly 38 million men of more than 30 years of age in the U.S. Finasteride can reduce prostate size and alleviate symptoms, making it a preferred treatment option, driving both prescription rates and market expansion. Also, with the rising life expectancy rate, a larger aging male population experiences symptoms like frequent urination and urinary retention.

- Rising growth of the telemedicine and online pharmacies: The rise in utilization of telemedicine platforms and the advent of e-pharmacies have made it easier for patients to access finasteride. Even in the regions with limited dermatology or urology clinics, online services can be provided. Online consultations have simplified the process of obtaining treatment. This convenience propels the number of patients who are willing to take therapy, expanding the reach of the finasteride. These factors are augmenting the market growth in both developed and emerging markets. Additionally, a number of pharmaceutical companies are investing in research and development to explore novel formulations.

Challenges

- Lack of health prioritization for males in national policies: The finasteride market expansion is due to the lack of male health prioritization in national policies in the healthcare sector. Various public health frameworks do not allocate any particular funding for addressing individuals or urological conditions, including BPH. For example, South Africa's recent National Health Strategic Plan has totally avoided the finasteride treatments, on the other hand, reducing access for low-and middle-income patients. The utilization of various treatments based on finasteride in basic healthcare packages is directly affected by this omission, which is indicative of a larger trend of underfunding in male health programs.

Finasteride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Finasteride Market Segmentation:

End-user Segment Analysis

Under the end-user segment, home care leads the segment and is anticipated to hold a share value of 62.9% by 2035. The sub-segment of home care will hold the greatest share among end users by 2035. According to the CDC report, outpatient and self-administered therapies are becoming more common treatments for BPH as well as hair loss among the population. The ease of long-term oral medication administration, along with growing prescription refills via online pharmacies, aids market growth. In addition, patient behavior in the post-pandemic era is inclined towards treatments undertaken at home and repeat e-prescription services. This shift aids a strong home care segment outlook, further complemented by digital health services and remote patient interaction.

Application Segment Analysis

In the application segment, androgenetic alopecia leads the segment and is anticipated to hold a share value of 58.7% by 2035. The sub-segment is expected to dominate the finasteride market by 2035, owing to the rising incidence of hair loss in men between the ages of 18 to 45. Moreover, growing usage of direct-to-consumer telehealth platforms and FDA approvals for oral treatments of hair loss have tremendously enhanced access. Generic finasteride tablets 1 mg have garnered widespread acceptance among patients and healthcare practitioners due to their cost efficiency and high therapeutic results.

Distributing Channel Segment Analysis

The specialty clinics subsegment is predicted to reach the largest share of the finasteride market during the forecasted period. These specialty centers have healthcare practitioners specializing in dermatology as well as urology. These places render focused treatment for conditions such as benign prostatic hyperplasia and androgenetic alopecia. In the current times, people are willing to have personalized care with modern diagnostic tools. This makes them a preferred place for patients looking for effective and specialized treatments. Moreover, the rise of telehealth platforms has further propelled the accessibility and appeal of specialty clinics, contributing to their anticipated dominance in the market.

Our in-depth analysis of the global finasteride market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Finasteride Market - Regional Analysis

North America Market Insights

The finasteride market in North America dominates the market and is expected to hold the market share of 40.9% by 2035. The market is fueled by expanding patient pools for BPH and androgenetic alopecia, broader reimbursement schemes, and high generic uptake. Rising prescription volume, telemedicine proliferation, and DTC e-pharmacy business models are the major drivers. Further, the U.S. Medicare and Medicaid expanded the coverage for finasteride, while Canada's public health system surged procurement for long-term home care use. Moreover, the competitive pricing and availability of the market are driven by the FDA-approved generics and Health Canada licensing.

The market in the U.S. reflects impressive demand across BPH patients. The market is supported by high-volume prescribing patterns, availability of FDA-approved generics, and widespread expansion of in direct-to-consumer (DTC) telehealth care. The American Hair Loss Association states that by the age of 35, 2/3rd of U.S. men will experience some extent of noticeable hair loss. Researchers are using finasteride on a wide level as an inhibitor that reduces dihydrotestosterone (DHT) levels, a hormone linked to hair follicle miniaturization in AGA.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the finasteride market and is expected to capture significant growth by 2034. The market is driven by an expanding patient population, growing healthcare access, and aggressive generic drug uptake. The increased incidence of androgenetic alopecia and benign prostatic hyperplasia (BPH) in elderly male populations aided regional governments in increasing public healthcare spending on dermatology treatments. Further, the clinical trials of new delivery methods and fixed-dose combinations are in progress across the region, which reflects continued R&D emphasis. The APAC market is also driven by accelerated urbanization and heightened health screening, contributing to early detection and long-term therapy compliance.

The market in India is set to register significant growth on the back of the rising presence of online platforms in the region. Also, there are rising efforts from the government to address the hair loss problem. The market in the country also gets benefits from a robust pharmaceutical industry that produces generic versions of finasteride. This makes the treatment more accessible and affordable for a larger segment of the population. The dominant market position is complemented by the cost-effective manufacturing platform and pro-export policies of India, which make it a prime supplier both of developed as well as emerging pharmaceutical markets.

Europe Market Insights

Europe's finasteride market is growing at a very high pace and is projected to capture a significant market share. Drivers of the market include aging male populations, higher diagnoses of benign prostatic hyperplasia (BPH) and androgenetic alopecia, and expanded insurance for generic treatments. Europe governments are incorporating finasteride into national lists of essential drugs, promoting the utilization of low-priced generics. The market is facilitated by robust regulatory systems and central price negotiation via Europe joint procurement arrangements. Finasteride's availability both within the public and private sectors of healthcare, specifically in the UK, Germany, France, Italy, and Spain, has driven increased volumes of prescriptions. Telemedicine take-up and electronic prescription models, particularly in Germany and France, have increased access further.

In Germany, there is a burgeoning awareness among the population about hair loss treatments. This awareness is resulting in higher acceptance and adoption of such treatments. Reimbursement policies guarantee drug expenditure for approved indications, and new digital health laws have surged the online provision of BPH drugs. The country boasts a well-developed healthcare infrastructure, ensuring feasible treatments. Also, the growth is propelled by the rising disposable income of the people in the country.

Key Finasteride Market Players:

- Teva Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Mylan N.V. (Viatris Inc.)

- Cipla Ltd.

- Merck & Co., Inc. (MSD)

- Aurobindo Pharma Ltd.

- Lupin Ltd.

- Torrent Pharmaceuticals Ltd.

- Hikma Pharmaceuticals

- Sandoz (Novartis Generics Division)

- Glenmark Pharmaceuticals

- Zydus Lifesciences Ltd.

- Towa Pharmaceutical Co. Ltd.

- Apotex Inc.

- Daewoong Pharmaceutical

- Biocon Ltd.

- Abbott Laboratories

- Duopharma Biotech Berhad

- Aspen Pharmacare

The global finasteride market is driven by the top pharma players in India due to their API production capacities, competitive pricing, and export regulatory approvals. Further, the U.S. and Europe companies maintain their brand value and distribution power, while Japan and South Korea players target domestic markets. Key strategies, including backward integration in API supply chains, product launches in topical formulations, and telehealth platforms, are used by the top players to increase patient reach. Leading players such as Teva, Sun Pharma, and Mylan are utilizing partnerships, biosimilar pipelines, and regulatory fast tracks to grow in regulated markets. Government-imposed price controls and generic adoption also fuel the market dynamics.

Below is the list of some prominent players operating in the global finasteride market:

Recent Developments

- In February 2025, Apotex expanded its branded dermatology portfolio through the in licensing of the Canadian rights to Seysara (sarecycline) and Finjuve (finasteride). Apotex's specialty pharma division is further expanding the company's branded dermatology portfolio.

- In June 2025, Torrent Pharmaceuticals announced a significant acquisition of a controlling stake in JB Chemicals & Pharmaceuticals from KKR, valued at approximately $3.01 billion on a fully diluted basis.

- Report ID: 2984

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Finasteride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.