Globale Markttrends für die Sicherung von Telekommunikationsdiensten, Prognosebericht 2025-2037

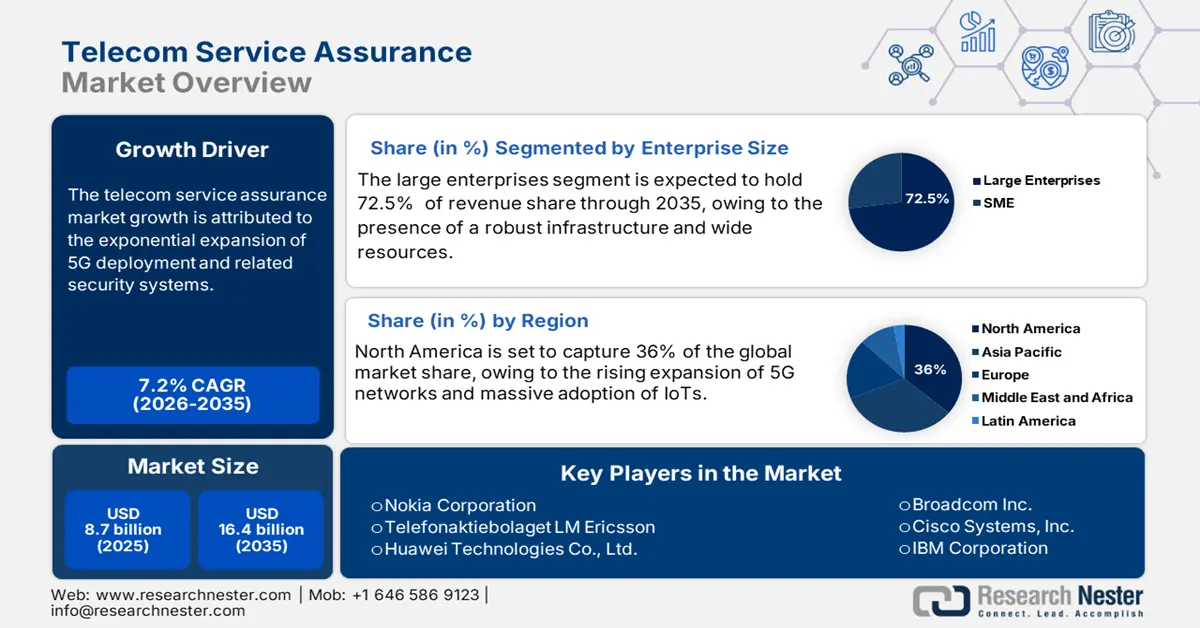

Der Markt für Telekommunikations-Service-Assurance hatte im Jahr 2024 ein Volumen von 8,2 Milliarden US-Dollar und dürfte bis Ende 2037 ein Volumen von 20,3 Milliarden US-Dollar erreichen. Im Prognosezeitraum 2025–2037 wird eine jährliche Wachstumsrate von 7,2 % erwartet. Im Jahr 2025 wird das Branchenvolumen für Telekommunikations-Service-Assurance auf 8,8 Millionen US-Dollar geschätzt.

Wichtige Wirtschaftsindikatoren verdeutlichen die Preisdynamik, die den gesamten Markt für Telekommunikations-Service-Assurance-Lösungen beeinflusst. Das US Bureau of Labor Statistics gab an, dass der Erzeugerpreisindex (PPI) für verschiedene Telekommunikationsdienste aufgrund der Marktkonkurrenz und des technologischen Fortschritts Schwankungen aufweist. Auch der Verbraucherpreisindex zeigt Veränderungen der Verbraucherpreise für Telekommunikationsdienste auf, was wiederum Investitionsentscheidungen innerhalb der Branche beeinflusst. Verschiedene Regierungen investieren in Cybersicherheit und Netzwerkstabilität, um Leistung und Zuverlässigkeit zu verbessern. Dadurch steigt die Nachfrage nach fortschrittlichen Service-Assurance-Lösungen deutlich an.

Gewährleistung von Telekommunikationsdiensten: Wachstumstreiber und Herausforderungen

Wachstumstreiber

- Steigender Ausbau der 5G-Netze und damit verbundene Sicherheitsmaßnahmen: Der Ausbau der 5G-Netze fördert die Nachfrage nach Lösungen zur Service-Assurance. Dienstanbieter müssen Sicherheit und Compliance gewährleisten. Die 5G-Architektur ist komplex und anfällig für Sicherheitslücken und Signalstürme. So kam es beispielsweise 2023 bei T-Mobile zu einem API-Verstoß und fast 37,5 Millionen Kundendaten. Solche Fälle verdeutlichen Sicherheitslücken in der 5G-Infrastruktur. Die Federal Communications Commission (FCC) prognostizierte zudem einen Anstieg der Cyberangriffe im Telekommunikationsbereich um 310 % ab 2020 im Zusammenhang mit dem Ausbau von 5G. Telekommunikationsunternehmen investieren in KI-gestützte Service-Assurance-Plattformen, um die Herausforderungen der Cyberbedrohungen zu meistern.

- Standardisierungsbemühungen für Interoperabilität:Die Standardisierungsbemühungen für eine reibungslose 5G-Interoperabilität wirken als Katalysator für den Markt für Service-Assurance im Telekommunikationsbereich. Diese Standardisierung ist wichtig, um eine nahtlose Integration zu gewährleisten und die Sicherheit zu erhöhen. Verschiedene Organisationen entwickeln Protokolle, um Netzwerke verschiedener Anbieter zu vereinheitlichen und die Nachfrage im Markt für Service-Assurance zu steigern. Im Jahr 2023 führte Dish Wireless eine Service-Assurance-Plattform ein, um die Standards des 3rd Generation Partnership Project zu erfüllen und die Netzwerkausfälle um 41 % zu reduzieren. Die Groupe Special Mobile Association prognostiziert, dass durch die Integration von Standardisierung bis 2025 5G-Kapazitäten im Wert von 96,2 Milliarden US-Dollar entstehen werden.

- Steigende Integration von KI und Automatisierung in die Servicesicherung:Die Integration von KI fördert das Marktwachstum, da sie dem Nutzer Vorteile wie Echtzeit-Fehlererkennung und prädiktive Analysen bietet. Research Nester schätzt, dass KI-gestützte Lösungen Ausfallzeiten reduzieren und die Betriebskosten um 31 % senken. Die Global System for Mobile Communications Association prognostiziert, dass KI-gesteuerte Automatisierung bis Ende 2025 jährlich 15,5 Milliarden US-Dollar einsparen kann. Nokias AVA und IBMs Watson AIOps gehören zu den bekanntesten KI-gesteuerten Assurance-Plattformen.

Technologische Fortschritte verändern die Service-Assurance im Telekommunikationsbereich

Der globale Markt für Service-Assurance im Telekommunikationsbereich erlebt einen bemerkenswerten Wandel, der durch die Einbindung moderner Technologien in zahlreichen Branchen vorangetrieben wird. KI, Blockchain, Network Slicing usw. gehören zu den wichtigsten Technologien, die von den Marktteilnehmern weithin eingesetzt werden. Diese Technologien schaffen ein proaktives und intelligenteres Service-Assurance-Ökosystem, das die Netzwerke der nächsten Generation unterstützt und das Kundenerlebnis verbessert. Führende Anbieter und Betreiber setzen modernste Technologien ein, um die Servicesicherheit im Telekommunikationsbereich zu revolutionieren.

|

Trend |

Branchenanwendung |

Akzeptanzrate |

Beispiel aus der Praxis |

|

Künstliche Intelligenz (KI) |

Telekommunikation |

86 % planen, ihre Investitionen in KI zu erhöhen. |

Optus nutzt KI, um das Kundenerlebnis und die Netzwerkstabilität zu verbessern. |

|

Blockchain |

Finanzen |

82 % der Finanzinstitute untersuchen oder implementieren Blockchain-Lösungen. |

HSBC und Bank of America integrieren die Solana-Blockchain für die Tokenisierung von Vermögenswerten. |

|

5G Network Slicing |

Produktionsindustrie |

Implementiert in Industriezweigen für dedizierte virtuelle Netzwerke |

Telefónicas 5G-Network-Slicing verbessert den Betrieb in verschiedenen Branchen. |

|

Cloud-native Architekturen |

Branchenübergreifend |

Ermöglicht skalierbare und flexible Service-Assurance-Lösungen. |

In den angegebenen Quellen nicht angegeben. |

|

Echtzeitanalysen |

Branchenübergreifend |

Verbessert Entscheidungsprozesse und betriebliche Effizienz |

Nicht in den angegebenen Quellen angegeben. |

Stärkung der Cybersicherheit in der Telekommunikations-Service-Assurance: Eine strategische Ausrichtung

Die Telekommunikationsbranche ist sehr anfällig für verschiedene Cyber-Bedrohungen. Die Bedeutung robuster Sicherheitsvorkehrungen. Datenpannen unterstreichen die Bedeutung umfassender Cybersicherheitsmaßnahmen für Unternehmen. Techniken wie Multi-Faktor-Authentifizierung und KI-gestützte Bedrohungserkennung reduzieren die Wahrscheinlichkeit potenzieller Sicherheitsverletzungen effizient. Unternehmen setzen TSA exponentiell ein, da bereits eine einzige Datenpanne zu Serviceunterbrechungen und Umsatzeinbußen führen kann. Unzureichende Zugriffskontrollen und schlechte Verschlüsselung erhöhen das Risiko erheblich. Die Integration fortschrittlicher Technologien wie IoT und 5G vergrößert die Angriffsfläche und macht die gesamte Infrastruktur anfälliger.

|

Unternehmen |

Art des Cyberangriffs |

Auswirkungen |

Mögliche Maßnahmen zur Minderung der Auswirkungen |

|

CDK Global |

Ransomware |

Betriebsstörungen bei ca. 15.100 Händlern; geschätzte direkte Verluste von 1,01 Milliarden USD |

Implementierung KI-gestützter Systeme zur Bedrohungserkennung |

|

Marks & Spencer |

Cyberangriff |

Voraussichtlicher Rückgang des Betriebsgewinns um 384 Millionen USD |

Stärkung der Netzwerksicherheitsinfrastruktur; Einführung einer Multi-Faktor-Authentifizierung |

|

AT&T |

Datenschutzverletzung |

Die FTC verhängte eine Geldstrafe von 13,2 Millionen US-Dollar wegen der Offenlegung der Daten von Millionen von Kunden. Persönliche Informationen |

Verbesserung der Datenverschlüsselungsprotokolle; Strenge Zugriffskontrollen implementieren |

|

British Library |

Ransomware |

Rund 610 GB Daten abgegriffen |

Erweiterte Endgeräteschutzlösungen einsetzen |

|

Technische Universität Münster |

Ransomware |

Datenleck im Darknet |

Einführung robuster Datensicherungs- und Wiederherstellungssysteme |

Herausforderungen

- Regulatorische Komplexität und Compliance-Kosten: Die Compliance-Kosten steigen deutlich, wenn sich zahlreiche Parameter länderübergreifend ändern. Dies führt auch zu Verzögerungen beim Markteintritt. Beispielsweise stellen technische Vorschriften und Konformitätsbewertungen in Indien erhebliche Hürden für ausländische Unternehmen dar und erfordern umfassende Test- und Zertifizierungsverfahren.

- Mangelnde Infrastrukturbereitschaft: Der Mangel an angemessener Infrastruktur, insbesondere in unterentwickelten und sich entwickelnden Regionen, behindert den Einsatz von Bewertungslösungen in der Telekommunikationsbranche. Beispielsweise sind 25,5 % der Sendemasten in Indien nicht in der Lage, fortschrittliche Telekommunikationsdienste zu integrieren, da dies die Nutzung dieser Dienste einschränkt.

Markt für Telekommunikationsdienstsicherung: Wichtige Erkenntnisse

| Berichtsattribut | Einzelheiten |

|---|---|

|

Basisjahr |

2024 |

|

Prognosejahr |

2025–2037 |

|

CAGR |

7,2 % |

|

Marktgröße im Basisjahr (2024) |

8,2 Milliarden US-Dollar |

|

Prognostizierte Marktgröße für das Jahr 2037 |

20,3 Milliarden US-Dollar |

|

Regionaler Umfang |

|

Segmentierung der Telekommunikationsdienstleistungssicherung

Komponenten (Lösungen {Sondensystem, Netzwerkmanagement, Personalmanagement, Fehlermanagement, Qualitätsüberwachung} Dienstleistungen {Professional Services, Managed Services})

Das Lösungssegment wird voraussichtlich den Markt für Telekommunikations-Service-Assurance dominieren und einen Marktanteil von 66,6 % erreichen. Grund dafür ist die zunehmende Komplexität der Telekommunikationsnetze. Das Marktwachstum wird auch durch die zunehmende Nutzung verschiedener Technologien wie 5G und IoT vorangetrieben. Netzwerkmanagement- und Fehlermanagementdienste sind die am häufigsten nachgefragten Lösungen der Telekommunikationsanbieter. Die Möglichkeit zur Echtzeit-Datenanalyse ist für Telekommunikationsbetreiber, die ihre Servicebereitstellung insgesamt verbessern möchten, unerlässlich. So konnte beispielsweise die KI-gestützte Lösung von AT&T Netzwerkausfälle um 32 % reduzieren.

Unternehmensgröße (Großunternehmen, kleine und mittlere Unternehmen)

Großunternehmen dominieren den Markt für Telekommunikations-Service-Assurance mit einem Marktanteil von 72,5 %. Dies ist auf ihre gut ausgebaute Infrastruktur und umfangreichen Ressourcen zurückzuführen. Die TSA-Tools unterstützen die Verwaltung hochkomplexer Netzwerke und bieten verbesserte Services in verschiedenen Ländern. Beispielsweise nutzen Großunternehmen wie BMW ATS-Lösungen, insbesondere 5G Network Slicing, in ihren Produktionsstätten, um niedrige Latenzen zu gewährleisten. Die Verbesserung des Kundenerlebnisses rückt zunehmend in den Fokus. Große Unternehmen müssen daher mehr Budget für den Kauf von Lösungen bereitstellen, um ein proaktives Management zu ermöglichen.

Unsere detaillierte Analyse des globalen Marktes für Telekommunikations-Service-Assurance umfasst die folgenden Segmente:

|

Komponente |

|

|

Betreiber Typ |

|

|

Bereitstellung |

|

|

Unternehmensgröße |

|

Vishnu Nair

Leiter - Globale GeschäftsentwicklungPassen Sie diesen Bericht an Ihre Anforderungen an – sprechen Sie mit unserem Berater für individuelle Einblicke und Optionen.

Telekommunikationsdienstleistungsbranche – Regionale Analyse

Markt für Telekommunikations-Service-Assurance in Nordamerika

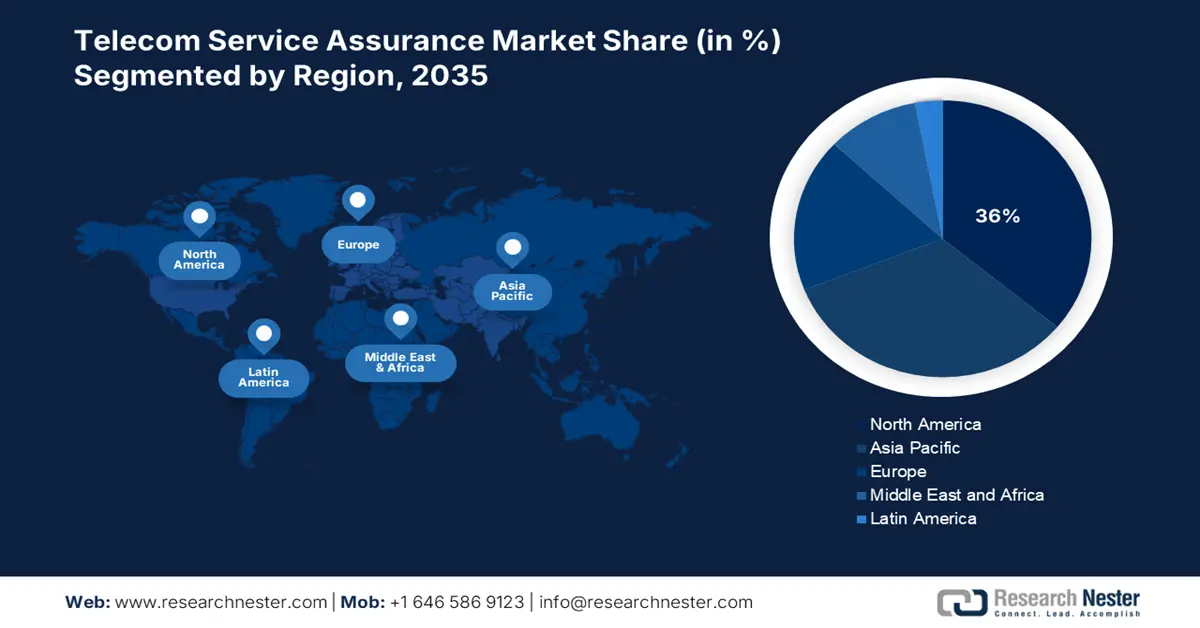

Der TSA-Markt in Nordamerika wird voraussichtlich 36 % des Marktanteils im Bereich der Telekommunikations-Service-Assurance erreichen und zwischen 2025 und 2037 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 9,8 % verzeichnen. Das Marktwachstum wird durch die zunehmende Einführung von 5G und die zunehmende Nutzung von IoT-Geräten vorangetrieben. Schätzungsweise 40,5 % der Unternehmen in der Region nutzen TSA-Lösungen zur Überwachung der Edge-Latenz. Das Wachstum in der Region wird auch durch die gut ausgebaute Infrastruktur und namhafte Unternehmen vorangetrieben.

In den USA verzeichnet der Markt für Telekommunikations-Service-Assurance aufgrund der steigenden Nachfrage nach zuverlässigen Internetdiensten ein deutliches Wachstum. Die Federal Communications Commission (FCC) hat maßgeblich zu diesem Wachstum beigetragen und Richtlinien umgesetzt, die die Einführung von Service-Assurance-Lösungen zur Verbesserung der Servicequalität fördern. Auch die Cybersecurity & Die Richtlinien der Infrastructure Security Agency (TSA) von 2023 betonen die Bedeutung der Einbindung der TSA für eine robuste Infrastruktur gegen Cyberbedrohungen. Die Bemühungen der Regierung und Investitionen des privaten Sektors in fortschrittliche Telekommunikation treiben das Marktwachstum im Land zusätzlich voran.

Asien-Pazifik-Raum Markt für Telekommunikations-Service-Assurance

Der Markt für Telekommunikations-Service-Assurance im Asien-Pazifik-Raum wird bis 2037 voraussichtlich 33,3 % des weltweiten Marktanteils erreichen. Das Marktwachstum ist auf die rasante digitale Transformation und unterstützende staatliche Programme zurückzuführen. In Japan erhöhte das Ministerium für Wirtschaft, Handel und Industrie (METI) im Jahr 2024 sein IKT-Budget um 15,5 % und konzentrierte sich dabei auf die Modernisierung der digitalen Infrastruktur und der Service-Assurance-Technologien. Darüber hinaus hat das chinesische Ministerium für Industrie und Informationstechnologie (MIIT) im Jahr 2022 7,6 Millionen USD für Projekte zur Gewährleistung von Telekommunikationsdiensten bereitgestellt, was einem Anstieg von 21 % gegenüber dem Vorjahr entspricht.

Unternehmen, die die Landschaft der Telekommunikations-Service-Assurance dominieren

- Unternehmensübersicht

- Geschäftsstrategie

- Wichtige Produktangebote

- Finanzielle Leistung

- Leistungskennzahlen

- Risikoanalyse

- Jüngste Entwicklung

- Regionale Präsenz

- SWOT-Analyse

Der Markt für Telekommunikationsdienstleistungen entwickelt sich rasant, da etablierte Akteure, IT-Giganten und neue Marktteilnehmer in innovative Technologien investieren. Wichtige Marktteilnehmer konzentrieren sich auf die Entwicklung von Produkten, die den strengen gesetzlichen Vorschriften und der Verbrauchernachfrage gerecht werden. Diese wichtigen Akteure verfolgen verschiedene Strategien wie Fusionen und Übernahmen, Joint Ventures, Partnerschaften und die Einführung neuer Produkte, um ihre Produktbasis zu erweitern und ihre Marktposition zu stärken.

Die 15 größten globalen Hersteller von Telekommunikations-Service-Assurance-Lösungen

|

Firmenname |

Land Herkunft |

Umsatzanteil 2024 |

|

Nokia Corporation |

Finnland |

15,2 % |

|

Telefonaktiebolaget LM Ericsson |

Südkorea |

13,3 % |

|

Huawei Technologies Co., Ltd. |

China |

12,1 % |

|

Broadcom Inc. |

Schweden |

10,3 % |

|

Cisco Systems, Inc. |

USA |

9,2 % |

|

IBM Corporation |

USA |

xx% |

|

Hewlett Packard Enterprise |

USA |

xx % |

|

Amdocs Limited |

USA |

xx % |

|

Accenture PLC |

USA |

xx% |

|

Tata Consultancy Services Limited |

Großbritannien |

xx % |

|

NEC Corporation |

Japan |

xx % |

|

Spirent Communications plc |

Vereinigtes Königreich |

xx% |

|

Comarch S.A. |

Polen |

xx% |

|

TEOCO Corporation |

Vereinigte Staaten |

xx% |

|

EXFO Inc. |

Kanada |

xx% |

Nachfolgend sind die Bereiche aufgeführt, die jedes Unternehmen im Markt für Telekommunikations-Service-Assurance abdeckt:

Neueste Entwicklungen

- Im November 2024 implementierte SK Telecom ein KI-gestütztes Kundenservicesystem mit multimodalen Modellen. Diese Verbesserungen steigern die Serviceeffizienz und die Kundenzufriedenheit durch die Nutzung KI-gestützter Kundeninteraktion.

- Im Februar 2024 brachte Tech Mahindra Sandstorm auf den Markt, einen Service zur Remote-Netzwerküberwachung und zur Gewährleistung der Sicherheit intelligenter Geräte. Diese Lösung liefert Echtzeit-Einblicke in die Interaktion zwischen Apps und Netzwerken, beschleunigt die Entwicklung und verkürzt die Markteinführungszeit für Betreiber.

- Report ID: 1928

- Published Date: Jun 24, 2025

- Report Format: PDF, PPT

- Entdecken Sie eine Vorschau auf die wichtigsten Markttrends und Erkenntnisse

- Prüfen Sie Beispiel-Datentabellen und Segmentaufgliederungen

- Erleben Sie die Qualität unserer visuellen Datendarstellungen

- Bewerten Sie unsere Berichtsstruktur und Forschungsmethodik

- Werfen Sie einen Blick auf die Analyse der Wettbewerbslandschaft

- Verstehen Sie, wie regionale Prognosen dargestellt werden

- Beurteilen Sie die Tiefe der Unternehmensprofile und Benchmarking

- Sehen Sie voraus, wie umsetzbare Erkenntnisse Ihre Strategie unterstützen können

Entdecken Sie reale Daten und Analysen

Häufig gestellte Fragen (FAQ)

Gewährleistung von Telekommunikationsdiensten Umfang des Marktberichts

Die kostenlose Stichprobe umfasst aktuelle und historische Marktgrößen, Wachstumstrends, regionale Diagramme und Tabellen, Unternehmensprofile, segmentweise Prognosen und mehr.

Kontaktieren Sie unseren Experten