Xenon Gas Market Outlook:

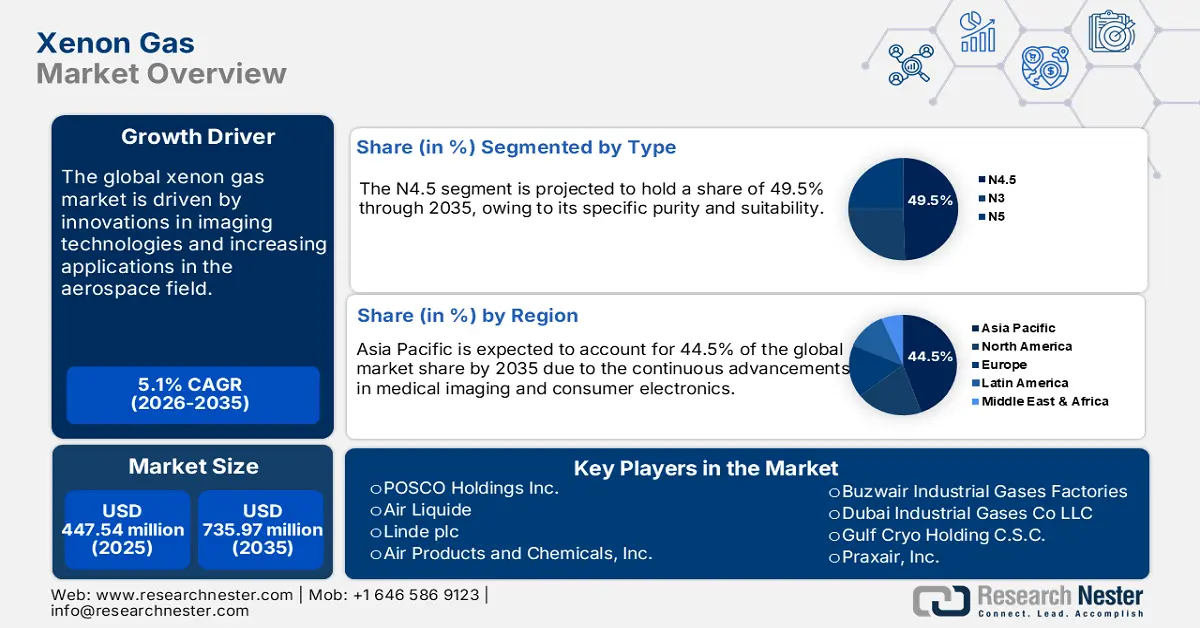

Xenon Gas Market size was over USD 447.54 million in 2025 and is projected to reach USD 735.97 million by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of xenon gas is evaluated at USD 468.08 million.

The continuous innovations in semiconductor manufacturing are set to drive the sales of xenon gas in the years ahead. The widespread use of xenon gas in semiconductor fabrication processes, such as EUV lithograph and plasma etching, is directly augmenting the revenues of key market players. For instance, the Semiconductor Industry Association (SIA) study states that the global sales of semiconductors reached USD 54.9 billion in February 2025, a rise of 17.1% compared to the previous year.

The robust demand for advanced consumer electronics is also fueling the application of xenon gas. Smartphones, TVs, computers, and wearables’ increasing sales are creating a profitable environment for xenon gas manufacturers. The smart home trend is set to amplify the sales of xenon gas during the foreseeable period. North America and European countries are more ahead in the adoption of smart home ecosystems than other regions, which is expanding the production operations of xenon gas in these areas. The World Economic Forum (WEF) estimates that the number of smart big appliances is expected to reach 177.6 million units by 2027 from 73.1 million units in 2022.

Key Xenon Gas Market Insights Summary:

Regional Highlights:

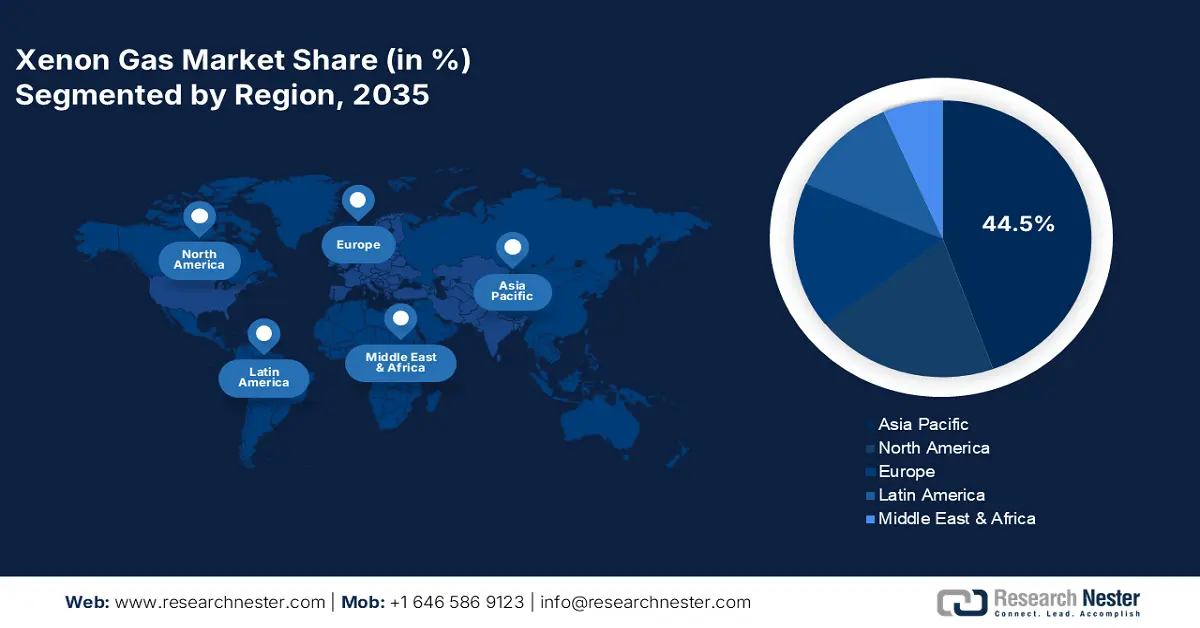

- Asia Pacific dominates the Xenon Gas Market with a 44.5% share, driven by rising industrial and urban activities and innovations in electrical and medical technologies, ensuring robust growth through 2026–2035.

- North America’s xenon gas market is poised for rapid growth by 2035, driven by collaborations between high-tech and aerospace firms and the expanding automotive sector.

Segment Insights:

- The Lighting Segment is projected to achieve a 35.6% share by 2035, fueled by innovations in energy-efficient lighting and zero-emission vehicle trends.

- The N4.5 Segment is projected to hold a 49.5% share by 2035, fueled by growing demand for N4.5 xenon in energy-efficient building technologies and semiconductors.

Key Growth Trends:

- Innovations in imaging technologies

- Emerging applications in aerospace and satellite

Major Challenges:

- Energy and capital-intensive business

- Regulatory challenges increase operational costs

Key Players: POSCO Holdings Inc., Air Liquide, Linde plc, Air Products and Chemicals, Inc., and Messer Group.

Global Xenon Gas Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 447.54 million

- 2026 Market Size: USD 468.08 million

- Projected Market Size: USD 735.97 million by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Xenon Gas Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in imaging technologies: The increasing use of xenon gas in the manufacturing of medical imaging technologies, including MRI and CT scans, is likely to propel the profits of key producers in the years ahead. Xenon gas’s ability to improve image clarity and offer neuroprotective effects is increasing its application in healthcare systems. Technological advancements are anticipated to drive innovations in xenon-based imaging technologies. In June 2023, Philips N.V. revealed that its breakthrough xenon-enabled MRI, combined with Polarean’s XENOVIEW, is offering enhanced regional maps of ventilated patients’ lungs for better disease management.

- Emerging applications in aerospace and satellite: The producers of xenon gas are estimated to benefit from the growing applications of this rare gas in aerospace and satellite technologies, such as ion propulsion systems in spacecraft. The rising investments in space missions and launches are likely to amplify the demand for xenon gas during the forecast period. In July 2024, SpaceX announced the launch of the Turksat 6A mission. The satellite of this company uses xenon gas-powered hall-effect propulsion motors for in-orbit maneuvers. Such innovations are offering double-digit percent revenue growth opportunities to xenon gas manufacturers.

Challenges

- Energy and capital-intensive business: The xenon gas production is an energy-intensive process, as the extraction is performed in the atmospheric environment. This increases the overall production costs and challenges new market entries. The small-scale companies hesitate to expand their production capacities due to limited budgets. Strategic partnerships and collaborations aiming for a joint venture are estimated to overcome these issues in the years ahead.

- Regulatory challenges increase operational costs: The strict environmental regulations are also expected to challenge the revenue growth of the xenon gas manufacturers. The xenon gas production and applications potentially harm the ozone layer. Furthermore, the compliance with the strict regulations increases the operational costs and limits the revenue cycle. The integration of sustainable production technologies is seen to aid market players in aligning with the environmental goals.

Xenon Gas Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 447.54 million |

|

Forecast Year Market Size (2035) |

USD 735.97 million |

|

Regional Scope |

|

Xenon Gas Market Segmentation:

Type (N3, N4.5, N5)

The N4.5 segment is anticipated to capture 49.5% of the global xenon gas market share throughout the forecast period. Its specific purity and suitability in several applications, such as modern optical solutions and semiconductors, are boosting the demand for N4.5 xenon gas. The energy-efficient buildings are also driving high sales of N4.5 xenon. The growth in green construction across the world is further creating a profitable environment for N4.5 xenon producers. The global green building materials market is projected to record sugnificant growth during the forecast period. The rise in the sales of insulating windows and glass facades is foreseen to propel the demand for N4.5 xenon gas.

Application (Lighting, Medical, Aerospace, Lasers & Imaging)

The lighting segment is expected to account for 35.6% of the global xenon gas market share through 2035. Innovations in high-intensity discharge lamps and automotive headlights are primarily fueling the sales of xenon gas. The sustainability trend and increasing adoption of zero-emission vehicles are poised to drive the applications of xenon gas in energy-efficient lighting technologies. According to ENERGY STAR, energy-efficient lighting can use up to 90 % less energy and lasts at least 15 times longer than conventional lighting. Thus, zero mission goals are poised to fuel the sales of xenon-based lighting solutions in the coming years.

Our in-depth analysis of the global xenon gas market includes the following segments:

|

Type |

|

|

Purity |

|

|

Packaging |

|

|

Application |

|

|

End use Industry |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Xenon Gas Market Regional Analysis:

Asia Pacific Market Forecast

The Asia Pacific xenon gas market is estimated to hold 44.5% of the global revenue share by 2035. The swift rise in industrial and urban activities, which are driving high applications of electrical technologies, is poised to fuel the sales of xenon gas in the coming years. Continuous innovations in medical technologies and electrical applications are foreseen to propel the applications of xenon gas. China and India’s dominance in the electrical devices trade and the technological supremacy of South Korea and Japan are further opening lucrative doors for xenon gas producers.

China’s increasing leadership in electronics and semiconductor manufacturing is set to amplify the sales of xenon gas. The report by the Observatory of Economic Complexity (OEC) estimates that the country exported around USD 48.4 billion of semiconductor devices in 2024. The top export economies were Hong Kong (USD 9.14 billion), the Netherlands (USD 4.79 billion), India (USD 3.81 billion), Brazil (USD 2.67 billion), and Pakistan (USD 2.0 billion). The same source also states that China captured 40.3% of the global semiconductor device export share in 2024.

The increasing investments in medical technology manufacturing are expected to increase the application of xenon gas in India. The expanding production units of xenon gas manufacturers in the country, owing to supportive government policies, are likely to augment the overall market growth during the forecast period. The India Brand Equity Foundation (IBEF) study highlights that the size of the medical devices market is likely to cross USD 20.5 billion by 2029. The country accounts for around 2.0% of the global medical device market share. Furthermore, India’s medical technology and diagnostic equipment markets are set to reach USD 50.0 billion by 2030 and USD 6.0 billion by 2027.

North America Market Statistics

The North America xenon gas market is foreseen to increase at the fastest pace from 2025 to 2035. The strong presence of industry giants is significantly driving the sales of xenon gas in the region. The increasing collaborations between high-tech companies and aerospace manufacturers are foreseen to propel the applications of xenon gas. The expanding automotive sector, coupled with the customization trend, is propelling the sales of xenon gas. The rising adoption of smart home ecosystems in both the U.S. and Canada is also set to increase the adoption of xenon-powered appliances.

The high-tech companies of the U.S. are fueling the use of xenon gas in aerospace and defense technologies. The xenon-powered aerospace technologies are more efficient and effective than their conventional counterparts. The Aerospace Industries Association (AIA) states that the country’s aerospace and defense sector totaled USD 955.0 billion in sales in 2023. The commercial direct sales crossed USD 311.0 billion, and the supply chain amounted to USD 422.0 billion in sales output during the same year.

The robust rise in the demand for electric vehicles, mainly due to the sustainability trend, is increasing the sales of xenon-based lighting technologies in Canada. The country’s growing dominance in the clean energy sector is fueling the use of xenon in the production of energy-efficient automotive lighting solutions. The registrations of zero-emission vehicles in the country increased from 48,411 units in Q1’24 to 81.204 units by Q4’24, according to Statistique Canada. The majority of registrations were observed in Quebec, Ontario, and British Columbia.

Key Xenon Gas Market Players:

- POSCO Holdings Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide

- Linde plc

- Air Products and Chemicals, Inc.

- Messer Group

- Iceblick Ltd.

- Proton Gases Pvt. Ltd.

- Coregas Pty Ltd.

- Matheson Tri-Gas, Inc.

- Electronic Fluorocarbons LLC

- American Gas Products

- RasGas Company Limited

- Bhuruka Gases Ltd.

- Buzwair Industrial Gases Factories

- Dubai Industrial Gases Co LLC

- Gulf Cryo Holding C.S.C.

- Praxair, Inc.

The leading companies in the xenon gas market are employing several organic and inorganic tactics to double their revenue growth. Technological advancements, new product launches, strategic collaborations & partnerships, mergers & acquisitions, and global expansions are some of them. The collaboration with end use industries is leading to the introduction of innovative xenon gas-based products. Organic marketing tactics are poised to offer a double-digit percent revenue growth to xenon gas manufacturers. Entering into untapped markets is also estimated to double the revenue of key market players in the years ahead.

Some of the key players include in xenon gas market:

Recent Developments

- In January 2025, Mass General Brigham Incorporated announced that its new research, along with Washington University School of Medicine, explored the novel and noble approach of xenon gas in medical science. The findings reveal that this rare gas has the potential to protect against Alzheimer’s Disease.

- In September 2024, POSCO Holdings Inc. announced the launch of POSCO Zhongtai Air Solution. Through this launch, the company is expanding its operations in the high-purity rare gas (neon, xenon, and krypton) production business.

- Report ID: 7606

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Xenon Gas Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.