Electric Truck Market Outlook:

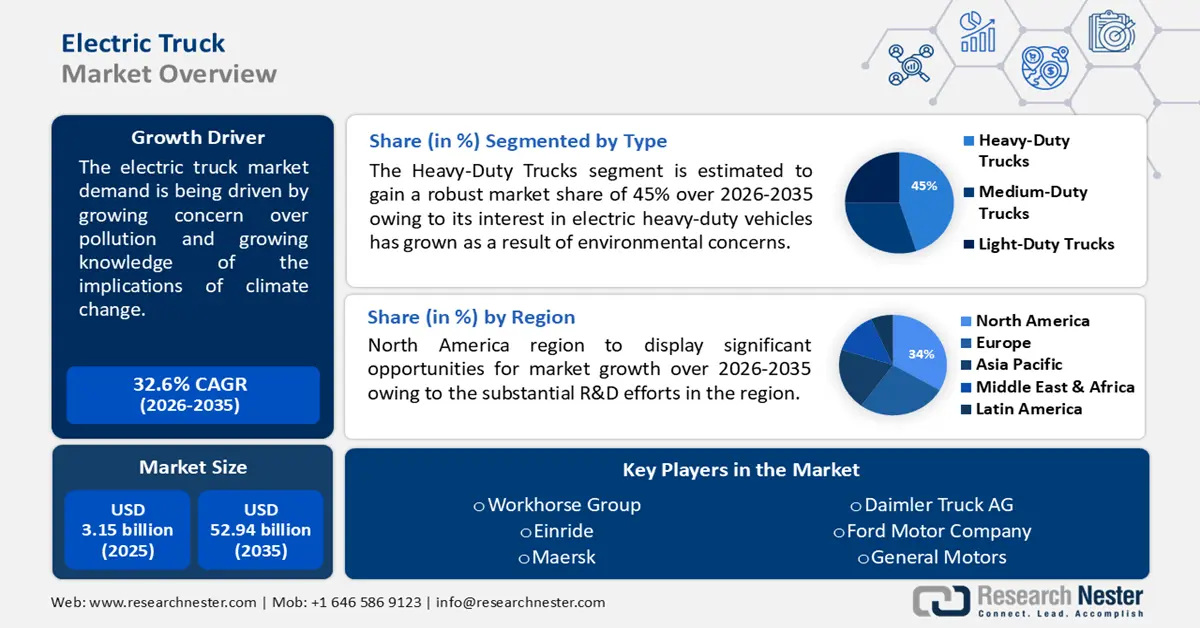

Electric Truck Market size was valued at USD 3.15 billion in 2025 and is likely to cross USD 52.94 billion by 2035, expanding at more than 32.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric truck is assessed at USD 4.07 billion.

The market demand is being driven by growing concern over pollution and growing knowledge of the implications of climate change. In addition, governments throughout the world are pushing for the usage of electric cars in an effort to lower greenhouse gas emissions. The AGGI reached 1.49 in 2022, meaning that the warming effect of greenhouse gases has increased by 49% since 1990.

In addition to these, factors that are believed to fuel the market growth of electric truck is due to growing technological developments in batteries will present profitable prospects in the worldwide electric truck market. In order to maximize the efficiency of electric trucks in long-haul operations, market participants are investing more in the innovation of battery technology to improve the driving range and charging capacities of electric trucks.

Key Electric Trucks Market Insights Summary:

Regional Highlights:

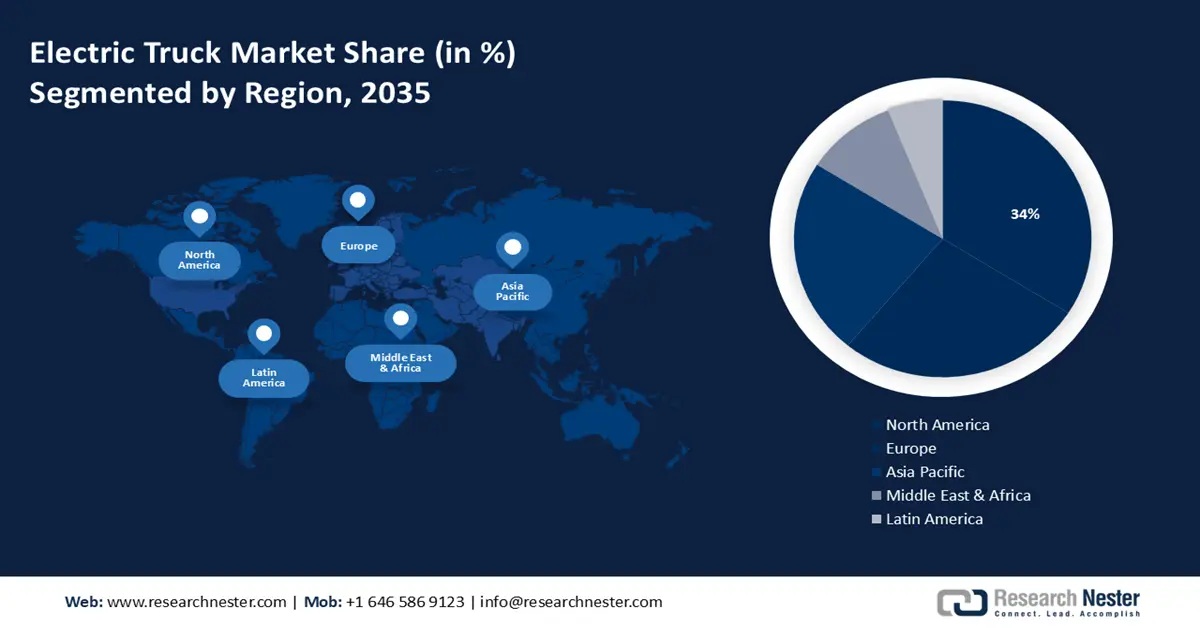

- North America electric truck market is predicted to capture 34% share by 2035, fueled by substantial R&D efforts, strong industry competition, and investments in zero-emission commercial vehicles.

- Europe market will achieve enormous growth during the forecast timeline, attributed to stringent emission regulations increasing demand for commercial electric vehicles.

Segment Insights:

- The heavy-duty trucks segment in the electric truck market is projected to hold a 45% share by 2035, fueled by growing demand for sustainable and zero-emission transportation.

- The fcev segment in the electric truck market is projected to capture a 35% share by 2035, influenced by increasing environmental regulations and the push for zero-emission alternatives.

Key Growth Trends:

- Growing need for electric trucks in the transportation and other sectors

- Advancement of technology for self-driving trucks

Major Challenges:

- Growing need for electric trucks in the transportation and other sectors

- Advancement of technology for self-driving trucks

Key Players: Einride, Maersk, Daimler Truck AG, Ford Motor Company, General Motors, GreenPower Motor Company, Proterra., Rivian, Volvo Group.

Global Electric Trucks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.15 billion

- 2026 Market Size: USD 4.07 billion

- Projected Market Size: USD 52.94 billion by 2035

- Growth Forecasts: 32.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Sweden

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Electric Truck Market Growth Drivers and Challenges:

Growth Drivers

-

Growing need for electric trucks in the transportation and other sectors - In the major EV markets worldwide, there has been an increase in demand for electric trucks in the logistics industry. Growth in medium- and heavy-duty trucks is anticipated as the adoption of electric vehicles can boost the industry's long-term profitability because EVs require significantly less money to charge than other fuels.

The US Postal Service placed an order for delivery trucks with Workhorse Group in January 2022. The World Economic Forum projects that in 2030, a 36% rise in the number of delivery vehicles operating in inner cities. Other sectors include product transportation, state services, and e-commerce businesses like Amazon and Walmart will see an increase in demand for electric trucks. Each of these elements could support market expansion. -

Advancement of technology for self-driving trucks - The recent development of self-driving trucks will have an impact on the electric truck business. AI is used by autonomous trucks to automate anything from long-distance deliveries to shipping yard operations. Leading automakers including Mercedes Benz Group AG, AB Volvo, and Tesla, Inc. have been working on producing autonomous electric trucks for the market. TuSimple and Navistar Inc. (US) established a collaboration to build self-driving trucks in December 2022. These fundamentals could all lead to electric truck market growth.

-

Increased use in the online retail sector - The market for electric trucks is anticipated to grow in the near future due to the growing usage of these vehicles for last-mile deliveries of goods from warehouses to clients. To cut down on pollutants and fuel costs, businesses are thinking about adding electric vehicles and electric pickup trucks to their fleets.

Tesla, Inc. stated in November 2022 that it had received 1.5 million preorders for their electric cyber truck worldwide. 20 VOLVO FH electric trucks will be supplied by AB Volvo to Amazon in Germany for delivery reasons, the company stated in October 2022. The market may grow as a result of all these variables.

Challenges

-

Extended duration of charging - When compared to other fuel choices, the charging period of an electric vehicle is significantly longer. Most public stations are equipped with Level 2 charges. Vehicles that are charging at Levels 1 and 2 may require 8 to 16 hours to reach 100% charge. An EV can be charged from 0% to 80% in around 60 minutes using a Level 3 charger.

Compared to CNG or diesel fueling, which takes less than five minutes, this is significantly greater. This has been a significant factor in the market's sluggish growth for electric trucks. Technological developments in the next years will shorten the charging period, but batteries for such rapid, high-voltage charging will still need to be produced. All these factors may impede market growth. -

One of the main obstacles to the broad adoption of electric trucks has been their high production costs.

-

The limited range of electric trucks in comparison to conventional internal combustion engine (ICE) vehicles is one of their main drawbacks.

Electric Truck Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

32.6% |

|

Base Year Market Size (2025) |

USD 3.15 billion |

|

Forecast Year Market Size (2035) |

USD 52.94 billion |

|

Regional Scope |

|

Electric Truck Market Segmentation:

Type Segment Analysis

Heavy-duty trucks segment is projected to dominate around 45% electric truck market share by the end of 2035. The segment growth can be attributed to the number of variables coming together to drive the adoption of these vehicles, which is gaining substantial traction. The market size is growing because interest in electric heavy-duty vehicles has grown as a result of environmental concerns and the demand for sustainable transportation options.

These cars provide practical substitutes for conventional diesel-powered trucks, cutting down on air pollution and greenhouse gas emissions. Also, they also have zero tailpipe emissions. This environmental benefit is consistent with fleet operators' commitment to more environmentally friendly operations and the growing corporate focus on sustainability. Diesel or electric, have 66–75% lower carbon emissions than other vehicles.

Propulsion Type Segment Analysis

By 2035, FCEV segment is likely to hold more than 35% electric truck market share. The market is growing faster due to the growing demand for zero-emission transportation options. These vehicles are a good substitute for traditional diesel trucks because they don't emit any harmful emissions while in use.

This quality is in line with sustainability objectives and environmental laws that are established by governments and corporations globally. Fuel cell electric trucks are an appealing alternative for enterprises looking for cleaner and greener transportation solutions because of their lower greenhouse gas emissions and air pollution.

Application Segment Analysis

In electric truck market, logistics & delivery segment is expected to account for more than 35% revenue share by the end of 2035. The emergence of last-mile deliveries and e-commerce has increased demand for automobiles that can maneuver through metropolitan areas with ease. Because they are quiet and agile, electric trucks are ideal for these kinds of jobs. They can deliver goods in noise-sensitive zones and navigate crowded metropolitan streets without creating any disturbances. The necessity for these vehicles in logistics and delivery is anticipated to increase as e-commerce keeps growing.

Our in-depth analysis of the market includes the following segments:

|

Propulsion Type |

|

|

Type |

|

|

End User |

|

|

Range |

|

|

Battery Capacity |

|

|

GVWR |

|

|

Level of Automation |

|

|

Battery Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Truck Market Regional Analysis:

North America Market Insights

North America region in electric truck market is predicted to capture over 34% revenue share by 2035. The market growth in the region is also expected on account of substantial R&D efforts and a large number of industry rivals will drive the North American market. For instance, Ford is investing over USD 6 billion to construct the F-150 hybrid car at a Michigan, USA plant. The growing demand for zero-emission commercial vehicles is expected to drive major investment into the market in North America. In addition, the market is expanding because regional government bodies are funding the construction of high-power charging stations along important thoroughfares in the form of charging networks.

European Market Insights

The European region will also encounter enormous growth for the electric truck market during the forecast period and will hold the second position owing to the European governments and environmental organizations are responding by enacting rigorous laws and regulations pertaining to emissions, which is increasing demand for commercial electric vehicles in this region. For instance, according to UNFCC, the European Union (EU) is committed to achieving its 2020 target of 20% reduction in greenhouse gas emissions during the second phase of the Kyoto Protocol. The EU wants to completely phase out greenhouse gas emissions by the year 2050.

Electric Truck Market Players:

- Workhorse Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Einride

- Maersk

- Daimler Truck AG

- Ford Motor Company

- General Motors

- GreenPower Motor Company

- Proterra.

- Rivian

- Volvo Group

Recent Developments

- Einride, a provider of autonomous, digital, and electric technologies for freight mobility, announced that it is expanding into the United Kingdom. This is a critical time for the UK, as road haulage accounts for more than 20% of domestic carbon emissions** and moves almost 1.4 billion tonnes of goods annually throughout the nation. A vision that Einride also shares, the UK Department for Transport is currently working to create a sustainable future for freight in which commodities are moved via affordable, dependable, resilient, seamless, and net zero means.

- Maersk declared that it would be growing its fleet of electric trucks in North America. Maersk has expanded its fleet by a total of 300 cars. The Performance Team - A Maersk Company, Maersk's North American storage, distribution, and transportation company, will be the primary user of the electric vehicles, which will be progressively delivered between 2023 and 2025.

- Report ID: 4777

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Trucks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.