Healthcare Companion Robots Market Outlook:

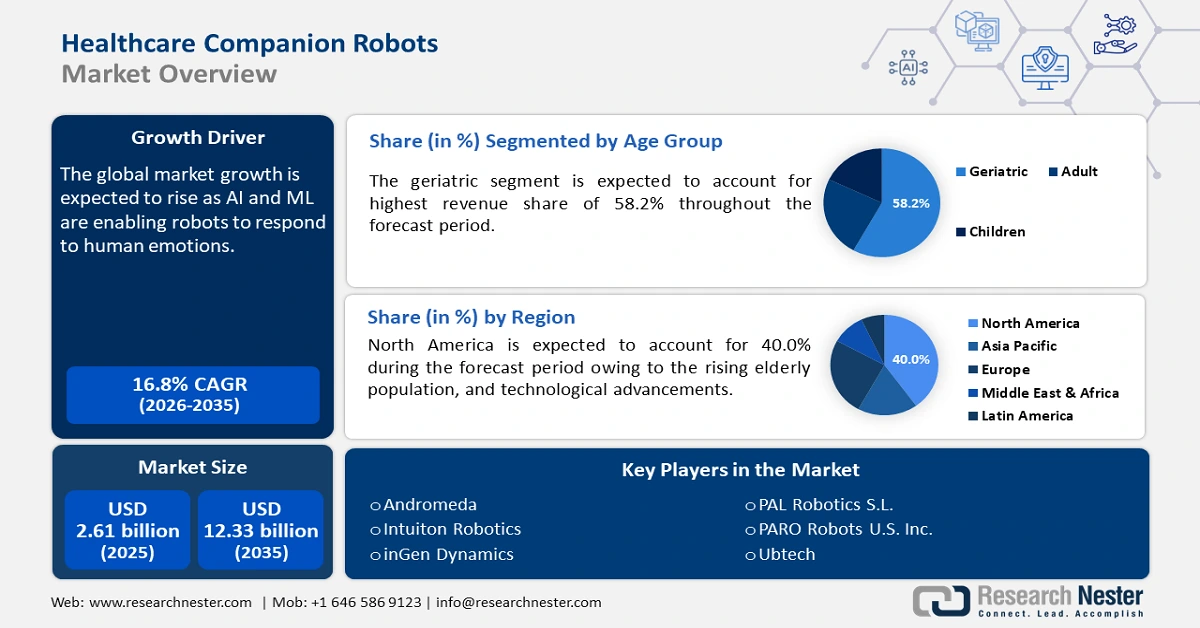

Healthcare Companion Robots Market size was over USD 2.61 billion in 2025 and is poised to exceed USD 12.33 billion by 2035, witnessing over 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare companion robots is estimated at USD 3 billion.

Increasing demand for home healthcare, demand for automation in medical services, and advancements in AI are significantly driving the global market growth. Additionally, the rising geriatric population, urbanization, changing lifestyle, and lack of time are also boosting the healthcare companion robots market growth.

The worldwide healthcare system is seeking solutions to manage rising patient loads, provide personalized healthcare, and reduce costs. Regions such as North America, Europe, and parts of Asia, where aging populations are prominent, are showcasing rising acceptance of healthcare companion robots for assistance. In addition, robotics advancements have led to enhancements in mobility and additional capabilities, allowing robotic assistance in a wider range of physical tasks. This comprises navigation ability for complex home settings and performing satisfactory motor tasks including object handling and personal care help. For instance, Humanoid robot company 1X announced the launch of a Neo Beta bipedal humanoid robot designed for home use, in September 2024.

Key Healthcare Companion Robots Market Insights Summary:

Regional Highlights:

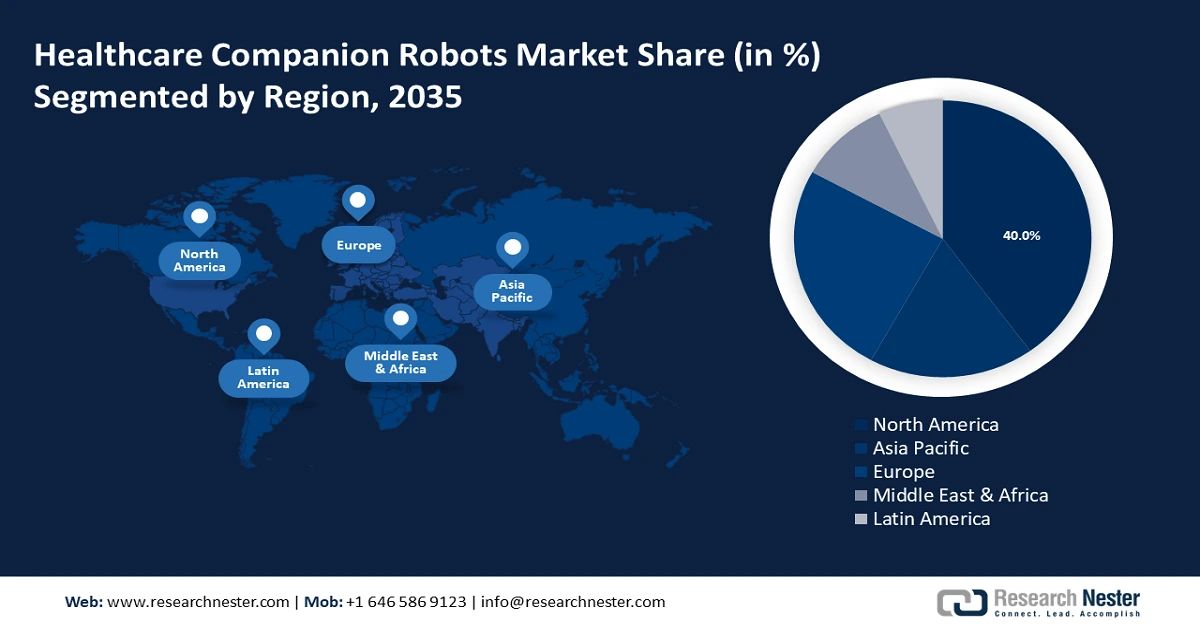

- North America leads the Healthcare Companion Robots Market with a 40% share, propelled by rising healthcare costs leading to automation and technology use, fostering significant growth by 2035.

- Rapid growth in the Asia Pacific healthcare companion robots market is projected through 2035, attributed to technological advancements and government initiatives.

Segment Insights:

- The Nursing Homes and Elderly Care Centers segment is poised for considerable growth through 2035, driven by increasing emphasis on enhancing quality of care and automation needs.

- The Geriatric segment is expected to achieve a 58.20% share by 2035, driven by rising geriatric health challenges and familiarity with assistive technologies.

Key Growth Trends:

- Rising demand for home assistance for the aging population

- Increasing demand for automation and convenience

Major Challenges:

- High cost of production

- Privacy challenges

- Key Players: Aeolus Robotics, Inc., Andromeda, ASUSTeK Computer Inc., Blue Frog Robotics & Buddy ASUS.

Global Healthcare Companion Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.61 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 12.33 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, Japan, South Korea, Singapore, India

Last updated on : 14 August, 2025

Healthcare Companion Robots Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for home assistance for the aging population: As the global population ages, particularly in developed nations, there is an increasing need for personalized care for the elderly, as many prefer to remain at home instead of opting for nursing facilities. As per the WHO, between 2015 and 2050, the world's population proportion over 60 years will increase from 12% to 22%. Older adults experience mobility issues, cognitive decline, and other chronic health conditions, that strain the healthcare system. Companion robots offer solutions including medication reminders, monitoring vitals, and assisting in daily tasks. The increasing demand for home-based automated assistance is hence projected to boost the global healthcare companion robots market growth.

- Increasing demand for automation and convenience: In today’s fast-paced world, both patients and healthcare providers are looking for ways to streamline care processes, improve efficiency, and reduce costs. Companion robots address these needs by automating routine tasks including monitoring patient conditions, delivering medications, and even providing companionship to combat loneliness. Additionally, this trend also includes patients recovering from surgeries or long-term illnesses. The convenience provided by healthcare robots, coupled with their ability to reduce human error is pushing the healthcare companion robots market forward at a rapid pace.

Challenges

- High cost of production: Developing sophisticated robots with advanced sensors, AI, and ML capabilities requires significant investments in research, design, and manufacturing. These robots must be equipped with complex hardware and software systems to perform scheduled tasks. As a result, the cost of producing these robots is high, which translates into expensive end-user prices, making them difficult to adopt. Without economies of scale or advancements that significantly reduce production costs, widespread adoption of healthcare companion robots will remain constrained.

- Privacy challenges: The companion robots often require access to sensitive personal information, including health data to function effectively. The potential for data breaches or misuse of personal information raises concerns among patients and healthcare providers. Furthermore, as these robots become more integrated into home environments, the lines between healthcare and personal privacy can blur, leading to fears such as constant surveillance or unintended data sharing. Without robust data protection protocols and strict regulatory frameworks, privacy concerns are limiting the adoption of these robots.

Healthcare Companion Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 2.61 billion |

|

Forecast Year Market Size (2035) |

USD 12.33 billion |

|

Regional Scope |

|

Healthcare Companion Robots Market Segmentation:

Age Group (Children, Adult, Geriatric)

Geriatric segment is predicted to hold healthcare companion robots market share of over 58.2% by the end of 2035. This demographic often faces a range of health challenges which make them ideal candidates for companion robots. While traditionally seen as a tech-resistant group, the elderly population is now becoming increasingly familiar with technology, driven by user-friendly interfaces. Cognitive conditions such as dementia, and Alzheimer’s disease prevalence are rapidly increasing. As per a report by the Alzheimer’s Association in March 2023, nearly 6.7 million Americans aged 65 and above are suffering from Alzheimer's dementia today. This number is projected to reach 13.8 million by 2060. These factors are projected to boost the rising demand for healthcare companion robots during the forecast period.

End use (Nursing homes and elderly care centers, Hospitals and clinics, Home healthcare)

The nursing homes and elderly care centers segment in healthcare companion robots market is expected to register considerable growth during the forecast period. This is primarily due to their unique requirements for patient care and the increasing emphasis on enhancing the quality of life for residents. According to the U.S. Department of Health and Human Services , there were around 1.2 million nursing facility residents in more than 15,000 certified nursing homes, in 2022. New York and California registered the highest numbers of residents in the country. The integration of companion robots in these settings addresses various operational challenges, including demand for personalized care solutions, and staffing shortages. By automating routine tasks, companion robots allow caregivers to focus more on direct patient interaction and care, enhancing the overall quality of service provided to residents.

Our in-depth analysis of the global healthcare companion robots market includes the following segments:

|

Robot Type |

|

|

Age Group |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Companion Robots Market Regional Analysis:

North America Market Analysis

North America industry is estimated to hold largest revenue share of 40% by 2035. The rising cost of healthcare in the region has led to a push for automation and technology integration to enhance patient care while reducing costs. Major companies such as the Intuition Robotics, and Ageless Innovation are leading the development of robots offering cognitive engagement and companionship in the region. Moreover, rising awareness of mental health and emotional well-being has further fueled the adoption of these robots in hospitals, care facilities, and even homes, as a part of a holistic approach.

The U.S. presents the biggest healthcare companion robots market in the North American region owing to the rising demand for advanced care solutions for the aging population and the shortage of healthcare workers. Moreover, the rising demand for home-based care and the increasing prevalence of chronic illness are hyping the demand for companion robots majorly for healthcare in the country. Personalized and non-invasive care solutions are highly in demand. Hence, companion robots offering critical support and assistance in fulfilling daily tasks, offering emotional companionship, and monitoring health conditions, are also witnessing rising demands.

Canada healthcare companion robots market is also expected to witness considerable growth. The country aims to address the rising chronic health condition cases, reduce caregiver burnout, and support mental health through companionship. As the country’s government prioritizes patient-centered care, companion robots are becoming a key in delivering innovative, long-term care solutions. In May 2023, Axniix announced a partnership with robot manufacturer Aeolus to assist in healthcare.

APAC Market Statistics

APAC is experiencing rapid growth, spurred by technological advancements in AI and robotics, in addition to government initiatives. The region’s aging demographic is projected to accelerate the need for robotic solutions to assist in elder care and healthcare management. As per an article posted by the World Economic Forum, in October 2021, Asia-Pacific is likely to see the most rapid increase in older citizens by 2050. The shortage of healthcare workers is also boosting the demand for companion robots to bridge the gap between rising healthcare services demand and the available workforce in the region.

China healthcare companion robots market is gaining momentum, driven by the rapidly aging population, urbanization, and growing demand for healthcare innovation. Companion robots are emerging as a key solution, providing daily task assistance, and health monitoring, particularly in the urban areas of the country where family caregivers are limited. Companies are also extending their footprint in the country owing to the rising demands. For instance, in Jun 2024, the family companion robot, named LOVOT, by GROOVE X, opened its first physical store in Shanghai, China. Furthermore, the local government is also investing heavily in robotics as a part of its Made in China 2025 initiative, aiming to enhance healthcare infrastructure through technological innovation.

The senior population in South Korea is growing rapidly making up about 8.53 million, which is 16% of the total population in the country, in 2021. As per Statistics Korea, the population is projected to reach 17 million by the end of 2040. With this rising number of elderly populations, there is an increasing chance of registering a rising number of patients suffering from dementia in the country. To address these factors, the local governments have introduced companion robots to single persons and those suffering from mental health issues, aiming to support their well-being. In September 2022, Mayongji Hospital announced the ongoing development of an AI-driven care robot for assistance to patients with dementia.

Key Healthcare Companion Robots Market Players:

- Aeolus Robotics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Andromeda

- ASUSTeK Computer Inc.

- Blue Frog Robotics & Buddy ASUS

- inGen Dynamics

- Intuition Robotics

- Luvozo

- PAL Robotics S.L.

- PARO Robots U.S., Inc.

- Ubtech

Companies are focusing on enhancing patient care solutions and improving quality of life. By integrating cutting-edge AI and robotics, the players are developing intelligent companions, majorly for the elderly and children population. Several investments are also taking place in the healthcare companion robots market for research & developmental activities. For instance, in August 2023, Intuition Robotics announced raising USD 25 million in additional funding to meet the surging demand for the company’s AI care companion ElliQ across government aging agencies and healthcare organizations. Some of the prominent companies include:

Recent Developments

- In September 2023, UBTECH Robotics announced a strategic partnership with the University of Hong Kong. The collaboration is focused on researching human-like visual perception algorithms and technology for service robots.

- In March 2022, Intuition Robotics announced the launch of ElliQ, which is a digital care companion aimed at healthier, happier aging. The robot accompanies elderly people to age independently and motivates them to live healthier lives.

- Report ID: 6527

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Companion Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.