Metabolic Genetic Testing Market Outlook:

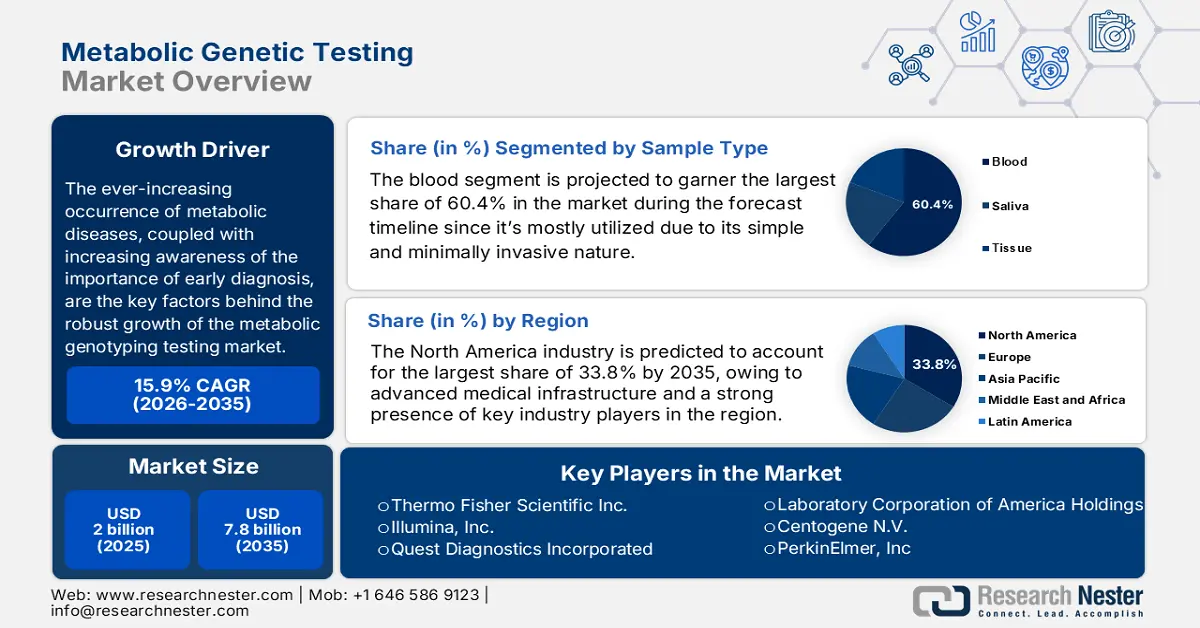

Metabolic Genetic Testing Market size was valued at USD 2.0 billion in 2025 and is projected to reach USD 7.8 billion by the end of 2035, rising at a CAGR of 15.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of metabolic genetic testing is estimated at USD 2.3 billion.

The ever-increasing occurrence of metabolic diseases, coupled with increasing awareness of the importance of early diagnosis, are the key factors behind the robust growth of the market. As per an article published by NIH in March 2024, around one-fourth of the population in Europe and Latin America is affected, while China’s prevalence reached 15.5% in a year. Whereas metabolic syndrome now also affects children and adolescents globally 3% and 5%, with prevalence increasing with age and slightly higher rates in women in some ethnic groups, thereby positively impacting market expansion.

Furthermore, payers' pricing in this field is extremely influenced by several factors such as test complexity, clinical utility, reimbursement policies, and overall healthcare cost savings. Testifying to this, the government of Australia in July 2025 reported that the IEM Program in the country offers help to individuals with protein metabolic disorders, covering the cost of low-protein foods required for their prescribed diets from the healthcare provider. It also stated that the program provides monthly payments, which are currently USD 298.36 to support dietary needs and maintain health.

Key Metabolic Genetic Testing Market Outlook: Market Insights Summary:

Regional Highlights:

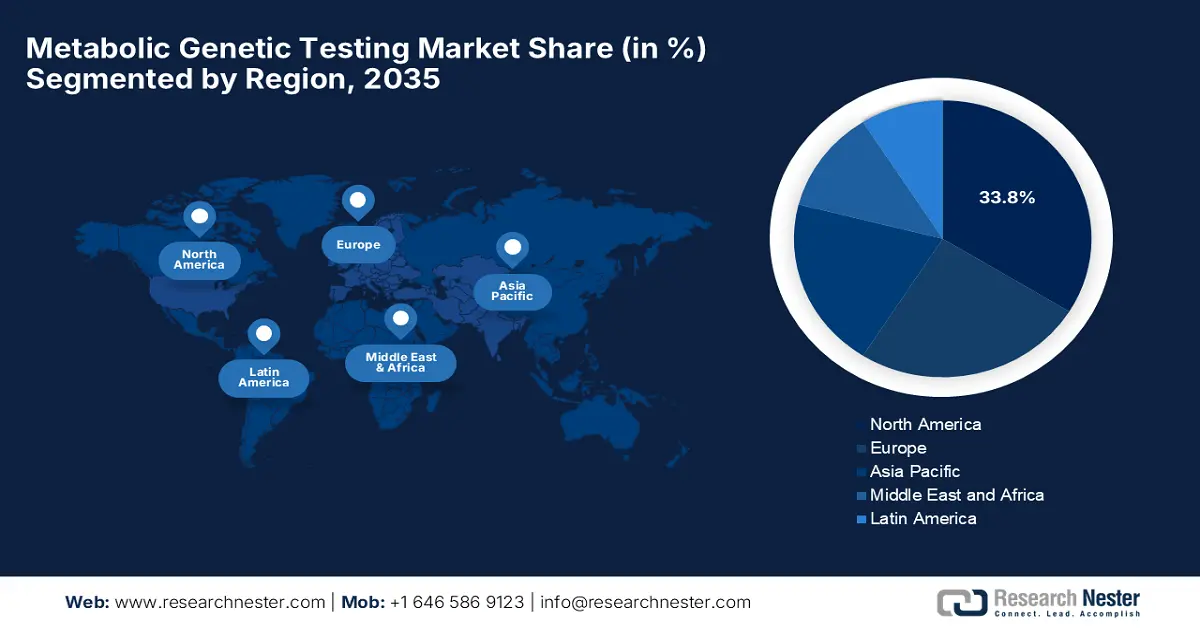

- North America is projected to command the largest 33.8% share of the metabolic genetic testing market by 2035, attributed to high healthcare expenditure, advanced infrastructure, and strong presence of leading industry participants.

- Asia Pacific is expected to witness the fastest growth from 2026 to 2035, fueled by the expansion of precision medicine programs, heightened awareness of genetic disorders, and increasing adoption of large-scale genomic initiatives.

Segment Insights:

- The blood segment in the metabolic genetic testing market is projected to hold a dominant 60.4% share by 2035, propelled by its simplicity, minimal invasiveness, and strong clinical validation.

- The next-generation sequencing segment is anticipated to account for 45.8% share by 2035, driven by its high throughput, extensive genomic coverage, declining sequencing costs, and superior variant detection capabilities.

Key Growth Trends:

- Advances in genetic testing techniques

- Government and healthcare programs

Major Challenges:

- Absence of standardized testing protocols

- Limited clinical awareness & expertise

Key Players: Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), Quest Diagnostics Incorporated (U.S.), Laboratory Corporation of America Holdings (U.S.), Centogene N.V. (Europe), PerkinElmer, Inc. (U.S.), Agilent Technologies, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Europe), Bio-Rad Laboratories, Inc. (U.S.), Qiagen N.V. (Europe), Myriad Genetics, Inc. (U.S.), Invitae Corporation (U.S.), OPKO Health, Inc. (U.S.), Siemens Healthineers AG (Europe), BGI Group (China), SRL, Inc. (Japan), Macrogen (South Korea), MedGenome (India), Sonic Healthcare (Australia), BP Healthcare Group (Malaysia).

Global Metabolic Genetic Testing Market Outlook: Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.0 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 7.8 billion by 2035

- Growth Forecasts: 15.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 20 October, 2025

Metabolic Genetic Testing Market - Growth Drivers and Challenges

Growth Drivers

- Advances in genetic testing techniques: This is the primary fueling factor for this landscape since the continued advancements in terms of next-generation sequencing and whole-exome sequencing are fostering an extremely progressive ecosystem for pioneers in this field. For instance, in June 2025, GoPath Diagnostics announced the launch of DiabetesNow, which is a genetic test panel designed to improve the diagnosis and classification of diabetes. The firm further stated that the panel analyzes 16 genes linked to monogenic diabetes, along with polygenic risk scores for type 1 and type 2 diabetes across different ancestries.

- Government and healthcare programs: The support from government initiatives and programs provides financial support for patients diagnosed with metabolic disorders, thereby driving demand for metabolic genetic testing. Besides public health policies that promote newborn screening and early diagnosis, further stimulate market growth. WHO notified that it updated its 2022 postnatal care guidelines to include new recommendations for universal newborn screening as part of ensuring optimal health and well-being, hence improving long-term outcomes and setting a credible standard for newborn care.

- Rising demand for personalized medicine: The shift towards personalized medicine is efficiently driving the growth of the market. As targeted therapies continue to develop, the demand for accurate genetic diagnostics also increases. In May 2022, Invitae reported that it expanded its Pharmacogenomics Panel, covering 38 genes and a clinical decision support tool, which advances personalized medicine by helping drug prescriptions based on genetic profiles. This is readily supported by growing regulatory backing and evidence of reduced hospitalizations, thereby driving wider adoption of pharmacogenomic testing.

Global Statistics and Genetic Insights in Diabetes Mellitus

|

Metric |

Value / Estimate |

Details |

|

Global Diabetes Cases (2021) |

537 million |

Adults worldwide |

|

Projected Cases (2045) |

783 million |

46% increase expected |

|

T1DM Global Prevalence (2021) |

8.4 million |

1.5 million under 20 years of age |

|

T1DM Projected Prevalence (2040) |

13.5-17.4 million |

60%–107% increase |

|

MODY General Prevalence |

1 in 10,000 adults; 1 in 23,000 children |

Based on genetic testing |

|

T2DM Heritability Estimate |

20% - 80% |

From family and twin studies |

|

Relative Risk (First-Degree Relatives of T2DM) |

~3× higher |

Compared to the general population |

|

Confirmed Genetic Etiology in Pediatric Diabetes |

~5.1% |

Reflecting monogenic forms |

Source: NIH

Key Strategic Developments in Metabolic Genetic Testing (2024-2025)

|

Year |

Company |

Announcement Summary |

Key Details / Partners |

|

2025 |

Microbix & EMQN |

Launched the EQA program for CYP2C19 gene variants to improve Clopidogrel dosing accuracy |

POCT genetic testing, UK & international labs enrolled |

|

2025 |

BlueGenesLab |

Expanded genetic panel adding 3 GLP-1–related genes for better metabolic disease treatment guidance |

GLP1R, CTRB1, CNR1 genes added |

|

2025 |

Variant Bio |

Multi-year research partnership with Novo Nordisk to discover novel metabolic disease drug targets |

Up to USD 50 million in funding, the VB-Inference platform is used. |

|

2024 |

CeGaT |

Expanded genetic testing services to the US & Canada, partnered with major insurers like Blue Cross Blue Shield |

National contracts, comprehensive ExomeXtra test |

Challenges

- Absence of standardized testing protocols: This is negatively impacting the growth of the market. There is no universally accepted framework for genetic testing, especially in interpreting variants of uncertain significance. Therefore, this variability in test panels, sequencing depth, and reports across laboratories often leads to inconsistent results, making it challenging for clinicians to analyze the outcomes, thereby limiting adoption in this sector.

- Limited clinical awareness & expertise: Most of the healthcare professionals in rural or underprivileged sectors are facing the challenge of a lack of adequate training in genomics. Also, a few are not so familiar with the implications of metabolic genetic testing, which leads to underutilization of available tests and delays in patient referrals. Further, the shortage of genetic counselors and clinical geneticists exacerbates this gap, limiting the integration of testing into routine patient care.

Metabolic Genetic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.9% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 7.8 billion |

|

Regional Scope |

|

Metabolic Genetic Testing Market Segmentation:

Sample Type Segment Analysis

Based on the sample type, blood segment is projected to garner the largest share of 60.4% during the forecast timeline. Blood collection is relatively simple, minimally invasive, and well validated, which positions the subtype as the dominant position in this sector. For instance, in June 2025, Myriad Genetics announced the launch of early access to its FirstGene Multiple Prenatal Screen, which is a single blood test offering prenatal genetic risk assessment without needing paternal DNA. It detects chromosomal aneuploidies, 22q11.2 deletion, and 10 severe recessive conditions using fetal cell-free DNA.

Technology Segment Analysis

In terms of technology, the next-generation sequencing segment is expected to capture a significant share of 45.8% by the end of 2035. The high throughput, broader coverage, falling costs per base, and ability to detect rate variants are the key factors behind the segment’s leadership. In May 2025 Innovative Genomics Institute reported that its team, led along with the Children’s Hospital of Philadelphia, developed the first personalized CRISPR therapy for a rare metabolic disease called CPS1 deficiency and delivered it to an infant patient in just six months.

Test type Segment Analysis

Based on the test type targeted gene panels segment is likely to capture a considerable share of 30.3% during the analyzed timeframe. These panels are cost-effective relative to whole-genome sequencing, especially when the disorder is among known metabolic gene sets. They reduce incidental findings, have faster turnaround, and are most established in terms of payer reimbursements. Furthermore, most of the prominent studies have evidenced that gene panels will be widely adopted in genetic testing, thereby fostering a favorable business environment.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Sample Type |

|

|

Technology |

|

|

Test Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metabolic Genetic Testing Market - Regional Analysis

North America Market Insights

North America is likely to dominate the global market by capturing the largest share of 33.8% by the end of 2035. The high healthcare spending, advanced medical infrastructure, and presence of key industry players are the key factors propelling this leadership. In October 2025, GeneDx reported that, along with a consortium of national partners, it launched BEACONS, which marks the first U.S. multi-state initiative to explore integrating genomic sequencing into newborn screening, efficiently backed by a USD 14.4 million NIH grant. Besides, the study will enroll up to 30,000 newborns across 10 states to assess the feasibility and impact of screening for the genetic conditions that are treatable at birth.

The U.S. holds a dominant position in the market, effectively attributed to its extensive healthcare expenditure and the country’s emphasis on personalized medicine and the integration of advanced diagnostic technologies. This can be exemplified by the U.S. FDA’s article published in December 2023, wherein it states the formation of a new Genetic Metabolic Diseases Advisory Committee to evaluate medical products targeting rare genetic metabolic disorders. It also stated that this expert panel will offer independent scientific and policy recommendations on treatments under review, addressing the complex challenges of drug development for these often life-limiting conditions.

Canada also closely follows the U.S. in the metabolic genetic testing market, owing to the aspect of increasing awareness of metabolic disorders and advancements in genetic research. In this regard, EasyDNA in January 2025 notified that it had launched its DNA Methylation Health Report, offering personalized health insights based on over 9,000 genetic markers. The test analyzes numerous fields such as digestion, metabolism, hormonal balance, stress, and inflammation, providing recommendations including required nutrients and suggested blood tests.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the metabolic genetic testing market from 2026 to 2035. This rapid progression is readily propelled by the push towards precision medicine, increasing awareness of genetic disorders, and deploying large genomic initiatives. On the other hand, the emergence of newborn screening and molecular diagnostics has been adopted broadly, which is further encouraging direct-to-consumer genetic testing, especially in urban settings. Further, the government programs and public health systems are supporting early disease detection and personalized care, which raises demand.

China is likely to garner the leadership role in the regional metabolic genetic testing market owing to its strong investment in genomic research, strong domestic manufacturing capabilities, and national precision medicine plans. In July 2025, BGI Group announced that it showcased its advancements in genetic metabolic testing as part of its broader precision health strategy at the 2025 China International Supply Chain Expo. Also, their high-throughput, AI-powered gene testing solutions included tools for diagnosing genetic metabolic disorders, integrating genomics with metabolomics.

India in the metabolic genetic testing market is expanding beyond its limits since healthcare providers and labs are deploying more comprehensive test panels, covering rare genetic disorders, newborn screening, and metabolic panels. In July 2025, MedGenome, a leading genetic diagnostics firm in the country, reported that it raised USD 47.5 million in Series E funding to expand its genomics and integrated diagnostics offerings across India. The company has a CAP-accredited lab in Bangalore, wherein it offers over 1,300 genetic tests, including solutions, hence making it suitable for standard market growth.

Cost Analysis of Newborn Screening for Inherited Metabolic Disorders Using Tandem Mass Spectrometry (MS/MS) in China (10-Year Data)

|

Cost Parameter |

MS/MS Screened Group |

|

Total Lifetime Cost per Patient (CNY) |

1,000,452 |

|

Total Lifetime Cost per Patient (USD) |

143,515 |

|

Incremental Cost-Effectiveness Ratio (ICER) |

67,417 CNY per QALY gained |

|

|

(USD 9,671 per QALY gained) |

|

Benefit-Cost Ratio (BCR) |

4.23 (return of 4.23 CNY per 1 CNY invested) |

|

Cost-Effectiveness Probability |

100% (MS/MS group cost-effective vs non-screened) |

Source: NIH, 2025

Europe Market Insights

The metabolic genetic testing market in Europe is portraying notable growth, primarily fueled by the increasing awareness of genetic disorders and the escalating investments in precision medicine initiatives. For instance, in March 2024, CENTOGENE reported that it had extended its strategic partnership with Takeda to continue providing diagnostic genetic testing for patients with lysosomal storage disorders such as Fabry disease, Gaucher disease, and Hunter syndrome, hence denoting a positive market outlook.

Germany is growing exponentially in the regional metabolic genetic testing market, successfully backed by its robust healthcare system and strong focus on genetic research and innovation. Besides the increased government funding for rare disease research, and rising number of specialized genetic testing centers is also contributing towards market progression. Furthermore, the high adoption rates, growing patient awareness are appreciably driving demand for accurate detection of metabolic genetic disorders.

The U.K. in the metabolic genetic testing market is highly propelled by the ongoing advancements in genomics and precision medicine, alongside government initiatives supporting rare disease diagnostics. In June 2022, Metabolon, Inc. declared that it had partnered with King’s College London to analyze metabolomics data from the TwinsUK registry, which is one of the largest and most detailed adult twin cohorts across all nations. Therefore, this collaboration aims to uncover new biomarkers and deepen understanding of the interaction between genetics, environment, and the microbiome in human health.

Key Metabolic Genetic Testing Market Players:

- Thermo Fisher Scientific Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Illumina, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Centogene N.V. (Europe)

- PerkinElmer, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Europe)

- Bio-Rad Laboratories, Inc. (U.S.)

- Qiagen N.V. (Europe)

- Myriad Genetics, Inc. (U.S.)

- Invitae Corporation (U.S.)

- OPKO Health, Inc. (U.S.)

- Siemens Healthineers AG (Europe)

- BGI Group (China)

- SRL, Inc. (Japan)

- Macrogen (South Korea)

- MedGenome (India)

- Sonic Healthcare (Australia)

- BP Healthcare Group (Malaysia)

- Invitae Corporation is recognized as the frontrunner in clinical genetic testing that offers high-end panels for inherited metabolic disorders. The company has also successfully streamlined access to metabolic genetic testing through its digital and at-home sample collection kits, thereby accelerating early diagnosis for rare metabolic conditions and integrating genetic counseling to support clinical decisions.

- Quest Diagnostics plays a pivotal role in this field by making integrations of metabolic genetic testing into its diagnostic network portfolio. Moreover, with the implementation of strategic acquisitions and partnerships, the company has successfully expanded its lab infrastructure and service reach, thereby facilitating widespread availability.

- Bupa UK has emerged as the first mover among insurers by offering tried genomic testing products such as Medication Check under its My Genomic Health Initiative. Therefore, this service identifies genetic sensitivities to medications commonly used in managing metabolic conditions such as type 2 diabetes and cardiovascular diseases, marking a major step in personalized preventive care within the insurance ecosystem.

- Centogene N.V. is a prominent player in rare metabolic and genetic disorders and leverages multiomic data and worldwide biobanks to accelerate the diagnosis of conditions such as Gaucher disease, PKU, and lysosomal storage disorders. The firm also has a CENTOGENE Biodatabank, which plays a pivotal role in enhancing test precision, thereby expanding access to next-generation sequencing for underserved populations.

- GeneDx, which was formerly part of Sema4, currently focuses on exome and genome sequencing for pediatric and neonatal metabolic disorders, positioning itself as a critical player in the early-life diagnostics segment. In addition, the company combines AI-driven variant interpretation with clinical reporting, supporting early intervention for inborn errors of metabolism.

Here is a list of key players operating in the global market:

The global metabolic genetic testing market represents an extremely competitive landscape, which is successfully led by pioneers based in the U.S. and Europe. These players are leveraging continued technological innovation in next-generation sequencing platforms and bioinformatics to secure and strengthen their market positions. For instance, in September 2024, Quest Diagnostics notified that it successfully completed the acquisition of select laboratory assets from Allina Health, aiming to enhance access to affordable, high-quality lab services across Minnesota and western Wisconsin, thereby diversifying its service portfolios.

Corporate Landscape of the Metabolic Genetic Testing Market:

Recent Developments

- In September 2025, Remedium Bio announced a strategic collaboration with Eli Lilly and Company to co-develop gene therapies targeting Type 2 Diabetes and Obesity, two of the largest segments within metabolic diseases, by utilizing its Prometheus gene therapy platform.

- In July 2025, Bupa announced that it had launched Medication Check, which is a £300 saliva-based DNA test that identifies how an individual's genetics affect their response to prescription medicines, following a pilot where 99% of participants showed genetic sensitivity.

- Report ID: 4332

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metabolic Genetic Testing Market Outlook: Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.