Zero Emission Trucks Market Outlook:

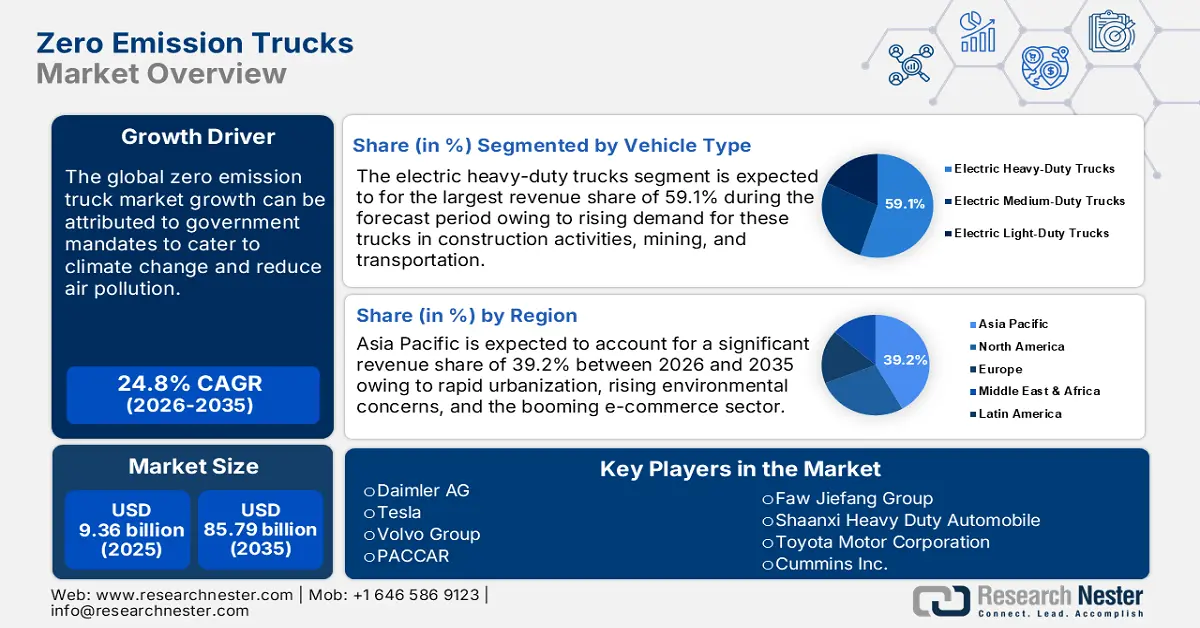

Zero Emission Trucks Market size was over USD 9.36 billion in 2025 and is projected to reach USD 85.79 billion by 2035, growing at around 24.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zero emission trucks is evaluated at USD 11.45 billion.

The zero emission trucks market growth can be primarily attributed to increasing government mandates to cater to climate change and reduce air pollution. Policies such as the U.S. Clean Air Act, India’s Council on Climate Change Act, 2021, Canada’s Net Zero Commissions Accountability Act, and the European Union’s Green Deal are steadily encouraging companies to adopt zero emission technology, including zero emission trucks across various sectors. Many governments across the globe are focused on implementing zero or low-emission zones where only zero-emission vehicles (ZEVs) are allowed. This has resulted in increasing overall sales of electric trucks.

Zero emission trucks are rapidly gaining traction across several sectors including logistics and transportation, last-mile delivery, and construction. According to the International Energy Agency (IEA), the sales of electric trucks have drastically increased by 35% in 2023 as compared to the sales in 2022. In June 2023, the North American Council for Freight Efficiency partnered with Rocky Mountain Institute to launch an initiative, Run on Less- Electric DEPOT that deployed more than 300 electric trucks of various sizes in different areas and applications to check where these trucks and where challenges persist.

Key Zero Emission Trucks Market Insights Summary:

Regional Highlights:

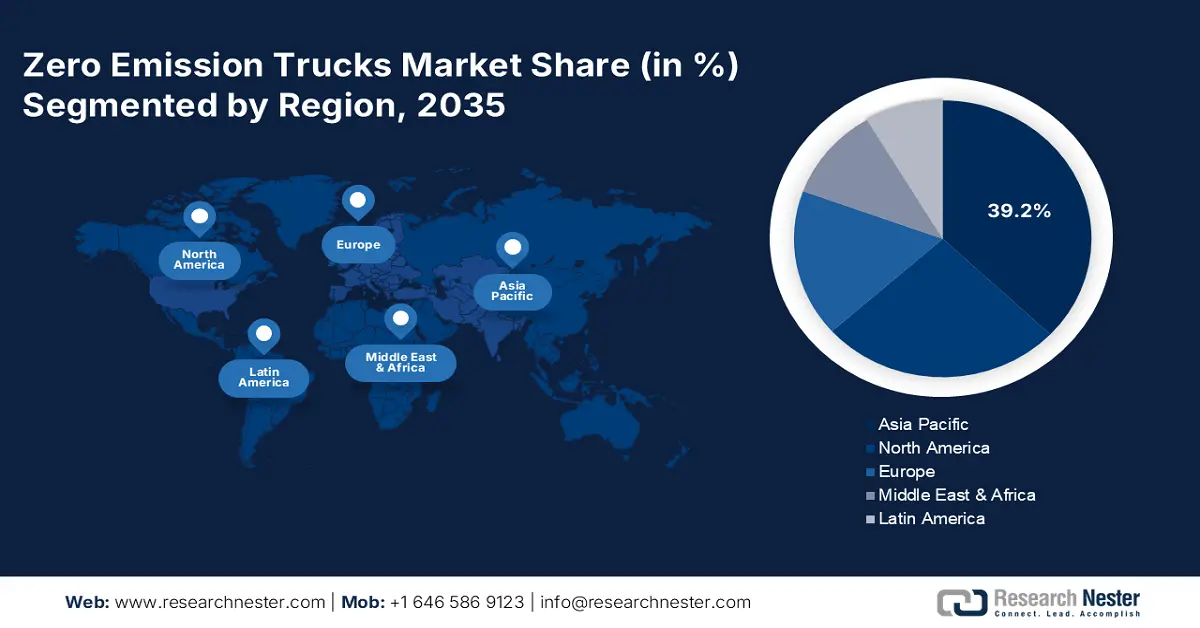

- Asia Pacific zero emission trucks market is anticipated to capture 39.20% share by 2035, driven by rapid urbanization, environmental concerns, and a booming e-commerce sector.

- North America market will register staggering growth during the forecast period 2026-2035, driven by rapid EV advancements, strict emission regulations, and presence of top zero-emission truck manufacturers.

Segment Insights:

- The electric heavy-duty trucks segment in the zero emission trucks market is projected to secure a 59.10% share by 2035, driven by high demand in freight transport, rapid adoption of zero-emission tech, and investments.

- The construction segment in the zero emission trucks market will experience rapid growth by 2026-2035, driven by the expanding building sector and emission reduction targets.

Key Growth Trends:

- Favorable government investments and policies

- High adoption of electric trucks in freight logistics and last-mile delivery

Major Challenges:

- Limited charging and refueling infrastructure

- Hesitance to buy due to technological uncertainty

Key Players: Tesla, Volvo Group, PACCAR, Faw Jiefang Group, Shaanxi Heavy Duty Automobile, Toyota Motor Corporation, Cummins Inc., and BYD Company Limited.

Global Zero Emission Trucks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.36 billion

- 2026 Market Size: USD 11.45 billion

- Projected Market Size: USD 85.79 billion by 2035

- Growth Forecasts: 24.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Sweden

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 18 September, 2025

Zero Emission Trucks Market Growth Drivers and Challenges:

Growth Drivers

-

Favorable government investments and policies: Governments worldwide play a crucial role in boosting the zero emission trucks market growth. For instance, the UK Government announced invested around 250 million in its Zero Emission HGV and Infrastructure Programme to run trials for zero-emission trucks. This project is expected to deploy around 370 trucks and more than 60 refueling and electrical charging infrastructure. On the other hand, NITI Aayog in India announced the launch of a platform, Electric Freight Accelerator for Sustainable Transport for large-scale freight electrification. Through this initiative, 16 manufacturing and logistics companies are expected to develop 7750 electrical freight vehicles by 2030.

Moreover, as governments offer favorable grants, subsidies, and tax redemptions, many companies operating in the construction sector, transportation and logistics, and last mile delivery are investing in zero emission trucks. - High adoption of electric trucks in freight logistics and last-mile delivery: Over the last few years, there has been a rapid expansion of e-commerce and several delivery companies are shifting to zero-emission vehicles to meet sustainability goals and reduce overall operating costs. In addition to this, many companies are investing in developing electric trucks for last-mile deliveries. In August 2023, Eicher partnered with Amazon to launch electric trucks for middle and last-mile deliveries. As per the agreement, Eicher plans to release 1,000 zero-emission trucks across different payloads for next five years.

One of the recent launches was in May 2024 when Tata Motor announced the launch of Ace EV 1000, a zero-emission mini truck that offers a higher payload of 1 tonne, developed for transporting FMCG goods, beverages, LPG, dairy and paints and lubricants.

Challenges

-

Limited charging and refueling infrastructure: Though zero-emission trucks are rapidly gaining traction across several sectors, there is limited availability of recharging units and infrastructure for electric and hydrogen-powered heavy-duty vehicles, including trucks, causing range anxiety among operators. In addition, setting up charging infrastructure requires high initial investment, which can be a barrier for emerging economies. These factors can lower the adoption of zero emission trucks, hampering overall market growth.

-

Hesitance to buy due to technological uncertainty: The adoption of zero emission trucks is likely to lower due to uncertainty and risks associated with the rapid development in EV and hydrogen-powered truck technology. Fleet operators may hesitate to invest in technology thinking the alternatives might be better and cost-effective or receive more regulatory support in the coming years.

Zero Emission Trucks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.8% |

|

Base Year Market Size (2025) |

USD 9.36 billion |

|

Forecast Year Market Size (2035) |

USD 85.79 billion |

|

Regional Scope |

|

Zero Emission Trucks Market Segmentation:

Vehicle Type Segment Analysis

The electric heavy-duty trucks segment is predicted to account for more than 59.1% zero emission trucks market share by the end of 2035 owing to high demand for heavy-duty trucks in freight transportation in logistics, mining or construction, rapid adoption of advanced zero-emission technology in these trucks, and rising investments in developing durable and sustainable trucks. In May 2024, Hyundai Motor Company officially launched its NorCAL Zero Project, a unique initiative to bring zero-emission freight transportation to California’s Central Valley and San Francisco Bay Area, using its hydrogen fuel cell technology.

The sales of electric heavy-duty trucks have significantly increased to combat the e-commerce expansion and rising construction activities worldwide. According to the International Energy Agency (IEA), in 2022, about 60,000 medium and heavy-duty trucks were sold overall, accounting for 1.2% of global truck sales.

Application Segment Analysis

Based on the application, the construction segment is expected to register rapid revenue growth during the forecast period owing to rapidly expanding building and construction sector and high adoption of different types of zero-emission trucks in construction activities to reduce carbon emissions and achieve sustainability goals. The segment growth can also be attributed to stringent emission reduction targets set by governments and the need for less noisy vehicles in non-sensitive areas like cities. To cater to this, companies including, Volvo Trucks develop a wide range of heavy-duty electric trucks and dump trucks, especially for the construction sector. These trucks come with simple chassis and a variety of bodies such as mixers, cranes, and tippers.

Our in-depth analysis of the zero emission trucks market includes the following segments:

|

Vehicle Type |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zero Emission Trucks Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is set to account for largest revenue share of 39.2% by 2035 owing to rapid urbanization, rising environmental concerns, and the booming e-commerce sector across the region. Governments in China, Japan, India, and South Korea are promoting zero emission vehicles, including trucks by offering benefits such as tax redemptions, subsidies, and other favorable policies. This is expected to boost zero emission trucks market growth in Asia Pacific in the coming years.

The zero emission trucks market in China is expected to witness robust growth during the forecast period owing to rapid advancements in battery technology and the presence of leading companies such as Geely, BYD, Foton, and Dongfeng. These companies are developing advanced products and technologies to keep up with the global competition. In April 2024, BYD announced the plan to launch its first electric pickup truck by the end of 2024 to compete with automotive giants including Tesla and Ford. Many companies in China along with local governments are investing in EV infrastructure to reach their goal of atleast 50% of vehicles being fully electric by 2035. This has resulted in rising sales of zero emission trucks in many parts of China. According to a report by Research Nester, China accounted for 80% of the global EV truck sales in the first half of 2024.

In India, the zero emission trucks market is anticipated to expand at a robust CAGR throughout the forecast period. This growth can be attributed to rapid urbanization, rising adoption of zero-emission vehicles including trucks and busses for last-mile delivery, logistics and transportation, construction, and waste management, and rising awareness about pollution and fuel emission. In August 2024, the Government of India released the Bharat Zero Emission Trucking (ZET) Policy Advisory to create a roadmap for policies including Net Zero 2070 and fulfill the country’s goal towards sustainable development. Another incident occurred in July 2024, when NITI Aayog collaborated with Smart Freight Centre India to accelerate the adoption of zero emission trucks in India. Initiatives like these are expected to boost zero emission trucks market growth going ahead.

North America Market Insights

North America is expected to register staggering growth during the forecast period owing to rapid advancements in electric vehicles, stringent government policies on vehicle emissions to combat climate change, and presence of leading companies focused on developing zero-emission vehicles and technology. For instance, Isuzu North America Corporation announced the development of class 6 and 7 zero-emission trucks in May 2024. The trucks are equipped with Aceelera by Cummins powertrain for the U.S. and Canada.

In the U.S., federal and several state governments have released strict emission regulations in order to enhance the sales of zero emission trucks and buses. Several e-commerce and fleet companies in the U.S. are adopting zero emission trucks to align with sustainability goals. According to the International Council on Clean Transportation (ICCT) (2022-2023 report), the heavy-duty EV trucks section contributed the largest to the number of new ZE-HDV registrations.

Canada zero emission trucks market is also expected to witness significant throughout the forecast period owing to high adoption of EV trucks across several sectors and Canada’s strategic moves and policies stating new passenger cars and light trucks should be zero emission by 2035. The Government of Canada is also supporting the zero emission trucks market growth by introducing policies to reduce key barriers and make it easy for the citizens in Canada to purchase ZEVs.

Zero Emission Trucks Market Players:

- Daimler AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tesla

- Volvo Group

- PACCAR

- Faw Jiefang Group

- Shaanxi Heavy Duty Automobile

- Toyota Motor Corporation

- Cummins Inc.

- BYD Company Limited

The competitive landscape of the zero emission trucks market is rapidly evolving as established key players, automotive giants and new entrants are investing in electrification and hydrogen technologies. Key players in the zero emission trucks market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global zero emission trucks market:

Recent Developments

- In September 2024, Volvo announced its plan to launch its FH Electric truck that can travel 600 km in one recharge. The company plans to launch the vehicle during the second half of 2025.

- In October 2024, Volvo Trucks released an update on developing hydrogen-powered trucks. The on-road tests are set to begin in 2026 and the commercial launch will occur towards the end of the decade.

- Report ID: 6492

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zero Emission Trucks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.