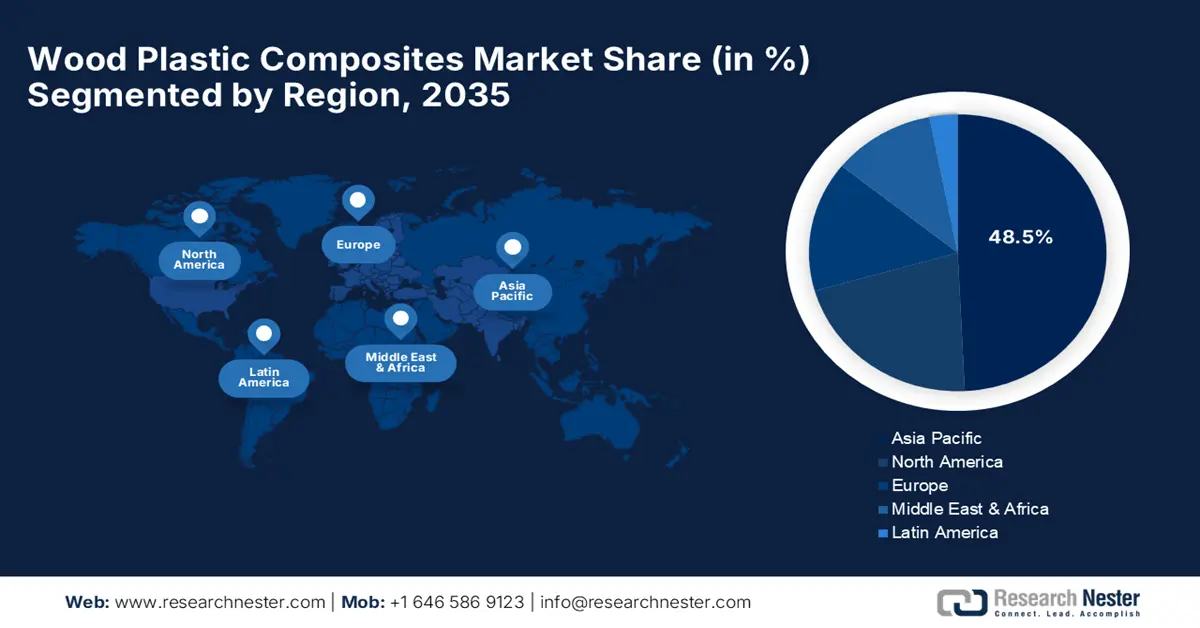

Wood Plastic Composites Market - Regional Analysis

APAC Market Insights

Asia Pacific is projected to lead the wood plastic composites market with a 48.5% share between 2026 and 2035. This growth is driven by rapid urbanization, rising construction activity, and rising government interest in green building materials in some regionally large economies. Rising disposable incomes and a rising preference for low-maintenance, aesthetically pleasing construction choices also contribute significantly. The region has dynamic product innovation, with businesses such as Reliance Industries in India launched RelWood, a new series of termite-resistant WPC boards for both domestic use and export.

China WPC market is the force behind the APAC, driven by huge government patronage for green building construction and enormous infrastructure projects that increasingly call for composite materials. Domestic producers are launching innovative products at a whirlwind rate, making specialty WPC products for varied applications, ranging from building facades to mass transit. For example, the Green Building Evaluation Standard provides credits for the use of wood plastic composites in façade and balcony applications, is further stimulating developers in key cities such as Shanghai and Beijing to replace traditional wood with these new-generation composites. China is the fastest growing export market for U.S. cellulose and held a value of USD 34.4 million, registering a CAGR of 12.3% during 2022-2023.

India wood plastic composites market is expanding at a considerable rate, largely attributed to the government efforts to encourage sustainable and affordable housing, with greater consciousness of the benefits of wood plastic composites over conventional materials in tropical economies like resistance to termites and moisture. The Make in India initiative is also encouraging domestic manufacturing and innovation. In addition to this, India's Ministry of Housing and Urban Affairs revamped guidelines in September 2024 for the use of WPC in affordable housing schemes owing to its durability and low maintenance, with pilot schemes launched in Maharashtra and Tamil Nadu states.

North America Market Insights

North America wood plastic composites market is expected to record a CAGR of 4.5% through 2037, owing to robust residential and commercial construction demand, particularly for decking, railing, and fencing applications. The region is fueled by high consumer recognition of wood plastic composites value proposition through low maintenance and durability, robust manufacturing base, and established distribution channels. Canada wood plastic composites market is experiencing robust growth fueled by stringent building codes that emphasize durability and sustainability, coupled with government incentives for green building. Wood plastic composites demand is experienced in applications that must endure harsh climatic conditions, including extreme cold and moisture.

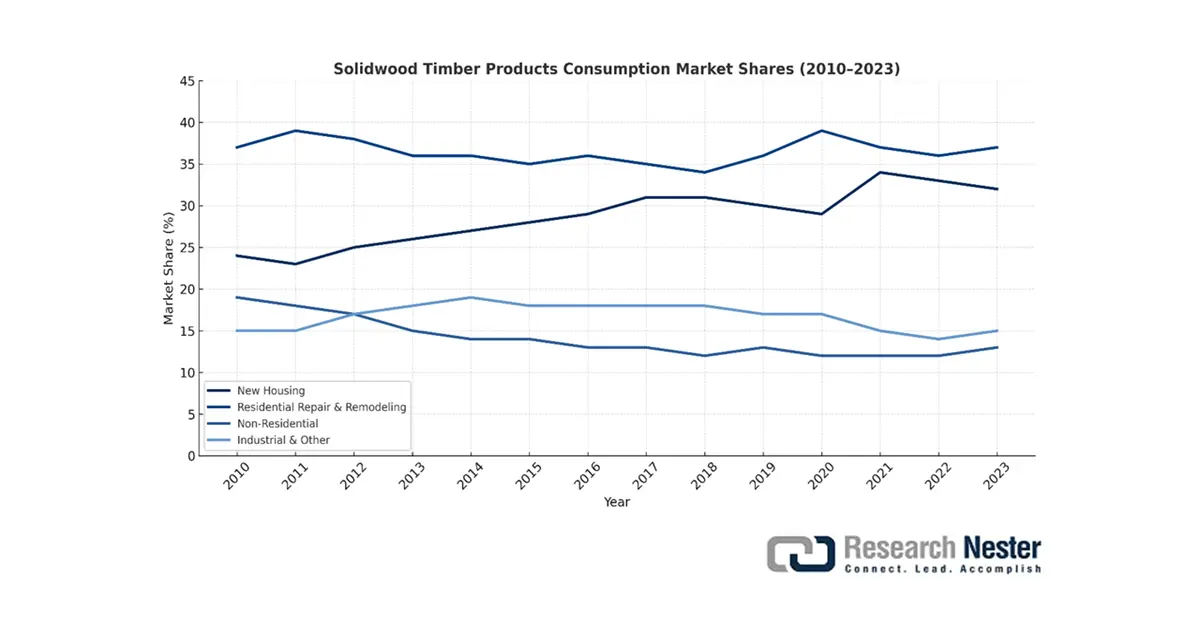

The U.S. wood plastic composites market is characterized by fierce innovation and sharp focus on sustainability, as builders and consumers alike increasingly demand green and high-performance building materials. Government initiatives promoting green buildings and recycled content are also fueling market expansion. Factors affecting the U.S. economy and demand for wood products in 2022 and 2023 included the efforts to control inflation by the Federal Reserve Board of Governors, the Russia-Ukraine war, international trade tensions, housing affordability, and the Israeli-Palestinian conflict. Hardwood lumber manufacturing and usage were significantly lower in 2023 as compared to the previous year (22.4% and 23.4%, respectively).

The U.S. forest products industry forms the key raw material supplier for wood plastic composites. It comprises of sectors 321-wood products and 322-paper and paperboard products, as classified by the National Industrial Classification System (NAICS) and contributed USD 161.4 billion (including 337 (furniture)) to the U.S. real GDP in 2023 (0.63% of the overall GDP) and USD 162.5 billion in 2022, according to the UNECE October 2024 report. The country is a leading producer of wood-based parts and components owing to the availability of plentiful forest resources and high manufacturing capacity.

Source: UNECE

The U.S. plays a pivotal role in the worldwide forest products industry and is a key consumer of pulp for paper and roundwood; the second largest end user of sawnwood, paper and paperboard, and recovered paper; the largest supplier of wood pellets, industrial roundwood, and pulp for paper. In 2024, cellulose was the most exported item out of 1,227 and held an export value of USD 1.54 billion. China (USD 330 million), Belgium (USD 233 million), India (USD 133 million), Brazil (USD 129 million), and Japan (USD 103 million) emerged as the main destinations. In June 2025, the U.S. exported USD 132 million and imported USD 54.8 million worth of cellulose. This led to a USD 77 million positive trade balance. The U.S. cellulose exports surged by USD 10.7 million (8.84%), from USD 121 million to USD 132 million. On the other hand, imports declined by USD 4.24 million (-7.18%), from USD 59.1 million to USD 54.8 million between May 2025 and June 2025, as stated by the OEC.