Chikungunya Treatment Market Outlook:

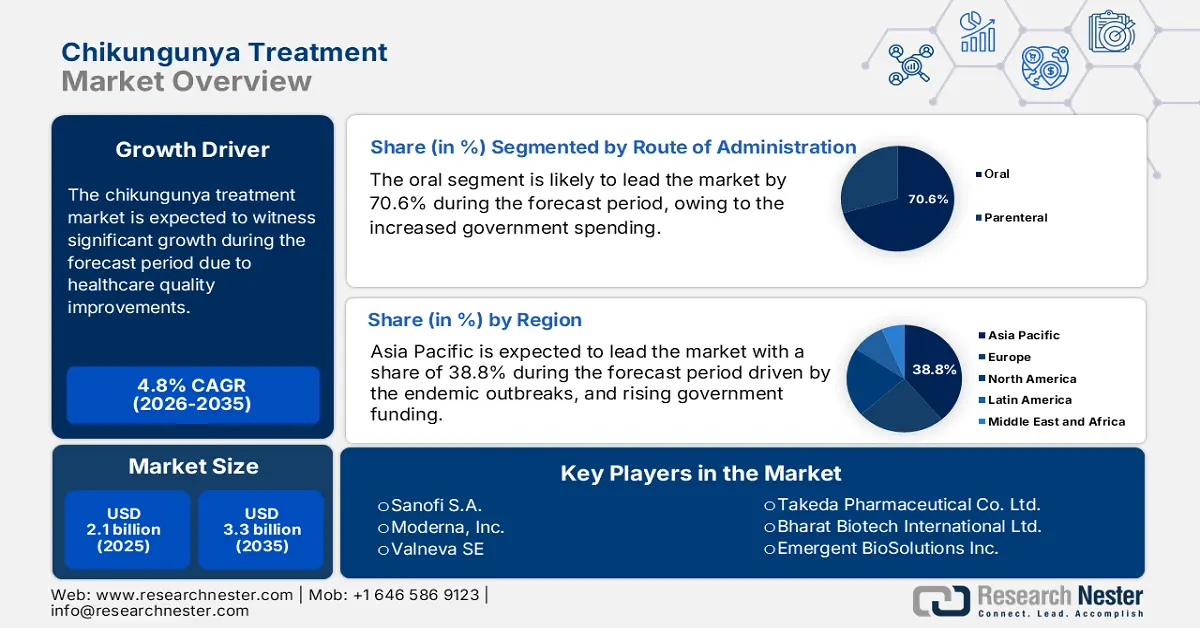

Chikungunya Treatment Market size was valued at USD 2.1 billion in 2025 and is projected to reach USD 3.3 billion by the end of 2035, rising at a CAGR of 4.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of chikungunya treatment is assessed at USD 2.2 billion.

The global chikungunya treatment market is driven by rising government investment in vector-borne disease control, demand for symptomatic relief treatment, including antivirals and NSAIDs, and an increase in incidence rates in endemic regions. The patient pool has a strong growth in tropical and sub-tropical regions. As per the Centers for Disease Control and Prevention, chikungunya virus cases have been reported over 103 countries and mostly confirmed in south and Southeast Asia, parts of the U.S., and Central America. Over 500,000 cases were registered globally in 2023, with 400 deaths reported, as per the European Centre for Disease Prevention and Control report in December 2023. This outbreak is creating a sustained demand for pharmaceutical interventions.

On the supply chain side treatment for chikungunya is mainly for generic NSAIDs, limited antiviral compounds, and supportive therapies including corticosteroids and fluids. API are mostly imported from India and China. As per the Rubicon Research report released in July 2024, the export of pharmaceuticals by India reached USD 24.0 billion, including 500 APIs. South Asia continues to be the hub for raw material acquisition and formulation. The device components in the healthcare sector, such as infusion kits and hospital syringes, are also imported to meet the demands. Strategic public procurement initiatives, such as Brazil’s Unified Health System (SUS), are helping local pharmaceutical manufacturers to scale up with chikungunya-related production via government tenders and subsidized raw material access.

Key Chikungunya Treatment Market Insights Summary:

Regional Highlights:

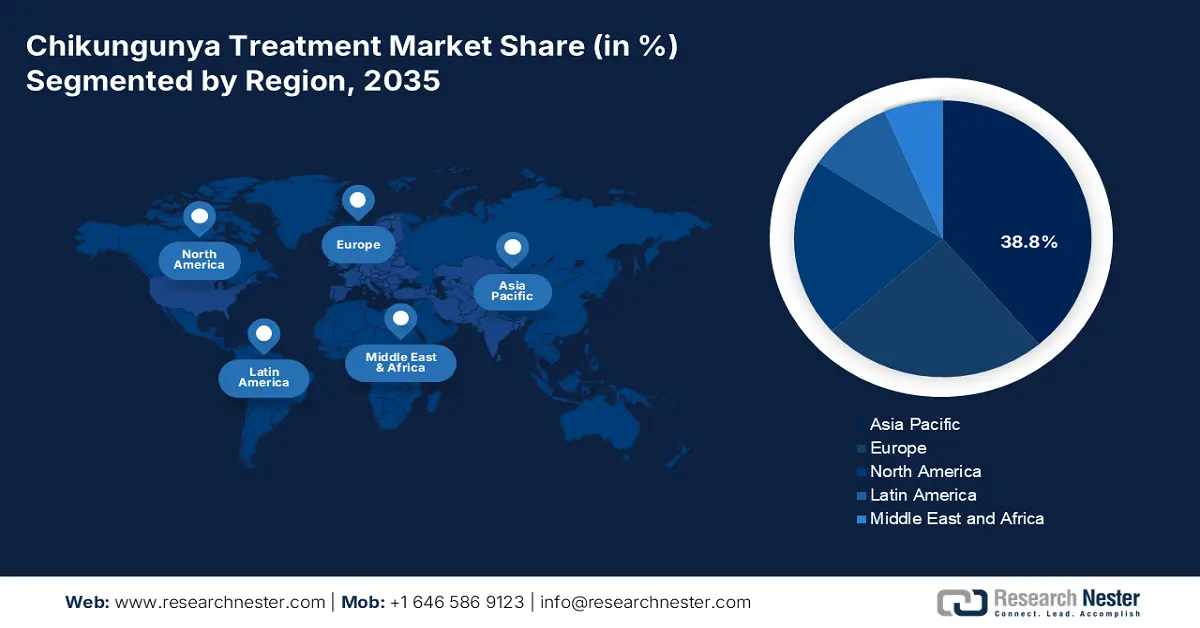

- Asia Pacific is set to command a 38.8% share of the chikungunya treatment market by 2035, propelled by expanding government spending and strengthened diagnostic surveillance in endemic countries.

- North America is anticipated to secure a substantial share by 2035, supported by rising outbreak incidence and structured public health surveillance.

Segment Insights:

- The oral sub-segment is projected to capture 70.6% of the market by 2035 in the chikungunya treatment market, bolstered by its rapid action, self-administration benefits, and widespread use of orally formulated analgesics.

- The medication segment is expected to maintain a significant share by 2035, sustained as providers rely on analgesics and antipyretics for managing symptoms in the absence of a universally approved vaccine.

Key Growth Trends:

- Healthcare quality improvement initiatives

- Rising government & Medicare spending on Chikungunya Drugs

Major Challenges:

- Pricing restraints in regulated markets

Key Players: Sanofi S.A., Moderna, Inc., Valneva SE, Takeda Pharmaceutical Co. Ltd., Bharat Biotech International Ltd., Emergent BioSolutions Inc., CSL Seqirus, Serum Institute of India Pvt. Ltd., Inovio Pharmaceuticals Inc., Zydus Lifesciences Ltd., GlaxoSmithKline plc (GSK), Cipla Ltd., Eubiologics Co., Ltd., Dr. Reddy’s Laboratories Ltd., BioNet-Asia Co. Ltd., Medigen Vaccine Biologics Corp., AbbVie Inc., Mitsubishi Tanabe Pharma Corp., Biocon Biologics Ltd., Duopharma Biotech Bhd.

Global Chikungunya Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 3.3 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Mexico, South Korea, United Arab Emirates

Last updated on : 2 September, 2025

Chikungunya Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Healthcare quality improvement initiatives: As per the Agency for Healthcare Research and Quality, the early-stage intervention in using chikungunya treatment protocols, including NSAIDs and antivirals, has minimized the hospitalization rates. The economic cost of chikungunya treatment over the past decade was approximately USD 49.9 billion, based on the Medical News Life Sciences report in December 2024. This study also aided the inclusion of chikungunya treatment in national quality improvement frameworks, particularly for outpatient care of post-viral arthritis.

-

Rising government & Medicare spending on Chikungunya Drugs: Chikungunya treatments are symptomatic and off-label; the U.S. Centers for Medicare & Medicaid Services started the reimbursements for NSAIDs in 2023 under outbreak-linked care categories. Meanwhile, Medicare has allocated USD 2,000 for annual out of pocket costs including high treatment cost that currently run many times higher, as per the Whitehouse report in 2025. Personal out-of-pocket costs for per case was USD 2,700, and Brazil holds the largest share of USD 9.8 billion, based on the Medical News Life Sciences report in December 2024.

-

Companies R&D innovations and strategies: Chikungunya research is highly focused on antiviral repurposing and vaccine innovation. The WHO R&D Blueprint has identified chikungunya as a priority pathogen, surging the partnerships between pharmaceutical firms and public health agencies for candidate development. In the U.S., the NIH reports that more than 70 active or completed chikungunya-related clinical studies are registered on ClinicalTrials.gov, including evaluations of repurposed antivirals such as Favipiravir and Ribavirin.

Historical Patient Growth on Chikungunya Cases from 2014 to 2024

|

Year |

US States |

US States |

US Territories |

US Territories |

|

2014 |

12‡ |

2,799 |

4,659 |

51 |

|

2015 |

1‡ |

895 |

237 |

0 |

|

2016 |

0 |

248 |

180 |

1 |

|

2017 |

0 |

156 |

39 |

0 |

|

2018 |

0 |

116 |

8 |

0 |

|

2019 |

0 |

192 |

2 |

0 |

|

2020 |

0 |

33 |

0 |

0 |

|

2021 |

0 |

36 |

0 |

0 |

|

2022 |

0 |

81 |

0 |

0 |

|

2023 |

0 |

152 |

0 |

0 |

|

2024 |

0 |

199 |

0 |

0 |

Source: CDC, August 2025

Challenges

-

Pricing restraints in regulated markets: Governments have imposed pricing caps to limit manufacturers margins in many countries, including Germany and France. Moreover, companies in Europe have overcome high pricing constraints by joining with national health agencies to boost market access and bundle chikungunya treatment with vector disease protocols. This strategy has made many companies to move on with broader reimbursement with existing budgets on healthcare. Furthermore, incorporation with national emergency response stocks resulted in long-term purchase contracts until 2030.

Chikungunya Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.3 billion |

|

Regional Scope |

|

Chikungunya Treatment Market Segmentation:

Route of Administration Segment Analysis:

The oral sub-segment leads the segment in the chikungunya treatment market and is poised to hold the share value of 70.6% by 2035. The segment is driven by the rapid onset of action, and self-administration, making it preferred for both hospitals and homecare. Further, most of the symptomatic treatments include acetaminophen and other analgesics, are formulated for oral use. According to the CDC report published in January 2025, analgesics are prescribed by most physicians, reaching 71.9%. Furthermore, the oral route minimizes the healthcare burden, and enhance compliance and accessibility, mainly in resource-limited regions. WHO guidance on oral drug administration supports this trend.

Treatment Type Segment Analysis

Medication segment remains dominant in the chikungunya treatment market and hold a considerable share by the end of 2035. This dominance is due to the urgent need for symptom management among chikungunya patients. Since no universally approved vaccine is broadly available, healthcare providers depend on widely accessible analgesics and antipyretics for fever and joint pain relief. Moreover, as per the CDC report in February 2024, the yearly chikungunya cases reported in the U.S. is nearly 100 to 200 requiring for medication. The demand for these drugs is sustained by recurring outbreaks, especially in tropical regions, supporting continuous market growth. Government initiatives prioritize rapid symptom alleviation in endemic populations. Refer to CDC for supportive management standards.

End user Segment Analysis

The hospitals and clinics have the maximum share and are expected to hold the largest chikungunya treatment market share by 2035. This rise is due to the crucial need for accurate and proper diagnosis, access to supportive therapies, and inpatient care for severe symptoms. Hospitals are a vital part in serving for oral NSAIDs and intravenous fluids in high-risk or elderly patients, mainly during epidemic peaks. As per the WHO, the clinical management in this treatment is delivered best way in the hospital setting, especially in regions with outpatient infrastructure.

Our in-depth analysis of the chikungunya treatment market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Distribution Channel |

|

|

End user |

|

|

Strain Type |

|

|

Treatment |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chikungunya Treatment Market - Regional Analysis

Asia Pacific Market Insights

APAC is the leading region in the chikungunya treatment market and will retain the market share of 38.8% at a CAGR of 8.2% in 2035. The region is driven by the increased government spending, endemic outbreaks, and enhanced diagnostic surveillance in countries such as Malaysia, India, Japan, China, and South Korea. According to the WHO September 2024 report, vector-borne diseases constitute more than 17% of all infectious diseases, including chikungunya disease, recording 700,000 deaths every year, with Asia-Pacific nations, being major contributors to the burden of the disease.

India holds the largest share in the chikungunya treatment market and is expected to have a revenue share of 35.5% by 2035. As per India’s National Health Mission report published I August 2025, the total number of confirmed chikungunya cases in 2023 was 11477 in all states. Further, the Ministry of Health and Family Welfare report in December 2022 states that the budget outlay for vector-borne disease in the year 2022 to 2023 was Rs. 575.65 crore. On the other hand, the rising patient pool has led to expanded procurement contracts with leading manufacturers like Bharat Biotech and Cipla for drug availability.

No. of Cases Registered in APAC region in 2025

|

Country |

Year |

No. of Cases |

|

India |

2025 |

1741 |

|

Sri Lanka |

2025 |

151 |

|

China |

2025 |

478 |

|

Australia |

2025 |

77 |

Sources: National Health Mission, Ministry of Health & Mass Media, Government of Hong Kong Special Administrative Region, Relief Web

North America Market Insights

North America is the fastest-growing region in the chikungunya treatment market and is expected to hold a considerable market share by 2035. The market is driven by the increasing outbreaks in government reimbursement programs and public health surveillance. As per the Lancet regional Health data in February 2024, 0.3% which is 12,172 out of 3,684,554 are the reported cases in the population of North America. Pharmaceutical R&D incentives and private-public partnerships are creating a structured growth model for emerging manufacturers in the region.

The U.S. chikungunya treatment market for chikungunya treatment is seeing increasing demand with sporadic outbreaks in Florida, Texas, and Puerto Rico, where subtropical environments have increased vector activity. Based on the Science Direct report in February 2024, more than 3.7 million acquired cases were reported till date, triggering state-level acquisition and clinical response development. NIH and AHRQ have amplified antiviral and supportive therapy R&D funding under federal grants. The market in America is ready for suppliers of cost-effective, scale-up-capable, and Medicare-covered oral therapies, particularly in areas with outbreak repetition.

Europe Market Insights

The Europe chikungunya treatment market is projected to have the largest market share by 2035. The market is expected to be the second largest regional market and is driven due to the warming temperature in Southern and Western regions in Europe. This temperature accelerates the rise in patient volume requiring the treatment. As per the NLM report in March 2025, nearly 4730 chikungunya cases were reported till 2023 in Europe. France, the UK, and Germany substantially increase the allocations to treatments related to chikungunya diagnosis, protocols, and vaccine R&D support.

Germany will lead Europe's chikungunya treatment market and is fueled by strong expenditure on healthcare and a highly developed medical infrastructure. Germany's healthcare budget allocation exceeded 474 billion euros in 2021, according to the Destatis report published in April 2023. Till 2023 Germany has reported 684 cases which is the 14.5% of the overall cases registered in the Europe, based on the NLM article in March 2025. This increase is due to the rise in Aedes mosquitoes, vector surveillance programs, and increased prescription rates for corticosteroids and antivirals. The German Medical Association incorporated vector-borne treatment modules into physician education, an indication of systemic preparedness.

Key Chikungunya Treatment Market Players:

- Sanofi S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Moderna, Inc.

- Valneva SE

- Takeda Pharmaceutical Co. Ltd.

- Bharat Biotech International Ltd.

- Emergent BioSolutions Inc.

- CSL Seqirus

- Serum Institute of India Pvt. Ltd.

- Inovio Pharmaceuticals Inc.

- Zydus Lifesciences Ltd.

- GlaxoSmithKline plc (GSK)

- Cipla Ltd.

- Eubiologics Co., Ltd.

- Dr. Reddy’s Laboratories Ltd.

- BioNet-Asia Co. Ltd.

- Medigen Vaccine Biologics Corp.

- AbbVie Inc.

- Mitsubishi Tanabe Pharma Corp.

- Biocon Biologics Ltd.

- Duopharma Biotech Bhd.

The global chikungunya treatment market players are driven by various leading vaccine innovators and emerging firms in the pharmaceutical sector. Sanofi, Moderna, and Valneva are the top players in the market, dominating with the advancements in the vaccine portfolio and global approvals in sight. On the other hand, companies in India like Bharat Biotech, Serum Institute, and Zydus follow a cost-effective manufacturing and public immunization program to lead the market. As the patient population rises in the chikungunya treatment market in the APAC region, the government partnerships and supply chain agility are central to maintain leadership in high high-potential market.

Below is the list of some prominent players operating in the global chikungunya treatment market:

Recent Developments

- In March 2025, Bavarian Nordic announces their commercial Launch of VIMKUNYA, which is a Chikungunya Vaccine in the U.S. This is the first vaccine for individual aged above 12.

- In December 2024, Valneva SE and Serum Institute of India together have signed exclusive license for chikungunya vaccine expansion in the Asia. The agreement was signed with the funding of $41.3 million.

- Report ID: 3573

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chikungunya Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.