Lipid Disorder Treatment Market Outlook:

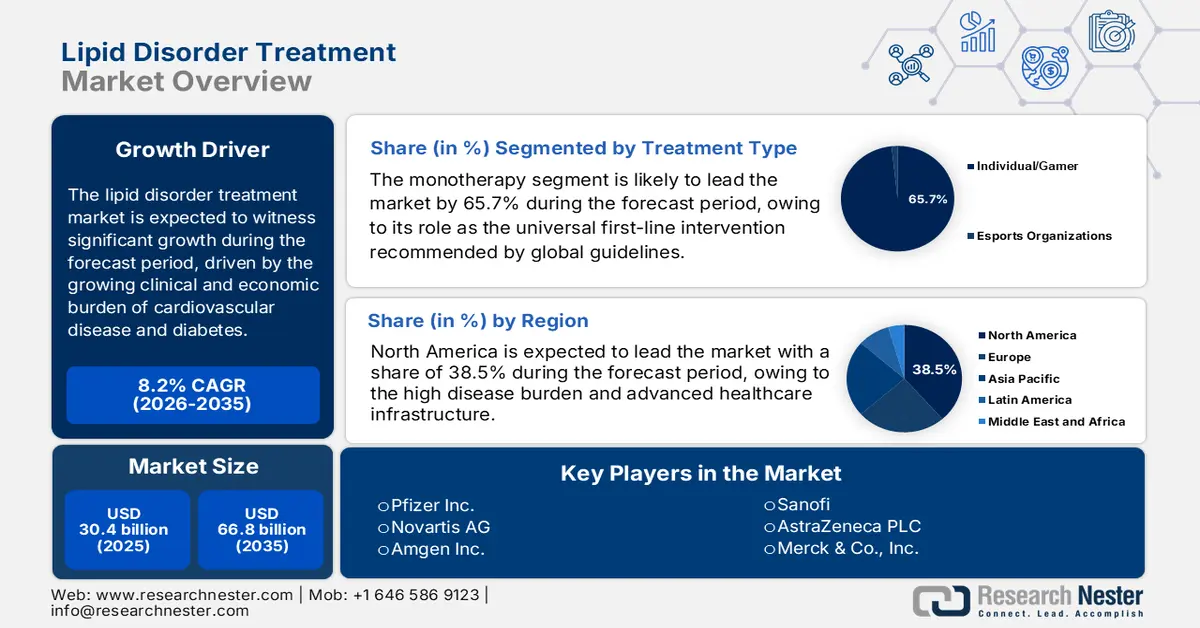

Lipid Disorder Treatment Market size was valued at USD 30.4 billion in 2025 and is projected to reach USD 66.8 billion by the end of 2035, rising at a CAGR of 8.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of lipid disorder treatment at USD 32.8 billion.

The global lipid disorder treatment market is shaped primarily by the growing clinical and economic burden of cardiovascular disease and diabetes, both of which are closely linked to dyslipidemia prevalence. In the U.S. CDC in October 2024 indicates that 86 million U.S. adults have total cholesterol levels above 200 mg/dL, and 25 million adults have total cholesterol levels above 240 mg/dL. This data indicates a sustained and expanding patient pool requiring long-term management and monitoring. This burden translates directly into healthcare utilization, and cardiovascular disease accounted for a high annual cost in the U.S. via healthcare services, medicines, and lost productivity. The scale of this impact is substantial; for example, the Health Affairs in March 2022 reports that the U.S. national expenditure is projected to reach USD 6.8 trillion by 2030, with cardiovascular conditions representing a major cost driver.

On the public payer side, the spending on heart disease in 2022 by the U.S. people reached USD 100 billion, based on the AHRQ in July 2025, reflecting the scale of pharmacologic and follow-up care tied to lipid control. At the policy level, the U.S. Preventive Services Task Force and the NIH continue to reinforce the lipid screening and risk-based treatment thresholds, which sustain steady demand from primary care networks, hospital systems, and integrated delivery organizations. In parallel, the World Heart Federation data in 2026 states that nearly 3.6 million deaths occur annually due to high cholesterol, positioning lipid management as a persistent public health priority across both high-income and emerging markets. From a market operations perspective, treatment demand is increasingly shaped by population aging, expanding insurance coverage, and national prevention strategies targeting non-communicable diseases.

Key Lipid Disorder Treatment Market Insights Summary:

Regional Highlights:

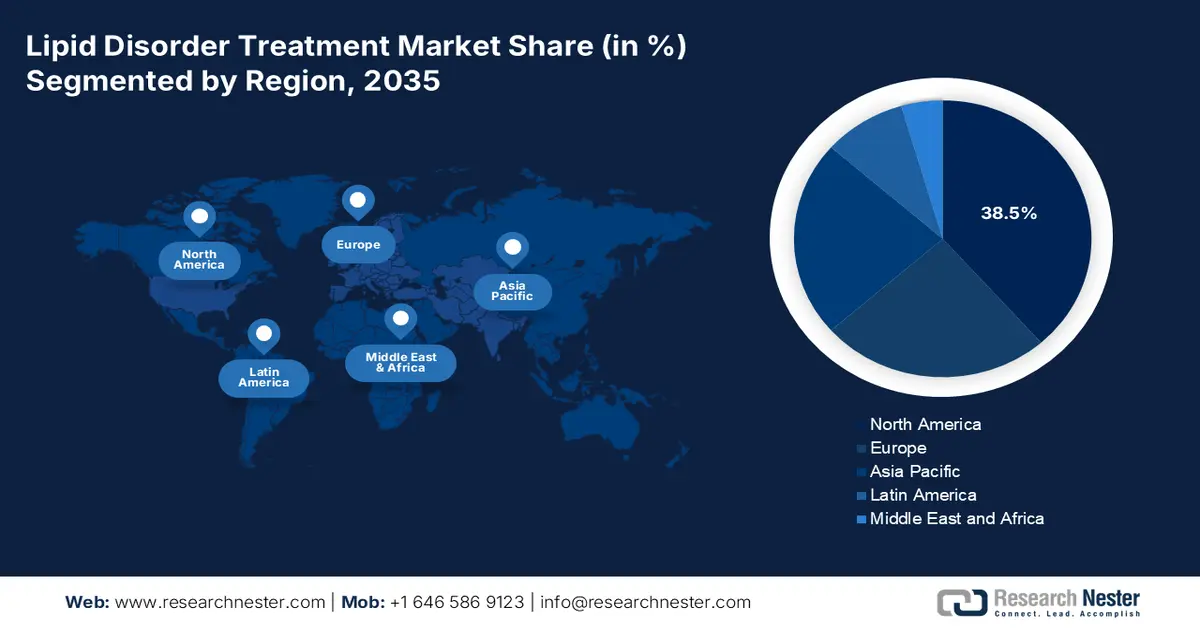

- North America is anticipated to secure a 38.5% revenue share by 2035 in the lipid disorder treatment market, underpinned by a high disease burden, advanced healthcare infrastructure, and early uptake of premium innovative therapies.

- Asia Pacific is forecast to expand at a CAGR of 7.8% during 2026–2035, accelerated by a rapidly growing patient pool driven by lifestyle-related diseases and rising healthcare awareness.

Segment Insights:

- Monotherapy is projected to account for a 65.7% share by 2035 in the lipid disorder treatment market, reinforced by its position as the universal first-line therapy endorsed by global clinical guidelines for primary and secondary prevention.

- Oral route of administration is expected to command the largest share by 2035, supported by patient-centric advantages such as convenience, non-invasiveness, and ease of long-term adherence.

Key Growth Trends:

- Rising public expenditure on cardiovascular disease management

- Aging population and government geriatric care budgets

Major Challenges:

- Exorbitant R&D costs and high failure rates

- Stringent regulatory and outcomes evidence hurdles

Key Players: Novartis AG (Switzerland), Amgen Inc. (U.S.), Sanofi (France), AstraZeneca PLC (UK/Sweden), Merck & Co., Inc. (U.S.), Abbott Laboratories (U.S.), GlaxoSmithKline plc (UK), Mylan N.V. (U.S.), Eli Lilly and Company (U.S.), Daiichi Sankyo Company, Limited (Japan), Regeneron Pharmaceuticals, Inc. (U.S.), Esperion Therapeutics, Inc. (U.S.), Cipla Limited (India), Dr. Reddy's Laboratories Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Hikma Pharmaceuticals PLC (UK/Jordan), Hanmi Pharmaceutical Co., Ltd. (South Korea), CSL Limited (Australia), Kotra Pharmaceuticals Sdn. Bhd. (Malaysia).

Global Lipid Disorder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.4 billion

- 2026 Market Size: USD 32.8 billion

- Projected Market Size: USD 66.8 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 13 January, 2026

Lipid Disorder Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising public expenditure on cardiovascular disease management: Governments are steadily increasing the healthcare allocation towards cardiovascular disease, where lipid disorders are a primarily modifiable risk factor. According to the CDC, in April 2023, data show that 1 in 9 health care dollars is spent on CVD, including direct medical spending and productivity losses, driving a sustained public payer investment in cholesterol management programs. According to the AHA Journal in June 2024, Medicare alone spent over USD 384 billion and is expected to increased at 214%, reinforcing the predictable reimbursement for lipid-lowering therapies. Similar budgetary prioritization is visible across Europe and parts of Asia, where national health systems are channeling funds into long term cardiometabolic risk reduction.

- Aging population and government geriatric care budgets: The rising aging population is a structural driver in the lipid disorder treatment market. The United Nations in 2023 reports that the global population aged 65 and above will double from 761 million in 2021 to 1.6 billion by 2050, significantly increasing the exposure to dyslipidemia and cardiovascular risk. The government is responding by expanding geriatric care budgets mainly in Japan, Europe, and North America, where the public insurance system cover long term cardiometabolic management. This demographic shift ensures durable growth in treatment volumes driven by public sector reimbursement rather than discretionary consumer spending. This demographic transition is also surging the government investment in the preventive lipid management within senior care programs.

- Advancements in drug delivery and dosing regimens: The emerging therapeutics are overcoming the historical adherence barriers via improved delivery systems. The development of long-acting injectables, such as siRNA therapies requiring administration only twice yearly, represents a significant trend. This directly addresses one of the key challenges in chronic lipid management: patient adherence to daily oral regimens. These innovations enhance the real-world effectiveness and are highly attractive to payers and health systems by potentially improving outcomes and reducing the management burden. The success of these models is encouraging R&D investment in next gen delivery platforms. The NIH highlights that such sustained release platforms can improve the mean medication possession ratios compared to daily oral therapies, directly impacting the long term cardiovascular outcomes.

Challenges

- Exorbitant R&D costs and high failure rates: Developing a novel lipid therapy requires significant investment and takes years, with a high clinical failure rate. The high-risk investment is a primary barrier, mainly for small and mid sized biotefs. For example, the top companies have faced immense financial strain developing their oral non-statin drug bempedoic acid, requiring extensive partnerships and financing rounds to complete its large-scale CLEAR Outcomes trials to prove cardiovascular benefit. The success of this trial was critical to secure the lipid disorder treatment market acceptance and reimbursement, a make-or-break moment for the company.

- Stringent regulatory and outcomes evidence hurdles: Regulators such as the FDA and EMA now mandate hard cardiovascular outcomes data for approval, not just LDL-C lowering. This requires long and expensive trials involving 10,000+ patients. Novartis successfully navigated this with its siRNA drug Leqvio, investing in the ORION outcomes trial program to supplement its strong efficacy data. Without this evidence, new agents struggle to be included in major treatment guidelines, severely limiting their commercial potential.

Lipid Disorder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 30.4 billion |

|

Forecast Year Market Size (2035) |

USD 66.8 billion |

|

Regional Scope |

|

Lipid Disorder Treatment Market Segmentation:

Treatment Type Segment Analysis

In the treatment type segment, monotherapy is leading in the lipid disorder treatment market and is poised to hold the share value of 65.7% by 2035. The segment is driven by the dominant role as the universal first-line intervention recommended by global guidelines for primary and secondary prevention. Its widespread use is underpinned by generic availability, proven mortality benefit in landmark trials, established safety profiles, and high patient adherence due to simple oral dosing. Despite the growing adoption of combination therapies for complex cases, the sheer volume of newly diagnosed patients and the emphasis on early aggressive LDL-C lowering with a single agent ensure monotherapy’s sustained lipid disorder treatment market volume. The CDC in October 2024 highlights that the scale of this segment is reported to be nearly 86 million U.S. adults who were eligible for or taking cholesterol-lowering medication, the vast majority initiated on statin monotherapy.

Route of Administration Segment Analysis

The oral route of administration is preferred in lipid management, capturing the largest share value in the lipid disorder treatment market. This preference is driven in patient centric factors such as convenience non invasiveness and ease of integration into daily routines, which directly support long term adherence, crucial for chronic condition management. While the injectable PCSK9 inhibitors and RNA-based therapies represent significant advances for high-risk patients, their use is reserved for specific populations failing oral regimens. The lipid disorder treatment market is further stimulated by the development of novel oral agents such as bempedoic acid and the oral PCSK9 inhibitors, which aim to combine the efficiency of advanced biologics with the convenience of a pill. The U.S. FDA data on drug approvals reflects this trend, showing that for metabolic and cardiovascular indications, including lipid disorders, were developed for oral delivery, highlighting the industry focus on this route.

Age Group Segment Analysis

The geriatric population is the largest sub-segment in the age group segment due to the direct correlation between age and cardiovascular risk. The prevalence of dyslipidemia, polypharmacy, and established atherosclerotic cardiovascular disease is highest in this cohort, necessitating lifelong, often intensive lipid-lowering therapy. Treatment strategies must carefully manage drug interactions and age-related considerations such as renal function. This demographic growth is driven by the global aging trends, creating a persistent and expanding patient pool. The National Institute on aging part of the NIH, projects the economic and healthcare impact of this shift, stating that the number of U.S. people aged 65 and older is expected to rise from 58 million in 2022 to about 82 million by 2050, by the PRB data in January 2024 ensuring a sustained demand for both foundational and advanced lipid therapies customized to older adults.

Our in-depth analysis of the lipid disorder treatment market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Disease Indication |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

Age Group |

|

|

Treatment Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lipid Disorder Treatment Market - Regional Analysis

North America Market Insights

The North America lipid disorder treatment market is projected to maintain a dominant global revenue share and is poised to hold the revenue share of 38.5% by 2035. The lipid disorder treatment market is driven by the region’s high disease burden, advanced healthcare infrastructure, and early adoption of premium-priced innovative therapies. The key drivers include a high prevalence of obesity and dyslipidemia, supportive reimbursement frameworks for novel agents, and robust treatment guidelines promoting aggressive LDL-C lowering. A primary trend is the shifting product mix from generic statins toward PCSK9 inhibitors, RNA-based therapies, and combination drugs supported by robust outcomes data. The lipid disorder treatment market is also shaped by value-based care initiatives and complex payer negotiations focusing on the total cost of care. Patient expectations of key biologics post will introduce biosimilar competition, moderating growth but increasing volume.

In the U.S. lipid disorder treatment market, the convergence of a large, underdiagnosed patient base and the rapid adoption of advanced lipid-lowering therapies is driving demand patterns across public and private healthcare systems. According to the NLM study in February 2024, nearly 20% to 60% prevalence of hypercholesterolemia reported across the population, and almost half of all affected individuals are unaware of their condition. The addressable treatment pool continues to expand via government-backed screening and cardiovascular prevention programs. The demand is mainly concentrated in high-risk cohorts. Dyslipidaemia affects 60% to 80% of patients with obesity and 60% to 90% of those with diabetes, creating a sustained need for first-line and escalation therapies. This epidemiologic pressure is surging uptake of newer drug classes such as PCSK9 inhibitors, siRNA therapy, and ACL inhibitors, mainly in statin-intolerant patients and those with established ASCVD or familial hypercholesterolemia.

Advances in Lipid-Lowering Drug Therapy

|

Drug Class |

Key Representative Drugs |

Primary Mechanism of Action |

Primary Lipid Effects |

Key Indications |

Notable Considerations |

|

PCSK9 inhibitors (monoclonal antibodies) |

Alirocumab and evolocumab |

Binds to and inhibits the PCSK9 protein |

↓ LDL-C (significant) and ↓ Lp(a) |

HeFH, clinical ASCVD (adjunct to diet/statins); HoFH (Evolocumab) |

Injectable (subcutaneous) and significant LDL-C lowering |

|

PCSK9 inhibitors (siRNA) |

Inclisiran |

siRNA targeting PCSK9 mRNA (prevents PCSK9 production) |

↓ LDL-C (significant) and ↓ Lp(a) |

Primary hyperlipidemia and HeFH (adjunct to diet/statins) |

Injectable (subcutaneous) and favorable dosing (eg, twice yearly) |

|

Adenosine triphosphate-citrate lyase inhibitor |

Bempedoic acid |

Inhibits ACL (upstream cholesterol synthesis) |

↓ LDL-C |

Established CVD or high risk, unable to take statins; primary hyperlipidemia, HeFH |

Oral, an option for statin-intolerant patients, and risk of tendonitis |

|

Microsomal triglyceride transfer protein inhibitor |

Lomitapide mesylate |

Inhibits MTP (reduces VLDL/chylomicron assembly) |

↓ LDL-C, ↓ total cholesterol and ↓ Apo B |

Homozygous familial hypercholesterolemia |

FDA box warning— Hepatotoxicity |

Sources: NLM December 2025

Canada lipid disorder treatment market is driven by the economies of patented medicines, which dominate the value creation in chronic cardiovascular care. The report from the Government of Canada in December 2024 depicts that the patented drugs accounted for 47% of total pharmaceutical sales with overall patented medicine revenue reaching USD 19.9 billion, up 82% YoY, indicating the growing weight of innovative therapies in long term disease management. This trend is directly relevant to lipid care, where newer treatments such as PCSK9 inhibitors, siRNA-based therapies, and ACL inhibitors remain largely patent-protected and are concentrated in high-risk populations, including patients with ASCVD, diabetes, and familial hypercholesterolemia. At the same time, the price regulation via the PMPRB is actively shaping the market access. Despite these, the continued growth in the R&D spending signals a sustained innovation and positions Canada as an expanding lipid disorder treatment market.

APAC Market Insights

The Asia Pacific lipid disorder treatment market is the fastest growing and is poised to grow at a CAGR of 7.8% during the forecast period 2026 to 2035. The market is driven by the massive and expanding patient base. The key drivers of the lipid disorder treatment market include the rapid epidemiological transition towards lifestyle-related diseases, rising rates of obesity and diabetes, increasing urbanization, and growing healthcare awareness. A significant trend is the twin-track market development premium on innovative therapies and gaining traction in high income market such as Japan and South Korea, while the high-volume generic statins continue to dominate in large price sensitive market such as India and China. Regulatory harmonization efforts, such as those by the ASEAN Pharmaceutical Regulatory Policy, aim to streamline market access while governments are increasingly focusing on national prevention programs to curb the rising economic burden of cardiovascular diseases.

The China lipid disorder treatment market is the largest and the most dynamic in the Asia Pacific region and is driven by a vast patient population and significant government effort to integrate the innovative therapies into the public health system. A primary growth catalyst is the annual update of the National Reimbursement Drug List, where successful negotiation for inclusion guarantees broad patient access and a massive volume uptick for selected medicines. For example, the PCSK9 inhibitor Evolocumab was included in the NRDL, immediately expanding its availability to millions of patients. The market operates under the strict volume-based procurement policies that aggressively lower prices for the generics and originator drugs. The report from the NLM study in September 2023 indicates that the prevalence of dyslipidemia among adults was approximately 35.6%, highlighting the immense and sustained underlying demand that drives the market growth despite pricing pressures.

The Japan lipid disorder treatment market is defined by the rapid adoption of innovative pharmaceuticals, a super-aging society, and a unique biennial drug price revision system under the NHI. This system forces automatic price cuts for existing drugs, creating a powerful incentive for manufacturers to launch new products with premium pricing. A key driver is the high cardiovascular risk of launching new products with premium pricing. A key driver is the high cardiovascular disease burden among the elderly; the government’s focus on preventive life course healthcare aims to extend healthy life expectancy, sustaining demand for effective lipid management. The Pharma Japan in October 2024 reported that in 2022, the national medical expenditure reached a record 46.7 trillion yen, with the pharmaceuticals accounting for a significant portion, reflecting the scale of the healthcare market in which lipid-lowering agents are a core component.

Europe Market Insights

High disease burden, robust cost effectiveness evaluation, and a complex multinational reimbursement landscape are driving the European lipid disorder treatment market. The primary driver is the significant prevalence of cardiovascular disease, the leading cause of mortality in the EU, according to the European Heart Network. The market access is heavily mediated by the national health technology assessment bodies, which apply rigorous economic analysis, often leading to slower adoption of premium-priced novel therapies compared to the U.S. A central trend is the implementation of the new EU HTA regulation, aiming to streamline joint clinical assessments across member states to improve the predictability and efficacy. This occurs alongside the EU’s major pharmaceutical legislation reform focused on ensuring supply security and stimulating innovation while controlling expenditure.

The real world prescribing patterns show a structurally conservative but gradually evolving therapy landscape that directly shapes the Germany lipid disorder treatment market. The NLM study in May 2025 states that the statins dominated the first-line treatment prescribed in 96.3% of the initial cases, with 72.6% of patients starting on moderate intensity regimens reflecting the strong influence of cost-effective guideline-driven care within the statutory health insurance system. However, only 17.4% of the patients undergo treatment modification, and escalation beyond the second-line therapy remains limited, highlighting the gap between the clinical need and therapeutic intensification. Among the second-line treatments, high-intensity statins and statin ezetimibe combinations dominate, including a gradual shift towards combination strategies to meet the LDL-C targets. From the market perspective, Germany is positioned as a volume-driven generics-led market at the base, with the future growth concentrated in escalation pathways, particularly among high-risk ASCVD and familial hypercholesterolemia populations, where reimbursement criteria increasingly support specialty lipid-lowering therapies.

The UK lipid disorder treatment market is defined by a centralized cost-effectiveness-driven approach led by the National Institute for Health and Care Excellence. Access to new high-cost lipid therapies such as PCSK9 inhibitors is strictly contingent on positive NICE recommendations, which have historically involved complex negotiations and managed access management. A major trend is the increasing use of population health management and novel commercial arrangements such as the Voluntary Schemes for Branded Medicines Pricing and Access. The high prevalence of cardiovascular risk factors sustains the demand. The NAO in November 2024 data reports that in the UK, nearly 6.4 million adults were living with cardiovascular disease, highlighting the sustained patient population requiring long-term management, including lipid-lowering treatment.

Deaths and Number of Living with Cardiovascular Disease

|

Nation |

No. of People Dying from CVD (2024) |

No. of People Under 75 Years Old Dying from CVD (2024) |

Estimated Number of People Living with CVD (latest estimate) |

|

England |

137,572 |

37,723 |

7 million + |

|

Scotland |

17,444 |

5,195 |

800,000 + |

|

Wales / Cymru |

9,260 |

2,660 |

400,000 + |

|

Northern Ireland |

4,416 |

1,330 |

230,000 + |

|

UK total |

169,205 |

47,257 |

8 million + |

Source: BHF January 2026

Key Lipid Disorder Treatment Market Players:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Amgen Inc. (U.S.)

- Sanofi (France)

- AstraZeneca PLC (UK/Sweden)

- Merck & Co., Inc. (U.S.)

- Abbott Laboratories (U.S.)

- GlaxoSmithKline plc (UK)

- Mylan N.V. (U.S.)

- Eli Lilly and Company (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Esperion Therapeutics, Inc. (U.S.)

- Cipla Limited (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Hikma Pharmaceuticals PLC (UK/Jordan)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- CSL Limited (Australia)

- Kotra Pharmaceuticals Sdn. Bhd. (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc. is a global dominating player in the lipid disorder treatment market and has revolutionized it with the blockbuster statin Lipitor. The company continues to leverage its massive scale and commercial infrastructure to maintain dominance in the statin segment while investing in next-gen therapies, including the novel oral treatments and combination drugs, to address residual cardiovascular risk and expand its cardiovascular portfolio beyond legacy products. According to the company’s annual report, the revenue ranges from USD 61.0 to USD 64.0 billion in 2025.

- Novartis AG maintains a powerful position in the lipid disorder treatment market via its highly efficacious drug. The company’s strategic initiative focuses on this first-in-class siRNA therapy that provides long-acting LDL-C reduction with biannual dosing, aiming to improve adherence and outcomes via a unique real-world implementation model and partnerships with healthcare systems to integrate this innovative treatment into standard care pathways. In 2024, the net sales in the therapeutic areas such as cardiovascular, renal, and metabolic reached USD 8,576 million.

- Amgen is a key innovator in the lipid disorder treatment market with its pioneering PCSK9 inhibitor Repatha. The company’s strategy indicates robust outcomes data from vast clinical trials to secure broad reimbursement and guideline inclusion. Amgen aggressively pursues market access and explores novel formulations and delivery systems to enhance patient convenience, solidifying Repatha as a standard for high-risk patients requiring intensive LDL cholesterol lowering.

- Sanofi is a leading player in the lipid disorder treatment market with the PCSK9 inhibitor Praluent. The company’s strategic initiatives have involved significant price reductions and outcomes-based agreements with the payers to improve accessibility. Sanofi focuses on penetrating the market for patients with familial hypercholesterolemia and established cardiovascular disease, leveraging its global commercial reach to compete effectively in the advanced lipid-lowering therapy space.

- AstraZeneca PLC holds a significant stake in the lipid disorder treatment market beyond traditional strains. Its strategy capitalizes on the cardiovascular risk reduction benefits of its diabetes drug Farxiga, which is now indicated for heart failure, thereby capturing a broad patient population with metabolic and lipid disorders. The company invests heavily in R&D for cardio metabolic diseases, seeking integrated treatment approaches that address interconnected risk factors such as dyslipidemia within broader cardiovascular outcomes trials.

Here is a list of key players operating in the global lipid disorder treatment market:

The global lipid disorder treatment market is highly competitive and is dominated by multinational pharmaceutical giants mainly from the U.S. and Europe. The key players compete via extensive R&D for next-gen PCSK9 inhibitors, RNA-based therapies, and combination drugs. The strategic initiatives include robust marketing of established statins, strategic mergers and acquisitions to boost the pipelines, and aggressive expansion into high-growth emerging markets. For example, in August 2025, AbbVie announced that it had completed its acquisition of Capstan Therapeutics. Further, the companies are increasingly engaging in patent litigation, pursuing biosimilar development as blockbusters lose exclusivity, and forming partnerships with biotech firms for innovative lipid-lowering agents to secure long term market share.

Corporate Landscape of the Lipid Disorder Treatment Market:

Recent Developments

- In July 2025, Novartis announced that the U.S. Food and Drug Administration (FDA) has approved a label update for Leqvio (inclisiran), enabling its use as monotherapy along with diet and exercise to reduce low-density lipoprotein cholesterol (LDL-C) in adults with hypercholesterolemia1.

- In February 2025, The U.S. Food and Drug Administration approved Mirum Pharmaceuticals Ctexli to treat adults with cerebrotendinous xanthomatosis, a rare lipid storage disease.

- In December 2024, Ionis Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) has approved TRYNGOLZA (olezarsen) as an adjunct to diet to reduce triglycerides in adults with familial chylomicronemia syndrome (FCS), a rare, genetic form of severe hypertriglyceridemia (sHTG) that can lead to potentially life-threatening acute pancreatitis (AP).

- Report ID: 8340

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lipid Disorder Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.