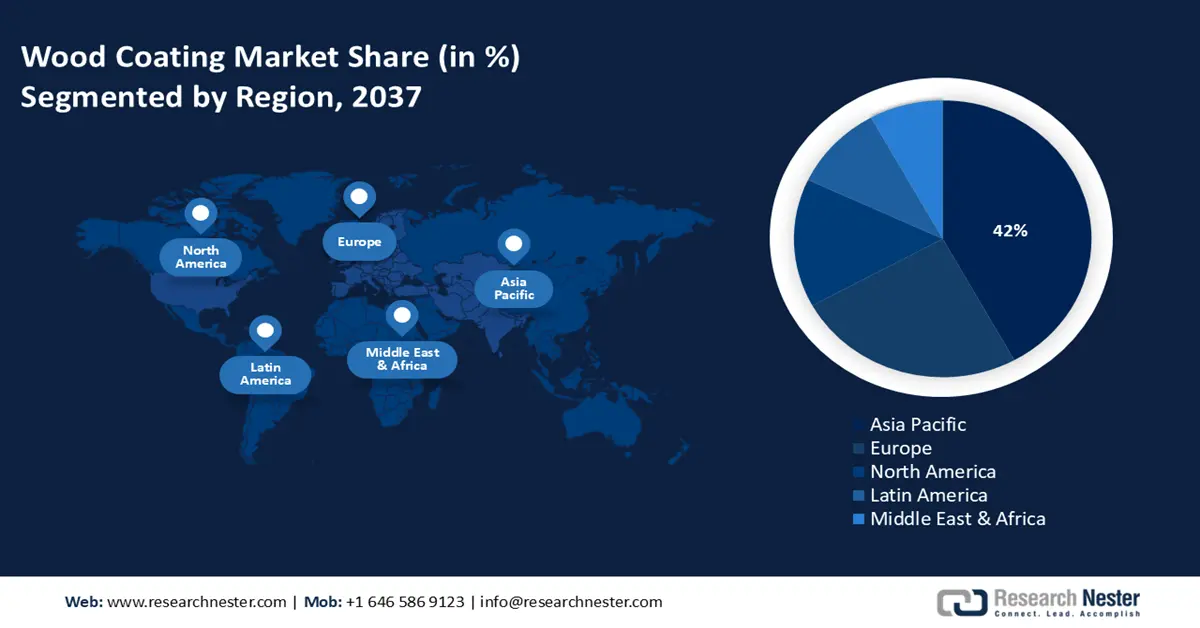

Wood Coating Market - Regional Analysis

Asia Pacific Market Insights

APAC’s wood coating market is anticipated to account for 42% of global revenue by 2037. This growth is propelled by swift industrialization, urbanization, and a growing demand for environmentally friendly coatings in the construction and automotive industries. Government initiatives aimed at promoting sustainability, such as China’s Green Chemical Industry Plan and Japan’s METI-funded clean technology projects, are expediting the adoption of these coatings. Additionally, rising investments in digitalization and circular economy models in South Korea and Malaysia further bolster growth. The regulatory push for low-VOC and bio-based wood coatings increases market potential across the region, positioning APAC as the fastest-growing center for innovative wood coating chemicals.

APAC Country-wise Wood Coating Chemical Market Data (2018–2024)

|

Country |

Key Development |

Government Spending/Initiative |

|

Japan |

2024: Allocated 4.6% of national industrial budget to wood coating chemicals; METI & NEDO increased funding by $1.2B since 2022 |

$1.2B increase (2022-24) |

|

China |

32% increase in green chemical spending over 5 years; 1.4M companies adopted sustainable processes in 2023 |

+40% (2018-23) |

|

India |

Investment in GaAlAs Wafer tech rose 26% (2015-23); $860M annual spending, 2.3M businesses adopting green chemistry |

$860M annual (2023) |

|

Malaysia |

Chemical firms using wood coating doubled (2013-23); Govt funding up 42% for green initiatives |

+50% funding increase |

|

South Korea |

Green chemistry investment +29% (2020-24); 560 companies implementing sustainable solutions |

+29% (2020-24) |

China is expected to lead the APAC wood coating market by 2037, propelled by government-supported green chemistry initiatives and advancements in industrial modernization. The proactive policies of the Ministry of Ecology and Environment, along with the NDRC’s substantial investments in sustainable chemical production, enhance demand. By 2023, over 1.4 million companies embraced eco-friendly chemical practices, indicating swift industrial compliance. The expansion of large-scale infrastructure, the rise in automotive manufacturing, and the development of urban housing further stimulate the consumption of wood coatings.

Europe Market Insights

Europe's wood coating market is expected to capture 27% of the global revenue by 2037, fueled by strict environmental regulations from ECHA and a growing demand for low-VOC and bio-based coatings. Additional government funding through initiatives like the European Green Deal is promoting innovation in sustainable chemical production. Major factors driving this trend include circular economy mandates and investments in cutting-edge manufacturing technologies in Germany, France, and the UK, which are encouraging the development of green chemical solutions and specialized wood coating.

Europe Market Demand & Budget Allocations by Country

|

Country |

Market Demand Highlights |

Budget Allocation to Chemical Sector |

|

United Kingdom |

In 2023, the UK allocated 8% of its environmental budget to Gallium Arsenide Wafer chemical initiatives, up from 5.6% in 2020. Wood coating demand is fueled by the construction and automotive sectors adopting sustainable coatings. |

9% of the environmental budget (2023) |

|

Germany |

Sustainable chemical spending reached €3.6 billion in 2024, with 11% demand growth in green chemicals since 2021. Heavy investments in circular economy and climate action through BMWK initiatives support wood coating innovation. |

€3.7 billion (2024) |

|

France |

Allocated 7% of industrial budget to wood coating chemicals in 2023, rising from 4.8% in 2021, driven by circular economy and sustainable manufacturing initiatives. Growth supported by France Chimie and the Ministry of Ecological Transition programs. |

8% of the industrial budget (2023) |

Germany is anticipated to maintain the largest revenue share in Europe’s wood coating market by 2037, driven by significant investments in sustainable chemicals and cutting-edge manufacturing technologies. The Federal Ministry for Economic Affairs and Climate Action (BMWK) endorses circular economy initiatives, while the German Chemical Industry Association (VCI) promotes innovation in low-VOC coatings. Germany’s robust industrial foundation and regulatory framework foster the adoption of environmentally friendly wood coatings, establishing it as the foremost market in Europe.

North America Market Insights

The wood coating industry in North America, predominantly driven by the United States and Canada, is anticipated to account for 24% of the worldwide revenue by 2037, exhibiting a CAGR of 4.9%. The main factors driving this growth include strict environmental regulations imposed by the EPA, an increasing demand for low-VOC coatings, and the expansion of both residential and commercial construction sectors. Additionally, government incentives are fostering clean chemical production and innovation, which in turn enhances the adoption of sustainable products within the wood coatings industry.