Non-woven Abrasives Market Outlook:

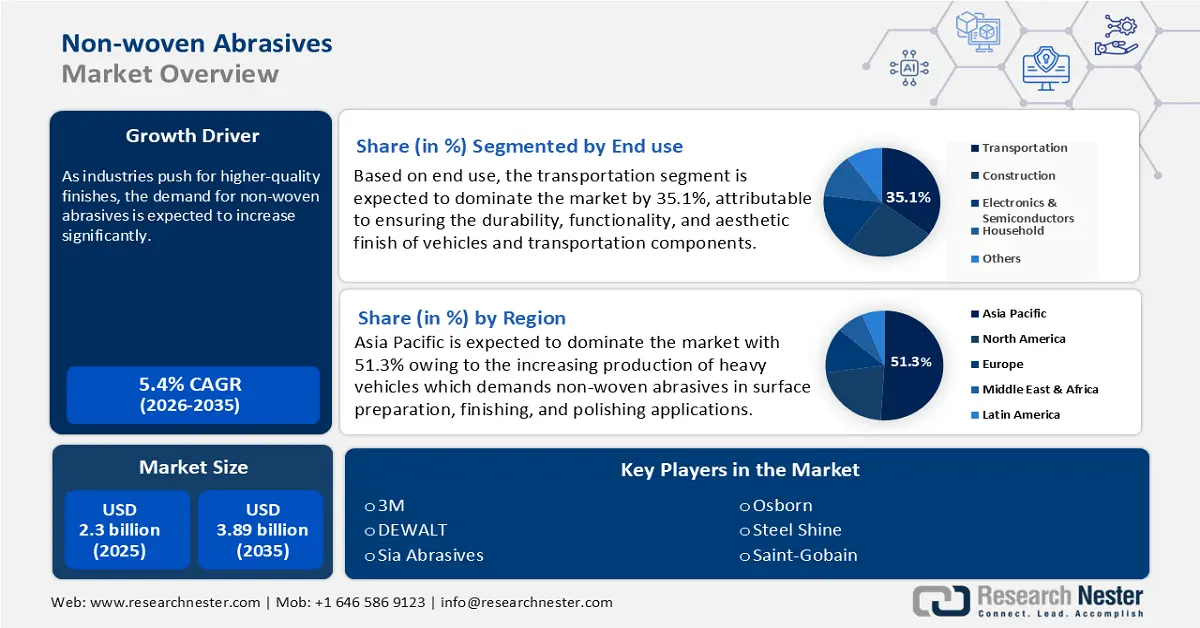

Non-woven Abrasives Market size was valued at USD 2.3 billion in 2025 and is expected to reach USD 3.89 billion by 2035, registering around 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-woven abrasives is evaluated at USD 2.41 billion.

The market is expanding significantly due to the diversification in market activities such as automotive, metalworking, aerospace, and electronics. For instance, in February 2022, Carborundum Universal Ltd. announced the purchase of Rhodius Abrasives for USD 62 million. With Rhodius' extensive operational base and global product distribution, the acquisition was made to improve the acquirer's technological and geographic access in the non-woven abrasives market.

In addition, the increased trend in automation of manufacturing processes and achieving high-quality finish without loss in time and cost efficiency pushes the demand for non-woven abrasives. For instance, in April 2022, Saint-Gobain Abrasives unveiled the new Norton Abrasive Process Solutions (APS) Program. The program assisted clients in selecting the best grinding and finishing option for the application, whether it be automated or off-hand, simple or complex for any abrasive operation. The APS Program utilizes the expertise of the Norton team, and access to 30 distinct machines using cutting-edge APS Robotic Automation Cell at the Higgins Grinding Technology Center. Advances in technology and material science continue to enhance the effectiveness of Non-woven abrasives, making them crucial for precision and reliability.

Key Non woven Abrasives Market Insights Summary:

Regional Highlights:

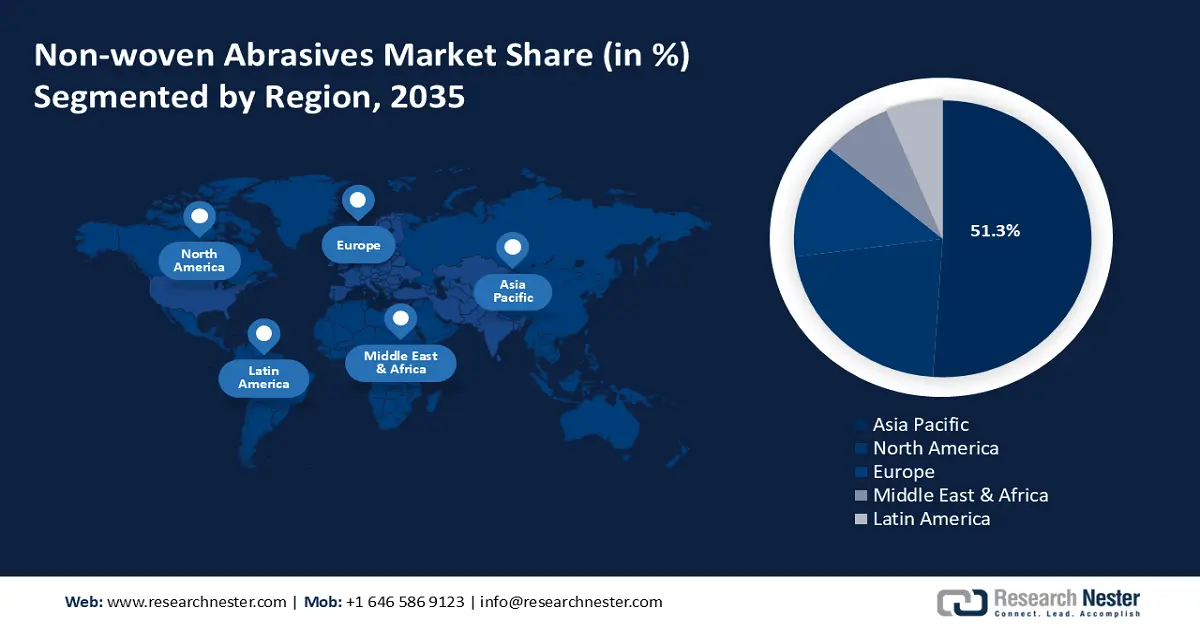

- Asia Pacific dominates the Non-woven Abrasives Market with a 51.3% share, driven by rapid industrialization and investments in automotive, electronics, and construction industries, positioning it as a global leader through 2026–2035.

- North America's Non-woven Abrasives Market is expected to grow steadily by 2035, driven by the increasing demand for strong, durable products and the trend of automation in manufacturing operations.

Segment Insights:

- The Disc Non-woven Abrasives segment is expected to experience high growth from 2026 to 2035, driven by its versatility and effectiveness in a wide range of applications.

- Transportation Non-woven Abrasives segment are forecasted to achieve 51.3% market share by 2035, driven by consistent results and minimal surface damage in vehicle manufacturing.

Key Growth Trends:

- Demand for high-quality surface finishes

- Shift towards automation and efficiency

Major Challenges:

- Raw material price fluctuation

- Competition from alternative abrasive materials

- Key Players: 3M, PFERD, Mirka Ltd., TGA Abrasives, Osborn, Steel Shine.

Global Non woven Abrasives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.41 billion

- Projected Market Size: USD 3.89 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (51.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Non-woven Abrasives Market Growth Drivers and Challenges:

Growth Drivers

- Demand for high-quality surface finishes: The surging demand for quality surface finishes catalyzes the non-woven abrasives market mainly due to a preference for product aesthetics as well as performance across industries. For instance, in February 2024, Grinding Techniques’ latest range includes non-woven abrasives, composed of abrasive grains fused to three-dimensional support of nylon fibers that can range from silicon carbide to aluminum oxide or ceramic alumina. It provides a consistent finish throughout the product’s lifetime by significantly reducing steps in the perfect finish. Non-woven abrasives offer a versatile solution that promises consistent and uniform finishes on surfaces. This capability affects the durability of products and customer satisfaction.

- Shift towards automation and efficiency: To fill the gaps created in the operations with new manufacturing systems, there is a rise in the demand for non-woven abrasives to meet emerging automation needs. For instance, in August 2021, Trutzschler Nonwovens developed a carded pulp (CP) solution for more economically and sustainable, non-man-made-fiber nonwoven. Utilizing AquaJet spunlaced technology in response to the growing demand for premium, single-use cleaning wipes. These materials provide significant adaptability and effectiveness in automated applications with their ability to deliver uniform surface finishes.

Challenges

- Raw material price fluctuation: Most synthetic fibers and abrasives used for non-woven materials are commodities sensitive to raw material price fluctuations. This results in increased production costs, which might then be transferred to consumers, influencing the price competitiveness of products derived from non-woven abrasives. Moreover, raw material price fluctuations can bring about disparities in quality and supply chain stability for manufacturers, since they may interfere with production schedules and levels of profit. Such uncertainty calls for strategic sourcing and inventory management, which complicates planning operations within companies in the market.

- Competition from alternative abrasive materials: The other significant challenge against non-woven abrasives is fierce competition by alternative abrasive materials. The advent of more advanced abrasive technologies that offer comparable or even superior performance at arguably lower cost, complex the market landscape. Therefore, ceramic and diamond abrasives become a favorite for tough and more efficient applications, hence more potential customers that use abrasive systems in search of cost-efficient solutions for their products without jeopardizing quality. The manufacturers are compelled to develop innovative products with ease of use to sustain in the market.

Non-woven Abrasives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.89 billion |

|

Regional Scope |

|

Non-woven Abrasives Market Segmentation:

End use (Transportation, Household, Electronic & Semiconductors, Construction, Other End uses)

Transportation segment is poised to account for more than 51.3% non-woven abrasives market share by the end of 2035. The ability of non-woven abrasives to give consistent results and minimize damage to surfaces makes them particularly valuable in the manufacturing process of vehicles and aircraft, where safety and aesthetic value assume importance. This creates a surge to bring better quality in the performance, propelling more investments on R&D in this sector. Furthermore, technological improvements in electric and hybrid automobile systems are forcing innovation within surface treatment processes, thereby further strengthening the transportation segment's leading position in the global market.

Product (Hand Pads & Rolls, Belts, Discs, Rolls, Wheels)

The disc segment of the non-woven abrasives market is expected to be highly growing due to the versatility and effectiveness of a wide range of applications. The disc design enables non-woven abrasives to be easily attached to power tools, thus assuring smooth flow and uniform results, something critical in a high-demand manufacturing environment. For instance, in January 2024, Saint-Gobain Abrasives introduced Norton RazorStar Fiber Discs, Quick-Change Discs, and Belts with creatively engineered shaped ceramic grains. This revolutionary technology offers unparalleled performance even in the most demanding grinding applications. Besides, increasing interest in the automated world and the booming use of robots within manufacturing lines, these non-woven abrasive discs continue their strong foothold in the market.

Our in-depth analysis of the global market includes the following segments:

|

End use |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-woven Abrasives Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific in non-woven abrasives market is set to dominate around 51.3% revenue share by the end of 2035. The rapid industrialization and investments in automotive, electronics, and construction industries with surface finishing requirements to improve product performance and aesthetics. The focus of the region on adopting advanced manufacturing technologies and a growing concern with efficiency and productivity is driving the requirement for non-woven abrasives. Asia Pacific, therefore, emerges as a crucial participant in the global scenario.

China remains a vividly growth-oriented market in non-woven abrasives, mainly on account of its manufacturing hub. Such an extensive base of industry creates a huge demand for top surface finishing solutions. A greater emphasis on product quality and efficiency along with innovations in manufacturing technologies, are the two factors that drive the adoption of the non-woven abrasives. Moreover, initiatives by the government to encourage innovation and sustainability focus on the development of advanced non-woven abrasive products, thus positioning China in a prominent position within the global market.

India is a rapidly evolving market driven predominantly by the increasing ambition of the manufactures to expand their operations and deliver the supreme materials. For Instance, in May 2023, Sak Abrasives announced the acquisition of Jowitt and Rodgers Co. The company produces resin-bonded grinding discs, wheels, automotive parts, cutlery, and bearings. This acquisition is anticipated to increase the market presence of the company in the U.S. brightening the prospect of India in the market.

North America Market Analysis

The non-woven abrasives market in North America is expected to be one of the emerging regions in the future, driven by the increasing demand for strong, durable products along with stringent governmental regulations involving manufacturing processes promote the necessity for reliable abrasive solutions. Moreover, an increased trend of automation in manufacturing operations further increases the need for non-woven abrasives, and that places North America in a very crucial position in global affairs.

The U.S., market exists under the auspices of an overwhelming demand from the advanced manufacturing sector primarily in aerospace, automotive, and metalworking industries. The emphasis on attaining good-quality surface finishes and high performance leads to the adoption of non-woven abrasives as their exceptional performance and versatility are at par with no other material. Moreover, environmentally friendly, recyclable abrasive materials are being adopted as a result of growing environmental concerns in the country.

In Canada, the non-woven abrasives market is primarily influenced by the expansion of the country's manufacturing sector. In addition, the approach toward sustainability and the eco-friendliness of the manufacturing processes is working for the implementation of non-woven abrasives and assisting Canada to be the emerging leader in the market. In addition, the ecosystem and regulatory environment supports the growth of Non-woven abrasives in the country.

Key Non-woven Abrasives Market Players:

- Saint-Gobain

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- DEWALT

- Carborundum Universal Limited (CUMI)

- Sia Abrasives

- PFERD

- Mirka Ltd.

- TGA Abrasives

- Osborn

- Steel Shine

The landscape in the companies of the market for non-woven abrasives is more of a mix of old and new manufacturers. Companies are exploring opportunities to innovate and improve their product offerings to cater to rising consumer preferences. For instance, in August 2023, 3M unveiled its latest abrasive robotics laboratory in Bengaluru, India. This facility represents the company’s 17th installation worldwide and is a strategic response to the burgeoning demand and is expected to play a pivotal role in advancing 3M’s research and development capabilities in abrasive technologies. catering to the specialized needs of the industry. Here's the list of some key players:

Recent Developments

- In August 2024, Saint-Gobain Abrasives initiated the construction of a new administration building for non-woven abrasives in Worcester, Massachusetts. The 47,000-square-foot structure will use Saint-Gobain's sustainable solutions to demonstrate the company's dedication to sustainability.

- In June 2023, Saint-Gobain Abrasives entered a new partnership with Dedeco. The new agreement focused on the Saint-Gobain abrasives supply chain for a sunburst line of thermoplastic-bonded abrasives to its North America customers, expanding its portfolio of abrasives across industrial markets.

- Report ID: 6795

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non woven Abrasives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.