Metabolic Panel Testing Market Outlook:

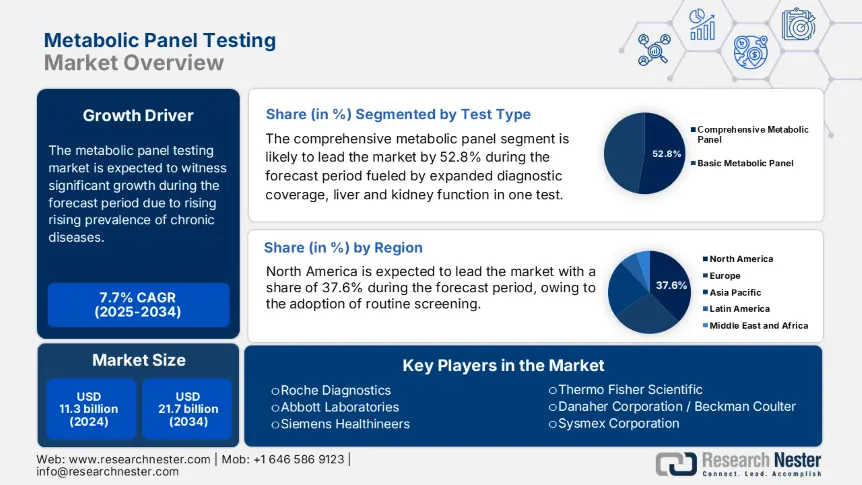

Metabolic Panel Testing Market size was valued at USD 11.3 billion in 2024 and is projected to reach USD 21.7 billion by the end of 2034, rising at a CAGR of 7.7% during the forecast period (2025-2034). In 2025, the industry size of metabolic panel testing is evaluated at USD 12.2 billion.

The global market is fueled by the rising prevalence of chronic diseases, including kidney disorders, liver dysfunction, and diabetes. As per the CDC report, nearly 37.7 million people in the U.S. are experiencing diabetes, and 96.5 million adults are prediabetic. These two populations in the U.S are strictly made to follow the metabolic panel screening. Further, the National Kidney Foundation has stated that 1 in 4 people in America are at high risk of kidney disease, making demand for these diagnostic and treatment surgeries. Moreover, the increasing conditions of liver disorder, endocrine dysfunction, and electrolyte imbalances provide an expanded utilization of tests mainly among aging and health issues-related populations.

On the supply chain side, the metabolic panel testing services depend on the seamless coordination among the analyzer manufacturers, regent production, and electronic consumable sourcing. As per the U.S. Census Bureau trade data, most of the diagnostics reagents and instruments are imported, which is nearly USD 6.7 billion from Switzerland and Germany. The producer price index in the U.S rose by 3.5% YoY for medical and diagnostic laboratory, while the consumer price index increased by 3.1% for medical care commodities in April 2025. In the research, development, and deployment, NIH allocated USD 1.5 billion in 2024 in diagnostic-based research. In 2024, intra-EU commerce in diagnostic kits grew 7.9% year over year, according to European Commission customs statistics, demonstrating the bloc's robust demand and unified sourcing practices.

Metabolic Panel Testing Market - Growth Drivers and Challenges

Growth Drivers

- Government spending via Medicare: The U.S. spending on the market has reached USD 1.4 billion under codes 80053 and 80048. These treatments are used for monitoring and diagnosing chronic diseases such as liver, diabetes, and kidney disorders. The CMS makes a routine metabolic screening under Medicare Part B, ensuring the accessibility of patients with chronic conditions. It is anticipated that government funding for high-volume testing and continuous reimbursement schemes would increase in favor of preventative diagnostics.

- Healthcare quality improvement: According to the AHRQ report, the regular application of metabolic panel testing in screening for chronic disease resulted in a 12.3% decrease in hospitalization within two years. The quality improvement program saved approximately $490 million in preventable healthcare expenses. The study points towards the importance of early detection of renal, hepatic, and metabolic derangements in the prevention of long-term complications. Standard diagnostics are incorporated into chronic disease guidelines today, and they have been found to be clinically useful and cost-effective measures in enhancing outpatient management results.

Historical Patient Growth & Its Impact on Market Dynamics

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 (Millions) |

2020 (Millions) |

% Growth (2010–2020) |

|

U.S |

47.5 |

68.1 |

43.9% |

|

Germany |

15.6 |

22.5 |

47.9% |

|

France |

13.9 |

19.6 |

40.6% |

|

Spain |

8.4 |

12.8 |

52.8% |

|

Australia |

4.7 |

6.9 |

49.2% |

|

Japan |

25.2 |

32.2 |

27.9% |

|

India |

28.8 |

58.3 |

104.3% |

|

China |

49.9 |

108.6 |

118.5% |

Strategic Expansion Models for Metabolic Panel Testing Market

Feasibility Models for Revenue Growth

|

Country |

Expansion Model |

Revenue Impact (2022–2024) |

Key Drivers |

|

India |

Public-Private Partnerships (PPPs) with diagnostic labs under Ayushman Bharat |

+12.8% |

MoHFW schemes expanded free diagnostic coverage; public lab capacity doubled between 2020–2024. Large test volumes reduced per-unit supplier cost. |

|

China |

County-level government procurement & Ministry of Health lab alliances |

+14.4% |

Tier 2–3 cities received increased diagnostics investment; NHC programs funded $1.2B in decentralized lab infrastructure between 2022–2024. |

|

U.S. |

Preventive care diagnostic bundles under Medicare Part B; DTC lab expansion |

+14.6% |

CMS allowed reimbursements for CMP/BMP in chronic disease programs; Telehealth testing adoption rose 28% YoY from 2022–2023. |

|

Germany |

DRG-based procurement of analyzers in public hospitals |

+9.5% |

Destatis reported a 17% increase in centralized lab automation tenders post-2021; reagent-volume contracts optimized supplier pricing. |

|

France |

Reagent co-financing under public insurance with centralized hospital procurement |

+10.3% |

INSEE noted 92% public hospital participation in national reagent bundling contracts; cost-sharing model enhanced supply chain feasibility. |

|

Japan |

Volume-based supplier contracts under national insurance system |

+6.6% |

MHLW included CMP testing in bundled geriatric screening; large-volume hospital deals enhanced long-term vendor contracts. |

|

Australia |

Routine screening funding through Medicare + Chronic Disease Management (CDM) plans |

+9.2% |

AIHW reported 33% increase in preventive testing between 2021–2024; outpatient metabolic screening included in CDM funding structure. |

Challenges

- Regulatory approval delays: Many robust national regulations delay the approval of diagnostic tools. According to Japan’s Ministry of Health, Labour and Welfare (MHLW), in 2022 introduced the latest diagnostic approval protocols, expanding the timeline for approval by six months for new technologies in metabolic panel treatment cases. This alternatively slows down the access for manufacturers to production and delays revenue realization. Companies should localize compliance resources and align with regulators to avoid further issues. For international providers hoping for fast product launches in high-value diagnostic markets, these regulatory restrictions present particular difficulties.

Metabolic Panel Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.7% |

|

Base Year Market Size (2024) |

USD 11.3 billion |

|

Forecast Year Market Size (2034) |

USD 21.7 billion |

|

Regional Scope |

|

Metabolic Panel Testing Market Segmentation:

Test Type Segment Analysis

Under the test type segment, the comprehensive metabolic panel dominates the segment and is expected to hold the market share of 52.8% by 2034. The comprehensive metabolic panel sub-segment is fueled by expanded diagnostic coverage, liver and kidney function, electrolytes, and protein levels in one test. As there is a rise in chronic disease, mainly in comorbidities such as kidney dysfunction and diabetes, a comprehensive metabolic panel is used in screening processes. As per the National Institutes of Health report, the metabolic screening strategies improve the management and early detection of chronic illness in the initial stage. This integrated value proposition makes the segment a clinically cost-effective and comprehensive option for healthcare providers.

End user Segment Analysis

Under the end user segment, hospitals are expected to lead with a 48.9% market share in 2034. The market is dominated by increased patient pool, lab infrastructure consolidation, and reimbursement unification. The U.S. hospitals where the majority of the Medicare Part B diagnostic spend of the Centers for Medicare & Medicaid Services (CMS) is related to metabolic panel testing used for routine diagnostics on chronic and acute care patients. The ability to process tests in-house with rapid turnaround also adds to the dominance of the segment, especially for inpatient and emergency care.

Our in-depth analysis of the global metabolic panel testing market includes the following segments:

|

Segment |

Subsegment |

|

Test Type |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metabolic Panel Testing Market - Regional Analysis

North America Market Insights

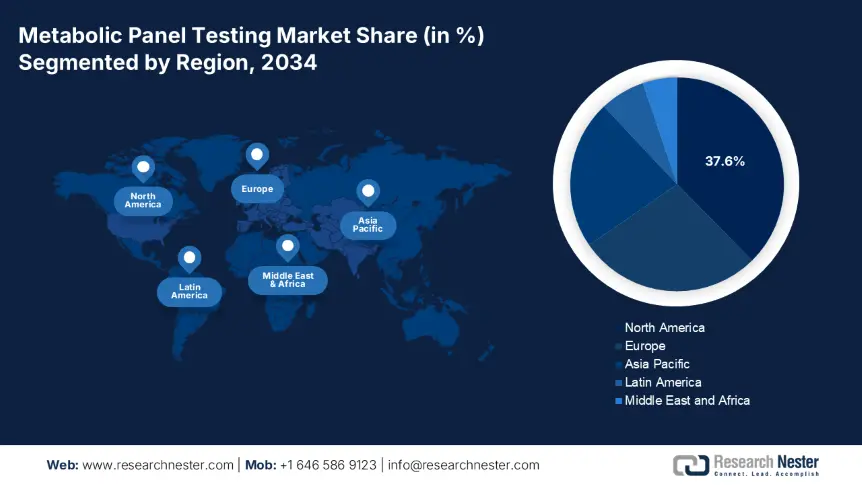

North America dominates the metabolic panel testing market and is projected to hold the market share of 37.6% at a CAGR of 7.1% by 2034. The market is driven by a rise in chronic cases, adoption of routine screening, and favorable reimbursement ecosystems. Moreover, the rising diabetic cases and kidney-related diseases in 2024 have impacted over 133.3 million people in the U.S., demanding testing in both primary and tertiary care. Further encouraging continued use are higher government payouts via Medicare and Medicaid. NIH and CIHI funding aid local innovation and test standardization among urban and rural labs. As the U.S. and Canada prioritize telehealth and preventive care, the adoption of metabolic panel tests is expected to rise with point-of-care analyzers and home-based diagnostics.

The U.S. market for metabolic panel testing is driven by increased incidences of chronic diseases and continued federal healthcare spending. As of 2024, more than 133.4 million adults live with diabetes, kidney disease, or other related metabolic disorders, which all necessitate regular BMP and CMP testing. Medicare funding for the market has increased by 15.6% from 2020 to 2024, reaching USD 800.5 million due to the enhancements in the reimbursement under coverage for preventive care. Medicaid increased diagnostic coverage by 10.6%, with USD 1.6 billion spent in 2024. The NIH and AHRQ spent more than USD 1.7 billion on diagnostic R&D, with metabolic test innovation a prime focus. Increased dependence upon automated laboratory platforms and telehealth-associated diagnostics has led key players to develop fast, mobile analyzers that can interface with EHR systems.

Asia Pacific Market Insights

The APAC region is the fastest-growing sector in the metabolic panel testing market and is projected to hold the market share of 22.6% with a CAGR of 8.4% by 2034. The market experiences a drastic shift due to rising chronic illness, healthcare modernization, and expanding public diagnostic infrastructure. The test volumes in the market are rising due to the increase in cases such as kidney disease, diabetes, and electrolyte imbalances. In addition to modern hospital facilities in metropolitan areas, the government's Healthy China 2030 program in China has extended the coverage of metabolic tests to rural areas. On the other hand, the local manufacturers are supported with local R&D to enhance the public funding, test accessibility, and national research priorities across AMED, NMPA, and MoHFW.

China is leading the metabolic panel testing market in Asia Pacific and is projected to have an 8.2% market share by 2034. China’s expenditure on metabolic diagnostics increased by 15.5% according to the statistics of the National Medical Products Administration, to cater to the healthcare priority of the government. On the other hand, 1.8 million people were diagnosed with metabolic conditions in 2023, indicating a surge in diagnostic demand. Under the Healthy China 2030 initiative, the automation of urban labs was obviously intensified. 181 newly built country hospitals had diagnostic services. These investments are evidence of a strong national policy to decentralize and modernize metabolic testing capability across the Chinese health system.

APAC Metabolic Diagnostics Government Investment & Policy Table (2021–2025)

|

Country |

Policy / Program Name |

Launch Year |

Government Focus / Investment |

|

Australia |

National Genomics and Diagnostics Roadmap |

2022 |

AUD 500.4 million allocated for diagnostic innovation and lab modernization across states. |

|

Japan |

Health Japan 21 (Phase II) Expansion |

2023 |

¥3.7 billion invested in metabolic and chronic disease diagnostics under MHLW & AMED programs. |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

2021 |

$2.5 billion budgeted to digitize diagnostics, including metabolic panel access via PMJAY scheme. |

|

South Korea |

Bio-Health Innovation Strategy |

2024 |

₩1.9 trillion committed to AI-based diagnostics and lab automation through MoHW. |

|

Malaysia |

MyHealth Integrated Community Screening Program |

2023 |

RM 280.5 million invested in public metabolic and chronic disease screening across rural clinics. |

Europe Market Insights

Europe metabolic panel testing market is expanding and is expected to hold the market share of 27.8% at a CAGR of 6.9% by 2034. The market is driven by the enhanced reimbursement structures, national chronic disease programs, and government-supported lab modernization. The rises in diseases such as diabetes, kidney dysfunction, and cardiovascular diseases are boosting the market across all the member states. Further, 30.4% of the elderly population in the EU experience metabolic disorder, highlighting strategic relevance of early diagnostics. The European Health Union assigned €2.8 billion under Horizon Europe to enhance the inter-member lab standardization and cross-border diagnostic innovation. The EU healthcare infrastructure makes the market more attractive for diagnostic testing and developing service providers.

Germany has the largest revenue share in Europe, with the Federal Ministry of Health (BMG) registering expenditure on diagnostic services in 2024, including metabolic testing, of €4.4 billion. This is a 12.3% increase in demand since 2021. Initiatives such as the Gesundheitsziele.de program incorporate metabolic testing into primary care using the DRG reimbursement scheme. Germany's health system provides broad access to testing at both public and private laboratories, and the German Medical Association (BÄK) reports a 9.8% rise in chronic disease screening from 2022 to 2023. Furthermore, the National Digital Health Strategy funding is enhancing lab interoperability and real-time reporting of diagnostics.

Europe Government Investment & Policy Initiatives (2021–2025)

|

Country |

Initiative / Policy |

Funding or Budget Allocation |

Launch Year |

|

UK |

NHS Diagnostic Recovery & 100 Community Diagnostic Centres Plan |

£2.7 billion investment into lab and diagnostic infrastructure |

2021 |

|

Spain |

Strategic Plan for Health and Innovation (PERTE Salud de Vanguardia) |

€1.9 billion to integrate advanced diagnostics incl. metabolic testing |

2022 |

|

Italy |

National Recovery and Resilience Plan (PNRR) – Mission 6 Health |

€15.8 billion total for health, incl. digital diagnostics |

2021 |

|

France |

Ma Santé 2022 & France 2030 health diagnostics innovation package |

€7.9 billion allocated to modernize diagnostics and lab automation |

2022 |

Key Metabolic Panel Testing Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global metabolic panel testing market is very competitive and led by key players from Europe, the U.S., and Asia Pacific. Companies like Roche, Abbott, and Siemens Healthineers are leading the market with expansive clinical therapies and hospital partnerships. Some players, including Sysmex, Mindray, and Tosoh are driving the global reach through affordability and automation. Companies in India such as Meril and Agappe are leading by providing cost-effectiveness platforms for startups. Public health collaborations, POC device proliferation, and AI based analyzer integration are examples of strategic developments.

The top 20 cohort of such key players include:

|

Company Name (Country) |

Market Share (%) |

Industry Focus |

|

Roche Diagnostics (Switzerland) |

13.6% |

Global leader in clinical chemistry analyzers (cobas systems), strong European and U.S. hospital presence. |

|

Abbott Laboratories (USA) |

11.9% |

Alinity and ARCHITECT systems for CMP/BMP testing, strong diagnostic outreach in North America. |

|

Siemens Healthineers (Germany) |

11.1% |

Provider of high-throughput chemistry analyzers with advanced lab automation technologies. |

|

Thermo Fisher Scientific (USA) |

7.7% |

Supplies reagents and diagnostic kits, strong presence in biopharma and clinical labs. |

|

Danaher Corporation / Beckman Coulter (USA) |

7.1% |

Focused on high-volume analyzers (DxC series) and integrated hospital diagnostics. |

|

Sysmex Corporation (Japan) |

xx% |

Known for electrolyte and metabolic diagnostics across Japan, Europe, and Southeast Asia. |

|

Bio-Rad Laboratories (USA) |

xx% |

Offers QC systems and reagents for ensuring metabolic panel accuracy. |

|

HORIBA Medical (France) |

xx% |

Mid-sized analyzer systems suitable for decentralized labs and clinics. |

|

Randox Laboratories (UK) |

xx% |

Biochip array technology and bespoke metabolic testing kits. |

|

Ortho Clinical Diagnostics (USA) |

xx% |

Vitros platforms with metabolic testing focus (now part of QuidelOrtho). |

|

Mindray Medical (China) |

xx% |

Competitive chemistry analyzers for growing Asian and African markets. |

|

Meril Life Sciences (India) |

xx% |

Rapidly expanding in India and Africa with affordable CMP/BMP analyzers. |

|

Tosoh Corporation (Japan) |

xx% |

Automated analyzers for niche metabolic/endocrine applications. |

|

Alere Inc. (USA) |

xx% |

Point-of-care metabolic diagnostics, absorbed by Abbott in 2017. |

|

Nova Biomedical (USA) |

xx% |

Blood chemistry analyzers used in ICUs and critical care settings. |

|

ARKRAY Inc. (Japan) |

xx% |

Small lab analyzers, strong in Southeast Asia and Latin America. |

|

Agappe Diagnostics (India) |

xx% |

Semi-automated analyzers for Tier 2 cities in India and Middle East. |

|

SD Biosensor (South Korea) |

xx% |

Portable diagnostic kits and testing solutions for emerging Asia. |

|

BioCare Diagnostics (Malaysia) |

xx% |

Local diagnostic kit supplier with regional expansion goals. |

|

Trajan Scientific and Medical (Australia) |

xx% |

Supplies analytical components, enabling partners in metabolic diagnostics workflows. |

Here are some leading players in the metabolic panel testing market:

Recent Developments

- In January 2024, Roche Diagnostics launched cobas, a pro integrated solution for high-throughput metabolic panel testing. The launch has reported a 9.7% increase in diagnostic segment revenue in Q1 2024.

- In May 2024, Beckman Coulter introduced the DxC 500 AU for comprehensive metabolic panels. The product has reduced reagent waste by 18.5% compared to the prior model.

- Report ID: 3994

- Published Date: Jul 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metabolic Panel Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert