Wood Coating Market Outlook:

Wood Coating Market size was USD 9.1 billion in 2024 and is estimated to reach USD 17.8 billion by the end of 2037, registering a CAGR of 5.7% during the forecast period, i.e., 2025-2037. In 2025, the industry size of wood coating is evaluated at USD 9.5 billion.

The primary factor contributing to the expansion of the global market is the increasingly strict regulations regarding volatile organic compounds (VOCs), especially in North America and Europe. According to the U.S. EPA’s National Emission Standards for Hazardous Air Pollutants, wood surface coatings such as xylenes, toluene, and formaldehyde must adhere to Maximum Achievable Control Technology standards, which were updated as recently as March 2025. For example, New York State has lowered the VOC limits for wood floor coatings to 275 g/L under the OTC Phase II rule, a reduction from the previous limit of 350 g/L. This regulatory environment compels manufacturers to invest in low-VOC formulations and emission control technologies, thereby increasing the demand for compliant coating systems.

The prices of raw material feedstock and the resilience of supply chains are crucial for scaling up manufacturing. In May 2025, the U.S. PPI for architectural coatings was recorded at 514.6, whereas the PPI for interior architectural coatings was noted at 153.9. The PPI for wood preservation fluctuated between 235 and 291 during the period from June to August 2024. These price points indicate inflation in input costs, specifically for resins, solvents, and additives, which are affecting coating profit margins and driving integration within raw material supply chains. Moreover, trade data concerning coated wood panels and raw chemicals indicates a 13% rise in international shipments for 2024, coupled with the initiation of new production lines in the Asia-Pacific area to meet export requirements. Additionally, research and development investments, especially in compliance technologies and low-VOC systems, saw an approximate rise of 9% in fiscal year 2024 within regulated markets.

Key Wood Coating Market Insights Summary:

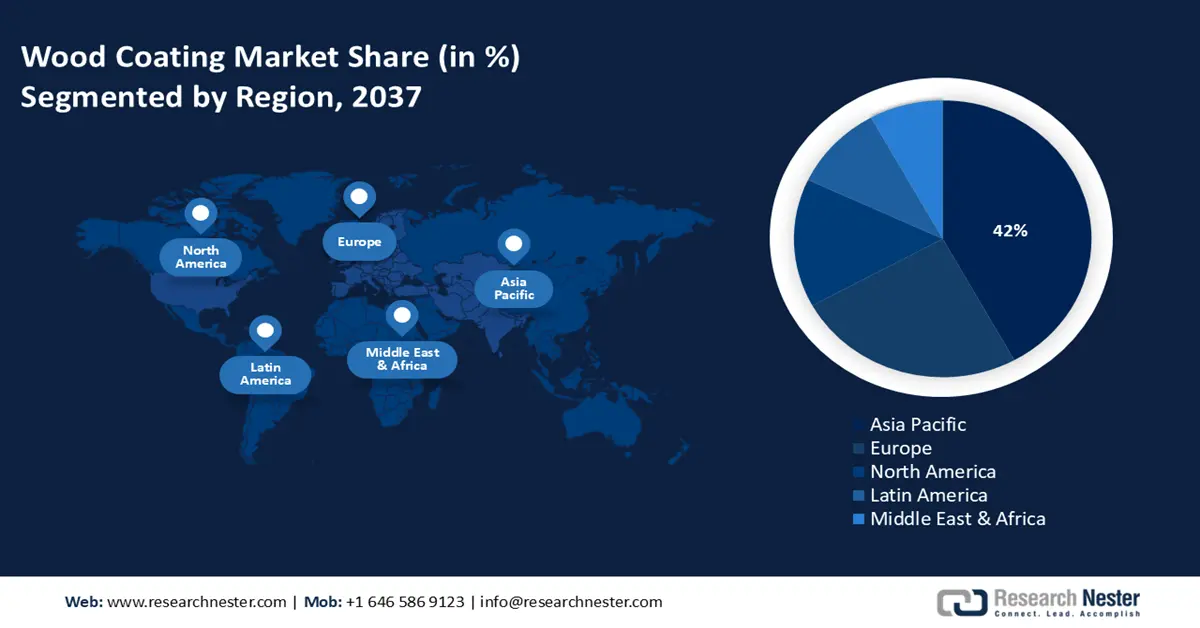

APAC’s wood coating market is projected to contribute 42% of the global revenue by 2037.

Europe's wood coating market is predicted to capture 27% of the global revenue by 2037.

The North American wood coating industry, primarily driven by the United States and Canada, is estimated to make up 24% of the global revenue by 2037.

The furniture & cabinetry segment is forecasted to hold 38% of the total wood coating market share by 2037.

The spray coatings segment is expected to represent 33% of the global wood coating market share.

Key Growth Trends:

- Green chemicals market expansion

- Circular economy & recycling initiatives

Key Players:

- The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, Dow Chemical Company, Akzo Nobel N.V., Axalta Coating Systems, LLC, Asian Paints Ltd., Nippon Paint Holdings Co., Ltd., Kansai Nerolac Paints Limited, RPM International Inc., Eastman Chemical Company, Arkema S.A., Allnex Group, Bona AB, Hempel A/S.

Global Wood Coating Market Forecast and Regional Outlook:

- 2024 Market Size: USD 9.1 billion

- 2025 Market Size: USD 9.5 billion

- Projected Market Size: USD 17.8 billion by 2037

- Growth Forecasts: 5.7% CAGR (2025-2037)

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

Last updated on : 3 July, 2025

Wood Coating Market - Growth Drivers and Challenges

Growth Drivers

- Green chemicals market expansion: Driven by the green chemicals sector, which encompasses bio-based polyols and recycled solvents, a growth of USD 10 billion is expected by 2027. This growth is transforming the wood coating sector as formulators are beginning to utilize more environmentally friendly options. The incorporation of eco-resins aids in achieving VOC compliance and adheres to increasingly stringent regulatory standards. These materials enhance product sustainability while also aligning with the goals of a circular economy. Consequently, the demand for green resins in wood coatings is projected to grow at a CAGR of 10–12% over the forthcoming five years. This transition facilitates both compliance with regulations and differentiation in the market.

- Circular economy & recycling initiatives: The European Union's BAT guidelines concerning the use of VOCs and solvents highlight the importance of material substitution and the efficiency of circular resources. These regulations promote the integration of circular-economy principles within the wood coating sector. It is anticipated that chemical recycling technologies will be able to reclaim as much as 32% of resin feedstocks by the year 2030, which will considerably decrease the costs associated with raw materials. This process of recovery diminishes reliance on virgin chemicals and fosters sustainable manufacturing practices. Consequently, there is an increasing demand for recyclable and environmentally friendly coating technologies, particularly in large-scale industrial production. This initiative aligns with the broader goals of the EU concerning climate action and waste minimization, thus fostering innovation and drawing in investment.

- Wood Coating Market: Demand & Supply Analysis

Demand & Supply Analysis (2023-2030)

|

Category |

2023 Data |

2030 Projection |

Supply-Side Insights |

Demand-Side Drivers |

|

Total Demand |

4.2 million metric tons |

6.1 million metric tons |

Production Capacity: 5.3M tons (2023) → 7.8M tons (2030) |

5.8% CAGR driven by construction & furniture growth |

|

Regional Demand Share |

||||

|

Asia-Pacific |

52% |

55% |

China dominates supply (45% global production) |

Urbanization (65% APAC population in cities by 2030) |

|

Europe |

22% |

20% |

Strict EU REACH compliance reduces small suppliers |

Green building codes (80% new builds require low-VOC) |

|

North America |

18% |

17% |

20% capacity expansion in U.S. (2024-26) |

DIY home renovation market ($500B in 2023) |

|

Technology Split |

||||

|

Water-based |

48% |

58% (+10pp) |

150+ new bio-based product launches (2023) |

VOC regulations boost adoption (85% EU penetration by 2030) |

|

Solvent-based |

40% |

32% (-8pp) |

Plant closures in Europe (-12% since 2020) |

Price-sensitive markets (India, Africa retain 40% share) |

|

UV-cured |

12% |

18% (+6pp) |

30 new UV line installations (2023) |

Automotive interiors demand (+25% YoY) |

|

Raw Material Supply |

||||

|

Acrylic Resins |

3.1M tons consumed |

4.4M tons required |

80% production concentrated in the EU/NA/China |

The furniture industry consumes 38% supply. |

|

Polyurethane |

2.8M tons consumed |

3.9M tons required |

MDI shortages cause 5-7% price hikes (2023) |

Flooring applications grow at 7.2% CAGR |

|

Price Trends |

||||

|

Water-based |

$3.50-$4.20/kg |

$3.80-$4.50/kg (+8%) |

Bio-based premiums: +15-20% |

LEED-certified projects pay a 12-18% premium |

|

Solvent-based |

$2.80-$3.40/kg |

$3.10-$3.80/kg (+11%) |

Rising crude oil impacts 60% of feedstocks |

Emerging markets tolerate 5-7% annual increases |

2. Wood Coating Chemicals: Five-Year Price History, Sales Volumes, and Influencing Factors (2018–2023)

Wood Coating Chemicals: Price History, Sales Volumes, and Regional Trends (2018–2023)

|

Category |

Details |

Statistics / Trends |

|

Price History (2018–2023) |

Ethylene prices in Asia increased by 16% in 2021 |

Asia Ethylene price: +16% (2021) |

|

Ammonia prices spiked 32% in Europe in 2022 |

Europe Ammonia price: +32% (2022) |

|

|

Unit Sales Volumes |

Global wood coating chemical sales grew at 5% CAGR |

2018–2023 CAGR: 5%; North America & Asia hold >60% market share |

|

Regional Price Trends |

Europe experienced ±13% price volatility; Asia experienced steady growth |

Europe Price variance: ±13%; Asia steady; North America +6% annual average increase |

|

Raw Material Costs |

Crude oil prices influenced resin and solvent costs |

Crude oil fluctuated between $50-$130/barrel (2018–2023) |

|

Geopolitical Events |

The Russia-Ukraine conflict caused a natural gas price spike |

European natural gas price: +90% (2022) |

|

Environmental Regulations |

VOC compliance costs increased by 20–25% post-2020 |

VOC-related costs rose 20–25% since 2020 |

|

Industry Trends |

Sulfuric acid demand grew, supporting coating chemical use |

Global sulfuric acid CAGR: 4.6% (2018–2023) |

3. Composition and Financial Trends of Japan’s Wood Coating Chemical Industry

Japan’s Chemical Shipment Composition and Polymer Demand Trends

|

Category |

Details |

Statistics / Trends |

|

Composition of Chemical Shipments |

Petrochemicals accounted for 46% of Japan’s chemical shipments in 2022 |

Petrochemicals: 46%; Total value: ¥13 trillion (2022) |

|

Growing demand for high-performance polymers in electronics |

Polymers' share grew by 6% CAGR (2018–2022) |

|

|

Shipment Value by Industry |

Shipments to the automotive sector grew 9% annually (2018–2023) |

Automotive shipments growth: 9% CAGR |

|

The electronics and pharmaceutical sectors grew at 7% and 8% CAGR, respectively. |

Electronics growth: 7% CAGR; Pharmaceuticals: 8% CAGR |

|

|

R&D & Capital Investment |

Mitsubishi Chemical R&D investment reached ¥160 billion in 2022 |

R&D focus: bioplastics, sustainability, digitalization |

|

Capital investments increased by 11% annually. |

Capital expenditure CAGR: 11% (2018–2023) |

|

|

Top 30 Companies’ Financials |

Shin-Etsu Chemical's profits rose 13% in 2023, totaling ¥1.3 trillion |

Profit growth: +13%; Sales: ¥1.3 trillion (2023)\ |

Challenges

- Pricing pressures from raw material volatility: The prices of raw materials, especially petrochemicals, experience considerable fluctuations, which have a direct effect on the production costs of wood coatings. According to the WTO, there was a 22% increase in global petrochemical prices between 2021 and 2022, attributed to disruptions in the supply chain. This volatility reduces profit margins and complicates pricing strategies. Smaller suppliers are particularly vulnerable due to their limited purchasing power and reduced flexibility. Ensuring stable prices is a significant challenge in a market characterized by volatility.

- Market access barriers due to tariffs and trade policies: Tariffs and trade limitations persist in obstructing global market entry for wood coating providers. In 2022, the United States enacted tariffs averaging between 15% and 20% on imports of specialty chemicals, which encompass wood coatings. These actions elevate expenses for importers, postpone product introductions, and diminish the international competitiveness of suppliers. The ensuing disruptions to supply chains lead to increased costs for end-users and complicated plans for global expansion. Effectively managing these obstacles is essential for the growth of manufacturers.

Wood Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.7% |

|

Base Year Market Size (2024) |

USD 9.1 billion |

|

Forecast Year Market Size (2037) |

USD 17.8 billion |

|

Regional Scope |

|

Wood Coating Market Segmentation:

End use Segment Analysis

The furniture & cabinetry segment is projected to represent 38% of the worldwide wood coating market share by the year 2037. This expansion is fueled by an increasing demand for premium furniture and a surge in residential construction worldwide. Additionally, renovation trends noted in North America and Europe further enhance the usage of coatings. Water-based and low-VOC coatings are becoming more popular due to changes in regulations. The Asia-Pacific region continues to be a significant manufacturing center, contributing to substantial demand. Technological advancements, including UV-cured finishes, enhance the longevity of products. Additionally, sustainability in the sourcing of raw materials plays a crucial role in shaping buyer preferences.

Application Segment Analysis

The spray coatings segment is expected to account for a 33% share of the global wood coating market. This is driven by their effectiveness in large-scale industrial wood finishing. The Occupational Safety and Health Administration (OSHA) emphasizes that spray techniques not only decrease application time but also enhance uniformity, all while adhering to safety and environmental regulations. The increasing use of automation in manufacturing industries, including furniture and cabinetry, is further propelling the demand for spray coatings, which is anticipated to secure a 33% market share by 2037.

Our in-depth analysis of the global wood coating market includes the following segments:

|

Segment |

Subsegment |

|

End use |

|

|

Application |

|

|

Resin Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wood Coating Market - Regional Analysis

Asia Pacific Market Insights

APAC’s wood coating market is anticipated to account for 42% of global revenue by 2037. This growth is propelled by swift industrialization, urbanization, and a growing demand for environmentally friendly coatings in the construction and automotive industries. Government initiatives aimed at promoting sustainability, such as China’s Green Chemical Industry Plan and Japan’s METI-funded clean technology projects, are expediting the adoption of these coatings. Additionally, rising investments in digitalization and circular economy models in South Korea and Malaysia further bolster growth. The regulatory push for low-VOC and bio-based wood coatings increases market potential across the region, positioning APAC as the fastest-growing center for innovative wood coating chemicals.

APAC Country-wise Wood Coating Chemical Market Data (2018–2024)

|

Country |

Key Development |

Government Spending/Initiative |

|

Japan |

2024: Allocated 4.6% of national industrial budget to wood coating chemicals; METI & NEDO increased funding by $1.2B since 2022 |

$1.2B increase (2022-24) |

|

China |

32% increase in green chemical spending over 5 years; 1.4M companies adopted sustainable processes in 2023 |

+40% (2018-23) |

|

India |

Investment in GaAlAs Wafer tech rose 26% (2015-23); $860M annual spending, 2.3M businesses adopting green chemistry |

$860M annual (2023) |

|

Malaysia |

Chemical firms using wood coating doubled (2013-23); Govt funding up 42% for green initiatives |

+50% funding increase |

|

South Korea |

Green chemistry investment +29% (2020-24); 560 companies implementing sustainable solutions |

+29% (2020-24) |

China is expected to lead the APAC wood coating market by 2037, propelled by government-supported green chemistry initiatives and advancements in industrial modernization. The proactive policies of the Ministry of Ecology and Environment, along with the NDRC’s substantial investments in sustainable chemical production, enhance demand. By 2023, over 1.4 million companies embraced eco-friendly chemical practices, indicating swift industrial compliance. The expansion of large-scale infrastructure, the rise in automotive manufacturing, and the development of urban housing further stimulate the consumption of wood coatings.

Europe Market Insights

Europe's wood coating market is expected to capture 27% of the global revenue by 2037, fueled by strict environmental regulations from ECHA and a growing demand for low-VOC and bio-based coatings. Additional government funding through initiatives like the European Green Deal is promoting innovation in sustainable chemical production. Major factors driving this trend include circular economy mandates and investments in cutting-edge manufacturing technologies in Germany, France, and the UK, which are encouraging the development of green chemical solutions and specialized wood coating.

Europe Market Demand & Budget Allocations by Country

|

Country |

Market Demand Highlights |

Budget Allocation to Chemical Sector |

|

United Kingdom |

In 2023, the UK allocated 8% of its environmental budget to Gallium Arsenide Wafer chemical initiatives, up from 5.6% in 2020. Wood coating demand is fueled by the construction and automotive sectors adopting sustainable coatings. |

9% of the environmental budget (2023) |

|

Germany |

Sustainable chemical spending reached €3.6 billion in 2024, with 11% demand growth in green chemicals since 2021. Heavy investments in circular economy and climate action through BMWK initiatives support wood coating innovation. |

€3.7 billion (2024) |

|

France |

Allocated 7% of industrial budget to wood coating chemicals in 2023, rising from 4.8% in 2021, driven by circular economy and sustainable manufacturing initiatives. Growth supported by France Chimie and the Ministry of Ecological Transition programs. |

8% of the industrial budget (2023) |

Germany is anticipated to maintain the largest revenue share in Europe’s wood coating market by 2037, driven by significant investments in sustainable chemicals and cutting-edge manufacturing technologies. The Federal Ministry for Economic Affairs and Climate Action (BMWK) endorses circular economy initiatives, while the German Chemical Industry Association (VCI) promotes innovation in low-VOC coatings. Germany’s robust industrial foundation and regulatory framework foster the adoption of environmentally friendly wood coatings, establishing it as the foremost market in Europe.

North America Market Insights

The wood coating industry in North America, predominantly driven by the United States and Canada, is anticipated to account for 24% of the worldwide revenue by 2037, exhibiting a CAGR of 4.9%. The main factors driving this growth include strict environmental regulations imposed by the EPA, an increasing demand for low-VOC coatings, and the expansion of both residential and commercial construction sectors. Additionally, government incentives are fostering clean chemical production and innovation, which in turn enhances the adoption of sustainable products within the wood coatings industry.

Key Wood Coating Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global wood coating sector is predominantly driven by firms based in the United States and Europe, with Sherwin-Williams, PPG, and BASF leading the way in innovation and sustainability efforts. Major players are channeling investments into VOC-compliant, waterborne formulations. Manufacturers in Asia, such as Nippon and Asian Paints, are concentrating on expanding within APAC. Mergers and acquisitions, along with research and development in green chemistry, are shaping the competitive landscape. Below is a table that outlines the top 15 global manufacturers in the wood coating chemical market, presented in a tabular format:

Top 15 Global Manufacturers in the Market

|

Company Name |

Country of Origin |

Estimated Market Share (Global) |

|

The Sherwin-Williams Company |

USA |

19–26% |

|

PPG Industries, Inc. |

USA |

~13% |

|

BASF SE |

Germany |

13–19% |

|

Dow Chemical Company |

USA |

11–16% |

|

Akzo Nobel N.V. |

Netherlands |

~16% |

|

Axalta Coating Systems, LLC |

USA |

xx% |

|

Asian Paints Ltd. |

India |

xx% |

|

Nippon Paint Holdings Co., Ltd. |

Japan |

xx% |

|

Kansai Nerolac Paints Limited |

Japan |

xx% |

|

RPM International Inc. |

USA |

xx% |

|

Eastman Chemical Company |

USA |

xx% |

|

Arkema S.A. |

France |

xx% |

|

Allnex Group |

Germany / Luxembourg |

xx% |

|

Bona AB |

Sweden |

xx% |

|

Hempel A/S |

Denmark |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In August 2024, Eastman Chemical Company launched Solus ES, a sustainable wood coating additive that comprises 76% recycled materials. This product improves UV resistance and processing efficiency, providing formulators with an environmentally friendly option that addresses the increasing demand for more sustainable solutions within the coatings sector.

- In May 2024, EPS introduced a fully bio-based polymer intended as a sustainable substitute for petrochemical resins used in wood coatings. This innovative product responds to the rising regulatory demands and the increasing consumer preference for environmentally friendly options, establishing EPS as a frontrunner in the field of sustainable coatings.

- Report ID: 1008

- Published Date: Jul 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wood Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.