Blue Hydrogen Market Outlook:

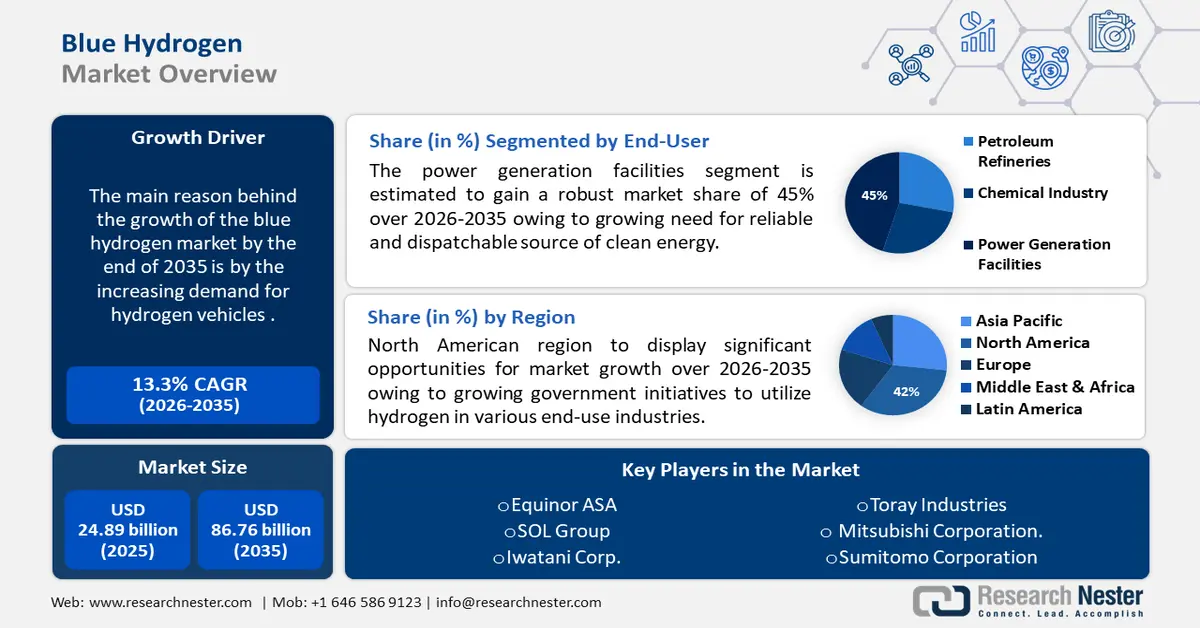

Blue Hydrogen Market size was over USD 24.89 billion in 2025 and is projected to reach USD 86.76 billion by 2035, witnessing around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blue hydrogen is evaluated at USD 27.87 billion.

The reason behind the growth is due to the growing production of hydrogen across the globe. Nowadays, commercial hydrogen production takes place as modern industrial consumers demand hydrogen, and also as world moves toward a net-zero energy future, it is quickly replacing fossil fuels as the preferred low- or no-carbon fuel. For instance, in 2023, global hydrogen production capacity reached to around 4 million tons per year, a 164% increase over 2022.

In addition to these, factors that are believed to fuel the market growth of blue hydrogen, the growing need for carbon capture, utilization, and storage (CCUS) technologies is believed to fuel the blue hydrogen market growth. By 2050, the demand for CCUS would be around two GTPA, over the current pipeline of projects as they have been anticipated by numerous industry professionals over the last thirty years as a necessary means of decarbonizing industries.

Key Blue Hydrogen Market Insights Summary:

Regional Highlights:

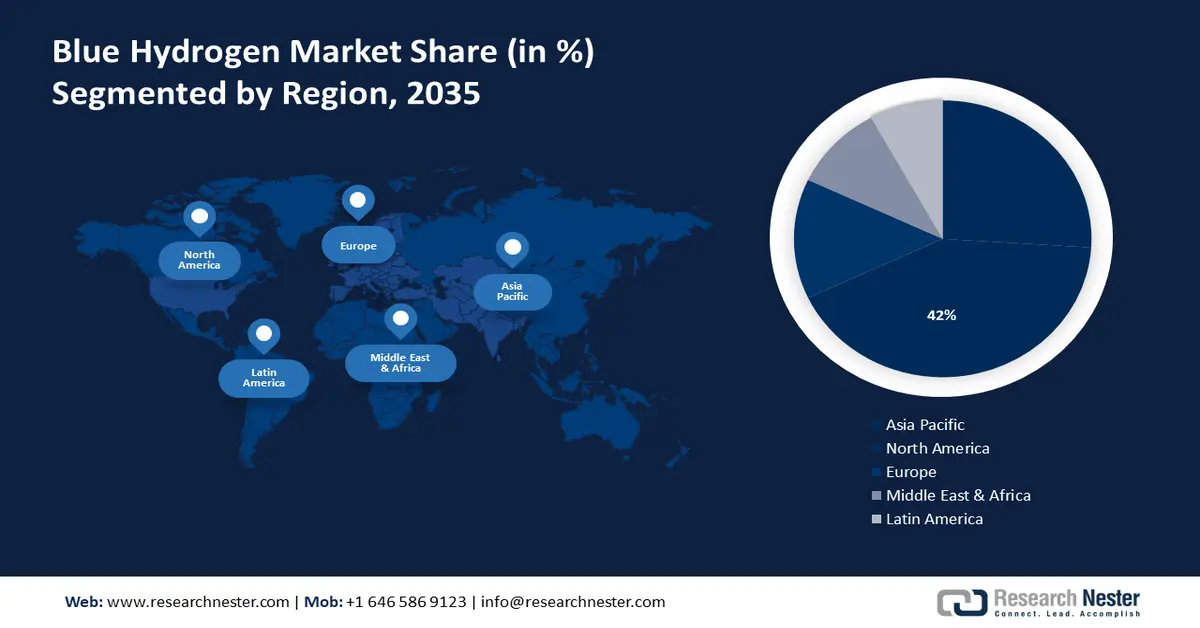

- North America blue hydrogen market will dominate more than 42% share by 2035, fueled by government initiatives to develop hydrogen hubs and use clean hydrogen in heavy industries.

- Europe market will exhibit huge CAGR during 2026-2035, attributed to sustainability initiatives like the European Green Deal and investments in renewable energy and transportation.

Segment Insights:

- The power generation facilities segment in the blue hydrogen market is anticipated to see robust growth by the forecast year 2035, driven by the growing need for a reliable and dispatchable source of clean energy.

Key Growth Trends:

- Growing greenhouse gas emissions

- Rising usage in petroleum refineries

Major Challenges:

- Higher global warming potential

- Stringent regulations can impact investment in blue hydrogen

Key Players: Linde Plc, Air Liquide, Shell Group of Companies, Air Products and Chemicals, Inc., Engie, Equinor ASA, SOL Group, Iwatani Corp., INOX Air Products Ltd., Exxon Mobil Corp.

Global Blue Hydrogen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.89 billion

- 2026 Market Size: USD 27.87 billion

- Projected Market Size: USD 86.76 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 16 September, 2025

Blue Hydrogen Market Growth Drivers and Challenges:

Growth Drivers

-

Growing greenhouse gas emissions - Blue hydrogen emits less emissions, by replacing fossil fuels such as natural gas in residential and commercial uses. For instance, global carbon dioxide (CO2) emissions from industrial processes and energy combustion increased by more than 320 Mt in 2022 to reach a record peak of 36 Gt.

Furthermore, with increasing concerns about climate change, there’s a growing need to reduce carbon capture and storage(CCS), offer a cleaner alternative to conventional hydrogen production methods, aligning with decarbonization goals and driving blue hydrogen market growth. - Increasing demand for hydrogen vehicles - Blue hydrogen is frequently promoted as a low-carbon fuel for powering automobiles, trucks, and trains, and is also used to generate electricity in fuel cell electric vehicles (FCEVs). As governments worldwide set ambitious targets to phase out internal combustion engine vehicles and promote clean mobility, the demand for hydrogen vehicles s expected to surge.

- Rising usage in petroleum refineries - A vital component of many refining processes involved in the creation of cleaner diesel and gasoline products is blue hydrogen, which is also considered a more economical way to cut carbon emissions from the manufacturing of ammonia and oil refinement. For instance, more than 30 million tons of hydrogen are needed annually, and one of the biggest markets for hydrogen is oil refining.

Challenges

-

Higher global warming potential - At the moment, the majority of hydrogen is created by steam-reforming methane in natural gas, which has a global warming potential (GWP) of 27–30 over 100 years. Methane has a 28-fold higher potential for global warming over 100 years than carbon dioxide since it stores more heat per molecule.

Many people consider it to be the second most significant greenhouse gas, following carbon dioxide (CO2), and is known as the principal cause of ground-level ozone, a dangerous air pollutant and greenhouse gas. For instance, since pre-industrial times, methane has contributed over 25% to global warming, and its abundance has increased more quickly than it has ever done. This high potential of global warming may hinder the blue hydrogen market expansion. - The requirement of high initial investment for carbon capture and storage (CCS) infrastructure may increase the overall production cost

- Stringent regulations can impact investment in blue hydrogen

Blue Hydrogen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 24.89 billion |

|

Forecast Year Market Size (2035) |

USD 86.76 billion |

|

Regional Scope |

|

Blue Hydrogen Market Segmentation:

End-User Segment Analysis

The power generation facilities segment is poised to gain the largest market share of about 45% in the year 2035. The segment growth can be impelled by growing need for reliable and dispatchable source of clean energy. Hydrogen-fired power plant provide flexibility in balancing grid demand and can serve as backup capacity during peak periods or when renewables are unavailable.

Additionally, the decarbonization imperative is driving utilities to invest in low-carbon energy solutions, with blue hydrogen emerging as a promising option to replace fossil fuels in conventional power generation, thus driving growth in this segment.

Technology Segment Analysis

The steam methane reforming segment in the blue hydrogen market is set to garner a notable share shortly. SMR, or steam methane reforming, is by far the most common method for producing hydrogen where methane from natural gas is heated during the process. Natural gas is converted to blue hydrogen via the method of steam methane reforming (SMR), which is a process that uses the interaction of hydrocarbons with water to produce syngas.

Blue hydrogen generation primarily uses steam methane reforming whereby in the presence of a catalyst, methane and steam react to create hydrogen at pressures between 3 and 25 bar (1 bar, or 14.5 psi). For instance, the process of SMR produces more than 90% of the hydrogen produced worldwide. Particularly, in the US over 94% of the hydrogen produced in the US comes from steam methane reforming, which is the most extensively utilized method for producing bulk gas.

In addition, the main goal of partial oxidation (POX), a particular kind of chemical reaction, is to create hydrogen. Compared to steam reforming (SR), partial oxidation of methane (POX) has greater potential for producing syngas and is extremely adaptable, having been used with lignite, bituminous materials, natural gas, propane, butane, and various petroleum distillates and residues.

Furthermore, combining the partial oxidation reaction with the steam reforming reaction is known as auto thermal reforming which is the process of creating hydrogen by using less energy than other methods since it produces syngas, which is a mixture of hydrogen, carbon monoxide, and carbon dioxide.

Our in-depth analysis of the market includes the following segments:

|

Technology |

|

|

Transportation Mode |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blue Hydrogen Market Regional Analysis:

North America Market Insights

Blue Hydrogen market in the North American region is estimated to hold the largest with a share of about 42% by the end of 2035. The market growth in the region is also expected on account of growing government initiative to utilize hydrogen. Around USD 7 billion has been set aside by the US government to aggressively support the construction of hydrogen hubs, or H2Hubs, around the nation that will employ several production techniques, denoted by colors such as pink, blue, and green hydrogen. Besides this, to spur the US clean hydrogen market, the use of clean hydrogen to power heavy industries such as aluminum and steel is being emphasized.

In addition, nearly all hydrogen produced commercially in the US is created via steam-methane reforming where natural gas is the main methane source for hydrogen synthesis. Moreover, large central plants that reform natural gas create more than 90% of the hydrogen produced in the United States today. For instance, the United States produces over 9 million metric tons of hydrogen yearly, or slightly more than 1 quadrillion BTUs.

European Market Insights

The European region will also witness huge growth for the blue hydrogen market during the forecast period and will hold the second position led by the growing focus on sustainability. Numerous efforts to support sustainable development and enterprises have been put into place as a result of the new EU growth strategy's emphasis on sustainability, such as the European Green Deal, which seeks to achieve carbon neutrality for the EU by 2050. The EU has set high goals to boost the use of renewable energy sources and cut greenhouse gas emissions, has also made significant investments in environmentally friendly transportation, and has instituted laws and programs to bolster companies that are dedicated to sustainability.

Additionally, blue hydrogen contributes to enhancing energy security and diversification by reducing dependence on imported fossil fuels. By utilizing domestic natural gas resources and investing in hydrogen production infrastructure, European countries can strengthen their independence and resilience to supply disruptions, as a result all these factors culminatively contribute the market growth.

Blue Hydrogen Market Players:

- Linde Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide

- Shell Group of Companies

- Air Products and Chemicals, Inc.

- Engie

- Equinor ASA

- SOL Group

- Iwatani Corp.

- INOX Air Products Ltd.

- Exxon Mobil Corp.

Recent Developments

- Linde Plc announced to supply clean hydrogen and captured carbon dioxide to Celanese, from its state-of-the-art carbon monoxide and hydrogen production facility that will be used to create methanol with a lower carbon intensity or its Fairway Methanol LLC joint venture with Mitsui & Co., Ltd.

- Air Liquide intends to start using its patented Cryocap carbon capture technology to collect emissions from other industrial processes by using the network.

- Report ID: 5688

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blue Hydrogen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.