Stem Cell Manufacturing Market Outlook:

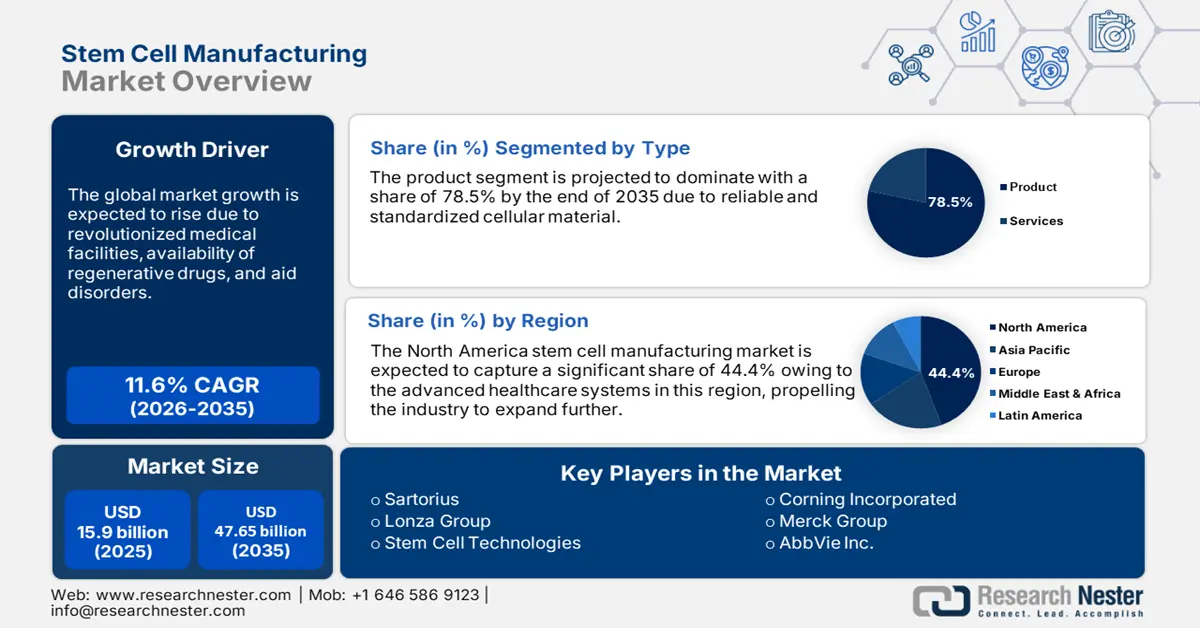

Stem Cell Manufacturing Market size was over USD 15.9 billion in 2025 and is anticipated to cross USD 47.65 billion by 2035, witnessing more than 11.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stem cell manufacturing is assessed at USD 17.56 billion.

The implementation of automation and system technologies is an effective approach toward the upliftment of the stem cell manufacturing market. For instance, the use of robotic arms can conduct a whole cell culture sub-process by maintaining consistent accuracy, focus, and speed, ultimately leading to increased process reliability and reduced variability. In January 2025, RoboSense launched "Hello Robot" at its global launch event comprising LiDAR development and intelligent robotics. The company unveiled EM4, E1R, and Airy- three high-performance digital LiDAR products, which are expected to boost the market.

Moreover, digitization is another factor that assists in improving and visualizing materials and the manufacturing process of stem cells. It creates a link to the inventory that includes change and warehouse control, staff mobilizing and scheduling plans, and optimizing real-time operation costs. For instance, a QbD approach requires a higher level of digitization for data management and integration of operation which is ideal and necessary for rapid cell manufacturing. As stated in the March 2023 IQIVA report, more than 60% of healthcare professionals require digital transformation and 65% are willing to adopt digital channels for regular activities, hence a positive outlook for the stem cell manufacturing market growth.

Key Stem Cell Manufacturing Market Insights Summary:

Regional Highlights:

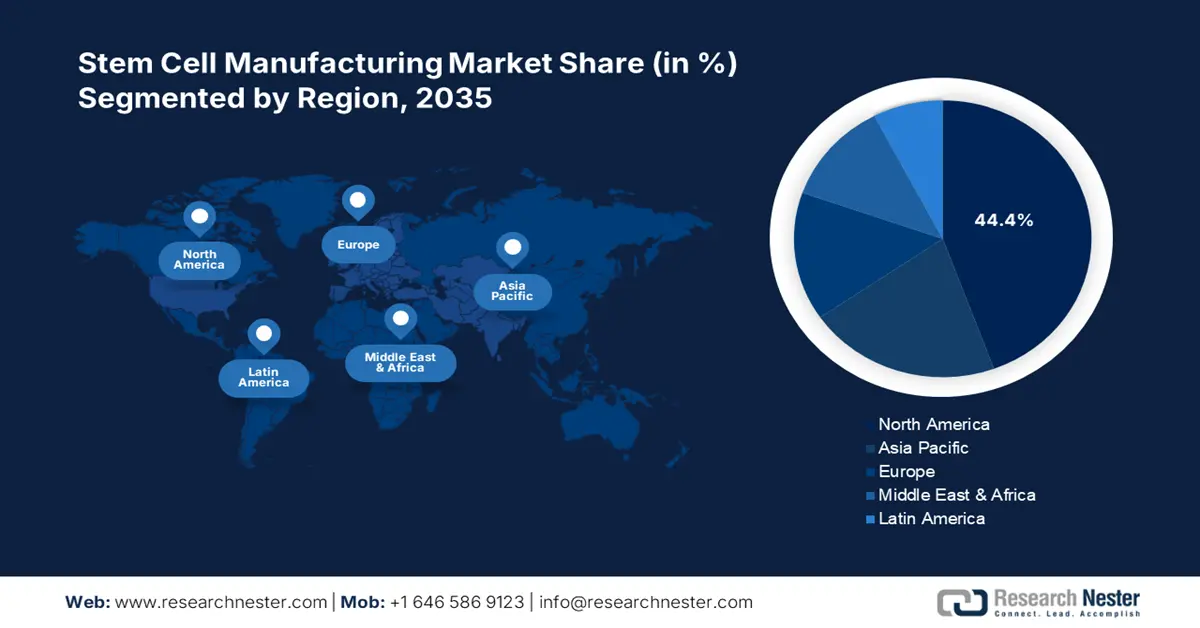

- North America leads the Stem Cell Manufacturing Market with a 44.4% share, driven by the presence of healthcare facilities accelerating adoption of latest stem cell therapeutics, ensuring strong growth through 2035.

- The APAC Stem Cell Manufacturing Market is anticipated to see lucrative growth by 2035, attributed to construction of medical centers and increased stem cell research proficiencies.

Segment Insights:

- Stem Cell Therapy segment is anticipated to hold around 47.5% share by 2035, driven by its ability to repair dysfunctional tissues using stem cells.

- The Product segment is projected to hold over a 78.5% share by 2035, fueled by the development of various cell-based therapy products.

Key Growth Trends:

- Rising incidence of chronic disorders

- Increased R&D for drug detection

Major Challenges:

- High cost

- Socio-ethical concern of human embryonic stem cells

- Key Players: Sartorius, BASF SE, Becton, Dickinson and Company, Lonza Group, Stemcell Technologies.

Global Stem Cell Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.9 billion

- 2026 Market Size: USD 17.56 billion

- Projected Market Size: USD 47.65 billion by 2035

- Growth Forecasts: 11.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Stem Cell Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

-

Rising incidence of chronic disorders: Noncommunicable diseases (NCDs) such as diabetes, respiratory issues, and cancer are leading causes of death across nations. The WHO 2024 report stated that approximately 18 million NCD deaths take place before the age of 70 years and out of these, 82% occur in low- and middle-income nations. Besides, as per the January 2023 NLM report, such conditions are poised to increase by 99.5%, that is accounting for 142.66 million by 2050 in the US. However, radiotherapy, psychological therapy, physical therapy, and surgeries can combat the occurrence, thus driving the stem cell manufacturing market.

- Increased R&D for drug detection: Biomedical innovation is modifying healthcare globally by launching the latest drugs through R&D funding. At present, the development costs have exceeded USD 3.5 billion per novel drug, along with 200 pharmaceutical firms, and over 80,000 clinical trials, as stated by Drug Discovery Today in their November 2024 report. In addition, disease understanding, improved decision-making, low regulatory thresholds, and advanced genetic knowledge are driving drug development, which eventually is expected to uplift the development of the stem cell manufacturing market.

Challenges

-

High cost: The value of stem cell therapy depends on several factors including type administration, quality and number of cells, laboratory locations, and stem cell source. Approximately, the charge of the therapy ranges between USD 5,000 to USD 50,000, as outlined by the DVC Stem in November 2024. Moreover, a single stem cell injection is valued at USD 4,000 with an additional cost of USD 800 for further injuries during the same session. In 2023, the most prevalent rate of the therapy, while utilizing an expanded cell product was between USD 15,000 to USD 30,000, hence a restraint for the stem cell manufacturing market.

- Socio-ethical concern of human embryonic stem cells: The process of isolating stem cells destroys human embryos due to which human embryonic stem cell (hESC) research is politically and ethically controversial. For instance, in Europe, the diversity of culture and society, the ethical acceptability of hESC does not exist. Overall, an embryo is regarded to constitute a moral status that is equivalent to the development of a human being. Owing to this, there are global debates that have resulted in constant changes in stem cell research, thus limiting the growth of the stem cell manufacturing market.

Stem Cell Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 15.9 billion |

|

Forecast Year Market Size (2035) |

USD 47.65 billion |

|

Regional Scope |

|

Stem Cell Manufacturing Market Segmentation:

Type (Product, Services)

Product segment is expected to capture over 78.5% stem cell manufacturing market share by 2035, based on the type. For instance, in December 2024, Thermo Fisher Scientific Inc. launched two latest products- the Gibco CTS Detachable Dynabeads CD4 and CTS Detachable Dynabeads CD8, to branch out innovative cell therapy. These products focus on the quality of cells and also create suitable workflow control, thus resulting in the maximization and potentiality of therapies to promote healthy lifestyles. Thereby, the development of various cell-based therapy products is positively boosting the market globally.

Application (Stem Cell Therapy, Drug Discovery and Development, Stem Cell Banking)

By the end of 2035, stem cell therapy segment is set to dominate around 47.5% stem cell manufacturing market share. According to the 2025 Mayo Clinic Organization, it is a constructive technique that repairs dysfunctional tissues by utilizing stem cells, ensuring organ transplantation with the use of cells instead of donor organs. It assists in aiding blood cancers with a success rate ranging between 60% to 70%, as reported by DVC Stem. Also, it is convenient for joint repairment, inflammatory, and autoimmune conditions, wherein the success rate is approximately 80%, thus an optimistic outlook on the market evolution.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stem Cell Manufacturing Market Regional Analysis:

North America Market Analysis

North America in stem cell manufacturing market is expected to hold over 44.4% revenue share by the end of 2035. According to the American Society of Hematology 2024 report, 13% of adults and 62% of children, undergoing is at risk of death. However, the presence of healthcare facilities has accelerated the adoption of the latest therapeutics from stem cells. For instance, the Dana-Farber Cancer Institute comprises the Connell and O'Reilly Families Cell Manipulation Core Facility (CMCF) program which processes 1,400 cellular products every year. This includes cellular therapies for over 600 pediatric and adult stem cell transplantations.

The U.S. stem cell manufacturing market is gaining traction due to the increasing awareness about stem cell transplantation. As per the 2025 Cleveland Clinic Organization report, nearly 18,000 people in the country are informed that they suffer from diseases that can be curable through a stem cell transplant. Besides, organizational investments in the country are also positively impacting the market. In February 2024, AstraZeneca funded USD 300 million to broaden its US manufacturing and ensure next-generation cell therapy discovery and evolution, resulting in the provision of over 150 job offers in manufacturing T-cell therapy.

Stem Cell Transplant Success Rate

|

Diseases |

Success Rate |

|

Multiple myeloma |

79% |

|

Hodgkin lymphoma |

92% |

|

Non-Hodgkin lymphoma |

72% |

Source: Cleveland Clinic Organization 2025

The stem cell manufacturing market in Canada is witnessing significant growth owing to a rising focus on personalized medicines, partnerships between contract manufacturers and biotechnology companies, and the regulatory environment. As per the BioMed Central Ltd July 2023 report, iPSC-based personalized medicine has been identified in Canada as a variant-preferred healthy control line. This acted as a solution to establish blood banks for donors and ensured the treatment of neonates with genetic diseases or congenital difficulties. Therefore, such types of personalized drugs are tailored to the environmental, genetic, and clinical features of patients.

APAC Market Statistics

The stem cell manufacturing market in APAC is the fastest-growing region and is poised to gain traction by the end of 2035. The aspect of constructing medical centers and providing stem cell research proficiencies is high driving the market upliftment. The success rate of this therapy is 65% to 85% in India and China has 200 clinical trials pertaining to the therapy. Hence, all these aspects are highly responsible for the market to flourish in the future.

The stem cell manufacturing market in India is anticipated to experience substantial growth since there is still investigation going on and the administrative body is showing support to clinical and pre-clinical researchers. As per the Indian Journal of Hematology and Blood Transfusion June 2024 report, haploidentical hematopoietic stem cell transplantation (HSCT) has escalated to 683 cases, accounting for 35% of pediatric and 26% of adult allogeneic HSCTs. Additionally, there has been a surge in matched unrelated donor (MUD) HSCT from 76 to 157 cases, due to which transplant facilities have increased from 37 to 114 in the country. All these developments are constituting a positive impact on the market upliftment.

The stem cell manufacturing market in China is gaining traction owing to advancements in cell therapies. As stated in The Lancet Haematology December 2022 report, chimeric antigen receptor (CAR), daratumumab, blinatumomab, and tyrosine kinase inhibitors (TKIs) are modern techniques to aid patients in China with haematological malignancies. Besides, the Administrative Measures on Stem Cell Clinical Research (AMSCCR) in the country ensures strategies for clinical research of stem cells. The regulatory body has ensured that mesenchymal stem cells (MSCs) constitute 83.3% of cell research, thus an effective therapy to overcome disorders.

Key Stem Cell Manufacturing Market Players:

- Sartorius

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Becton, Dickinson and Company

- Lonza Group

- Stemcell Technologies

- Corning Incorporated

- Merck Group

- Thermo Fisher Scientific

- AbbVie Inc.

- Accegen

- Bioserve India

- Pluri Inc.

Companies dominating the stem cell manufacturing market are gaining rapid exposure due to the increase in demand for stem cells for cancer treatment as well as regenerative therapies. In addition, the launch of products and services by organizations through collaborations and agreements is also driving market growth. For instance, in July 2024, Qkine reported its partnership with StemCultures to merge its complex protein manufacturing and engineering with StemCultures’ proprietary controlled-release technologies to provide current reagents for precision stem cell differentiation and expansion.

Recent Developments

- In July 2024, Bioserve India launched the latest stem cell products from REPROCELL to contribute towards drug development and scientific research through innovation and ensure advancements in therapeutic discovery and regenerative medicine.

- In January 2024, Pluri Inc. declared the inauguration of a business division to offer cell therapy manufacturing services as a Contract Development and Manufacturing Organization (CDMO): PluriCDMO.

- Report ID: 7162

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stem Cell Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.