Artemisinin Antimalarial Drugs Market Outlook:

Artemisinin Antimalarial Drugs Market size was valued at USD 680.16 million in 2025 and is set to exceed USD 1.2 billion by 2035, registering over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of artemisinin antimalarial drugs is evaluated at USD 715.66 million.

The increasing prevalence of malaria is primarily augmenting the market growth worldwide. Underdeveloped and developing countries are mainly witnessing issues related to diseases caused by mosquitoes. For instance, according to a report by the World Health Organization (WHO), there were around 249 million cases of malaria, globally, in 2022. Such statistics underscore the need for effective treatment options, fuelling the market growth.

Africa is the most prevalent region for malaria, accounting for 94.0% of all malaria cases in 2022. The governments in the region are implementing several initiatives to increase disease awareness and care, this is generating lucrative opportunities for artemisinin antimalarial drug manufacturers.

Key Artemisinin Antimalarial Drugs Market Insights Summary:

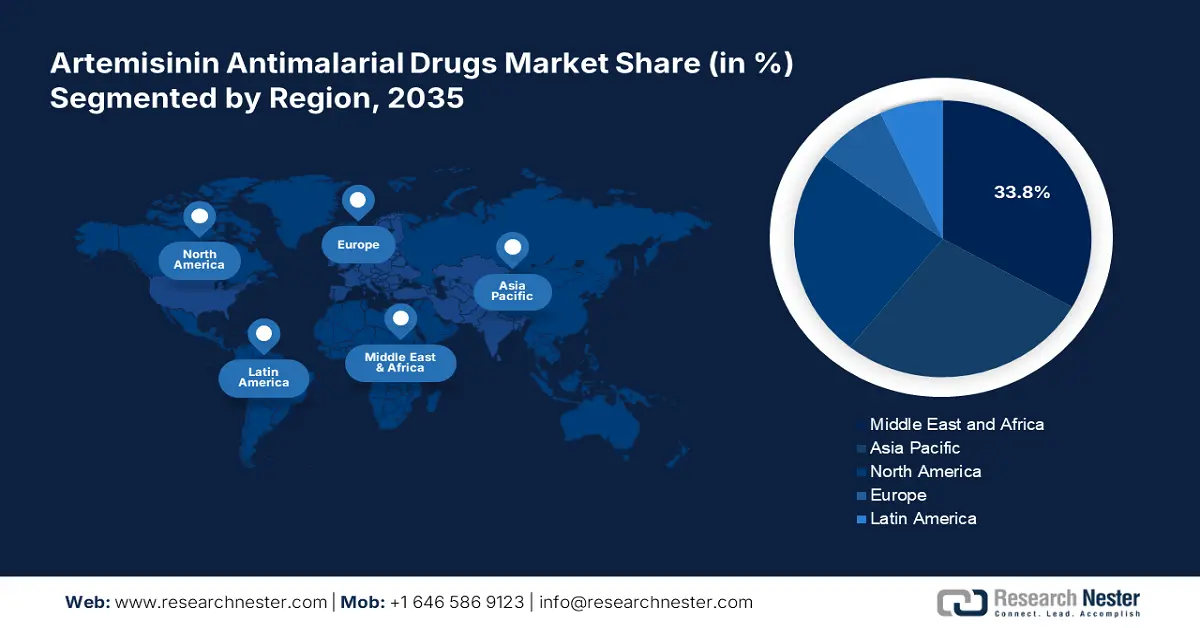

Regional Highlights:

- MEA’s 33.8% share in the artemisinin antimalarial drugs market is driven by the high prevalence of malaria, sustaining dominance through 2026–2035.

Segment Insights:

- The Antimalarial Tablets segment is projected to secure an 80.1% share by 2035, driven by innovations in tablet formulations and their ease of administration.

- The Plasmodium Falciparum segment of the Artemisinin Antimalarial Drugs Market is projected to maintain a 65.8% share by 2035, driven by the high prevalence and severity of this malaria type.

Key Growth Trends:

- Shift towards combination therapies

- Advancements in drug formulations and delivery

Major Challenges:

- Resistance to artemisinin antimalarial drugs

- Strict and lengthy approval processes

- Key Players: Cipla Limited, Novartis AG, Sanofi S.A., GlaxoSmithKline Pharmaceuticals Ltd, Shanghai Desano Pharmaceutical Group Co., Ltd, Mylan N.V., and Shanghai Fosun Pharmaceutical Co., Ltd.

Global Artemisinin Antimalarial Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 680.16 million

- 2026 Market Size: USD 715.66 million

- Projected Market Size: USD 1.2 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: MEA (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Brazil, Japan, United States

- Emerging Countries: China, India, Thailand, Vietnam, Indonesia

Last updated on : 14 August, 2025

Artemisinin Antimalarial Drugs Market Growth Drivers and Challenges:

Growth Drivers:

- Shift towards combination therapies: The growing need for advanced therapeutic approaches is fuelling the demand for artemisinin-based combination therapies. Combination therapies enhance the effectiveness of treatment offering improved patient care. Many studies estimate that artemisinin-based combination therapies are first-line treatments for uncomplicated malaria, which increases their adoption rate and boosts overall market growth. Many pharma companies are actively investing in research and development activities to create advanced formulations and combinations to improve therapeutic profiles. For instance, in November 2023, Novartis and Medicines for Malaria Venture (MMV) announced the decision to move to a Phase 3 study for an innovative ganaplacide/lumefantrine-SDF combination to treat uncomplicated malaria among children and adults.

- Advancements in drug formulations and delivery: Innovations in drug delivery systems such as long-acting injectables and formulations are expected to augment the artemisinin antimalarial drugs market growth in the coming years. The long-acting injectables offer sustained release of the active ingredient for a longer time, which reduces the frequency of dosing. These innovative injectables are expected to be beneficial in malaria-endemic regions where adherence to daily oral regimens can be challenging. Also, the integration of nanotechnology in medicine formulations can improve drug solubility and stability, contributing to overall market growth.

For instance, in October 2023, the Johns Hopkins Bloomberg School of Public Health revealed that their researchers are working on the development of atovaquone-based long-acting antimalarial injectables. Such innovations are expected to aid in enhancing malaria patient care.

Challenges:

- Resistance to artemisinin antimalarial drugs: The increasing resistance of malaria to artemisinin and its derivatives is expected to significantly hamper the market growth in the coming years. Adaption can majorly reduce the effectiveness of artemisinin-based treatments.

- Strict and lengthy approval processes: Strict rules and lengthy product approval procedures hinder the introduction of new drug formulations. Such stringent regulatory approvals significantly hamper the profit shares of the market players as they might not grab trending opportunities through product launches. Many small pharma companies or start-ups witness huge losses as they have invested high in research and development for innovative antimalarial drugs.

Artemisinin Antimalarial Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 680.16 million |

|

Forecast Year Market Size (2035) |

USD 1.2 billion |

|

Regional Scope |

|

Artemisinin Antimalarial Drugs Market Segmentation:

Product (Antimalarial Injections, Antimalarial Tablets)

Antimalarial tablets segment is likely to account for more than 80.1% artemisinin antimalarial drugs market share by the end of 2035.The ongoing innovations in antimalarial tablet formulations are promoting their sales growth. The easy administration and high potential results are majorly driving the consumption of antimalarial tablets. Travelers often get affected by mosquito-related diseases including, malaria and to avoid any serious effects, they rely on antimalarial tablets. For instance, according to the U.S. Department of Veterans Affairs, mefloquine a white round tablet can help travelers to get cured of malaria infections.

Malaria Type (Plasmodium Falciparum, Plasmodium Vivax, Plasmodium Ovale, Plasmodium Malariae, Plasmodium Knowlesi)

The plasmodium falciparum segment in artemisinin antimalarial drugs market is anticipated to capture a significant share of the global revenue by 2035 owing to the high prevalence of plasmodium falciparum and its severity. Plasmodium falciparum is a dominant parasite and accounts for a 65.8% prevalence rate, globally. Thus, such a high prevalence rate substantially drives the need for advanced medications including artemisinin-based combination therapies. Underdeveloped countries in Asia Pacific and MEA are particularly driving high demand for artemisinin antimalarial medications.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Malaria Type |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artemisinin Antimalarial Drugs Market Regional Analysis:

Middle East and Africa Market Forecast

Middle East and Africa industry is anticipated to account for largest revenue share of 33.8% by 2035. The high prevalence of malaria and lack of hygiene in some parts of these regions particularly, in Africa is majorly fuelling the demand for advanced artemisinin antimalarial drugs.

Israel is one of the top markets for innovations in the medical device and pharma sectors, which is contributing to the development of advanced artemisinin antimalarial medications. The presence of advanced healthcare infrastructure and research organizations in the country is driving the sales of modern artemisinin antimalarial drugs. Israel has the world’s best and broadest health basket and according to the Government of Israel over 110 medical technologies and drugs were included in the basket at USD 178.5 million in 2024.

Nigeria is one of the African countries with a high burden of malaria, around 28% of the prevalence rate. International artemisinin antimalarial drug manufacturers are entering the Nigeria market to earn maximum revenue shares. The country is also carrying out several anti-malaria programs, which is fuelling the demand for injectable artemisinin antimalarial drugs.

Asia Pacific Market Statistics

Asia Pacific is foreseen to witness steady demand for artemisinin antimalarial drugs owing to the rise in malaria cases in some countries. China, Indonesia, and India are some of the economies with a high prevalence of malaria. The continuous innovations and malaria awareness programs are anticipated to boost the sales of artemisinin antimalarial drugs.

In India, the rising investments in healthcare infrastructure development and supportive government initiatives on malaria elimination are contributing to the market growth. For instance, the National Strategic Plan by India focuses on eliminating malaria by 2030.

Key Artemisinin Antimalarial Drugs Market Players:

- Cipla Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Rusan Pharma Ltd.

- Sanofi S.A.

- Shin Poong Pharmaceutical Co., Ltd.

- Guilin Pharmaceutical Co., Ltd.

- Ipca Laboratories Ltd.

- KPC Pharmaceuticals, Inc.

- AdvaCare Pharma USA LLC

- Calyx Chemicals and Pharmaceuticals Ltd.

- GlaxoSmithKline Pharmaceuticals Ltd

- Ajanta Pharma Limited

- Shanghai Desano Pharmaceutical Group Co., Ltd

- Mylan N.V.

- Shanghai Fosun Pharmaceutical Co., Ltd.

Key players in the artemisinin antimalarial drugs market are investing heavily in the development of new formulations and delivery systems to enhance efficacy and patient compliance. They are also innovating fixed-dose combination therapies, which could enhance the effectiveness of treatment and aid in combating resistance. Industry giants are also collaborating with other players and research organizations to foster innovation and boost drug development. Furthermore, they are expanding into high-potential regions such as Asia Pacific, and Middle East & Africa where malaria prevalence is high to earn high profits.

Some of the key players include:

Recent Developments

- In July 2024, the Safety of Antimalarials in the FIrst TRimEster (SAFIRE) consortium funded by Global Health EDCTP3 Joint Undertaking (EDCTP3), and the Swiss State Secretariat for Education, Research, and Innovation (SERI) plans to undertake a Phase 3 clinical trial assessing antimalarial drugs in women in their first trimester of pregnancy. The enrolment for this trial is expected to start in 2025 and is foreseen to offer effective and safe results on antimalarials.

- In July 2024, GlaxoSmithKline Pharmaceuticals Ltd and the Medicines for Malaria Venture (MMV) revealed the launch of single-dose radical cure medicine to prevent the relapse of plasmodium vivax malaria in Brazil and Thailand. This single-dose medication is formulated using tafenoquine and co-administered with chloroquine, all set to eliminate malaria around the globe.

- In April 2024, Novartis AG and the Medicines for Malaria Venture (MMV) revealed the positive results from the phase II/III CALINA study. This elaborates that the innovative formulation of Coartem can be used for babies weighing less than 5kg with malaria. The trial was conducted in several African countries and showed safe and effective results.

- Report ID: 6615

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.